Do Texas State Employees Pay Social Security As public servants State of Texas employees provide critical services to Texans ERS works to support current and former state employees through the State of Texas defined benefit retirement plan To have a comfortable retirement income you cannot rely on a pension plan and Social Security alone Instead you will need to plan invest and

Social Security or from employment in a district that pays into both TRS and Social Security Most Texas school districts do not pay into Social Security Which Social Security benefits am I eligible to receive To be eligible for a Social Security pension benefit you must be at least 62 years old and have a minimum of 40 Social Security Most employees of Texas agencies become members of the ERS retirement plan as soon as they start working Note Employees of higher education institutions do not participate in the ERS retirement program Visit the Higher Education Employees page for more information Throughout their careers with the state employees contribute a percentage of their salaries to the ERS Retirement Trust Fund

Do Texas State Employees Pay Social Security

Do Texas State Employees Pay Social Security

https://mte-media.s3.amazonaws.com/wp-content/uploads/2022/01/25200239/which-states-dont-tax-social-security-benefits.jpg

For Colorado State Employees Pay Lags And Turnover Climbs

https://www.denverpost.com/wp-content/uploads/2019/11/TDP-L-STATE_EMPLOYEES__HHR3757.jpg?w=1024&h=683

https://www.reviewaraidee.com/wp-content/uploads/2021/09/pay-social-security-40-1-1536x1536.jpeg

Before Jan 1 1996 state employees received a state paid FICA supplemental payment of 5 85 percent up to a maximum of 965 25 on their first 16 500 of FICA covered wages The 74th Legislature passed Senate Bill 102 eliminating the state paid Social Security payment effective Dec 31 1995 State and local government employees who are covered by Social Security and Medicare pay into these programs They have the same rights as workers in the private sector State Social Security Administrators Each state has a designated official called the State Social Security Administrator who is responsible for the state s Section 218

Sec 606 063 CONTRIBUTIONS BY STATE AGENCY A state agency may pay contributions on social security coverage of the agency s state employees who are paid from the state treasury as required by an agreement with the secretary from funds appropriated to the comptroller for that purpose Administration of the Texas Social Security Program Administrative responsibilities were transferred to ERS in 1975 As the administrator ERS has oversight for managing referendums or elections held by political subdivisions that provide for Social Security or Medicare Only coverage for employees of local governments State employees

More picture related to Do Texas State Employees Pay Social Security

How Much Will I Get From Social Security When I Retire

https://media.marketrealist.com/brand-img/W6UsbhMwx/0x0/how-much-will-i-get-from-social-security-when-i-retire-1633347572623.jpg

2018 Social Security Payments Schedule The Motley Fool

https://g.foolcdn.com/editorial/images/422690/ss-card-and-money-gettyimages-177533853.jpg

What s Your State s Highest Paid Job Memolition

https://i2.wp.com/memolition.com/wp-content/uploads/2014/03/198ioih2yz6wujpg.jpg

As public servants State of Texas employees provide critical services to Texans ERS works to support current and former state employees through the State of Texas defined benefit retirement plan To have a comfortable retirement income you cannot rely on a pension plan and Social Security alone Instead you will need to plan invest and 3 Social Security If Applicable Approximately 96 of public school employees do not pay into the social security system This makes it even more important to have personal savings If you are currently contributing or have contributed in the past you may receive a social security benefit

[desc-10] [desc-11]

