How Much A Year Is 22 Dollars An Hour After Taxes Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary It can also be used to help fill steps 3 and 4 of a W 4 form This calculator is intended for use by U S residents The calculation is based on the 2024 tax brackets and the new W 4 which in 2020 has had its first major

Hourly wage Hourly wage Hours worked per day Days worked per week Weeks worked per year Your weekly paycheck Step 2 Federal income tax liability There are four substeps to take to work out your total federal taxes Step 2 1 Gross income adjusted The formula is Gross income Pre tax deductions Gross income adjusted 2013 46 992 If you file in Georgia as a single person you will get taxed 1 of your taxable income under 750 If you earn more than that then you ll be taxed 2 on income between 750 and 2 250 The marginal rate rises to 3 on income between 2 250 and 3 750 4 on income between 3 750 and 5 250 5 on income between 5 250 and

How Much A Year Is 22 Dollars An Hour After Taxes

How Much A Year Is 22 Dollars An Hour After Taxes

https://savvybudgetboss.com/wp-content/uploads/2021/12/20-dollars-an-hour-is-how-much-a-year-1-1280x720.jpg

25 An Hour Is How Much A Year Can I Live On It Money Bliss

https://moneybliss.org/wp-content/uploads/2021/09/25-per-hour-is-how-much-per-year.jpg

Calculating Your Compensation Hourly To Salary Calculator Reintech

https://reintech.io/rails/active_storage/blobs/redirect/eyJfcmFpbHMiOnsibWVzc2FnZSI6IkJBaHBBaHBZIiwiZXhwIjpudWxsLCJwdXIiOiJibG9iX2lkIn19--7c31643c9e9bf67d867963af29f6bf15b99a2c7f/Знімок екрана 2022-03-22 о 17.22.13.png

Employees pay 1 45 from their paychecks and employers are responsible for the remaining 1 45 If you earn wages in excess of 200 000 single filers 250 000 joint filers or 125 000 married people filing separately you will have to pay an additional 0 9 Medicare surtax which employers do not match The Hourly Wage Tax Calculator uses tax information from the tax year 2023 to show you take home pay See where that hard earned money goes Federal Income Tax Social Security and other deductions If you do any overtime enter the number of hours you do each month and the rate you get paid at for example if you did 10 extra hours each

The average annual salary in the United States is 69 368 which is around 4 537 a month after taxes and contributions depending on where you live However extremely high earners tend to bias averages Likewise average salaries vary state by state such as California s salaries averaging 83 876 a year compared to Florida s at 63 336 The amount entered here will be multiplied times the hours you enter in the next field to come up with your gross pay 12 22 24 32 35 or 37 2024 Tax Rate Single Married Filing Jointly Head of Household Unlimited companies employees and payroll runs for only 199 a year All 50 states including local taxes and multi state

More picture related to How Much A Year Is 22 Dollars An Hour After Taxes

22 An Hour Is How Much A Year After Taxes

https://michaelryanmoney.com/wp-content/uploads/2022/11/22-an-hour-is-how-much-a-year.jpg

Hourly Rate Equivalent To Yearly Salary DominicTeresa

https://www.howtofire.com/wp-content/uploads/23-dollars-an-hour-1024x800.png

28 An Hour Is How Much A Year SpendMeNot

https://spendmenot.com/wp-content/uploads/2022/09/27-an-Hour-Is-How-Much-a-Year.jpg

In 2022 your employer will withhold 6 2 of your wages up to 147 000 for Social Security Additionally you must pay 1 45 of all of your wages for Medicare without any limitations If you Whether your pay is weekly bi weekly monthly or yearly this calculator can help you figure out your after tax income once you enter your gross pay and additional details Use our take home pay

