Hourly Rate For Semi Monthly Payroll A1 A semi monthly pay schedule involves receiving paychecks twice a month usually around the 15th and last day of the month Q2 Can I use a semi monthly calculator for hourly employees A2 Yes the semi monthly calculator is adaptable for both salaried and hourly employees Q3 Are deductions the same for everyone

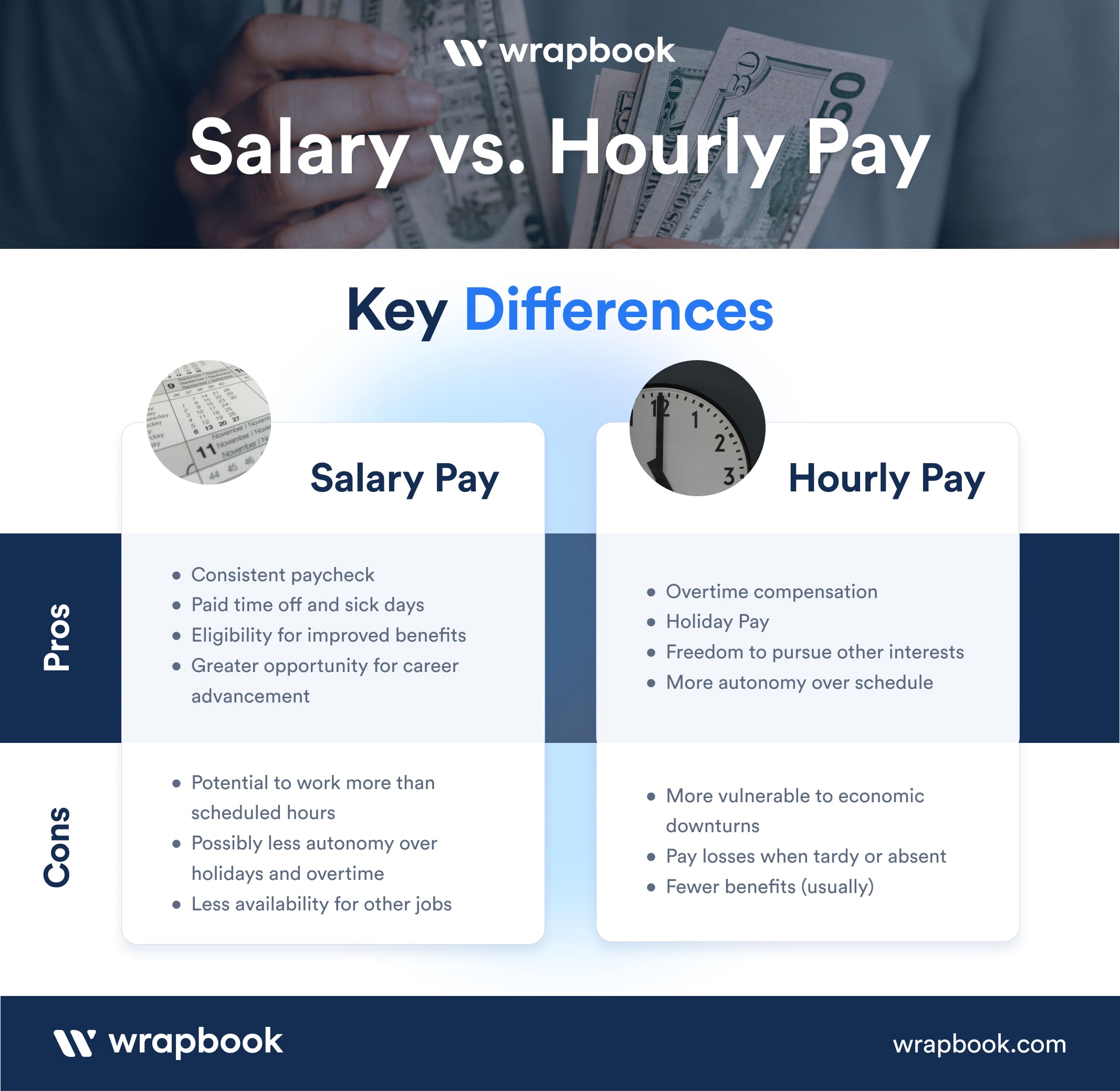

If you take a worker s annual salary 87 400 for example and divide it by 2 087 you ll have determined the hourly rate which in this case is 41 87 per hour Hourly Wage Calculation When giving a semimonthly paycheck to a salaried employee you divide their annual gross salary by 24 the total number of pay periods For example say you pay a salaried employee 72 000 annually using a semimonthly payroll calendar You ll divide 72 000 by 24 to get 3 000 In other words you ll pay them a gross salary of 3 000

