What Is The Aia Allowance For 2023 HM Revenue Customs Policy paper Legislating the Annual Investment Allowance AIA at 1m Published 15 March 2023 Who is likely to be affected Businesses investing more than 200 000 in

Wednesday 12th July 2023 Following the announcement of the Full Expensing in the spring budget companies are presented with a choice of reliefs for their plant machinery expenditure This article will examine the commonalities and differences between the Annual Investment Allowances AIA and Full Expensing General description of the measure This measure will temporarily increase the limit of the annual investment allowance AIA from 200 000 to 1 000 000 for qualifying expenditure on plant and

What Is The Aia Allowance For 2023

What Is The Aia Allowance For 2023

https://images.contentstack.io/v3/assets/blt3de4d56151f717f2/blt8743826b67930bd8/63767939ac59ed1089b31054/table_1.png

AIA Korea HQ Steven Leach Group

https://www.sla-group.com/wp-content/uploads/sites/3/2016/03/AIA-main-new.jpg

End Of The AIA Transitional Limit Beware Of The Traps

https://www.accountingfirms.co.uk/wp-content/uploads/2021/10/annual-investment-allowance-AIA.png

The Annual Investment Allowance AIA is a valuable tool for business owners to claim tax relief It allows you to deduct 100 of your expenditure excluding VAT on most assets used in the business This allowance has been extended until April 2023 and there are now new eligibility criteria for claiming AIA What is Annual Investment Allowance The Annual Investment Allowance AIA allows businesses to deduct the full cost of plant and machinery investments up to 1 000 000 not including cars against taxable profits in the year they re bought

You can deduct the full value of an item that qualifies for annual investment allowance AIA from your profits before tax If you sell the item after claiming AIA you may need to pay tax To support businesses to invest and grow the government is setting the AIA at its highest ever permanent level of 1 million from 1 April 2023 The AIA is a form of tax relief capital allowance that is available for businesses investing in plant and machinery enabling them to make a full tax deduction for qualifying capital expenditure up

