A Salary Reduction Plan Is Also Known As A 62 A salary reduction plan is also known as a A 401 k plan B Money purchase plan C Profit sharing plan D Salary reduction plan E Stock bonus plan e 63

A n cannot be changed or ended irrevocable trust An employer s contribution will vary according to the company s profits in a Profit sharing plan This is also known as an inter vivos trust Living trust A salary reduction plan is also known as a 401 k plan A n administers a trust Salary Reduction Contribution A cash or deferred contribution arrangement of an employer sponsored retirement plan under which participants can choose to set aside part of their pre tax

A Salary Reduction Plan Is Also Known As A

:max_bytes(150000):strip_icc()/401k-retirement-plan-beginners-357115_FINAL2-430f125e634544fe80440a1cf026eafe.png)

A Salary Reduction Plan Is Also Known As A

https://www.thebalancemoney.com/thmb/Zk5vHtGLbBP1-iwLMiDVgM_ZAWs=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/401k-retirement-plan-beginners-357115_FINAL2-430f125e634544fe80440a1cf026eafe.png

:max_bytes(150000):strip_icc()/401kplan.asp-4103bbcbcf0943068955a6c47d6eca0c.png)

What Is a 401(k) and How Does It Work?

https://www.investopedia.com/thmb/9Rj4BAvEf2P_WLFphJolmALSRUw=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/401kplan.asp-4103bbcbcf0943068955a6c47d6eca0c.png

:max_bytes(150000):strip_icc()/PAYE-4191518-final-1-dd5d1c31e57448ec9f12724edebebee3.png)

Pay As You Earn – PAYE Definition

https://www.investopedia.com/thmb/8SmLn1leLjYIIzK9JBtYhbPoNME=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/PAYE-4191518-final-1-dd5d1c31e57448ec9f12724edebebee3.png

A salary reduction contribution plan allows employees to reduce their taxable income by investing for retirement So an employee s salary isn t really reduced rather the employer deducts a percentage of their salary and deposits the funds in a retirement savings plan so the money can grow tax deferred Common employer sponsored retirement Payroll Deduction Plan A contribution plan in which an employer deducts a specified amount from an employee s pay and puts the funds toward insurance healthcare or an investment account In most

A 403 b plan also known as a tax sheltered annuity plan is a retirement plan for certain employees of public schools employees of certain Code Section 501 c 3 tax exempt organizations and certain ministers A 403 b plan allows employees to contribute some of their salary to the plan The employer may also contribute to the plan for The most common types of salary reduction plans are 401 k plans tax deferred annuity or 403 b plans these generally cover university professors and public school teachers and 457 plans sponsored by state and local governments and other tax exempt organizations A SIMPLE IRA is also a salary reduction plan

More picture related to A Salary Reduction Plan Is Also Known As A

What is a Salary Band? A Guide for HR Professionals

https://d341ezm4iqaae0.cloudfront.net/assets/2020/03/11210002/Salary_Bands02.jpg

:max_bytes(150000):strip_icc()/Dollar-Cost-Averaging-DCA-f79fcd89eaa34bb7adad3dacc3129798.png)

Dollar-Cost Averaging (DCA) Explained With Examples and Considerations

https://www.investopedia.com/thmb/4HAKzkL446Dw8p_bn9iYrBqO39g=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/Dollar-Cost-Averaging-DCA-f79fcd89eaa34bb7adad3dacc3129798.png

:max_bytes(150000):strip_icc()/payroll-4191484-3x2-final-1-008077377d4a4d36bec1424f414b0d9d.png)

What Is Payroll, With Step-by-Step Calculation of Payroll Taxes

https://www.investopedia.com/thmb/rGOF-QKE0eYuw246KZxYS2u7wAs=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/payroll-4191484-3x2-final-1-008077377d4a4d36bec1424f414b0d9d.png

A salary reduction also frequently occurs when an employee decides to leave a current management role to go back into a job as an individual contributor Salary Reduction by Personal Choice In a third scenario say that you are job searching You receive several job offers that are a salary reduction from what you believe you are qualified to 7 SIMPLE IRA Sponsor Eligible Employer employer with 100 or fewer employees that does not currently maintain another plan Key Advantage salary reduction plan with little administrative paperwork Employer s Role set up plan employer may use Form 5304 SIMPLE or Form 5305 SIMPLE transmit contributions for employees to SIMPLE IRA no annual filing requirement

Terms in this set 11 A salary reduction plan is also known as a 401k plan An employer may choose to match the contribution made by employees in a n 401 k plan or salary reduction plan Julian s annual contributions to his retirement are not tax deductible but his earnings accumulate tax free He is investing in a Thus it is Income tax Another type of supplemental retirement program is the salary reduction plan mare commonly known as a 401 k Some features of this type of plan include the following An employee option to divert part of their salary to a company sponsored tax sheltered savings account In this way the earnings diverted accumulate

