What Is The Average Interest Rate On A Car Loan After Chapter 7 Our car loan calculator estimates a monthly car payment and total loan cost based on vehicle price interest rate and loan length Try different calculator scenarios to determine the best auto

Chapter 7 Average Loan Rate Chapter 13 Average Loan Rate New Used New Used Average credit score at time of filing Chapter 7 560 Average Loan Rate New 10 58 Average Loan Rate Used 16 56 Chapter 13 540 Average Loan Rate New 10 58 Average Loan Rate Used 16 56 Average credit score one year after filing Chapter 7 620 Average Loan Used cars are typically less expensive but used car loans often come with higher interest rates Types of bankruptcy The two most common types of bankruptcy are Chapter 7 and Chapter 13

What Is The Average Interest Rate On A Car Loan After Chapter 7

What Is The Average Interest Rate On A Car Loan After Chapter 7

https://mlsjoxwh2dv5.i.optimole.com/cb:fJ2b~7176/w:auto/h:auto/q:90/f:avif/https://finmasters.com/wp-content/uploads/2022/12/Average-Car-Loan-Interest-Rates-by-Credit-Score.jpg

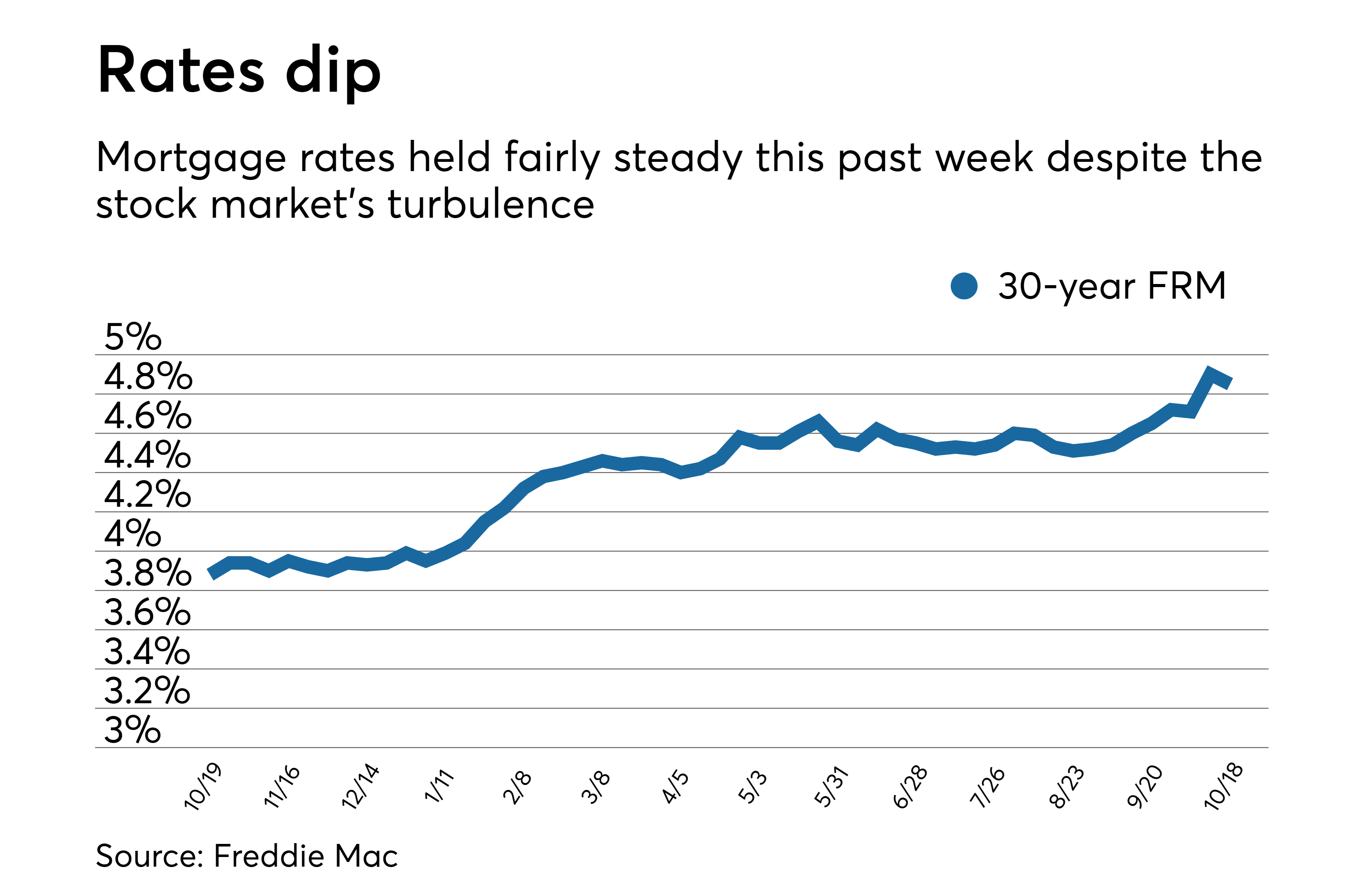

Predicted Mortgage Rates 2025 Maya Brooke

https://www.i1.creditdonkey.com/image/1/fixed-mortgage-graph.png

Interest Rates Estimates 2025 Joshua M Matter

http://therealestatetrainer.com/wp-content/uploads/2015/02/Mortgage-Rate-Projections-2015.jpg

