Do State Employees Pay Social Security State and local government employees may be covered for Social Security and Medicare either by mandatory coverage or under a Section 218 Agreement between the state and the Social Security Administration Under some circumstances an employee may be excluded from Social Security or Medicare or both

Congress passed a law in July 1991 extending Social Security on a mandatory basis to most state and local employees These are employees not covered by an agreement or a Social Security equivalent public pension system Except for workers specifically excluded by law employees hired after March 31 1986 also have Medicare protection State and Local Government Employment En espa ol Work you do for a state or local government agency including a school system college or university is covered by Social Security in certain cases If you are covered by both your state or local pension plan and Social Security you pay Social Security and Medicare taxes just as you

Do State Employees Pay Social Security

Do State Employees Pay Social Security

https://mte-media.s3.amazonaws.com/wp-content/uploads/2022/01/25200239/which-states-dont-tax-social-security-benefits.jpg

13 Things You Need To Know About Social Security Vision Retirement

https://images.squarespace-cdn.com/content/v1/5e987637e1c6961885db98a3/1670294092041-83GET7D9MPEF1GO4KRGS/What+you+need+to+know+about+Social+Security.png

Instacart The 2 Billion Grocery Delivery Startup Is Reclassifying

https://o.aolcdn.com/images/dar/5845cadfecd996e0372f/dd12fc31b9c34efca46c74c9cb5e389bcfd02f85/aHR0cDovL28uYW9sY2RuLmNvbS9oc3Mvc3RvcmFnZS9taWRhcy9hMWU3ZDkxYTVhNDZhN2Q4MTFkMWFhMTY1MzNiY2Y1Ni8yMDIxNzY1MTgvaW5zdGFjYXJ0LXNob3BwZXJzLmpwZw==

The Social Security Act allows state and local government employers to exclude some employees from Social Security coverage but only if these employees are enrolled in a retirement plan that meets federal regulations requiring sufficiently generous benefits See here for more information Yes Some positions do not pay into Social Security In 2018 there were 23 2 million state and local government employees 16 6 million 72 had Social Security coverage The other 6 6 million 28 did not have Social Security coverage through their government employment Eight states California Texas Ohio Massachusetts Illinois Colorado Louisiana and Georgia accounted for almost

Social Security Coverage of State and Local Government Employees Social Security is the single largest federal program in terms of the number of Analyst in Social Policybeneficiaries as well as budget It pays cash benefits to over 67 million beneficiaries each month and total benefit payments are almost 119 billion on a monthly basis Your employee contribution rate to CalPERS is also lower than your colleague in the full formula plan For example for state miscellaneous members in Social Security the contribution rate is 8 depending on the bargaining unit or local government agency where you do not pay Social Security taxes the pension you receive from that agency

More picture related to Do State Employees Pay Social Security

2018 Social Security Payments Schedule The Motley Fool

https://g.foolcdn.com/editorial/images/422690/ss-card-and-money-gettyimages-177533853.jpg

For Colorado State Employees Pay Lags And Turnover Climbs

https://www.denverpost.com/wp-content/uploads/2019/11/TDP-L-STATE_EMPLOYEES__HHR3757.jpg?w=1024&h=683

How Much Will I Get From Social Security When I Retire

https://media.marketrealist.com/brand-img/W6UsbhMwx/0x0/how-much-will-i-get-from-social-security-when-i-retire-1633347572623.jpg

Published October 10 2018 Updated May 26 2021 Yes According to Social Security Administration SSA data 89 percent of U S workers ages 21 to 64 are in covered employment meaning they pay into the Social Security system via payroll or self employment taxes But there are groups of non covered employees Social Security benefits are not subject to state income tax in 39 states You are not required to pay any Social Security tax on income that goes past the wage base limit which for 2024 is

Your benefits may increase when you work As long as you continue to work even if you are receiving benefits you will continue to pay Social Security taxes on your earnings However we will check your record every year to see whether the additional earnings you had will increase your monthly benefit If there is an increase we will send you Key Takeaways Working for or retiring from the federal or state government means you have special considerations regarding Medicare coverage The date on which you started your service as a federal or state employee may affect your receipt of Part A and Social Security benefits People in Federal Employee Health Benefits Plans should consider

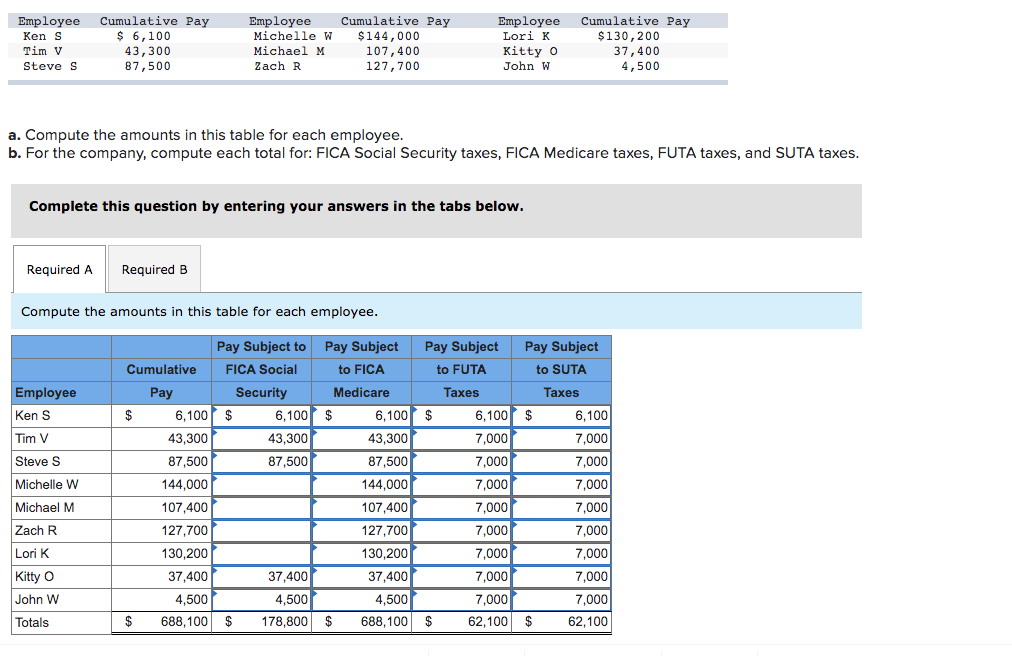

Solved Mest Company Has Nine Employees FICA Social Security Chegg

https://media.cheggcdn.com/media/809/809e7c39-ea50-49e8-9060-41e35d42b3b4/phpFuZvNg.png

https://www.reviewaraidee.com/wp-content/uploads/2021/09/pay-social-security-40-1-1536x1536.jpeg

Do State Employees Pay Social Security - Your employee contribution rate to CalPERS is also lower than your colleague in the full formula plan For example for state miscellaneous members in Social Security the contribution rate is 8 depending on the bargaining unit or local government agency where you do not pay Social Security taxes the pension you receive from that agency