Anne Arundel County Tax Rate Anne Arundel Co The local tax rates for calendar year 2024 are as follows For taxpayers with filing statuses of Single Married Filing Separately or Dependent the local tax rates are as follows Tax General Article 10 106 b a county must provide notice of a county income tax rate change to the Comptroller on or before July 1 prior

Recordation and Transfer Taxes are excise taxes imposed and governed by State and Public Local Law for the privilege of recording an instrument in the County Land Records or in some cases with the State Department of Assessments and Taxation Anne Arundel County has enacted several local property tax credits for the benefit of the Anne Arundel County property tax bills are mailed to the mailing address per the property records maintained by the Maryland Department of Assessments and Taxation If you ve moved you will need to update the mailing address by calling the Maryland Department of Assessments and Taxation at 410 974 5709

Anne Arundel County Tax Rate

Anne Arundel County Tax Rate

https://www.capitalgazette.com/resizer/znX2rRxuYTYHiXPP2zYTm8z36pU=/1200x0/top/arc-anglerfish-arc2-prod-tronc.s3.amazonaws.com/public/TDV6TESELNAALJIO32NF6WKQMQ.jpg

Pay Anne Arundel County Water Bill Utility And Tax Bill Payment

https://i0.wp.com/southernmarylandchronicle.com/wp-content/uploads/2022/09/fgghfghf.png?fit=1200%2C675&ssl=1

Anne Arundel Utility And Tax Bill Payment Information Anne Arundel County

https://www.aacc.edu/media/college/cashier/Step-8.jpg

Residents of Anne Arundel County pay a flat county income tax of 2 56 on earned income in addition to the Maryland income tax and the Federal income tax Nonresidents who work in Anne Arundel County pay a local income tax of 1 25 which is 1 31 lower than the local income tax paid by residents Anne Arundel County and Frederick County both use graduated tax rates Anne Arundel County In 2025 Anne Arundel County s tax rates are 2 7 2 94 and 3 2 but the tax brackets used depend on an individual s filing status For individuals who are single dependent or married filing separately the 2 7 rate applies

The median property tax in Anne Arundel County Maryland is 2 456 per year for a home worth the median value of 370 100 Anne Arundel County collects on average 0 66 of a property s assessed fair market value as property tax Anne Arundel County has one of the highest median property taxes in the United States and is ranked 288th of the 3143 counties in order of median property taxes Please enter new search criteria This screen can be used to find property tax bills Access your account by entering either not both The house number and the street name

More picture related to Anne Arundel County Tax Rate

:quality(70)/arc-anglerfish-arc2-prod-tronc.s3.amazonaws.com/public/DMCH5X55UVFLLP27TXNAK4AXEU.jpg)

Five Things About The Anne Arundel County Tax Cap Capital Gazette

https://www.capitalgazette.com/resizer/kyDmip95Veb7YlOmQwktS4Ehv3M=/1200x630/filters:format(jpg):quality(70)/arc-anglerfish-arc2-prod-tronc.s3.amazonaws.com/public/DMCH5X55UVFLLP27TXNAK4AXEU.jpg

Anne Arundel County Map Gadgets 2018

https://www.aacounty.org/sebin/d/i/aacoMap.jpg

Meet Jessica Haire For Anne Arundel County Executive MoCoGOPClub

https://montgomerycountyrepublicanclub.com/wp-content/uploads/2022/08/296665530_454620183342694_77510278596102019_n-1365x1024.jpg

The median property tax also known as real estate tax in Anne Arundel County is 2 456 00 per year based on a median home value of 370 100 00 and a median effective property tax rate of 0 66 of property value Anne Arundel County collects relatively high property taxes and is ranked in the top half of all counties in the United States by property tax collections The county s effective property tax rate is 0 86 However home values in the county are very high which means annual property tax payments for many homeowners are too The median property tax payment in Anne Arundel County is 3 719 per year nearly 700 higher than the U S median Howard County

[desc-10] [desc-11]