More picture related to What Is The Aia Allowance For 2023

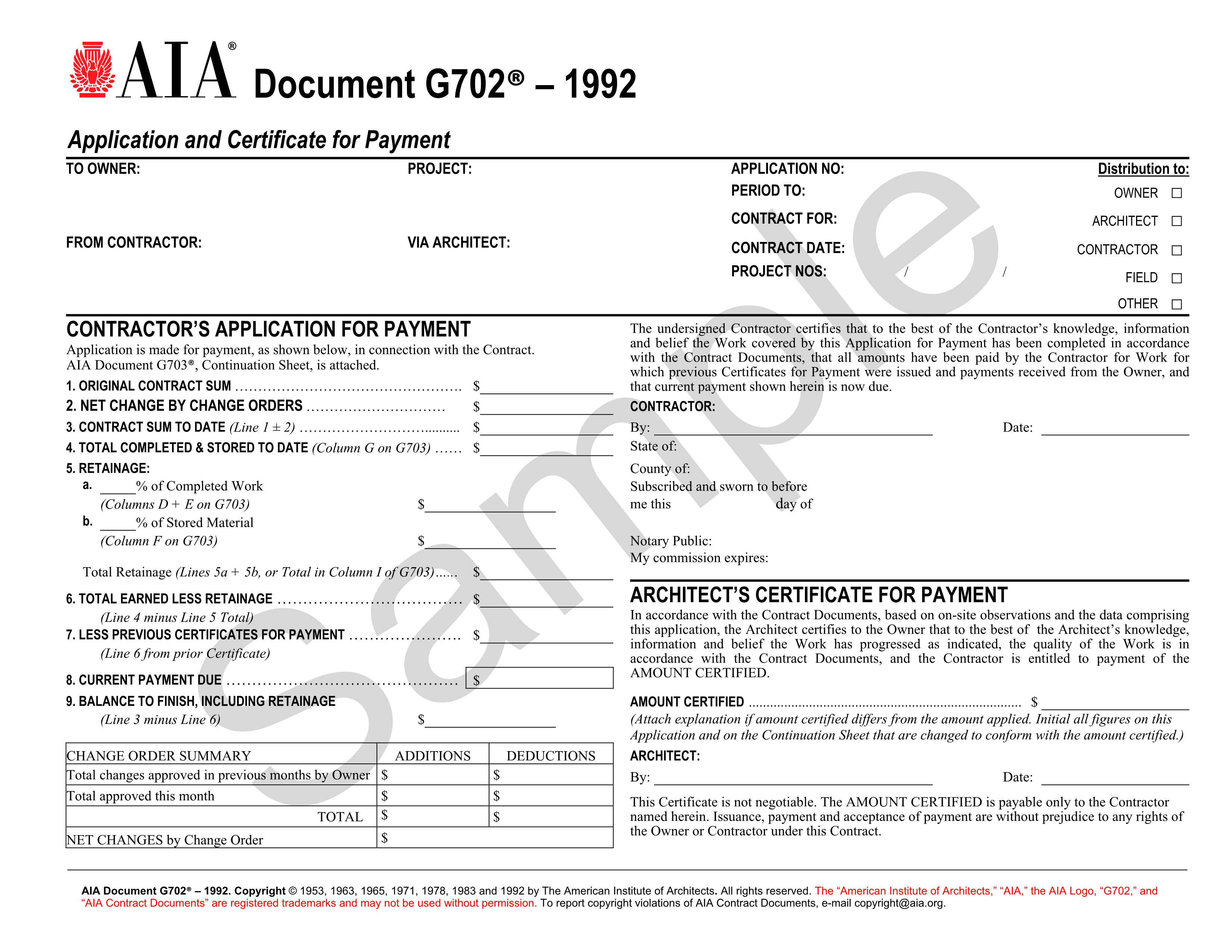

Subcontractor s Guide To The AIA G703 Continuation Sheet Procore

https://www.procore.com/library/wp-content/uploads/2019/11/AIA-form.png

Emirates Luggage Allowance Excess Baggage Fees Sherpr

https://www.sherpr.com/wp-content/uploads/2022/01/Emeriates-New-1024x771.png

Boston Society For Architecture AIA National

https://www.architects.org/uploads/_auto600/AIA-red-3x1.png

The Annual Investment Allowance AIA is a type of tax break available to British companies It is intended to be used for capital asset purchases According to the AIA a company may deduct from its profits before tax for a given tax year You may be able to deduct a part or entire amount of eligible capital expenditures The Annual Investment Allowance AIA is a form of tax relief for British businesses that is designated for the purchase of business equipment The AIA allows a business to deduct the total

The Annual Investment Allowance AIA represents an accelerated tax relief on qualifying expenditure The current 1m AIA threshold was due to be reduced back to 200 000 on the 1st January 2022 From the 1st January 2022 the Annual Investment Allowance will be extended for a further 15 months until the 31st March 2023 As the temporarily increased annual investment allowance AIA is due to revert to the standard 200 000 AIA limit from 1 April 2023 the transition period will have potentially significant impacts on businesses claiming the allowance resulting in some surprising results in relevant tax assessments

AIA Construction Codes For Construction Billing Planyard

https://planyard.com/wp-content/uploads/2021/11/xaia-g702.jpg.pagespeed.ic_.HheoVCNP7q-1024x791.jpg

Aia G702 Template

https://zdassets.aiacontracts.org/ctrzdweb02/previewimgs/Preview_G702-1992_1.png

What Is The Aia Allowance For 2023 - Matthew Greene Director Capital Allowances PwC United Kingdom Tel 44 0 7730 067871 From 1 April 2023 until 31 March 2026 companies subject to UK corporation tax will receive a 100 first year tax deduction for expenditure they incur on qualifying plant or machinery essentially reducing the in year cost of plant or machinery by 25