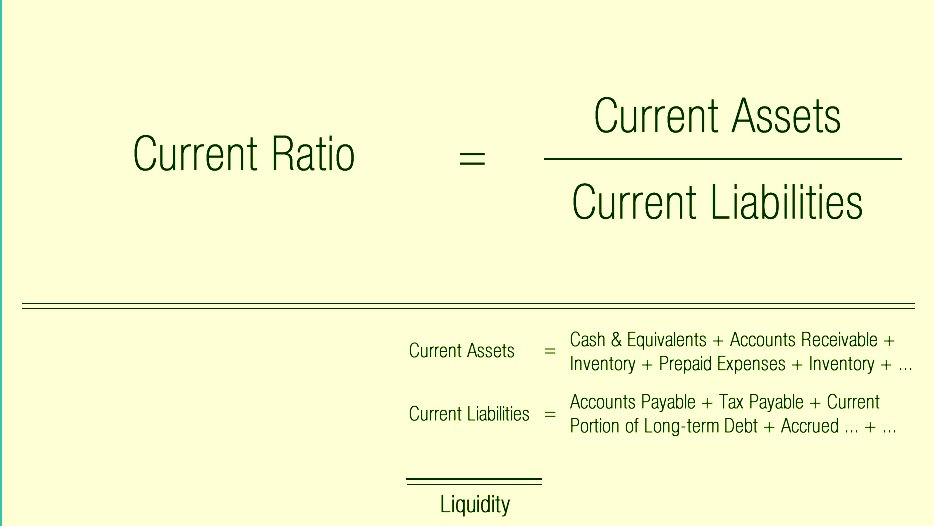

What Is The Formula For Calculating The Current Ratio In Financial Analysis The current ratio also known as the current asset ratio the current liquidity ratio or the working capital ratio is a financial analysis tool used to determine the short term liquidity of a business It takes all of your company s current assets compares them to your short term liabilities and tells you whether you have enough of the former to pay for the latter

Ratio Analysis Types and Formulas We calculate the formula for Ratio Analysis by using the following steps 1 Liquidity Ratios These ratios indicate the company s cash level liquidity position and capacity to meet its short term liabilities The formula of some of the major liquidity ratios are Current Ratio Current Assets Current On the other hand the current liabilities are those that must be paid within the current year Formula For Current Ratio The current ratio is calculated using the formula shown below The numerator generally includes assets such as cash short term marketable securities sundry debtors accounts receivables stocks inventories and prepaid

