How Much Do You Make Biweekly After Taxes In Texas Social Security 6 2 Medicare 1 45 to 2 35 Other non tax deductions health insurance 401k etc also reduce your take home pay The combined tax percentage usually ranges from 15 to 30 of your paycheck Updated on Jul 06 2024 Free tool to calculate your hourly and salary income after federal state and local taxes in Texas

FICA contributions are shared between the employee and the employer 6 2 of each of your paychecks is withheld for Social Security taxes and your employer contributes a further 6 2 However the 6 2 that you pay only applies to income up to the Social Security tax cap which for 2023 is 160 200 168 600 for 2024 Use our US salary calculator to find out your net pay and how much tax you owe based on your gross income salaryafter tax Salary After Tax Home 12 Biweekly payments per year 26 Working weeks per year 52 Working days per week 5 Working hours per week Texas 69 472 4 753 Florida 63 336 4 393 New York 83 720

How Much Do You Make Biweekly After Taxes In Texas

How Much Do You Make Biweekly After Taxes In Texas

https://i.pinimg.com/originals/73/e5/19/73e519320e03e1a2db0330e552482dd1.jpg

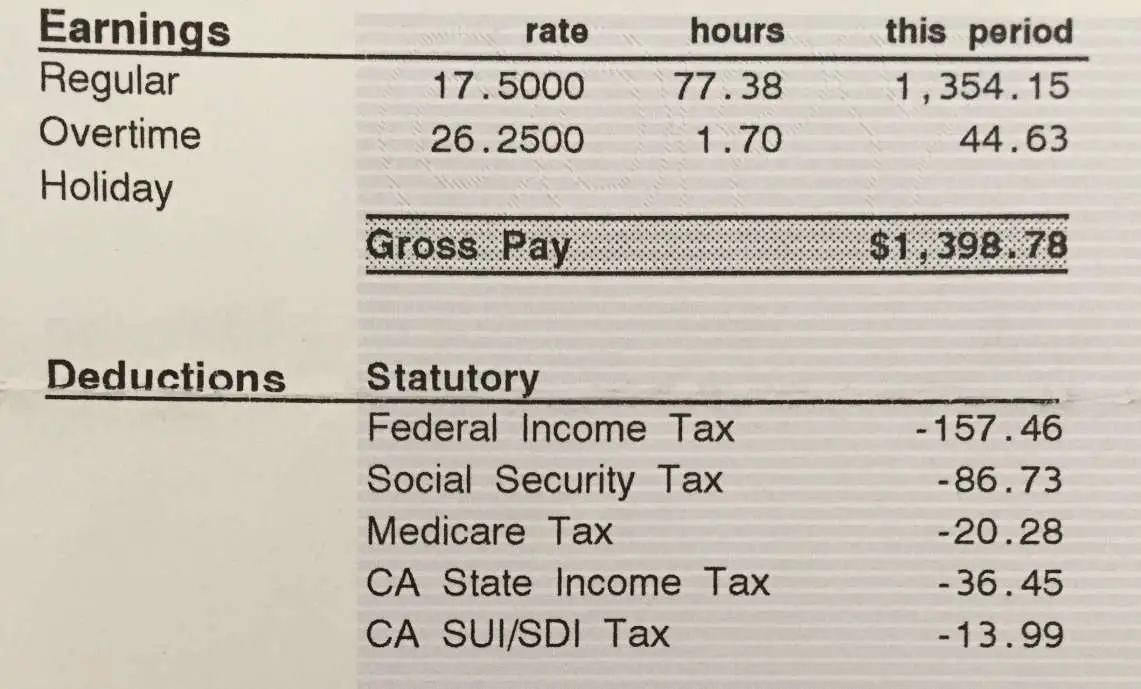

How Much Did Jane Earn Before Taxes New Countrymusicstop

https://i.ytimg.com/vi/ieA-bmoFk3k/maxresdefault.jpg

How Much Tax Is Taken Out Of Paycheck In Texas TaxesTalk

https://www.taxestalk.net/wp-content/uploads/see-what-a-100k-salary-looks-like-after-taxes-in-your-state.jpeg

Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary It can also be used to help fill steps 3 and 4 of a W 4 form This calculator is intended for use by U S residents The calculation is based on the 2024 tax brackets and the new W 4 which in 2020 has had its first major The paycheck tax calculator is a free online tool that helps you to calculate your net pay based on your gross pay marital status state and federal tax and pay frequency After using these inputs you can estimate your take home pay after taxes The inputs you need to provide to use a paycheck tax calculator

