How Do You Calculate Hourly Rate For Semi Monthly Payroll If all you have is the annual gross salary paid semi monthly divide this value by 2080 the average number of work hours in any calendar year If you or your employee made 50 000 in

Divide her salary for the pay period by the number of hours salary is based on For example 50 000 divided by 24 pay periods comes to 2 083 33 which is her semi monthly salary Divide 2 083 33 by 86 67 hours to get hourly rate of 24 04 While semi monthly salaried employees are paid 24 times annually you may need to prorate their salary First determine the total number of hours worked by multiplying the hours per week by the number of weeks in a year 52 Next divide this number from the annual salary For example if an employee has a salary of 50 000 and works 40 hours per week the hourly rate is 50 000 2 080 40 x 52 24 04 How do I calculate taxes from paycheck

How Do You Calculate Hourly Rate For Semi Monthly Payroll

How Do You Calculate Hourly Rate For Semi Monthly Payroll

https://www.bookstime.com/wp-content/uploads/2021/08/9d2fb7f5c1.jpg

Salary Vs Hourly The Difference How To Calculate Hourly Rate From Salary Wrapbook 2022

https://assets-global.website-files.com/5fa0baa5ea5c262586cf8fd0/61392d52372fbfda6e87bb22_Salary vs Hourly - Pros and Cons - Infographic - Wrapbook.jpg

How Do I Calculate My Hourly Rate UK Salary Tax Calculator 2023

https://i0.wp.com/www.income-tax.co.uk/wp-content/uploads/2022/06/how-do-i-calculate-my-hourly-rate-scaled.jpg

Federal Paycheck Quick Facts Federal income tax rates range from 10 up to a top marginal rate of 37 The U S real median household income adjusted for inflation in 2022 was 74 580 9 U S states don t impose their own income tax for tax year 2023 How Your Paycheck Works Income Tax Withholding The Salary Calculator converts salary amounts to their corresponding values based on payment frequency Examples of payment frequencies include biweekly semi monthly or monthly payments Results include unadjusted figures and adjusted figures that account for vacation days and holidays per year Result

The gross pay in the hourly calculator is calculated by multiplying the hours times the rate You can add multiple rates This calculator will take a gross pay and calculate the net pay which is the employee s take home pay Semi monthly is twice per month with 24 payrolls per year If you earn over 200 000 you can expect an extra tax of 9 of your wages known as the additional Medicare tax Your federal income tax withholdings are based on your income and filing status

More picture related to How Do You Calculate Hourly Rate For Semi Monthly Payroll