Hourly Rate For Semi Monthly Payroll

Hourly Rate For Semi Monthly Payroll

https://support.timesheetmobile.com/hc/en-us/article_attachments/115011055928/3c5f0cb4e5f06eaa2eb27df43bcc1b33542b2c30765db134f0cdc1b2f7c575be.png

Examples Of 2021 Semi Monthly Payroll Calendar Calendar Template

https://oyungurup.com/wp-content/uploads/2021/01/the-art-of-calculating-overtime-on-a-semi-monthly-pay-schedule-examples-of-2021-semi-monthly-payroll-calendar.jpg

Semi Monthly Hourly Pay Calculator AilidhShiloh

https://luxtemplates.com/wp-content/uploads/2021/07/Payroll-Pay-Stubs.png

To figure out prorated pay from a semimonthly payroll divide his annual salary by 24 and then divide the result by the number of workdays in the semimonthly pay period This will Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information What is the difference between bi weekly and semi monthly Bi weekly is once every other week with 26 payrolls per year Semi monthly is twice per month with 24 payrolls per year

When calculating the gross amount of the salaried semi monthly paychecks of your employees simply divide their annual salary by 24 For instance an employee who makes an annual salary of 48 000 will have a semi monthly paycheck of 2 000 This can be calculated using this formula 48 000 24 2 0000 July 24 2020 As a business owner payroll can be your highest expense And determining your pay frequency can impact your business s financial health A semimonthly payroll schedule occurs twice a month A biweekly payroll schedule occurs every two weeks

More picture related to Hourly Rate For Semi Monthly Payroll

Printable Hourly To Salary Chart Printable Word Searches

https://mycareersalary.com/wp-content/uploads/2018/07/Hourly-Salary-Equivalents.jpg