Texas does not have a state income tax so your salary is not subject to state income tax In Texas paychecks are taxed only federal taxes federal income tax Social Security and Medicare Bi weekly is once every other week with 26 payrolls per year or 27 during a leap year like 2024 Semi monthly is twice per month with 24 payrolls per The following is the formula for each pay frequency Daily Your net pay Days worked per week Weeks worked per year Your daily paycheck Weekly Your net pay 52 Your weekly paycheck Bi weekly Your net pay 26 Your bi weekly paycheck Semi monthly Your net pay 24 Your semi monthly paycheck

More picture related to How Much Do You Make Biweekly After Taxes In Texas

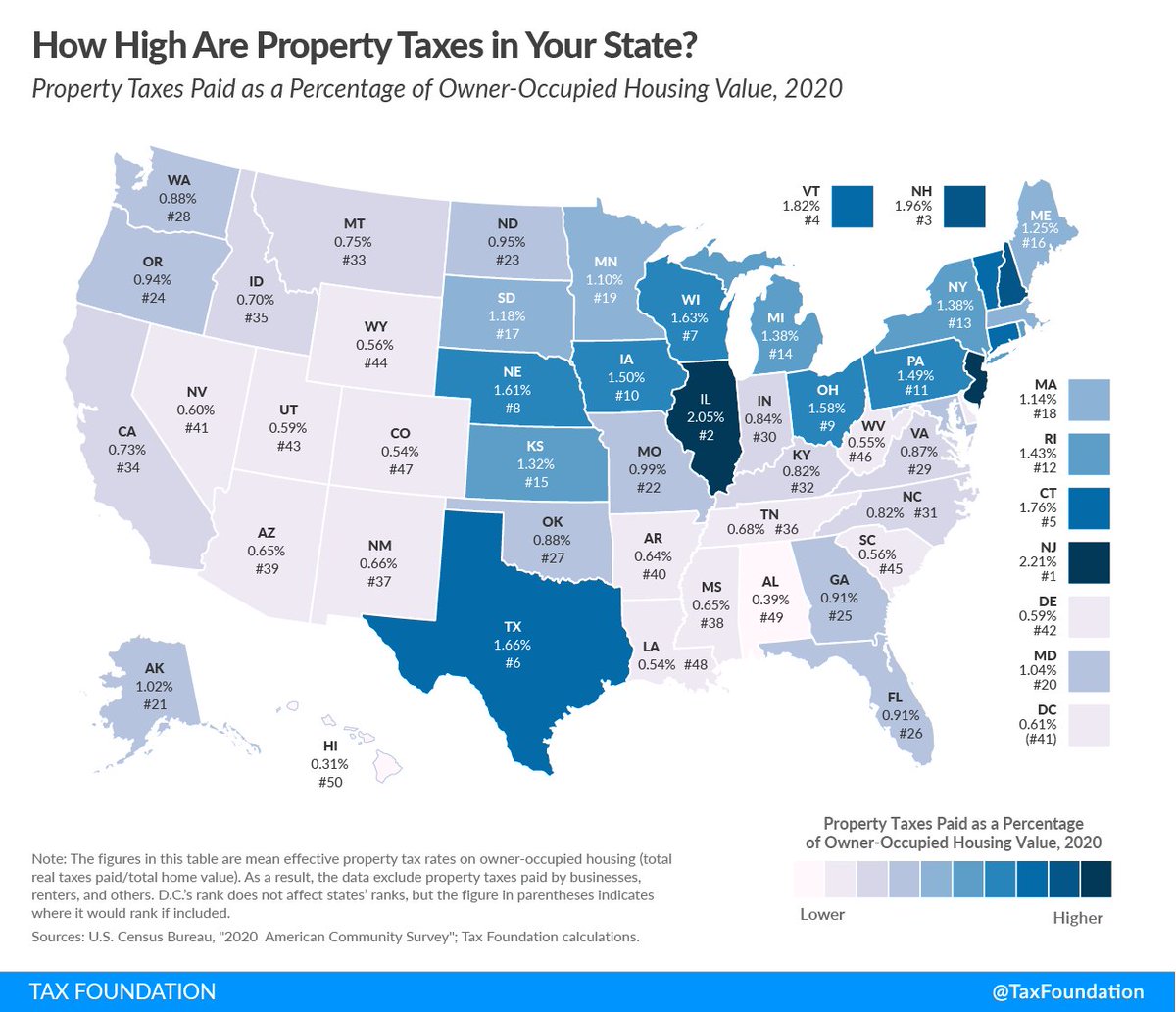

M Nolan Gray On Twitter Probably Not An Accident That New Jersey

https://pbs.twimg.com/media/FfYHvR1XkAMtoxY.jpg

How To Calculate Payroll Taxes In California TaxesTalk

https://www.taxestalk.net/wp-content/uploads/how-to-calculate-paycheck-after-taxes-in-california-tax.jpeg

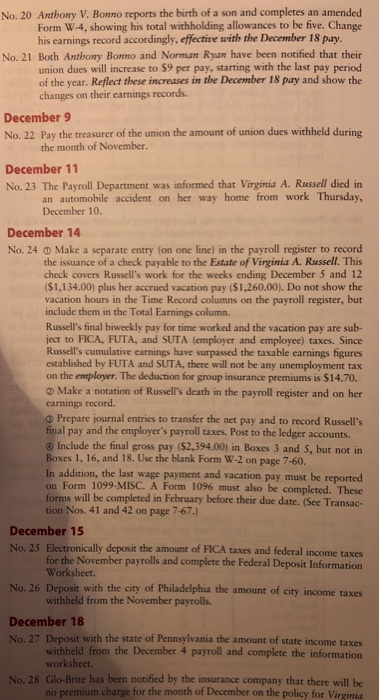

Accounting Archive December 13 2018 Chegg

https://media.cheggcdn.com/media/853/853d8974-2b4d-458a-8d18-47d8b401c601/image.png

Whether your pay is weekly bi weekly monthly or yearly this calculator can help you figure out your after tax income once you enter your gross pay and additional details Use our take home pay In 2022 your employer will withhold 6 2 of your wages up to 147 000 for Social Security Additionally you must pay 1 45 of all of your wages for Medicare without any limitations If you