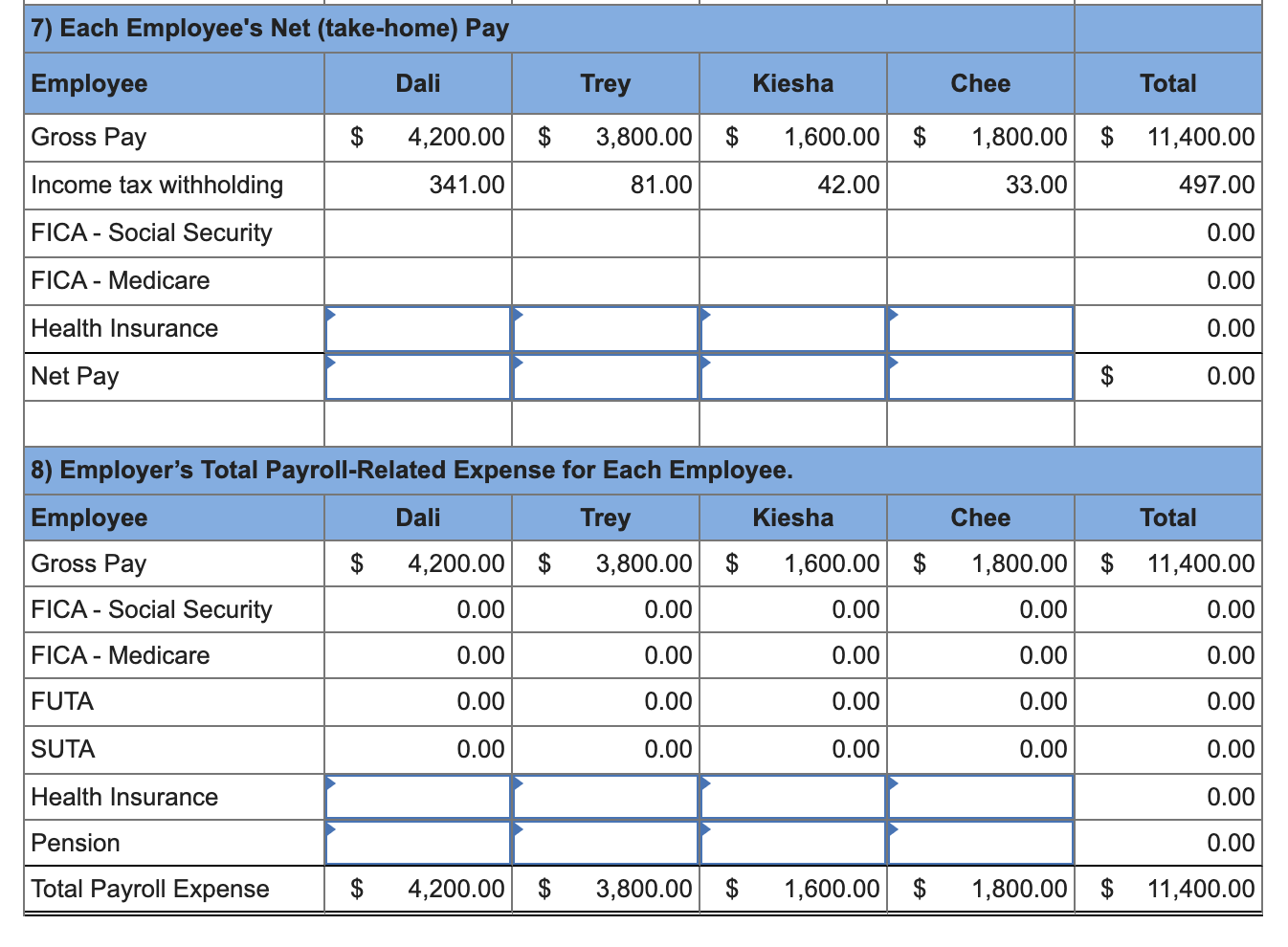

Solved Paloma Company Has Four Employees FICA Social Chegg

https://media.cheggcdn.com/media/829/829cbdea-689d-4a04-822d-85ef6fa6471d/phpy1MkMc

S Corp Tax Savings Calculator NewWay Accounting

https://static.showit.co/800/t0_lGhRVTGGy-jSFlCZ5QQ/156755/screen_shot_2022-01-31_at_1_58_00_pm.png

Do Texas State Employees Pay Social Security - Sec 606 063 CONTRIBUTIONS BY STATE AGENCY A state agency may pay contributions on social security coverage of the agency s state employees who are paid from the state treasury as required by an agreement with the secretary from funds appropriated to the comptroller for that purpose