Anne Arundel County Local Income Tax Rate Residents of Anne Arundel County pay a flat county income tax of 2 56 on earned income in addition to the Maryland income tax and the Federal income tax Nonresidents who work in Anne Arundel County pay a local income tax of 1 25 which is 1 31 lower than the local income tax paid by residents

Taxable Income Tax Rate Taxable Income Tax Rate Three attachments accompany this memorandum the first is the local tax rate used by the Central Anne Arundel County 02 3 20 over 480 000 Single MFS and dependent taxpayer 2 25 1 25 000 2 75 25 001 50 000 Anne Arundel County 2 457 2 457 City of Annapolis 1 467 1 940 3 407 Town of Highland Beach 2 382 1 000 3 382 Anne Arundel County excluding the City of Annapolis and the Town of Highland Beach Public utility operating real property is subject to a 0 280 State Tax per 100 of the full assessed value Services Departments

Anne Arundel County Local Income Tax Rate

Anne Arundel County Local Income Tax Rate

https://i0.wp.com/www.countyforms.com/wp-content/uploads/2022/10/local-earned-income-tax-return-form-pennsylvania-mifflin-county.png?fit=950%2C1229&ssl=1

Pay Anne Arundel County Water Bill Utility And Tax Bill Payment

https://i0.wp.com/southernmarylandchronicle.com/wp-content/uploads/2022/09/fgghfghf.png?fit=1200%2C675&ssl=1

Bloomington City Council Postpones Vote On Local Income Tax Rate

https://snworksceo.imgix.net/ids/d130796d-d2cb-4b1c-834b-e974efc074d0.sized-1000x1000.jpg?w=800&h=600

Anne Arundel Co The local tax rates for taxable year 2025 are as follows For taxpayers with filing statuses of Single Married Filing Separately and Dependent taxpayer the local tax rates are as follows 1 0270 of Maryland taxable net income of 1 through 50 000 2 0294 of Maryland taxable net income of 50 001 through 400 000 and INCOME TAX RATE The local income tax is computed without regard to the impact COUNTY RATES Local tax is based on taxable income and not on Maryland state tax Listed below are the actual 2024 local income tax rates Anne Arundel Cecil Frederick Allegany 3 03 Anne Arundel see below

The Office of Finance is responsible for billing and collecting most of Anne Arundel County s taxes Review the information below to learn about the type of taxes and supporting programs offered by the county Tax Information Business Personal Property Tax Current Tax Rates Real Property Tax 2025 Maryland local income taxes including the nonresident income tax rate and tax forms Local Income Tax Rates in Maryland Choose any locality for details Allegany County 3 05 Anne Arundel County 2 56 Baltimore 3 05 Baltimore County 2 83 Calvert County 2 80 Caroline County 2 63 Carroll County

