What Is My Salary Hourly Rate Let s look at some common round salary figures and their equivalent hourly pay rates 40 000 a year is how much per hour If you have an annual salary of 40 000 it equates to a monthly pre tax salary of 3 333 33 weekly pay of 769 23 and an hourly wage of 19 23 per hour These figures are pre tax and based upon working a 40 hour week

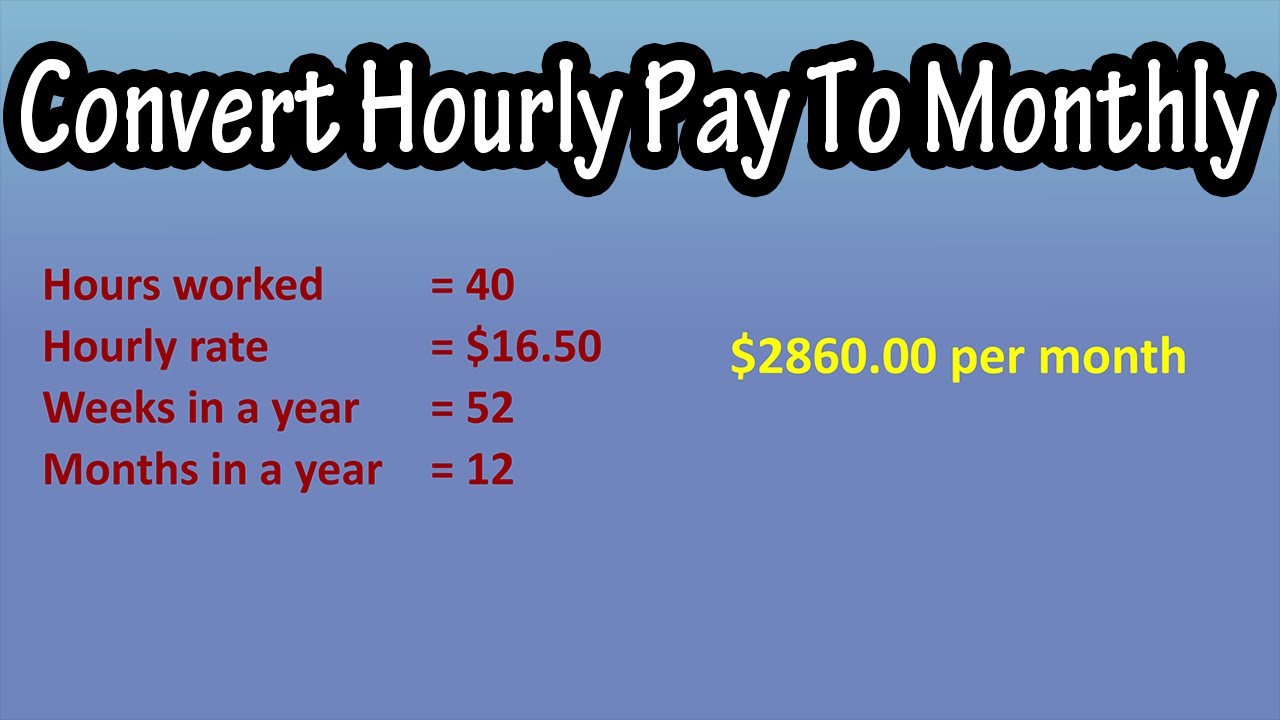

How do I calculate hourly rate First determine the total number of hours worked by multiplying the hours per week by the number of weeks in a year 52 Next divide this number from the annual salary For example if an employee has a salary of 50 000 and works 40 hours per week the hourly rate is 50 000 2 080 40 x 52 24 04 Federal Paycheck Calculator Federal income tax rates range from 10 up to a top marginal rate of 37 The U S real median household income adjusted for inflation in 2022 was 74 580 9 U S states don t impose their own income tax for tax year 2023

