135k Salary After Taxes California The tax calculation below shows exactly how much California State Tax Federal Tax and Medicare you will pay when earning 135 000 00 per annum when living and paying your taxes in California The 135 000 00 California tax example uses standard assumptions for the tax calculation

The graphic below illustrates common salary deductions in California for a 135k Salary and the actual percentages deducted when factoring in personal allowances and tax thresholds for 2024 You can find the full details on how these figures are calculated for a 135k annual salary in 2024 below 22 59 30 496 09 Income Tax 7 65 10 327 50 FICA The graphic below illustrates common salary deductions in California for a 135k Salary and the actual percentages deducted when factoring in personal allowances and tax thresholds for 2021 You can find the full details on how these figures are calculated for a 135k annual salary in 2021 below 23 76 32 070 00 Income Tax 7 65 10 327 50 FICA

135k Salary After Taxes California

135k Salary After Taxes California

https://www.nerdwallet.com/assets/blog/wp-content/uploads/2018/01/mortgage-rates-january-2-GettyImages-588954686-1920x1152.jpg

Kostenloses Foto Zum Thema Bucht D mmerung Drau en

https://images.pexels.com/photos/1121217/pexels-photo-1121217.jpeg?auto=compress&cs=tinysrgb&dpr=2&h=750&w=1260

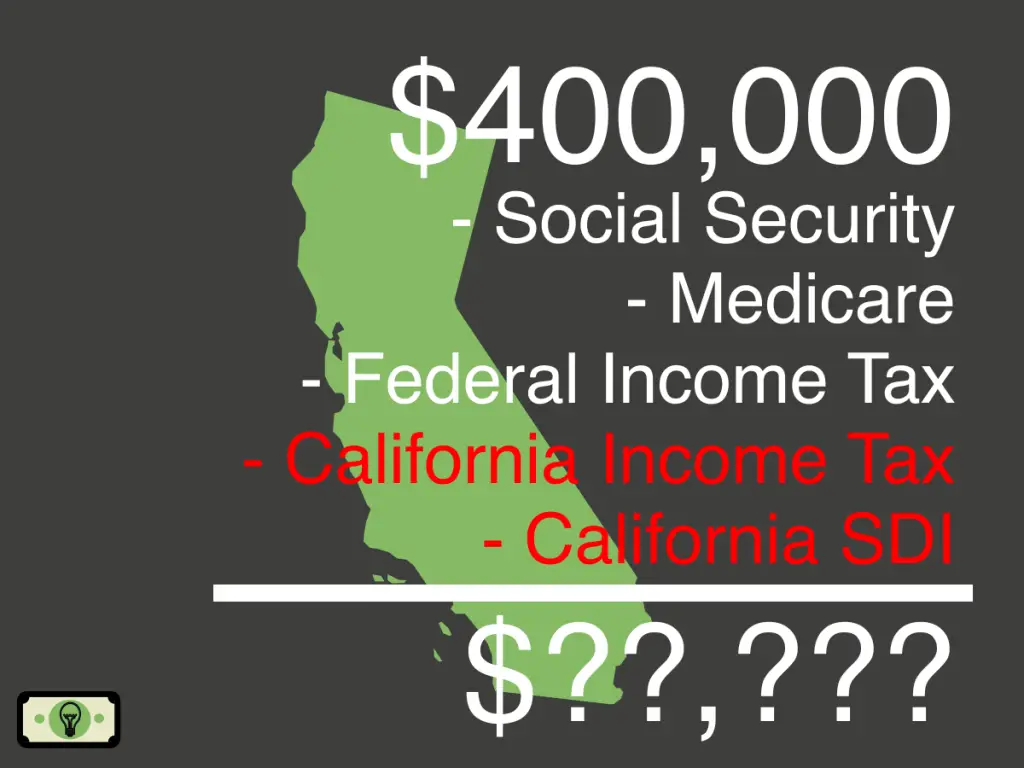

400K Salary After Taxes In California single 2023 Smart

https://smartpersonalfinance.info/wp-content/uploads/2022/08/ca-400000-after-taxes-2-sm-1024x768.png

If you earn 135 000 00 or earn close to it and live in California then this will give you a rough idea of how much you will be paying in taxes on an annual basis However an annual monthly weekly and daily breakdown of your tax amounts will be provided in the written breakdown The graphic below illustrates common salary deductions in California for a 135k Salary and the actual percentages deducted when factoring in personal allowances and tax thresholds for 2022 You can find the full details on how these figures are calculated for a 135k annual salary in 2022 below 23 56 31 801 06 Income Tax 7 65 10 327 50 FICA

This salary calculation is based on an annual salary of 135 000 00 when filing an annual income tax return in California lets take a look at how we calculated the various payroll and incme tax deductions How to Calculate Federal Tax and State Tax in California in On a 135 000 salary you owe 23 408 in federal income tax Additionally the employer will withhold 8 370 00 for social security and 1 957 50 for medicare We calculate the taxes here as annual amounts Your employer will withhold the part applicable to each paycheck monthly or bi weekly California Income Tax

More picture related to 135k Salary After Taxes California

Kostenloses Foto Zum Thema Auge Bokeh Bunt

https://images.pexels.com/photos/1595732/pexels-photo-1595732.jpeg?auto=compress&cs=tinysrgb&dpr=2&h=650&w=940

Matthew Stafford s 40 Million Salary After Taxes California Map

https://i.pinimg.com/736x/1d/e8/02/1de80251521acd849fd5ac527ab0fe83.jpg

Kostenloses Foto Zum Thema Berge Drau en Gras

https://images.pexels.com/photos/1204430/pexels-photo-1204430.jpeg?auto=compress&cs=tinysrgb&dpr=3&h=750&w=1260

Income tax calculator California Find out how much your salary is after tax Enter your gross income Per Where do you work Salary rate Annual Month Weekly Day Hour Withholding Salary 130 000 Federal Income Tax 21 928 State Income Tax 9 510 Social Security 8 060 Medicare 1 885 SDI State Disability Insurance 1 430 Total tax California income tax rate 1 00 13 30 Median household income in California 81 575 U S Census Bureau Number of cities that have local income taxes How Your California Paycheck Works Your job probably pays you either an hourly wage or an annual salary

Summary If you make 55 000 a year living in the region of California USA you will be taxed 11 676 That means that your net pay will be 43 324 per year or 3 610 per month Your average tax rate is 21 2 and your marginal tax rate is 39 6 This marginal tax rate means that your immediate additional income will be taxed at this rate Proposition 13 passed by California s voters in 1978 sets the maximum allowable property tax rate at 1 of a home s assessed value It also limits increases in assessed value to 2 every year except if the home has changed ownership or undergone construction

Kostenloses Foto Zum Thema Berg Drau en Felswand

https://images.pexels.com/photos/464409/pexels-photo-464409.jpeg?auto=compress&cs=tinysrgb&dpr=2&h=750&w=1260

Kostenloses Foto Zum Thema Attraktiv Bild Drau en

https://images.pexels.com/photos/1800433/pexels-photo-1800433.jpeg?auto=compress&cs=tinysrgb&dpr=3&h=750&w=1260

135k Salary After Taxes California - If you earn 135 000 00 or earn close to it and live in California then this will give you a rough idea of how much you will be paying in taxes on an annual basis However an annual monthly weekly and daily breakdown of your tax amounts will be provided in the written breakdown