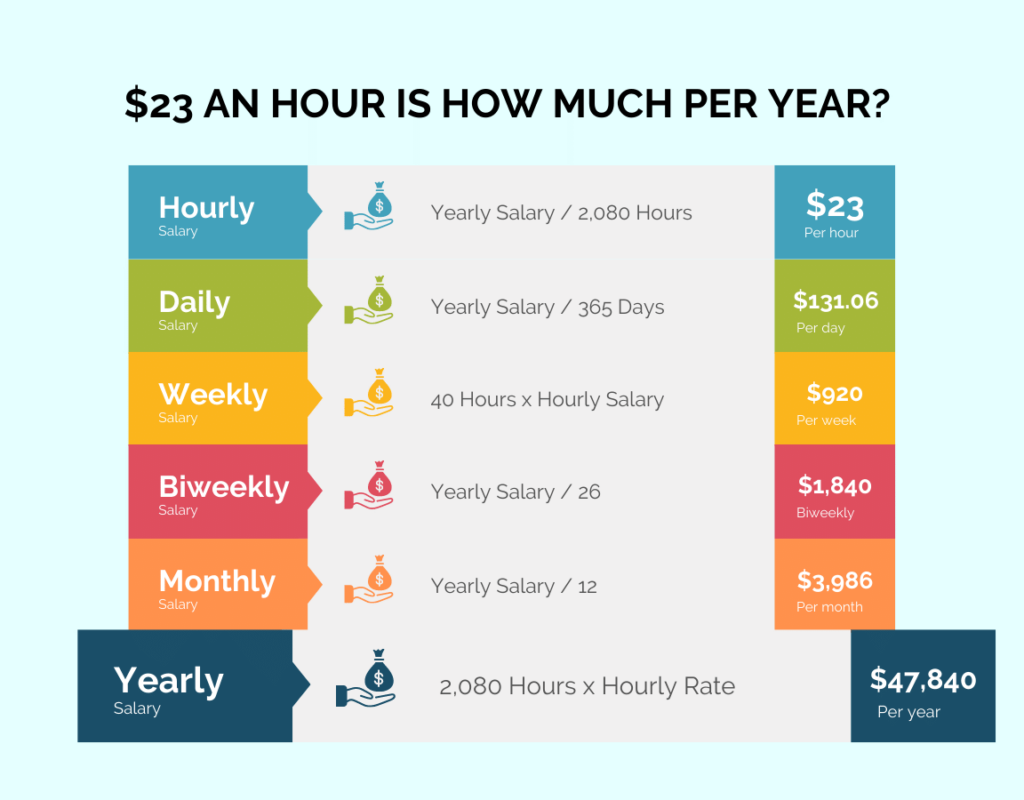

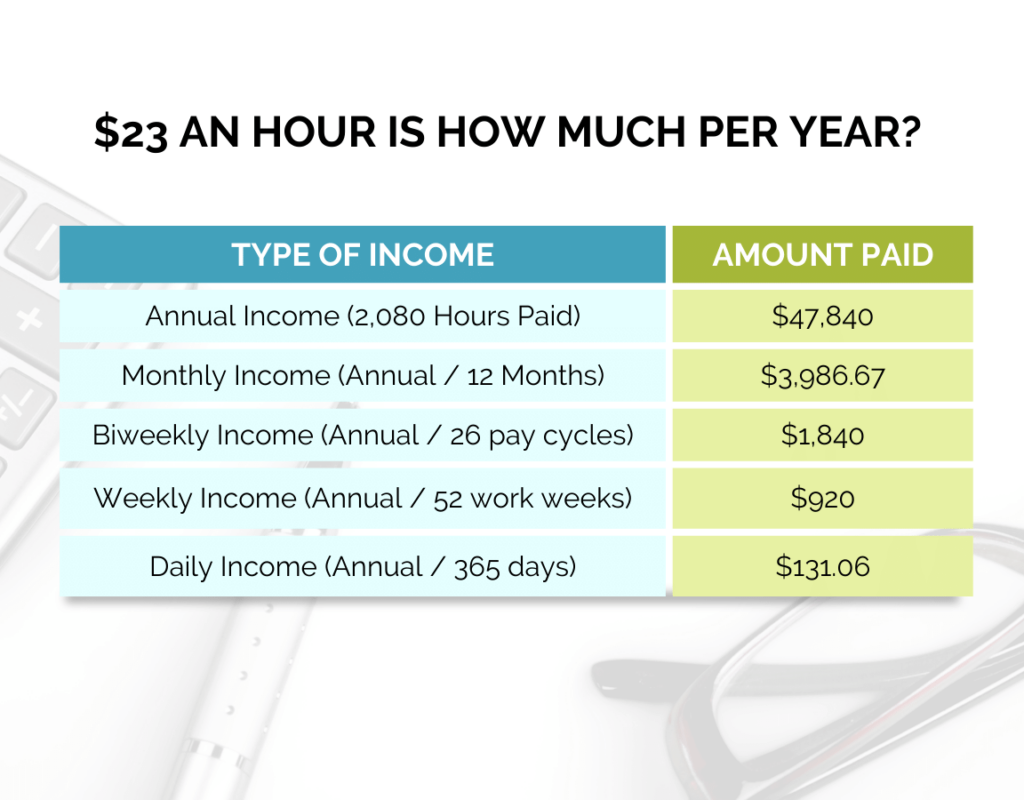

A typical working year is 260 days 260 working days are equal to 52 working weeks I Our today s question is 25 an hour is how much a year not adjusted for holidays and vacation In this case your hourly pay is 25 dollars You worked 25 hours per week for 5 days per week We re going to use equations typical for all hourly to salary The paycheck tax calculator is a free online tool that helps you to calculate your net pay based on your gross pay marital status state and federal tax and pay frequency After using these inputs you can estimate your take home pay after taxes The inputs you need to provide to use a paycheck tax calculator

Translate Annual Salary To Hourly KerrynBalqees

https://www.howtofire.com/wp-content/uploads/23-an-hour-salary-1024x800.png

20 An Hour Is How Much A Year Good Financial Cents

https://www.goodfinancialcents.com/wp-content/uploads/2023/04/20-dollars-per-hour-scaled.jpg

How Much A Year Is 22 Dollars An Hour After Taxes - The Hourly Wage Tax Calculator uses tax information from the tax year 2023 to show you take home pay See where that hard earned money goes Federal Income Tax Social Security and other deductions If you do any overtime enter the number of hours you do each month and the rate you get paid at for example if you did 10 extra hours each