What Is Net Income For Tax Purposes Canada The above deductions result in net income before adjustments line 23400 on the tax return The line 23400 amount is used to calculate clawbacks of OAS employment insurance and Canada Recovery Benefit and to calculate Canada Workers Benefit Medical Expense Tax Credit and many other tax credits Net Income For Tax Purposes Line 23600

For this reason you would need to reconcile your business net income with the net income required for tax purposes using the schedule 1 form How to Calculate Net Income For Individuals Your net income is shown on line 23600 of your income tax and benefit return To get your net income first you need to calculate your total income on line The proper definition of net income means gross minus expenses tax deductions For a T4 employee employee your deductions expenses are basically RRSP and maybe the WFH tax credit Basically the colloquial use of net income is incorrect because the tax you pay isn t an expense and when we say net income we should really be saying after tax income

What Is Net Income For Tax Purposes Canada

What Is Net Income For Tax Purposes Canada

http://hustlersdigest.com/wp-content/uploads/2021/02/how-to-find-net-income-scaled.jpg

How Do You Get From Net Income For Tax Purposes To Taxable Income To

https://kpu.pressbooks.pub/app/uploads/sites/162/2019/04/Screen-Shot-2020-01-04-at-2.42.00-PM-1.png

How Do You Get From Net Income For Tax Purposes To Taxable Income To

https://kpu.pressbooks.pub/app/uploads/sites/34/2019/05/Screen-Shot-2020-01-04-at-2.38.37-PM.png

Your federal net income is reported on line 23600 Your Qu bec net income is reported on line 275 Note If you need this information to complete the Newcomers page in H R Block s tax software you ll also need to determine how much of the income reported on line 23600 was earned while your spouse was living in and outside of Canada if Calculating net income for tax and OAS purposes I like your definition of net income Kevin It sounds logical But it is not the definition the Canada Revenue Agency CRA uses

2025 federal income tax rates These rates apply to your taxable income Your taxable income is your income after various deductions credits and exemptions have been applied There are also various tax credits deductions and benefits available to you to reduce your total tax payable Understanding the difference between total income net income and taxable income is crucial for managing your finances in Canada These terms may seem interchangeable but they each have a distinct meaning and play different roles in how your taxes are calculated Misunderstanding these can lead to errors on tax filings missed deductions and even a

More picture related to What Is Net Income For Tax Purposes Canada

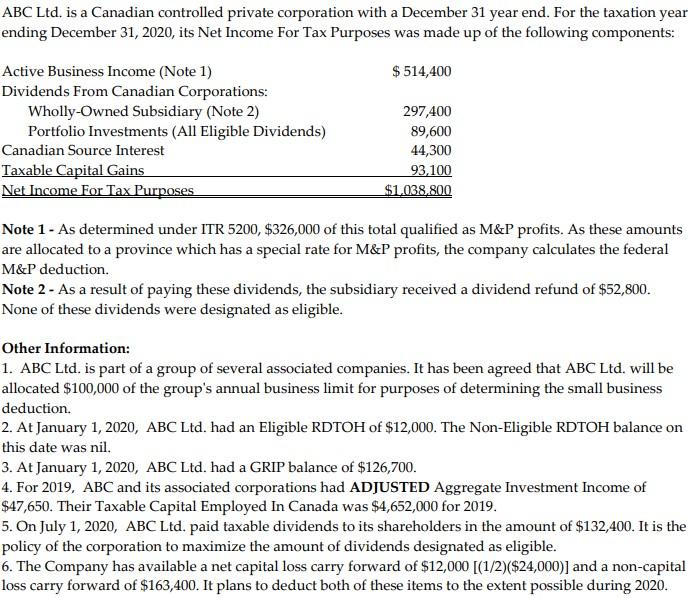

ABC Ltd Is A Canadian Controlled Private Corporation Chegg

https://media.cheggcdn.com/media/8e5/8e5569dd-5ef1-4c25-95fd-55a52e54d13c/phpWuHcE5

