How Much Do You Take Home Earning 50000 FICA contributions are shared between the employee and the employer 6 2 of each of your paychecks is withheld for Social Security taxes and your employer contributes a further 6 2 However the 6 2 that you pay only applies to income up to the Social Security tax cap which for 2023 is 160 200 168 600 for 2024

The average annual salary in the United States is 69 368 which is around 4 537 a month after taxes and contributions depending on where you live However extremely high earners tend to bias averages Likewise average salaries vary state by state such as California s salaries averaging 83 876 a year compared to Florida s at 63 336 You can use a paycheck tax calculator to estimate your take home pay after taxes The paycheck tax calculator is a free online tool that helps you to calculate your net pay based on your gross pay marital status state and federal tax and pay frequency After using these inputs you can estimate your take home pay after taxes

How Much Do You Take Home Earning 50000

How Much Do You Take Home Earning 50000

http://www.smartserve.co/wp-content/uploads/2019/07/income.jpg

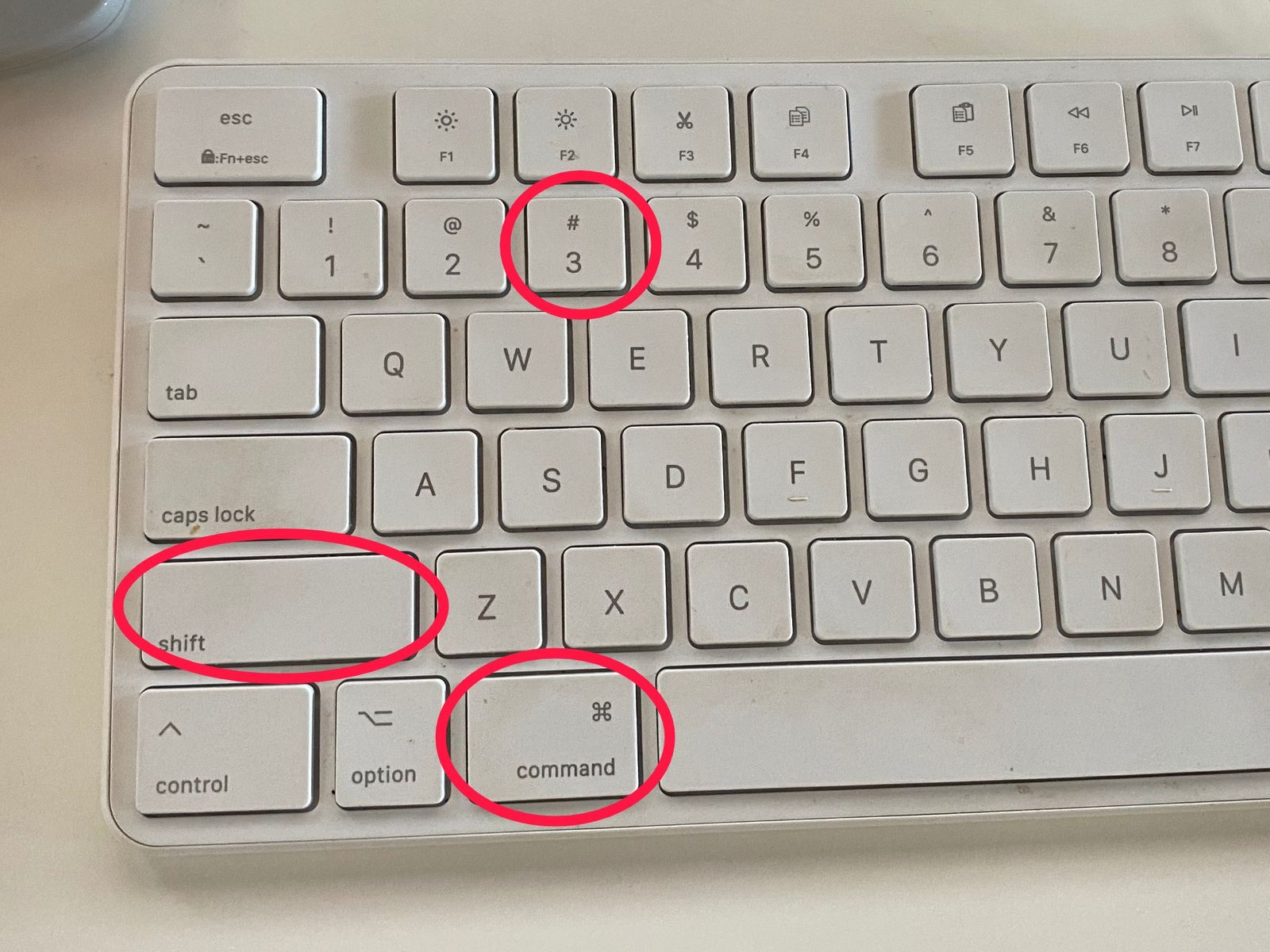

How To Take And Edit Screenshots On A Laptop

https://www.kapwing.com/resources/content/images/2021/05/Mac_Keyboard.jpeg

How Much Do You Need To Buy A House Cadence Planning

https://static.twentyoverten.com/content/featured/howmuchdoyouneedtobuyahouse.jpg

Connecticut has a set of progressive income tax rates meaning how much you pay in taxes depends on how much you earn There are seven tax brackets that range from 3 00 to 6 99 Take Home Salary Save more with these rates that beat the National Average 5 00 for up to 50 000 5 50 for up to 100 000 6 00 for up to 200 000 In 2022 your employer will withhold 6 2 of your wages up to 147 000 for Social Security Additionally you must pay 1 45 of all of your wages for Medicare without any limitations If you

Take Home Pay for 2024 40 083 50 We hope you found this salary example useful and now feel your can work out taxes on 50k salary if you did it would be great if you could share it and let others know about iCalculator We depend on word of mouth to help us grow and keep the US Tax Calculator free to use Arizona Paycheck Quick Facts Arizona income tax rate 2 50 Median household income 72 581 U S Census Bureau Number of cities that have local income taxes 0