How to Qualify for a Car Loan After Bankruptcy Qualifying for a car loan after bankruptcy is doable but it can take a little more work than buying a car when in good financial standing The key to qualifying for a car loan after bankruptcy is to improve your credit score and save for a solid down payment Improve your credit score To After Chapter 7 bankruptcy you can expect higher interest rates on car loans Your average rate will depend on your credit score If you have a superprime score 781 850 you ll likely see rates around 5 38 for new cars and 6 80 for used ones With a prime score 661 780 expect about 6 89 for new and 9 04 for used vehicles

Unfortunately a low credit score will result in a high interest rate The average auto loan rate for deep subprime borrowers is currently at 15 43 percent for new car purchases and 21 55 percent If your score is below 560 you should expect to pay up to a 30 interest rate on a car loan By waiting a year after Chapter 7 discharge you may work your credit score into fair territory and reduce your car loan s APR by about half But expect new car APRs to remain at the highest level one year after entering Chapter 13 reorganization

More picture related to What Is The Average Interest Rate On A Car Loan After Chapter 7

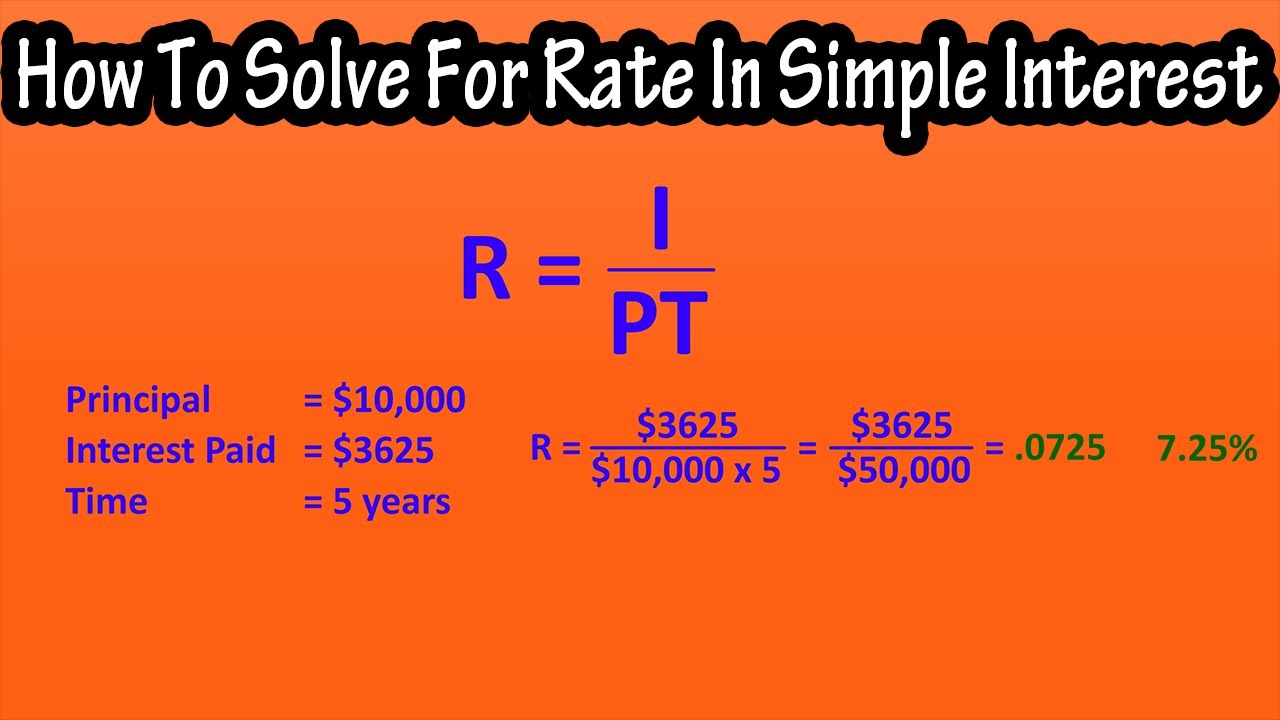

Simple Interest Formula

https://i.ytimg.com/vi/HqHbOc8zXgs/maxresdefault.jpg

2025 Mortgage Rates History In India Malik Luna

https://arizent.brightspotcdn.com/39/1d/6eea3689485fb4ffbe23f91599d5/nmn101818-rates.png

Interest Rates Estimates 2025 Bodhi Jensen

https://wsp-blog-images.s3.amazonaws.com/uploads/2022/12/12004614/Loan-Amortization-Schedule-Calculator-960x753.jpg

However buyers with high credit scores receive the best interest rates available when taking out a car loan Those with low credit scores receive the highest rates For example as of February 2011 Community America Credit Union offers auto loans with an annual percentage rate ranging between 3 75 percent and 15 percent Chapter 7 bankruptcy gives you a fresh financial slate but leaves a black mark on your credit report that lingers for 10 years Here are the average auto loan interest rates by credit score Credit score New Car Used Car Deep subprime 300 500 15 43 a low score subjects you to a higher car loan interest rate and tougher loan terms

[desc-10] [desc-11]

Apr Interest Rate Calculator

https://i.ytimg.com/vi/p8f8XP2tmvE/maxresdefault.jpg

Interest Rates 2025 Usa Katie Haml Harris

https://arizent.brightspotcdn.com/2a/de/5ec51cb342fd821ad934651f3786/nmn071919-rates.png

What Is The Average Interest Rate On A Car Loan After Chapter 7 - [desc-14]