What Is The Formula For Calculating The Current Ratio In Financial Analysis

What Is The Formula For Calculating The Current Ratio In Financial Analysis

https://www.planprojections.com/wp-content/uploads/current-ratio-formula.png

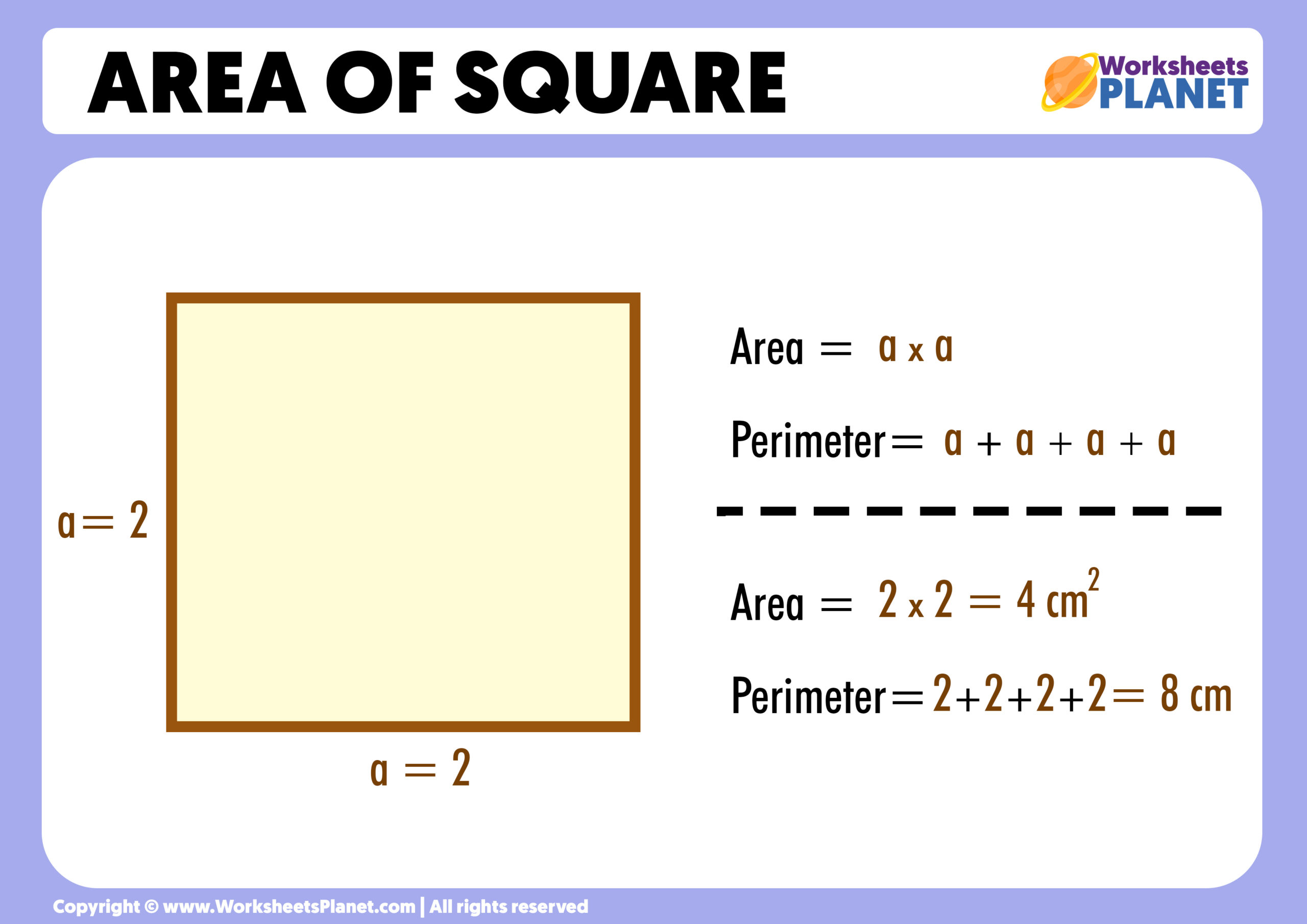

Area Of Square

https://www.worksheetsplanet.com/wp-content/uploads/2022/09/Area-of-Square-scaled.jpg