More picture related to How Much Do You Take Home Earning 50000

How To Take Screenshots In Windows 10

https://sm.pcmag.com/pcmag_in/photo/u/use-the-wi/use-the-windows-key-print-screen-shortcut_3269.jpg

New Earning Website Today Make Money Online 2022 Earn 50 000 Per

https://i.ytimg.com/vi/dQ-CBgyBYds/maxresdefault.jpg

How Much Of My Net Income Should Go To Mortgage MortgageInfoGuide

https://www.mortgageinfoguide.com/wp-content/uploads/heres-how-to-figure-out-how-much-home-you-can-afford.jpeg

The Salary Calculator tells you monthly take home or annual earnings considering UK Tax National Insurance and Student Loan The latest budget information from April 2024 is used to show you exactly what you need to know Hourly rates weekly pay and bonuses are also catered for Why not find your dream salary too Calculate your take home pay after various taxes For United States residents Constantly updated to keep up with the tax year

50 000 After Tax Explained This is a break down of how your after tax take home pay is calculated on your 50 000 yearly income If you earn 50 000 in a year you will take home 38 022 leaving you with a net income of 3 169 every month Now let s see more details about how we ve gotten this monthly take home sum of 3 169 after extracting your tax and NI from your yearly Take home pay 50 000 State income tax paid for single person 0 Marginal state income tax 2 Effective state income tax 0 Jordan Rosenfeld contributed to the reporting of this article Methodology For this study GOBankingRates analyzed the 2024 tax rates to find the average amount the average person pays in state taxes in each state

Ordinary People With Extraordinary Life How Much Do You Know About

https://3.bp.blogspot.com/_KGjxxFlKCzg/TOX1QSD6FKI/AAAAAAAAA7o/do7Yyah08Ig/s1600/q.JPG

How Much Do You Like Avocados Me Funny

https://cdn.verbub.com/images/how-much-do-you-like-avocados-me-319854.jpg

How Much Do You Take Home Earning 50000 - And in the case of a bonus amount of more than 1 million 37 is deducted from the remaining amount For example if you receive a 2 million bonus then 22 is taxed on the first million which is 1000000 0 22 220000 and 37 is taxed on the rest of the bonus amount which is 2000000 1000000 0 37 370000