How Much Money Do I Make After Taxes In California There is no income limit on Medicare taxes 1 45 of each of your paychecks is withheld for Medicare taxes and your employer contributes another 1 45 If you make more than a certain amount you ll be on the hook for an extra 0 9 in Medicare taxes Here s a breakdown of these amounts for the current tax year

Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary It can also be used to help fill steps 3 and 4 of a W 4 form This calculator is intended for use by U S residents The calculation is based on the 2024 tax brackets and the new W 4 which in 2020 has had its first major State income tax 1 to 13 3 Social Security 6 2 Medicare 1 45 to 2 35 state disability insurance 1 2 The total tax varies depending on your earnings number of dependents and other factors The combined tax percentage usually ranges from 20 to 35 Updated on Jul 06 2024

How Much Money Do I Make After Taxes In California

How Much Money Do I Make After Taxes In California

https://www.gannett-cdn.com/-mm-/3eb9009c1a9366e33a28c376eca11ea26824544a/c=0-44-580-370/local/-/media/2018/04/22/USATODAY/usatsports/MotleyFool-TMOT-33d5f547-taxes_large.jpg?width=3200&height=1680&fit=crop

How Much Do Doctors Make After Taxes And Insurance Expert Guide

https://images.squarespace-cdn.com/content/v1/5269fbd3e4b0eb2b76ccc1db/1611969818632-2DX1RQW9JIYQSEHWIN5I/how-much-do-doctors-make.jpg

How Much Money Do Lawyers Make After Taxes YouTube

https://i.ytimg.com/vi/S13rtgVdzNg/maxresdefault.jpg

Launch ADP s California Paycheck Calculator to estimate your or your employees net pay Free and simple Fast easy accurate payroll and tax so you can save time and money Payroll Overview Overview Small Business Payroll 1 49 Employees Midsized to Enterprise Payroll 50 1 000 Employees Compare Packages Also known as paycheck tax or payroll tax these taxes are taken from your paycheck directly They are used to fund social Security and Medicare For example in the 2020 tax year the Social Security tax is 6 2 for employees and 1 45 for the Medicare tax

In 2022 your employer will withhold 6 2 of your wages up to 147 000 for Social Security Additionally you must pay 1 45 of all of your wages for Medicare without any limitations If you California Income Tax Calculator 2023 2024 Learn More On TurboTax s Website If you make 70 000 a year living in California you will be taxed 10 448 Your average tax rate is 10 94 and your

More picture related to How Much Money Do I Make After Taxes In California

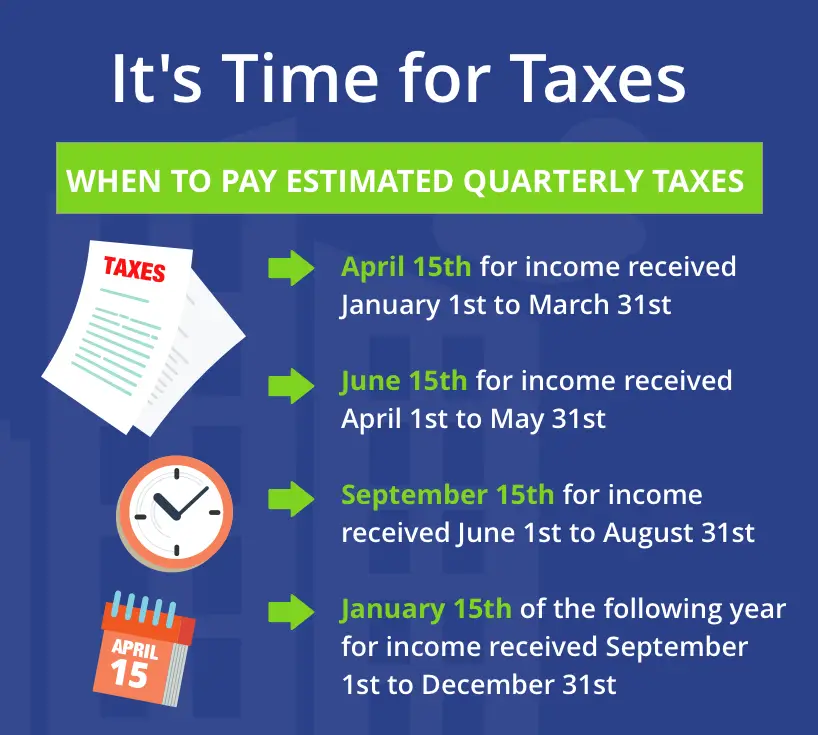

How To Pay Taxes As An Independent Contractor TaxesTalk

https://www.taxestalk.net/wp-content/uploads/taxes-for-independent-contractors-definitive-guide-on-when-and-how-to-file.png

How Much Will I Make After Taxes California TaxesTalk

https://www.taxestalk.net/wp-content/uploads/what-you-really-earn-after-taxes-in-each-state-your-salary-is-50000.jpeg

What Do I Make After Taxes TaxesTalk

https://www.taxestalk.net/wp-content/uploads/how-much-do-i-make-after-taxes-per-hour-calculator-tax-walls.png

The paycheck tax calculator is a free online tool that helps you to calculate your net pay based on your gross pay marital status state and federal tax and pay frequency After using these inputs you can estimate your take home pay after taxes The inputs you need to provide to use a paycheck tax calculator Unlimited companies employees and payroll runs for only 199 a year All 50 states including local taxes and multi state calculations Federal forms W 2 940 and 941 Check out PaycheckCity for federal salary paycheck calculators withholding calculators tax calculators payroll information and more Free for personal use

California s base sales tax is 6 00 This means that regardless of where you are in the state you will pay an additional 6 00 of the purchase price of any taxable good Many cities and counties also enact their own sales taxes ranging from 1 25 to 4 75 So the maximum combined rate is 10 75 California has one of the highest rates in the country ranging from 1 to 12 3 depending on your income bracket The amount you owe again depends on your filing status your taxable income and other factors Form DE 4 is similar to Form W 4 but it is specific to California It tells your employer how much state income tax to withhold from

How Much Taxes Do I Have To Pay For Unemployment TaxesTalk

https://www.taxestalk.net/wp-content/uploads/do-i-have-to-pay-taxes-on-unemployment-benefits-clark-1024x683.jpeg

1 Differentiate With Respect To X Brainly

https://us-static.z-dn.net/files/dbb/d44b023e83041b673a8ac8d2d239bf3a.jpg

How Much Money Do I Make After Taxes In California - How to calculate annual income To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year For example if an employee earns 1 500 per week the individual s annual income would be 1 500 x 52 78 000