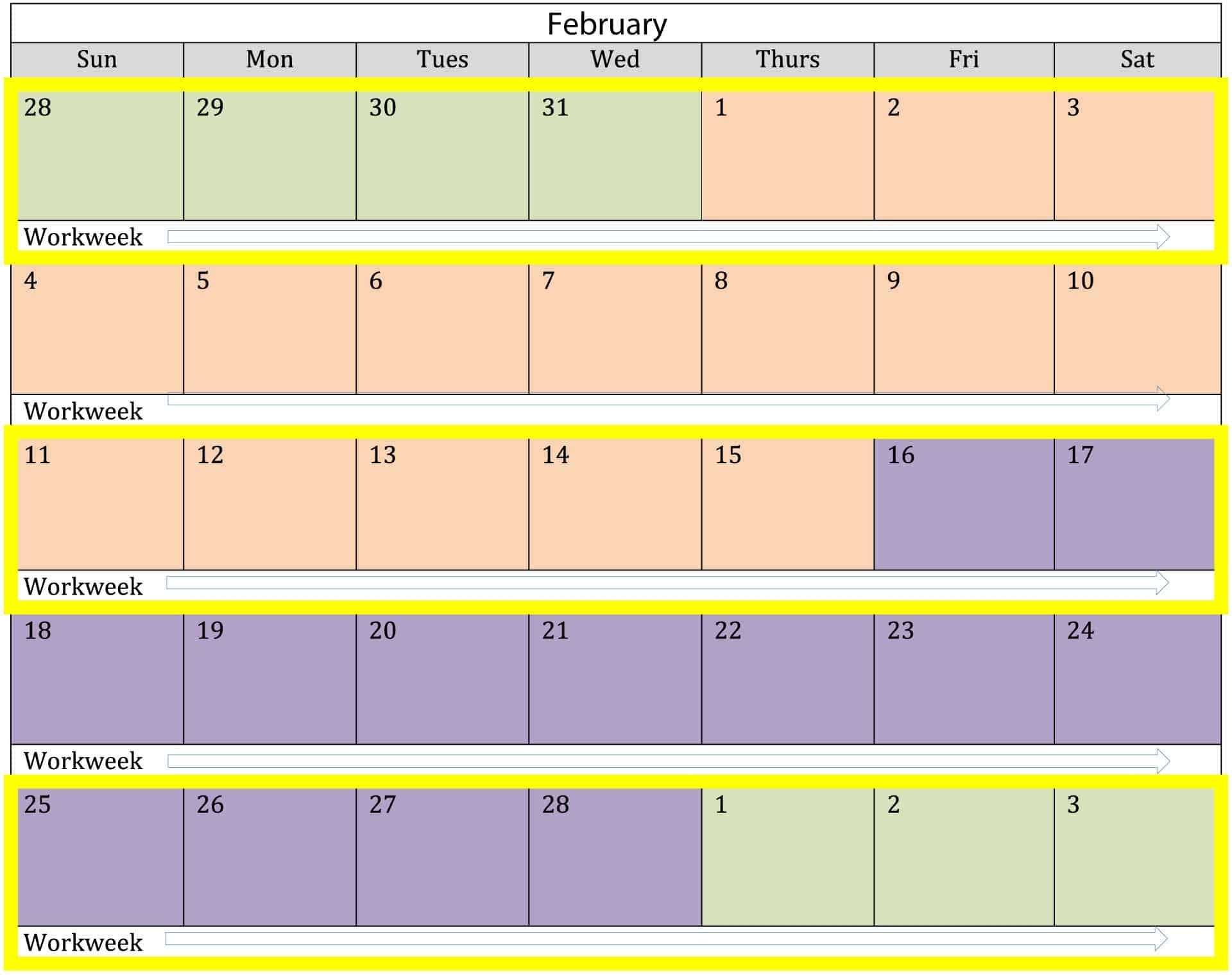

Overtime Hours In A Semi Monthly Pay Period Pay Period Calendars

https://oyungurup.com/wp-content/uploads/2021/01/the-art-of-calculating-overtime-on-a-semi-monthly-pay-schedule-examples-of-2021-semi-monthly-payroll-calendar.jpg

20 Pilgrims Coloring Page CharlesAnice

https://homeschoolgiveaways.com/wp-content/uploads/2022/08/Pilgrim-Coloring-Pages-to-Print-for-Thanksgiving.webp

Calculate Hourly Rate For Semi Monthly Payroll CharlesAnice

https://lh3.googleusercontent.com/blogger_img_proxy/ANbyha1lnVk8XIzeJZDd8XsXF5Z7PoT8v_WMimhp6peK5jpnZKy_lJL_2KIFxhhLU-xU2v8LDqSAiIePRjYccpKv-qPUNsq38ox0gE2Cj8pBwekoEDT5ehoN2f3oKZFWFn-qbQMdPcfpuLD6g0oMcskEiWqdLS6zW71V_7mVMxa1z5ORKQ=s0-d

You can calculate your weekly wage in two ways The first is to multiply your weekly wage by four and the second is to multiply your biweekly wage by two Either option should get you the same result Using the example above these are the options for this calculation 312 50 x 4 1 250 625 x 2 1 250 Step 2 Calculate the annual salary To convert your semi monthly salary into an hourly rate you first need to determine your annual salary Multiply your semi monthly salary by 24 the number of pay periods in a year This will give you your gross annual salary Step 3 Account for taxes and deductions

How to convert a monthly salary to an hourly rate To calculate your hourly rate based upon your monthly salary multiply your monthly figure by 12 and then divide it by the number of hours you work per week and again by the number of paid weeks you work each year Hourly Monthly salary 12 Hours per week Weeks per year These hours are equivalent to working an 8 hour day for a 4 day 5 day work week for 50 weeks per year Annual Income Monthly Income 1 600 Hourly Equivalent 2 000 Hourly Equivalent 10 000 833 33 6 25 5 00

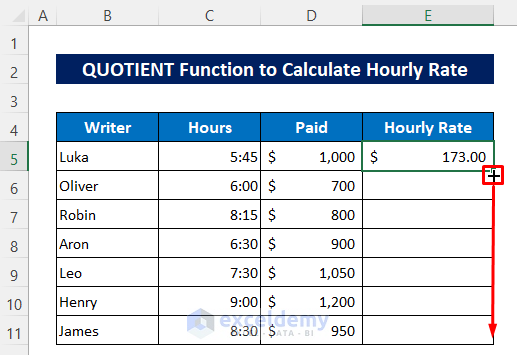

Effective Hourly Rate Calculator GaiusTimoor

https://www.exceldemy.com/wp-content/uploads/2022/02/How-to-Calculate-Hourly-Rate-in-Excel-6.png

Hourly Rate To Yearly Rate Calculator ClausAbdiaziz

https://i.pinimg.com/originals/59/da/c7/59dac7ca6fa0c59d293d6a45cf1ce613.jpg

How Do You Calculate Hourly Rate For Semi Monthly Payroll - The gross pay in the hourly calculator is calculated by multiplying the hours times the rate You can add multiple rates This calculator will take a gross pay and calculate the net pay which is the employee s take home pay Semi monthly is twice per month with 24 payrolls per year