Fast easy accurate payroll and tax so you can save time and money Payroll Overview Overview Small Business Payroll 1 49 Employees Midsized to Enterprise Payroll 50 1 000 Employees Compare Packages Find the package that s right for your business Time Attendance Time Attendance Manage labor costs and compliance with easy time Texas payroll taxes Here s what you need to know about withholding payroll taxes in Texas Texas payroll taxes start with employees filling out Form W 4 This information helps you determine how much you should withhold If an employee does not complete this form you will need to withhold tax as though no exemptions were claimed

I Just Downloaded A Simple Free 2022 Biweekly Payroll Calendar For

https://i.pinimg.com/originals/4a/a5/5f/4aa55ff6cc1f43c10f6a28d69ff3d2ad.png

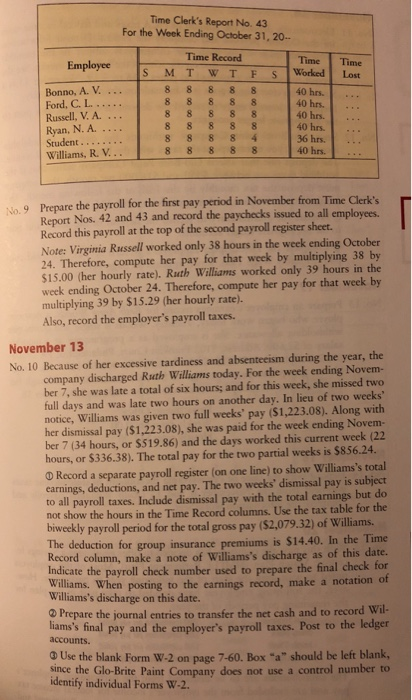

Accounting Archive December 13 2018 Chegg

https://media.cheggcdn.com/media/37f/37fb41f7-d521-476a-92a7-67b76704f92a/image.png

How Much Do You Make Biweekly After Taxes In Texas - Taxes Knowing your salary after tax or take home pay can give you a clearer picture of your actual earnings helping you plan your expenses savings and investments better Our paycheck calculator is designed to provide accurate breakdowns giving you insights into how much of your earnings go to federal state and FICA taxes