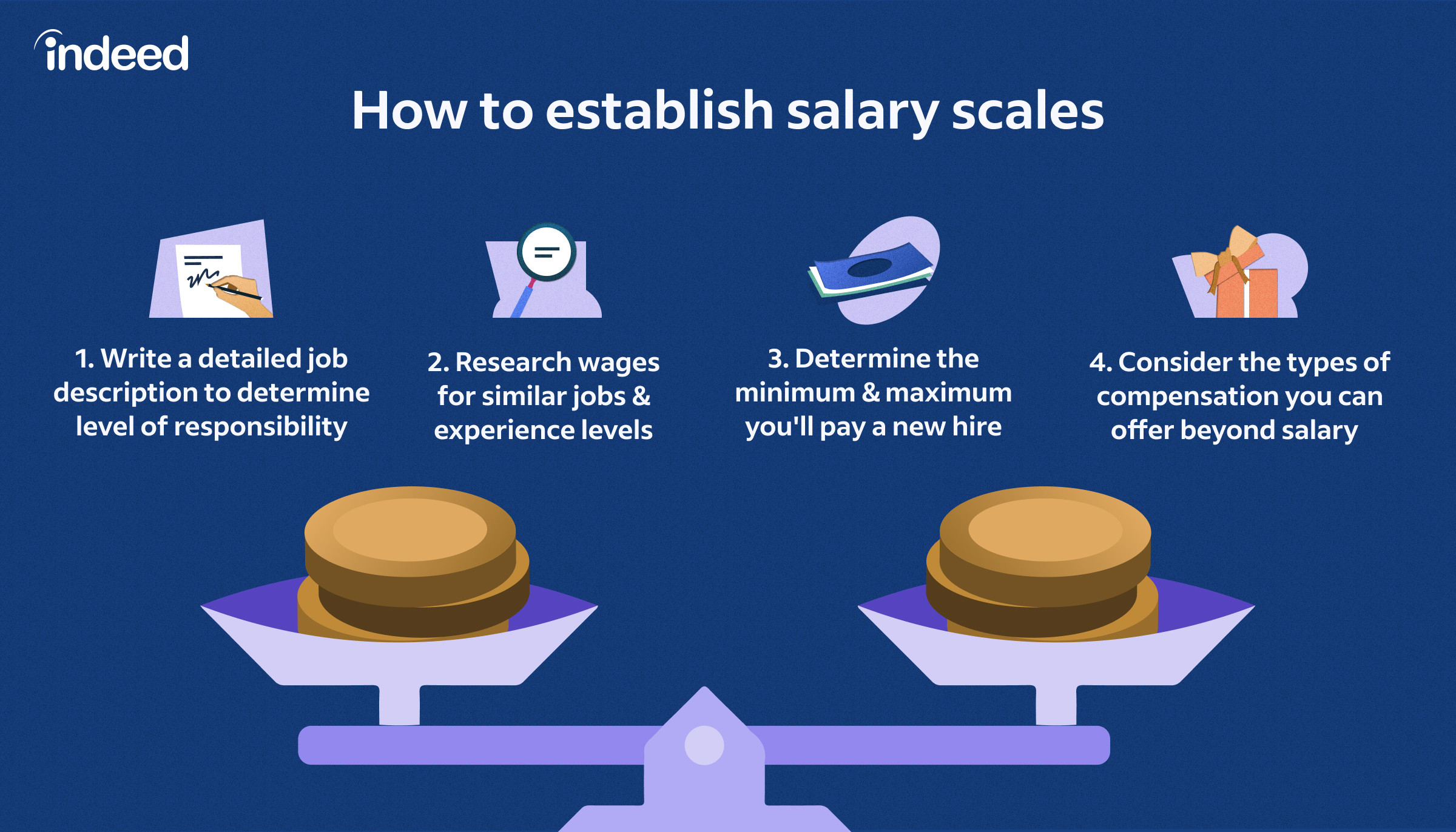

What Is a Scale of Salary? A Guide for HR Professionals

https://d341ezm4iqaae0.cloudfront.net/assets/2020/03/19232728/Salary_Scales01-1.jpg

:max_bytes(150000):strip_icc()/what-is-included-on-a-pay-stub-2062766-FINAL-edit-f9458e043f2e4c5ab87a4ef5cec0cd5d.jpg)

How To Read a Pay Stub

https://www.thebalancemoney.com/thmb/qWN0kqMop0Uz29CLXINjdQtLcjI=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/what-is-included-on-a-pay-stub-2062766-FINAL-edit-f9458e043f2e4c5ab87a4ef5cec0cd5d.jpg

A Salary Reduction Plan Is Also Known As A - Payroll Deduction Plan A contribution plan in which an employer deducts a specified amount from an employee s pay and puts the funds toward insurance healthcare or an investment account In most