What Is Tangible Net Worth In Balance Sheet Your tangible net worth is equal to the value of all of your assets minus any liabilities and any intangible assets including copyrights goodwill intellectual property patents and trademarks

Calculation of Tangible Net Worth with Example Below is the balance sheet for fiscal 2012 2013 of a company in the manufacturing industry in the United States It prepares its finances according to U S GAAP An analyst wants to analyze the firm s balance sheet position and calculate its tangible net worth To calculate Tangible Net Worth Tangible Net Worth Total Assets Total Liabilities Intangible Assets Tangible Net Worth 1 500 000 800 000 50 000 Tangible Net Worth 650 000 In this example the tangible net worth of the manufacturing company is 650 000 This represents the net value of the company s physical

What Is Tangible Net Worth In Balance Sheet

What Is Tangible Net Worth In Balance Sheet

https://cfohub.com/wp-content/uploads/2022/10/5-Differences-Between-Tangible-and-Intangible-Assets.png

What Is Tangible Net Worth

https://insights.masterworks.com/wp-content/uploads/2023/01/iStock-896076386-scaled.jpg

Tangible Assets Examples And Formula Financial Falconet

https://www.financialfalconet.com/wp-content/uploads/2022/06/Blue-3D-Business-Math-Poster-724x1024.png

Tangible net worth is a financial metric used to assess the value of an entity s physical assets For companies it excludes any value derived from intangible assets such as copyrights patents and intellectual property On the other hand for individuals it involves evaluating assets like real estate holdings investment accounts and Tangible net worth is an important component of debt covenants It is considered very important by most lending parties because as mentioned earlier it can be used to assess a company s actual physical net worth while not having to include all the assumptions and estimations involved with the valuation of intangible assets

Investments TNW is calculated by deducting the firm s total liabilities and any intangible assets on the balance sheet from the firm s total assets The formula for calculating it is as follows Tangible Net Worth TNW Total Assets Total Liabilities Intangible Assets All the variables are taken at book value and any off balance sheet Tangible Net Worth calculated as Total Equity minus Intangible Assets assesses a business s net worth without intangible components It aids in conservative balance sheet analysis crucial when intangible assets like acquired businesses inflate net worth

More picture related to What Is Tangible Net Worth In Balance Sheet

:max_bytes(150000):strip_icc()/Tangible_Asset_Final-f9dc5210e5ef4d70903299b737465db2.png)

What Is A Tangible Asset Comparison To Non Tangible Assets

https://www.investopedia.com/thmb/TEyH7_-L61yV-KQwIyo4Xrs1XUg=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/Tangible_Asset_Final-f9dc5210e5ef4d70903299b737465db2.png

Patrimonio Neto Tangible Definici n Significado F rmula Y C lculo

https://invatatiafaceri.ro/wp-content/uploads/Term-t-tangible-net-worth_Final-859579ef8b3f4e4a8fc8e85ee57c659a.png

Debt To Tangible Net Worth Formula Calculator

https://wsp-blog-images.s3.amazonaws.com/uploads/2023/02/08222558/Debt-to-Tangible-Net-Worth-Calculator.jpg

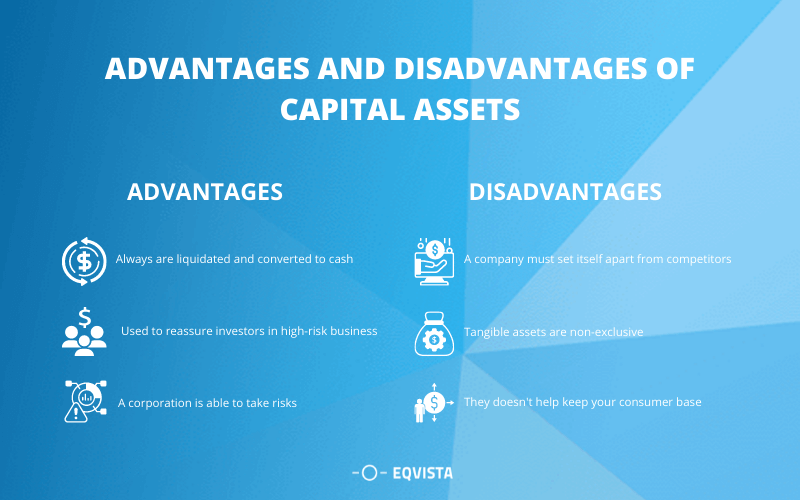

Tangible net worth TNW is an important financial metric that lenders use to assess a company s financial health and ability to repay debt Calculating tangible net worth requires a company s balance sheet income statement and statement of cash flows With proper data the calculation process includes Step 1 Determine Total Assets Tangible net worth is a measure of a company s financial strength and stability that takes into account only its physical assets and real estate TNW is calculated by subtracting a company s total liabilities from the value of its physical assets such as cash real estate and equipment Tangible net worth is used to assess a company s

Step 3 Debt to Tangible Net Worth Calculation Example In closing we ll divide our company s total outstanding debt balance by its tangible net worth which comes out to 50 Debt to Tangible Net Worth 60 million 120 million 0 50 or 50 0 The debt to tangible net worth ratio of 0 5x or 50 0 implies that approximately half of Now that we know net worth we must now figure out if there are any intangible assets on the balance sheet Since goodwill is considered an intangible asset it needs to be subtracted from net worth in order to calculate tangible net worth Tangible Net Worth Net Worth Intangible Assets Tangible Net Worth 70 000 40 000

:max_bytes(150000):strip_icc()/nettangibleassets-final-397d30b1c7ce453fa3d9236c2c375325.png)

Net Tangible Assets Definition Calculation Examples

https://www.investopedia.com/thmb/j-wJiU41sInJ2B7q7kHDGpBDdtY=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/nettangibleassets-final-397d30b1c7ce453fa3d9236c2c375325.png

How To Calculate Tangible Assets Eqvista

https://eqvista.com/app/uploads/2022/01/Advantage-and-Disadvantages-of-Tangible-Assets.png

What Is Tangible Net Worth In Balance Sheet - Tangible net worth is an important component of debt covenants It is considered very important by most lending parties because as mentioned earlier it can be used to assess a company s actual physical net worth while not having to include all the assumptions and estimations involved with the valuation of intangible assets