How Much Do I Pay In Taxes If I Make 300k Foreign Tax Credit This is a non refundable credit that reduces the double tax burden for taxpayers earning income outside the U S Children Child Tax Credit It is possible to claim up to 2 000 per child 1 400 of which is refundable The child tax credit starts to phase out once the income reaches 200 000 400 000 for joint filers

See how your refund take home pay or tax due are affected by withholding amount Choose an estimated withholding amount that works for you Results are as accurate as the information you enter What you need Have this ready Paystubs for all jobs spouse too Estimate Federal Income Tax for 2020 2019 2018 2017 2016 2015 and 2014 from IRS tax rate schedules Find your total tax as a percentage of your taxable income Calculate net income after taxes

How Much Do I Pay In Taxes If I Make 300k

How Much Do I Pay In Taxes If I Make 300k

https://3.bp.blogspot.com/-ByuT6BOgDjU/Vyy7AaAwVqI/AAAAAAAAAhY/muxBhH3clRIZ86N1IAPr3rctNb6Z_lLlwCKgB/s1600/taxes_image_for_webpage.jpg

Taxes

https://www.bizprofitpro.com/wp-content/uploads/2019/03/tax2-1200x800.jpeg

30 Funny Tax Memes That Won t Help You Do Your Taxes But Will Make You

https://pleated-jeans.com/wp-content/uploads/2023/04/irs-income-tax-memes-1024x536.jpg

When your income jumps to a higher tax bracket you don t pay the higher rate on your entire income You pay the higher rate only on the part that s in the new tax bracket 2024 tax rates for a single taxpayer For a single taxpayer the rates are Tax rate on taxable income from up to 10 0 11 600 12 11 601 47 150 22 View how much tax you may pay in other states based on the filing status and state entered above State Net Pay Effective State Tax Rate Rank Alaska 62 759 0 00 1 Florida 62 759 0 00 1

As you pay your tax bill another thing to consider is using a tax filing service that lets you pay your taxes by credit card That way you can at least get valuable credit card rewards and points when you pay your bill The IRS has authorized three payment processors to collect tax payments by credit card PayUSAtax Pay1040 and ACI Payments Inc You can use our Federal Tax Brackets Calculator to determine how much tax you will pay for the current tax year or to determine how much tax you have paid in previous tax years To do so all you need to do is Select a tax year Select a filing status either single or joint Enter your income amount Click Calculate

More picture related to How Much Do I Pay In Taxes If I Make 300k

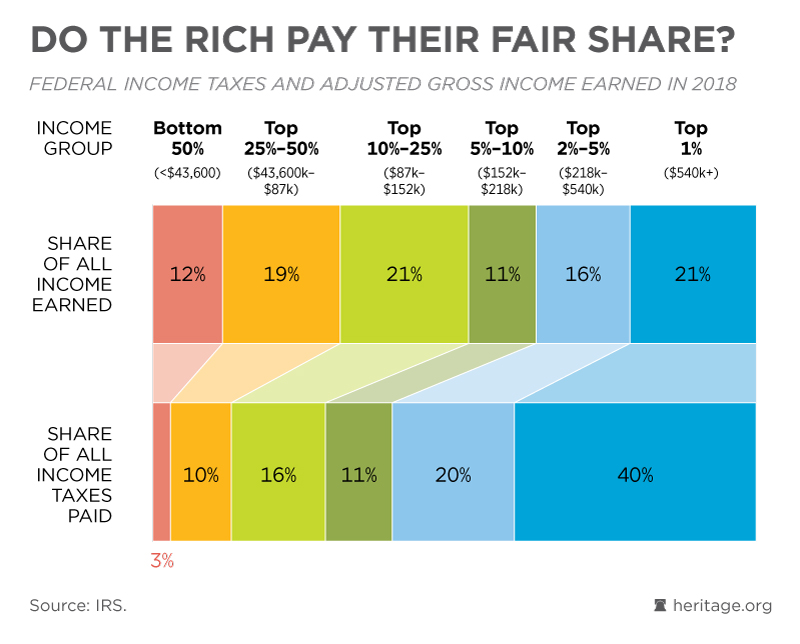

Do The Rich Pay Their Fair Share Federal Budget In Pictures

https://www.federalbudgetinpictures.com/wp-content/uploads/2021/02/FBIP-SOCIAL-04.jpg

Fed Rates 2025 Imran Faye

https://www.taxpolicycenter.org/sites/default/files/publication/137756/01_6.png

What Is The Starting Pay At Lowes

https://creative.artisantalent.com/hs-fs/hubfs/Content_Offers/2016_-_Spring_Hiring_Tools_Campaign/Salary_Guide/2016-Artisan-SalaryGuide-national.jpg?width=1953&height=2529&name=2016-Artisan-SalaryGuide-national.jpg

Luckily when you file your taxes there is a deduction that allows you to deduct the half of the FICA taxes that your employer would typically pay The result is that the FICA taxes you pay are still only 6 2 for Social Security and 1 45 for Medicare How Your Paycheck Works Deductions Tax Year 2025 2026 If you live in California and earn a gross annual salary of 72 280 or 6 023 per month your monthly take home pay will be 4 715 This results in an effective tax rate of 22 as estimated by our US salary calculator

[desc-10] [desc-11]

Irs Tax Withholding Tables 2018 Calculator Cabinets Matttroy

https://i.ytimg.com/vi/Bpta4olQddw/maxresdefault.jpg

How Much Money You Take Home From A 100 000 Salary After Taxes

https://i.pinimg.com/736x/44/7a/ee/447aee88612d958ba5133c2d68141a31.jpg

How Much Do I Pay In Taxes If I Make 300k - View how much tax you may pay in other states based on the filing status and state entered above State Net Pay Effective State Tax Rate Rank Alaska 62 759 0 00 1 Florida 62 759 0 00 1