How Much Will I Make After Taxes In Texas Social Security 6 2 Medicare 1 45 to 2 35 Other non tax deductions health insurance 401k etc also reduce your take home pay The combined tax percentage usually ranges from 15 to 30 of your paycheck Updated on Jul 06 2024 Free tool to calculate your hourly and salary income after federal state and local taxes in Texas

Summary If you make 55 000 a year living in the region of Texas USA you will be taxed 9 076 That means that your net pay will be 45 925 per year or 3 827 per month Your average tax rate is 16 5 and your marginal tax rate is 29 7 This marginal tax rate means that your immediate additional income will be taxed at this rate Salary Paycheck Calculator Texas Paycheck Calculator Use ADP s Texas Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees Just enter the wages tax withholdings and other information required below and our tool will take care of the rest Looking for managed Payroll and benefits for your business

How Much Will I Make After Taxes In Texas

How Much Will I Make After Taxes In Texas

https://www.taxestalk.net/wp-content/uploads/what-you-really-earn-after-taxes-in-each-state-your-salary-is-50000.jpeg

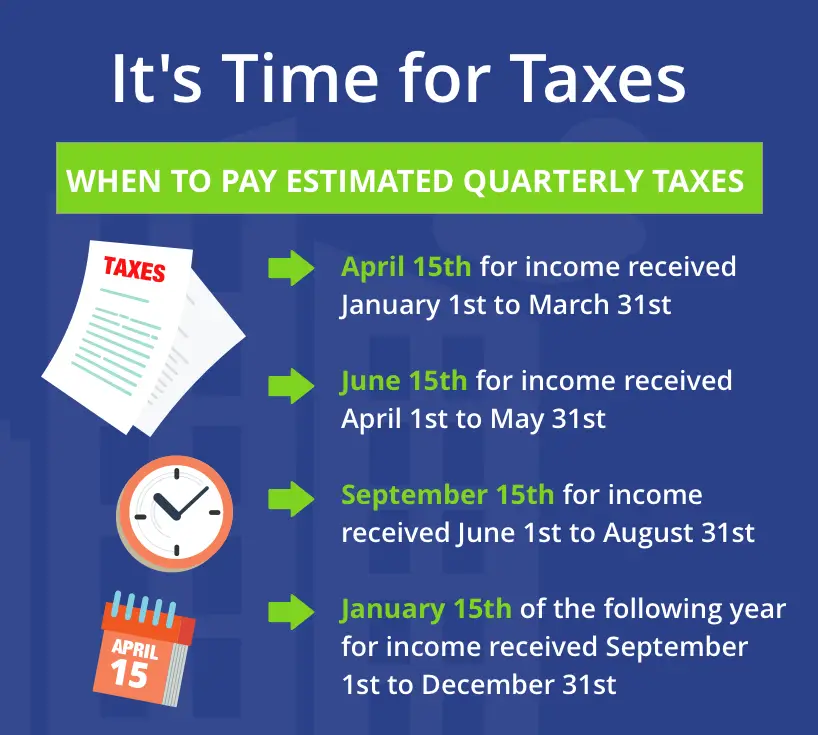

How To Pay Taxes As An Independent Contractor TaxesTalk

https://www.taxestalk.net/wp-content/uploads/taxes-for-independent-contractors-definitive-guide-on-when-and-how-to-file.png

What Do I Make After Taxes TaxesTalk

https://www.taxestalk.net/wp-content/uploads/how-much-do-i-make-after-taxes-per-hour-calculator-tax-walls.png

FICA contributions are shared between the employee and the employer 6 2 of each of your paychecks is withheld for Social Security taxes and your employer contributes a further 6 2 However the 6 2 that you pay only applies to income up to the Social Security tax cap which for 2023 is 160 200 168 600 for 2024 Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary It can also be used to help fill steps 3 and 4 of a W 4 form This calculator is intended for use by U S residents The calculation is based on the 2024 tax brackets and the new W 4 which in 2020 has had its first major

Step 3 enter an amount for dependents The old W4 used to ask for the number of dependents The new W4 asks for a dollar amount Here s how to calculate it If your total income will be 200k or less 400k if married multiply the number of children under 17 by 2 000 and other dependents by 500 Add up the total Texas State Income Tax Calculation Calculated using the Texas State Tax Tables and Allowances for 2024 by selecting your filing status and entering your Income for 2024 for a 2025 Texas State Tax Return Medicare Contributions 1 45 in 2024 with an additional 0 9 for those whose earnings exceed 200 000 00 in 2024

More picture related to How Much Will I Make After Taxes In Texas

How Much Will I Really Make After Taxes Tax Walls

https://lh3.googleusercontent.com/proxy/wyPeBvBEJmZy7D8YEJ-n4mu4tomnsT9AsIEu9OMAiedITMPWrnfDjJjeCUkBb2RehNJn9U9rPDikWpUnGi9QV748LyXKUjaDRlRYtBRNne-3C9Qm-nVlYEMe0U-MaT1599_8RaahGMhi_c4GFo7FWA=w1200-h630-p-k-no-nu

How Much Taxes Do I Have To Pay For Unemployment TaxesTalk

https://www.taxestalk.net/wp-content/uploads/do-i-have-to-pay-taxes-on-unemployment-benefits-clark-1024x683.jpeg

I Paid For YouTube Ads To Make Money On ClickBank HOW MUCH WILL I

https://i.ytimg.com/vi/-WccHzHxGtg/maxresdefault.jpg

To effectively use the Texas Paycheck Calculator follow these steps Enter your gross pay for the pay period Choose your pay frequency e g weekly bi weekly monthly Input your filing status and the number of allowances you claim Add any additional withholdings or deductions such as retirement contributions or health insurance premiums Texas Salary Tax Calculator for the Tax Year 2024 25 You are able to use our Texas State Tax Calculator to calculate your total tax costs in the tax year 2024 25 Our calculator has recently been updated to include both the latest Federal Tax Rates along with the latest State Tax Rates

This is the gross pay for the pay period before any deductions including wages tips bonuses etc You can calculate this from an annual salary by dividing the annual salary by the number of pay They are mandatory payroll taxes that fund the Social Security and Medicare programs Social Security tax is 6 2 of your pay up to a certain limit 160 200 in 2023 while Medicare tax is 1 45 of your pay with no limit If you earn more than certain limits you will also pay an additional 0 9 Medicare surtax

How Much Tax Is Taken Out Of Paycheck In Texas TaxesTalk

https://www.taxestalk.net/wp-content/uploads/see-what-a-100k-salary-looks-like-after-taxes-in-your-state.jpeg

How Much Will I Make After Taxes California TaxesTalk

https://www.taxestalk.net/wp-content/uploads/las-vegas-nevada-property-taxes-buy-or-sell-1-702-882-8240.png

How Much Will I Make After Taxes In Texas - FICA contributions are shared between the employee and the employer 6 2 of each of your paychecks is withheld for Social Security taxes and your employer contributes a further 6 2 However the 6 2 that you pay only applies to income up to the Social Security tax cap which for 2023 is 160 200 168 600 for 2024