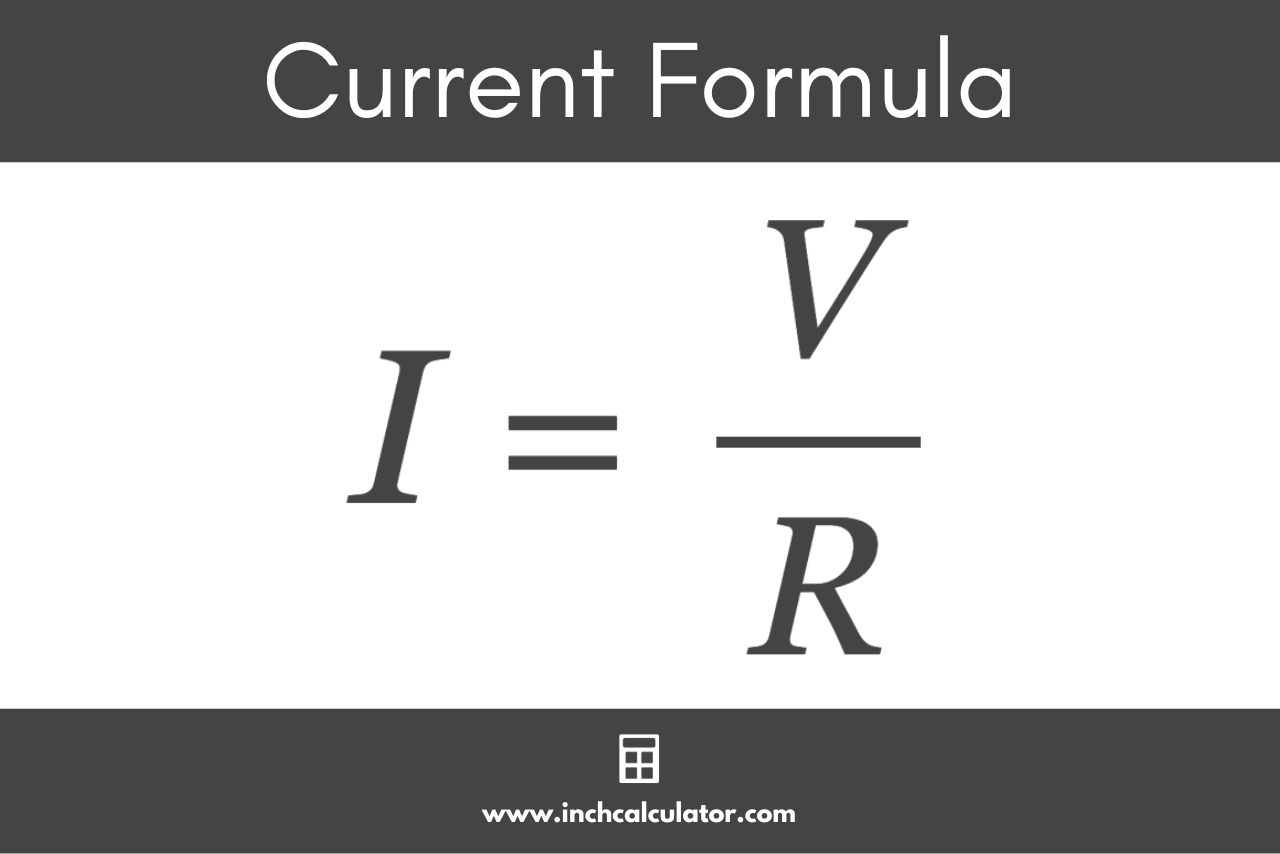

Current Calculator Calculate Amps Inch Calculator

https://www.inchcalculator.com/wp-content/uploads/2023/08/current-formula.png

The current ratio is a very common financial ratio to measure liquidity Current ratio is equal to total current assets divided by total current liabilities A ratio greater than 1 means that the company has sufficient current assets to pay off short term liabilities A high ratio implies that the company has a thick liquidity cushion Current ratio Current assets Current liabilities 1 100 000 400 000 2 75 times The current ratio is 2 75 which means the company s currents assets are 2 75 times more than its current liabilities Significance and interpretation Current ratio is a useful test of the short term debt paying ability of any business

Below is a video explanation of how to calculate the current ratio and why it matters when performing an analysis of financial statements Video CFI s Financial Analysis Courses Additional Resources Thank you for reading this guide to understanding the Current Ratio Formula To keep educating yourself and advancing your finance career The final step in calculating the current ratio is to apply the current ratio formula Current Ratio Current Assets Current Liabilities Using the example from the previous steps the company s current assets total 200 000 and its current liabilities amount to 150 000 Plugging these values into the formula Current Ratio 200 000

More picture related to What Is The Formula For Calculating The Current Ratio In Financial Analysis

Current Ratio Examples Of Current Ratio With Excel 59 OFF

https://www.paayi.com/wp-content/uploads/2018/05/current-ratio-formula-1.jpg

Calculate

https://wsp-blog-images.s3.amazonaws.com/uploads/2022/12/29174639/Simple-Interest-Formula.jpg

:max_bytes(150000):strip_icc()/Current_Ratio-eb91b25d3dcb46439d4f733dc19d0a0f.png)

Current Ratio Explained With Formula And Examples 43 OFF

https://www.investopedia.com/thmb/sHBECCSRDfhtaqet7ytsDQ5FTMc=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/Current_Ratio-eb91b25d3dcb46439d4f733dc19d0a0f.png

This ratio is stated in numeric format rather than in decimal format Here is the calculation GAAP requires that companies separate current and long term assets and liabilities on the balance sheet This split allows investors and creditors to calculate important ratios like the current ratio On U S financial statements current accounts are There are three potential outcomes from the formula If the current ratio is less than 1 0 The business currently owes more than it owns and a cash injection may be needed to keep the business afloat in the short term If the current ratio is between 1 0 and 2 0 The business is generally considered to be healthy since it owns more than it owes If the current ratio is greater than 2 0 The