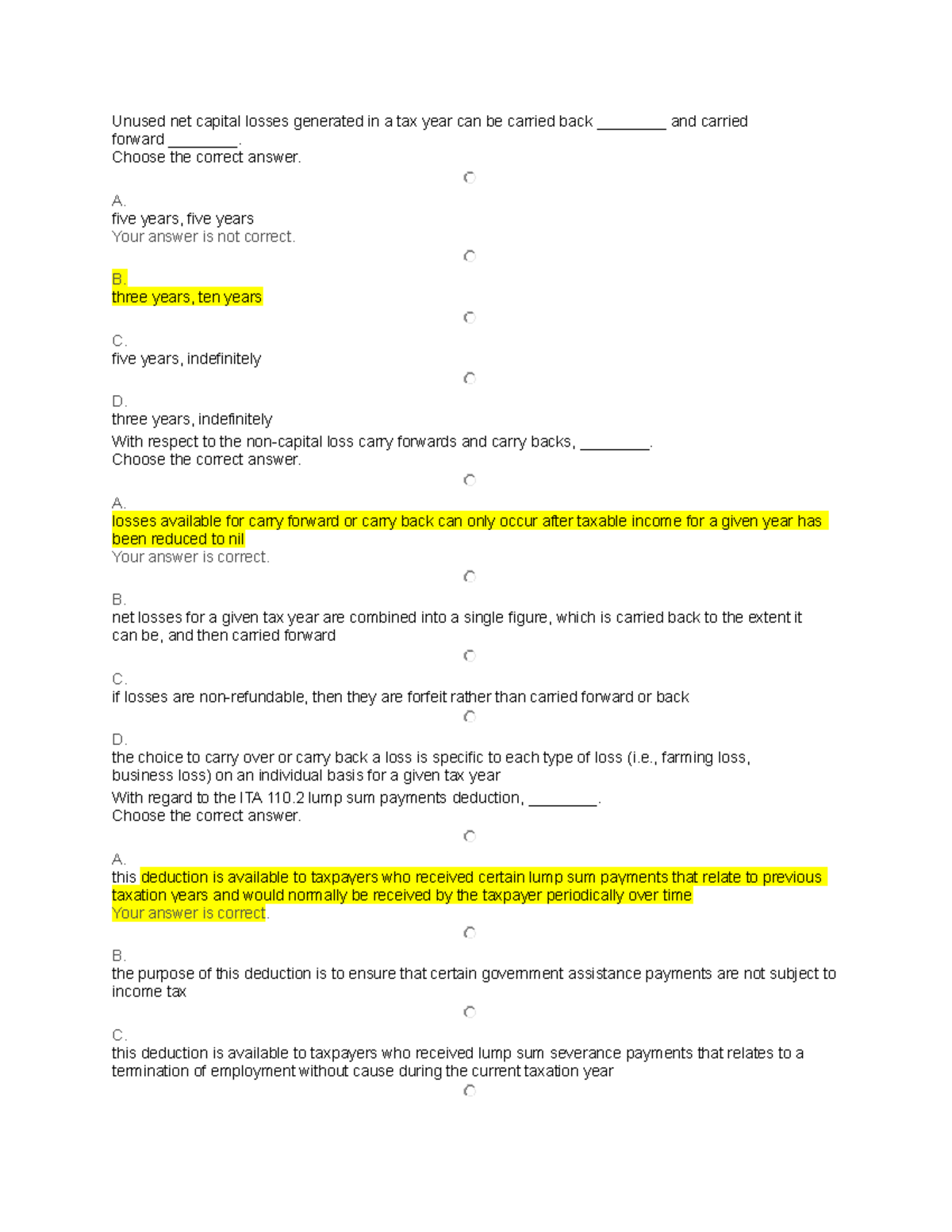

Sample Question For Tax 2 Unused Net Capital Losses Generated In A

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/74ba378144ce6f5321b7ff0772ffaa3a/thumb_1200_1553.png

Hodv b Choroba Stato nos How To Calculate Net Profit Pay ialenstvo

https://images.contentful.com/ifu905unnj2g/66K2AdsLlvARouig6tdw8D/9fb05a7c0c4b54eca5f4d7bb8c04ce1c/Net_income_formula.jpg

Interest and other investment income including bank accounts term deposits GICs and other similar investments Canada savings bonds treasury bills earnings on life insurance policy foreign income investment filter 12200 Net partnership income limited or non active partners only 12500 Registered disability savings plan income Division B income Net Income for Tax Purposes is determined by using the ordering rules found in Section 3 of ITA Under the ordering rules formula a person s net income for tax purposes would be calculated as follows Step 1 ITA 3 a Determining income revenues net of expenses from employment business property and other sources for the year

[desc-10] [desc-11]

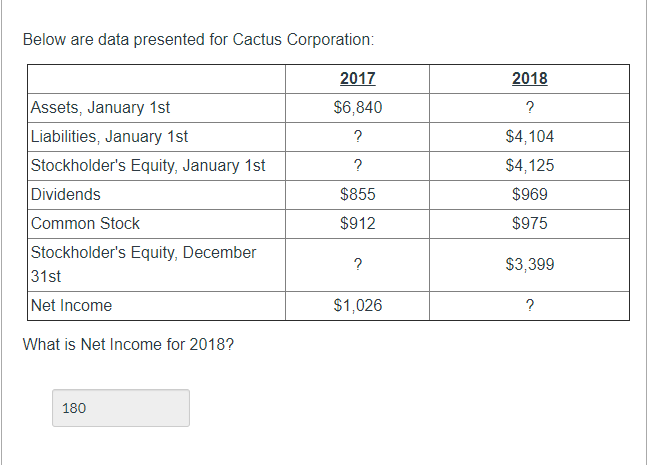

Solved Below Are Data Presented For Cactus Corporation 2018 Chegg

https://i.gyazo.com/0f5cdf3173264cd563eef79debb468f0.png

How Do You Get From Net Income For Tax Purposes To Taxable Income To

https://kpu.pressbooks.pub/app/uploads/sites/84/2019/05/Screenshot-2022-12-30-at-11.24.42-PM.png

What Is Net Income For Tax Purposes Canada - Understanding the difference between total income net income and taxable income is crucial for managing your finances in Canada These terms may seem interchangeable but they each have a distinct meaning and play different roles in how your taxes are calculated Misunderstanding these can lead to errors on tax filings missed deductions and even a