Calculate Hourly Rate For Semi Monthly Payroll KerrisKhyran

https://staffscapes.com/wp-content/uploads/2019/03/semi-monthly-pay-period.jpg

Semi Monthly Payroll Calendar 2023 Printable Word Searches

https://i.pinimg.com/originals/73/e5/19/73e519320e03e1a2db0330e552482dd1.jpg

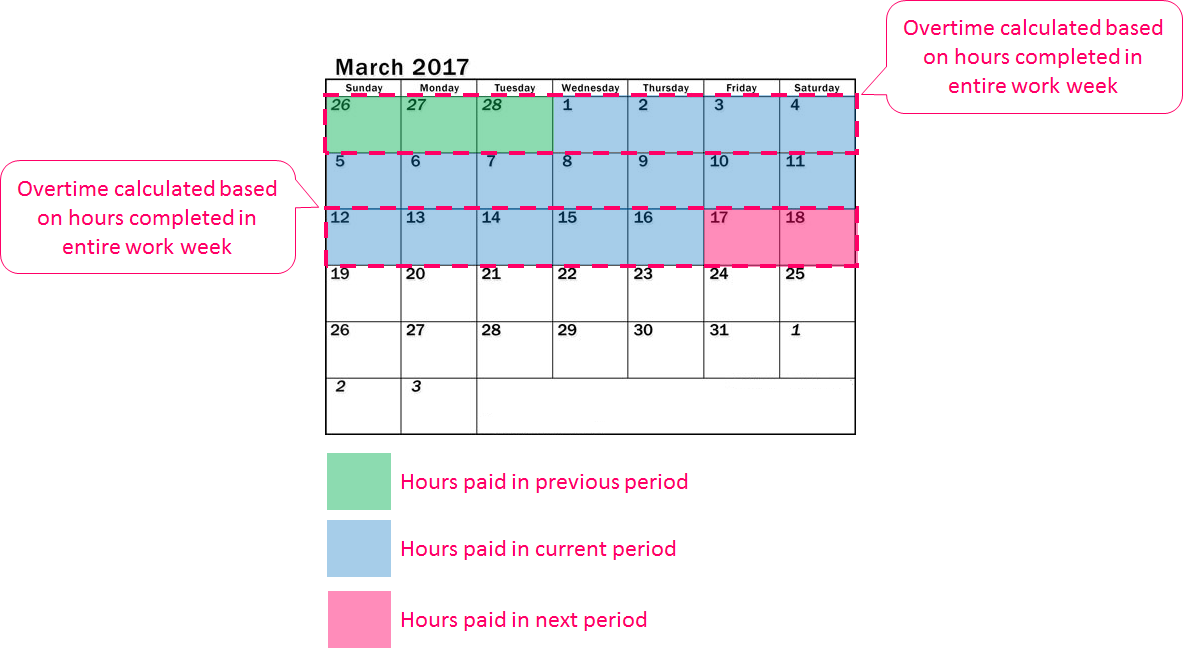

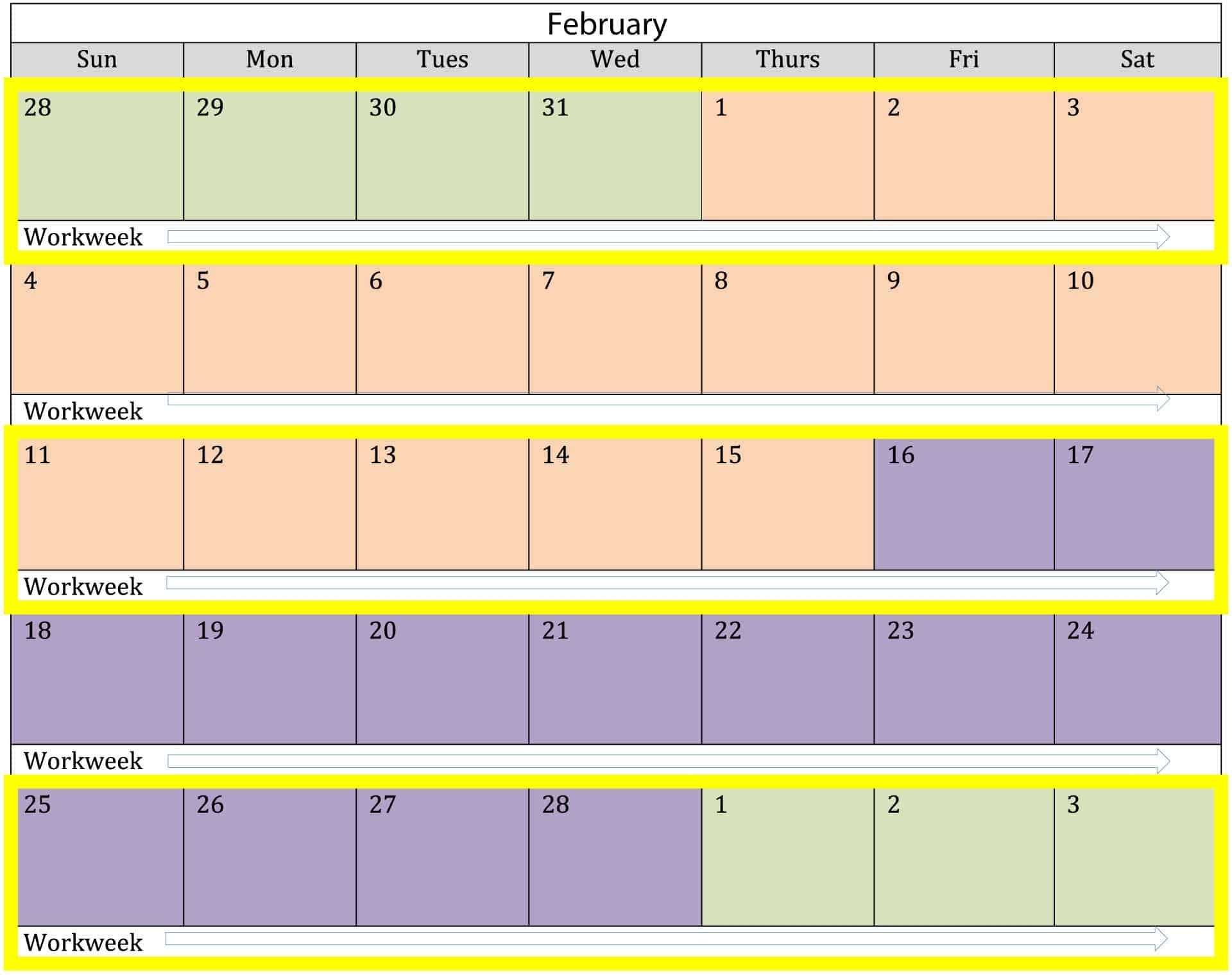

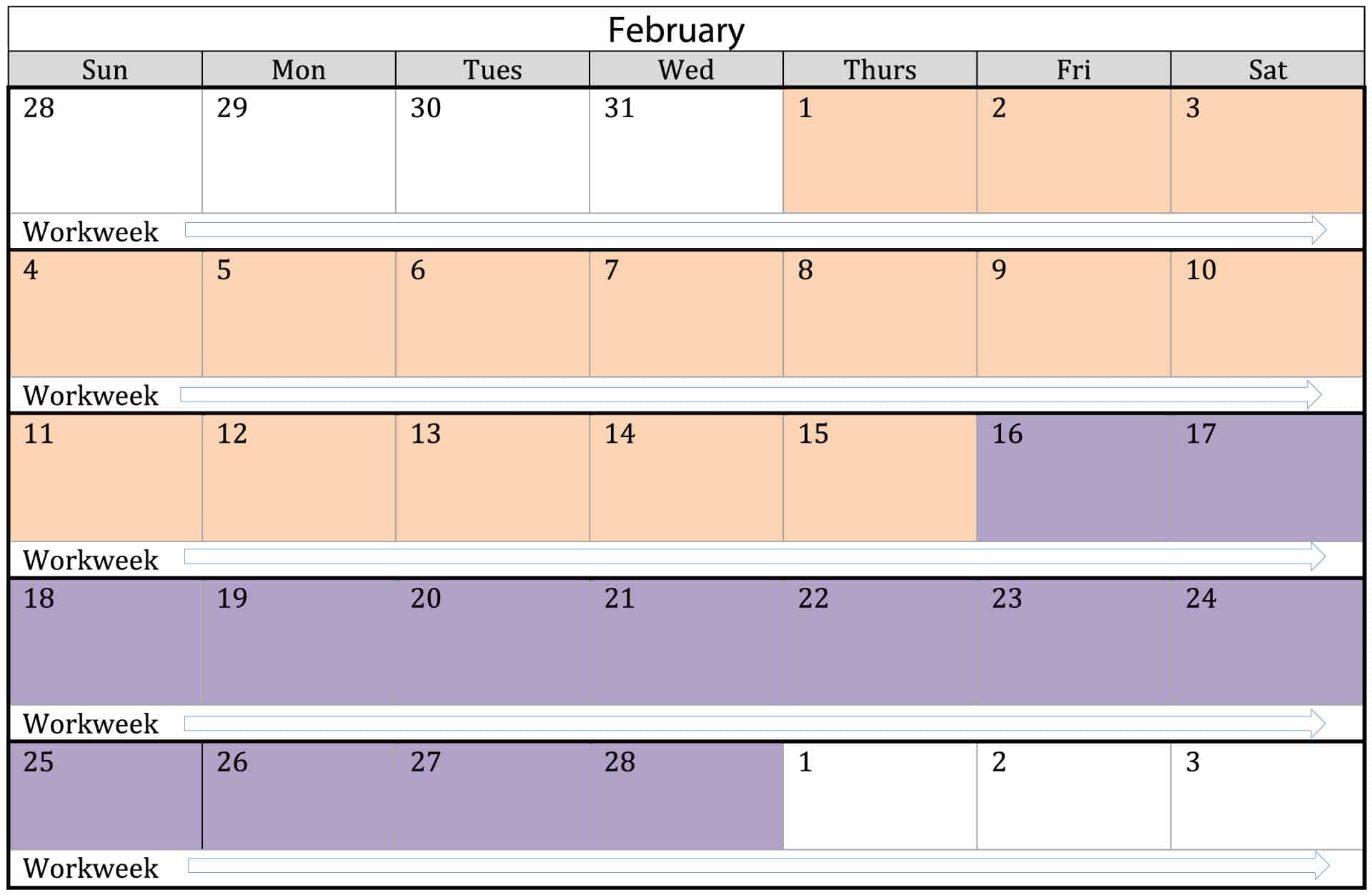

Overtime pay for that week will be 10 x 4 OT hrs 40 The last workweek is split and does not end in the current pay period Payroll will calculate and pay overtime for this workweek in the Semi monthly payroll is a pay cycle in which employees are paid twice a month or every half month Employers who use a semi monthly payroll cycle pay their employees two times every month usually on the 15th and the last day of the month If the employer uses a semi monthly payroll cycle and a pay date falls on a weekend then the employees

Determine the gross pay When determining gross pay you multiply the number of hours worked in the semimonthly pay period by the hourly rate of the employee For example if the hourly rate is 25 per hour and the total amount of hours worked in the semi monthly pay period is 70 this makes the gross pay 70 x 25 1 750 Taxes and other It can convert an hourly wage into the following common pay periods daily weekly bi weekly semi monthly monthly quarterly and annually Or you can enter a weekly monthly or annual wage and see what your effective hourly wage rate is It s simple to use Enter the wages you want to convert into the payroll conversion calculator

Salary Vs Hourly The Difference How To Calculate Hourly Rate From

https://assets-global.website-files.com/6467d96400e84f307e2196ef/6467d96400e84f307e21a675_Salary vs Hourly - Pros and Cons - Infographic - Wrapbook.jpg

2023 Payroll Form Printable Forms Free Online

https://thumbor.forbes.com/thumbor/fit-in/x/https://www.forbes.com/advisor/wp-content/uploads/2023/01/Monthly_Payroll_Calendar-pdf-1.jpg

Hourly Rate For Semi Monthly Payroll - For both reasons you should know your employee s daily rate Divide the gross semi monthly salary for a full pay period by the number of calendar days in that pay period A semi monthly gross pay of 2 000 equates to a daily rate of 133 33 in a pay period with 15 days In a pay period with 16 days the daily rate would be 125