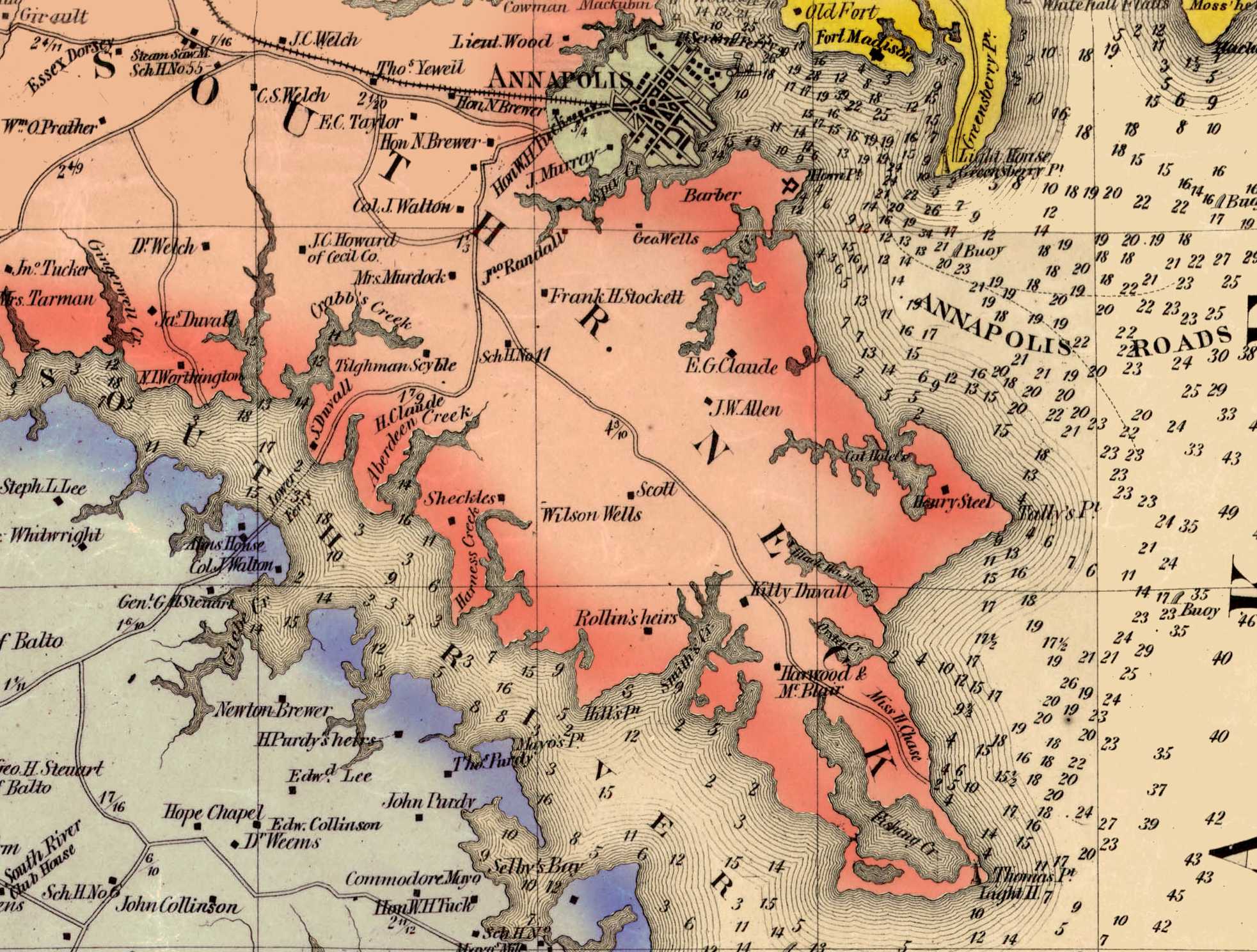

Martenet s 1860 Map Of Anne Arundel County Maryland

https://press.martenet.com/anne_arundel_map/images/Arundel_detail.jpg

Anne Arundel County Tax Lien Certificates Prosecution2012

https://i2.wp.com/prosecution2012.com/wp-content/uploads/2021/04/anne-arundel-county-lien-cert.jpg

Anne Arundel County Tax Rate - [desc-12]