What Is My Salary Hourly Rate

What Is My Salary Hourly Rate

https://i.ytimg.com/vi/ev3JQIvAaPY/maxresdefault.jpg

Determine Hourly Rate From Yearly Salary AarviZenish

https://i2.wp.com/scrn-cdn.omnicalculator.com/finance/[email protected]

:max_bytes(150000):strip_icc()/salary-vs-hourly-employee-397909_FINAL-fce8be5f596c446b8e32baccb628b82e.png)

Salaried Vs Hourly Employees What Is The Difference

https://www.thebalancemoney.com/thmb/lY8ITvpfNR5xxy8G426pWDOPizo=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/salary-vs-hourly-employee-397909_FINAL-fce8be5f596c446b8e32baccb628b82e.png

The pay raise calculator can help you to calculate the salary increase given the current and future wage amounts and vice versa You can choose whichever form is most convenient for you be it the hourly weekly monthly or annual rate and the rest will be converted automatically a 10 annual raise is the same as a 10 monthly The gross pay in the hourly calculator is calculated by multiplying the hours times the rate You can add multiple rates This calculator will take a gross pay and calculate the net pay which is the employee s take home pay Gross pay Taxes Benefits deductions Net Pay

Enter the number of hours worked per week Our rate of pay calculator will find your daily weekly biweekly monthly and yearly pay rate For example you earn 15 per hour and work a standard 8 hours a day or 40 hours a week Converting the hourly pay to salary your rate of pay is monthly pay hourly hours per week 52 12 15 Usually overtime pay is time and a half or 1 5 times your normal hourly rate Unlike salaried employees with a fixed annual income the total pay for hourly employees can vary significantly each

More picture related to What Is My Salary Hourly Rate

Pay Scale Template

https://gs-payscale.com/wp-content/uploads/2021/06/pay-scale-00-scaled.jpg

Calculate Full Time Salary Hourly Rate HerbertMaazin

https://images.ctfassets.net/pdf29us7flmy/c4d34bba-1dea-58d3-92ff-a535afb52613/6f00aee571b46a8818e7a4ceed3f9dfd/resized.png?w=720&q=100&fm=jpg

Calculating Yearly Salary Into Hourly Rate SharinaAmillie

https://i.ytimg.com/vi/89MDPaCgLDQ/maxresdefault.jpg

To start using The Hourly Wage Tax Calculator simply enter your hourly wage before any deductions in the Hourly wage field in the left hand table above In the Weekly hours field enter the number of hours you do each week excluding any overtime If you do any overtime enter the number of hours you do each month and the rate you get If you make 15 per hour and are paid for working 40 hours per week for 52 weeks per year your annual salary pre tax will be 15 40 52 31 200 Using this formula we can calculate the following annual incomes from basic hourly pay It s important to remember that these figures are pre tax and deductions

Choosing a good hourly rate As with the price of any good exchanged on a free market hourly wages are determined primarily by supply and demand which will be specific to your business niche your expertise sometimes to your location and language skills Generally the freer an economy is the more one s human capital plays a role in determining what income one is able to achieve As your income goes up the tax rate on the next layer of income is higher When your income jumps to a higher tax bracket you don t pay the higher rate on your entire income You pay the higher rate only on the part that s in the new tax bracket 2023 tax rates for a single taxpayer For a single taxpayer the rates are

Salary Vs Hourly The Difference How To Calculate Hourly Rate From

https://assets-global.website-files.com/5fa0baa5ea5c262586cf8fd0/61392d1aef9b212036f5dbcf_Salary vs Hourly - Featured Image - Wrapbook.jpg

Is It Better To Be Hourly Or Salary Wealth Meta

https://d100i36hiycpc5.cloudfront.net/blog/2018_04_featured_image/hourly_vs_salary.jpg

What Is My Salary Hourly Rate - The pay raise calculator can help you to calculate the salary increase given the current and future wage amounts and vice versa You can choose whichever form is most convenient for you be it the hourly weekly monthly or annual rate and the rest will be converted automatically a 10 annual raise is the same as a 10 monthly