More picture related to Anne Arundel County Local Income Tax Rate

Anne Arundel Utility And Tax Bill Payment Information Anne Arundel County

https://www.aacc.edu/media/college/cashier/Step-8.jpg

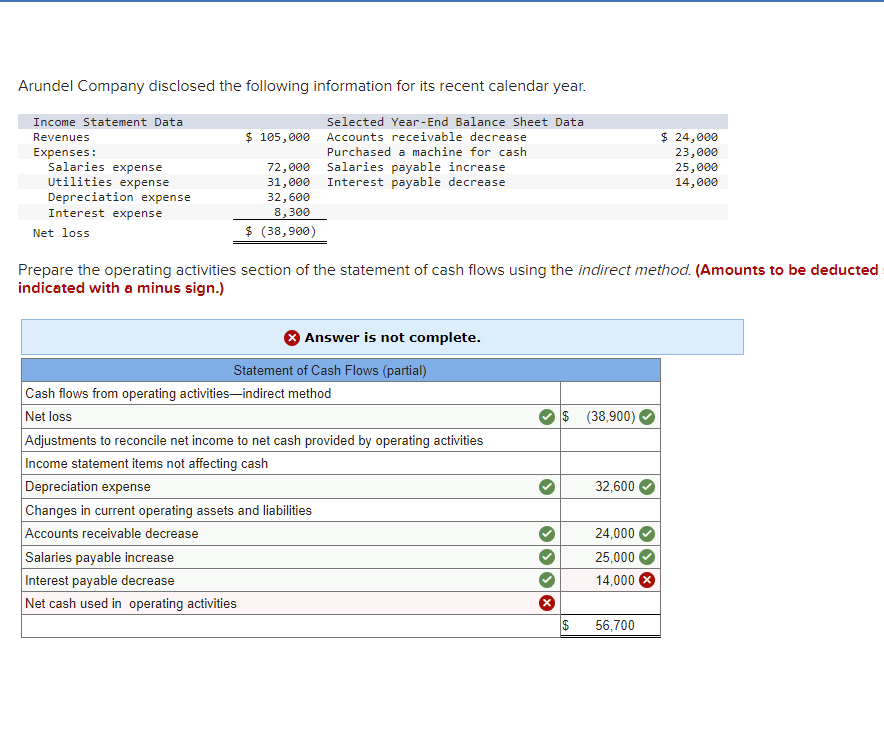

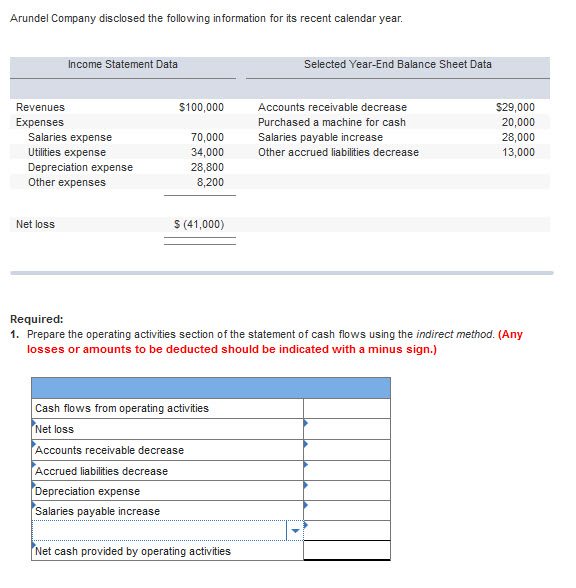

Solved Arundel Company Disclosed The Following Information Chegg

https://media.cheggcdn.com/media/70f/70fdbfe4-6227-4505-a980-c85de3acbd67/phpXRGTtD

Solved Arundel Company Disclosed The Following Information Chegg

https://media.cheggcdn.com/media/880/880c014a-257a-497a-b365-d1cac0f51621/phpVNtdAc.png

County FY 2016 FY 2017 FY 2018 FY 2019 FY 2020 FY 2021 FY 2022 Allegany 0 9780 0 9770 0 9760 0 9750 0 9750 0 9750 0 9750 Anne Arundel 0 9230 0 9150 0 9070 0 9020 0 9350 0 9340 0 9330 Local Income Tax Rates in Maryland 2 County FY 2021 FY 2022 FY 2021 FY 2022 FY 2021 FY 2022 FY 2021 FY 2022 Allegany 3 50 Local Income Tax Each county and Baltimore City must impose a local income tax on the Maryland taxable income of its residents at a rate of at least 2 25 and up to 3 2 Chapter 23 of the 2021 special session increased the minimum required local income tax rate from 1 to 2 25 Local income tax rates may be changed only by ordinance or

[desc-10] [desc-11]

Anne Arundel MD Confined Aquifer Wells Water Table Wells USGS

http://md.water.usgs.gov/groundwater/web_wells/current/confined/counties/anne_arundel/anne_arundel.gif

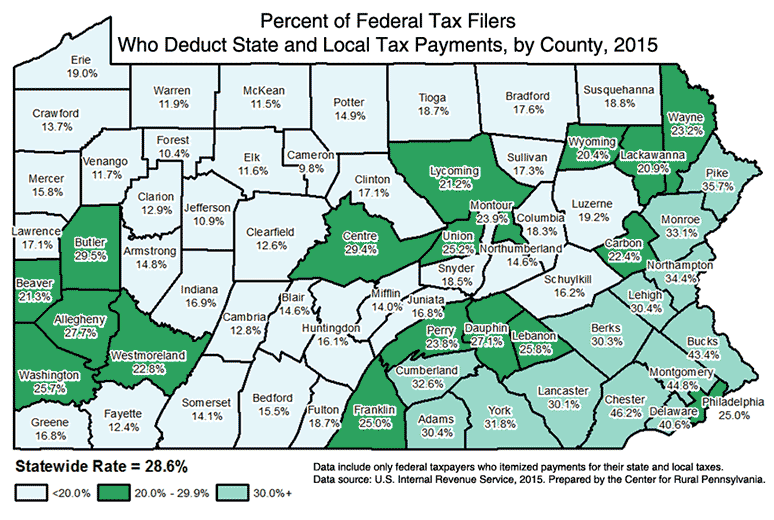

DataGrams Center For Rural PA

https://www.rural.pa.gov/Resources/datagrams/assets/431/demographics_datagram_state_local_tax_deductions_02.png

Anne Arundel County Local Income Tax Rate - [desc-14]