[desc-10] [desc-11]

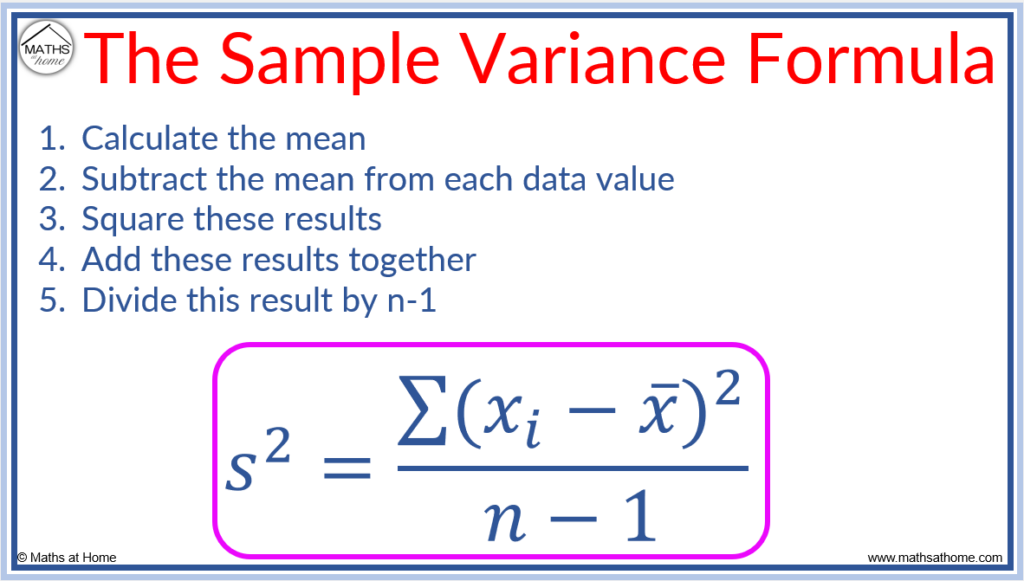

How To Calculate Variance Mathsathome

https://mathsathome.com/wp-content/uploads/2022/12/how-to-calculate-the-variance-of-a-data-set-1024x581.png

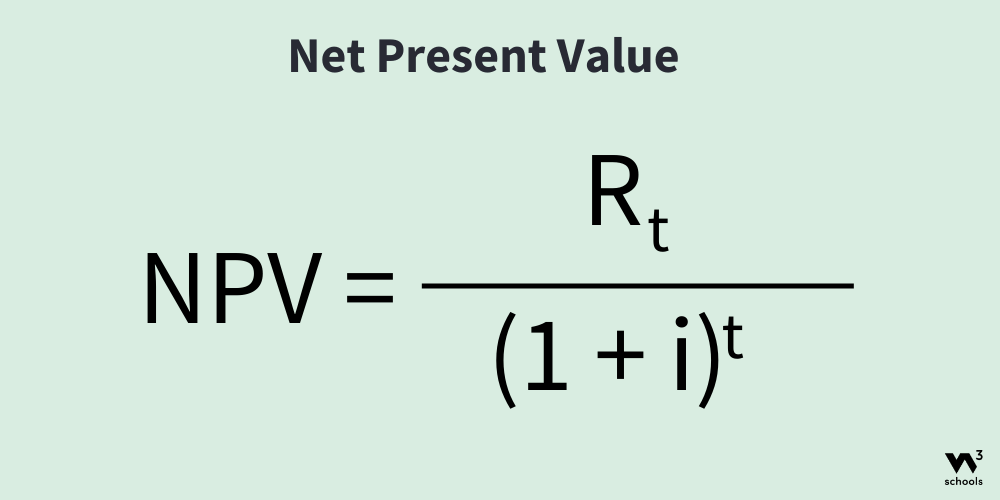

Net Present Value NPV What It Means And Steps To 51 OFF

https://www.w3schools.com/excel/img_excel_npv_formula.png

What Is The Formula For Calculating The Current Ratio In Financial Analysis - Current ratio Current assets Current liabilities 1 100 000 400 000 2 75 times The current ratio is 2 75 which means the company s currents assets are 2 75 times more than its current liabilities Significance and interpretation Current ratio is a useful test of the short term debt paying ability of any business