How Much Should I Pay In Taxes If I Make 100k Estimate your 2023 taxable income for taxes filed in 2024 with our tax bracket calculator Want to estimate your tax refund Use our Tax Calculator Tax Bracket Calculator Enter your tax year filing status and taxable income to calculate your estimated tax rate What Is My Tax Rate 2021 Filing status Annual taxable income

The rate on the first 11 000 of taxable income would be 10 then 12 on the next 33 725 then 22 on the final 5 275 falling in the third bracket This is because marginal tax rates only apply to income that falls within that specific bracket That brings 100 000 in gross income down to 75 200 in taxable income Moreover the tax brackets for married couples who file jointly are more favorable The calculated tax ends up being

How Much Should I Pay In Taxes If I Make 100k

How Much Should I Pay In Taxes If I Make 100k

https://i.ytimg.com/vi/V9X30VkLRtY/maxresdefault.jpg

What Price House Can I Afford If I Make 100k A Year Check This

https://qohouse.com/wp-content/uploads/2022/05/what-price-house-can-i-afford-if-i-make-100k-a-year-768x390.jpg

How Much Do You Pay In Taxes If You Make 40k

https://financeband.com/assets/675/how-much-do-you-pay-in-taxes-if-you-make-40k.jpg

Use this tool to Estimate your federal income tax withholding See how your refund take home pay or tax due are affected by withholding amount Choose an estimated withholding amount that works for you Results are as accurate as the information you enter Curious how much you might pay in federal and state taxes this year You can use our Income Tax Calculator to estimate how much you ll owe or whether you ll qualify for a refund Simply

Federal Paycheck Quick Facts Federal income tax rates range from 10 up to a top marginal rate of 37 The U S real median household income adjusted for inflation in 2022 was 74 580 9 U S states don t impose their own income tax for tax year 2023 How Your Paycheck Works Income Tax Withholding When your income jumps to a higher tax bracket you don t pay the higher rate on your entire income You pay the higher rate only on the part that s in the new tax bracket 2023 tax rates for a single taxpayer For a single taxpayer the rates are Tax rate on taxable income from up to 10 0 10 275 12 10 276 41 775 22

More picture related to How Much Should I Pay In Taxes If I Make 100k

Do I Pay More Taxes If I Make More Money Understanding The Canadian

https://i.ytimg.com/vi/zupYEeHuZE8/maxresdefault.jpg

How Much House Can I Afford 15 Year Fixed SWOHM

https://lh3.googleusercontent.com/proxy/uMr9gY8TOq9BciwNp3TgCE_RvUkEN-7qkShqNF_UNPDa_Ix4PYJFBizHVAyr1mX8MCG7d9u5BfykknEvxkidTuhVKJtmpiGOH5ljpnllW66QN_jHiecLwu2noAX3o_i5=w1200-h630-p-k-no-nu

29000 A Year Is How Much A Month After Taxes New Update

https://i.ytimg.com/vi/ieA-bmoFk3k/maxresdefault.jpg

The standard deduction or itemizing your deductions the standard deduction amounts for tax year 2023 are the following 13 850 for single taxpayers or couples filing separately under 65 years The standard deduction is the amount taxpayers can subtract from income if they don t list deductions separately When it comes to filing your taxes one of the first big decisions to make is

The fastest and easiest way to make estimated tax payments is electronically using Direct Pay or Electronic Federal Tax Payment System Taxpayers can visit IRS gov for other payment options More information Pay as You Go So You Won t Owe Estimated Taxes Form W 4S Request for Federal Income Tax Withholding from Sick Pay 2024 US Tax Calculation for 2025 Tax Return 100k Salary Example If you were looking for the 100k Salary After Tax Example for your 2024 Tax Return it s here Brace yourselves for a surprise

36 How Much Can I Borrow If I Make 100k JacilynAnnesu

https://i.pinimg.com/736x/69/52/a7/6952a7a08275cb3b45d2bff0201ab33c.jpg

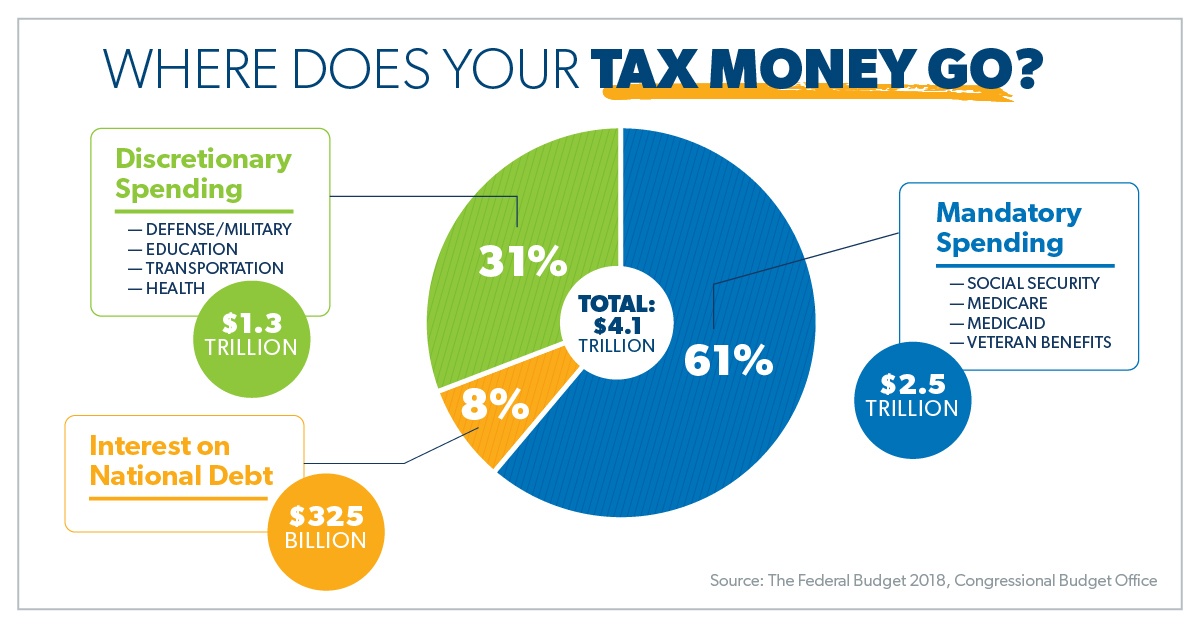

Waar Gaat Je Belastinggeld Heen Adam Faliq

https://cdn.ramseysolutions.net/media/b2b/elp/blog/where-does-your-tax-money-go-infographic.jpg

How Much Should I Pay In Taxes If I Make 100k - Not everyone is required to file taxes but most Americans must and likely will submit a return Of the 176 2 million individuals and married couples who could file a return in 2020 about 144 5