What Is Margin Of Safety In Cost Accounting With Example In investing the margin of safety represents the difference between a stock s intrinsic value the actual value of the company s assets or future income and its market price Investors calculate this margin based on assumptions and buy securities when the market price is significantly lower than the estimated intrinsic value

What is margin of safety MOS Definition explanation formula computations examples of margin of safety This article explains the concept in a simple way The margin of safety formula is equal to current sales minus the breakeven point divided by current sales the result is expressed as a percentage

What Is Margin Of Safety In Cost Accounting With Example

What Is Margin Of Safety In Cost Accounting With Example

https://i.ytimg.com/vi/Q3BcTAYRqBo/maxresdefault.jpg

How To Do Margins In Canva Precision Designing Made Easy YouTube

https://i.ytimg.com/vi/9Sg9-S8cusk/maxresdefault.jpg

Calculation Of PV Ratio BEP Margin Of Safety And Increase And

https://i.ytimg.com/vi/Ud695i_tQ8o/maxresdefault.jpg

What is Margin of Safety The margin of safety in cost accounting is referred to as a financial ratio that measures the amount of sales that have exceeded the break even point This financial ratio indicates the actual profit of the company once it pays for all fixed and variable costs You might wonder why it is known as the safety margin ratio Margin of Safety in Cost Accounting In cost accounting the margin of safety is an essential concept that helps businesses measure how much their sales can decline before they hit the break even point It acts as a financial cushion allowing businesses to plan and make informed decisions without the fear of falling into losses Below are key aspects of the margin of safety in cost accounting

Margin of safety is a financial ratio that estimates the value of sales above the break even point It is the revenue a business or company receives after deducting the fixed and variable costs associated with producing its products and services Margin of safety is a term used in costing to determine the difference between the expected or budgeted sales and the actual or breakeven sales for a business It is an essential metric to assess a company s financial health and evaluate its ability to absorb unexpected changes in the market

More picture related to What Is Margin Of Safety In Cost Accounting With Example

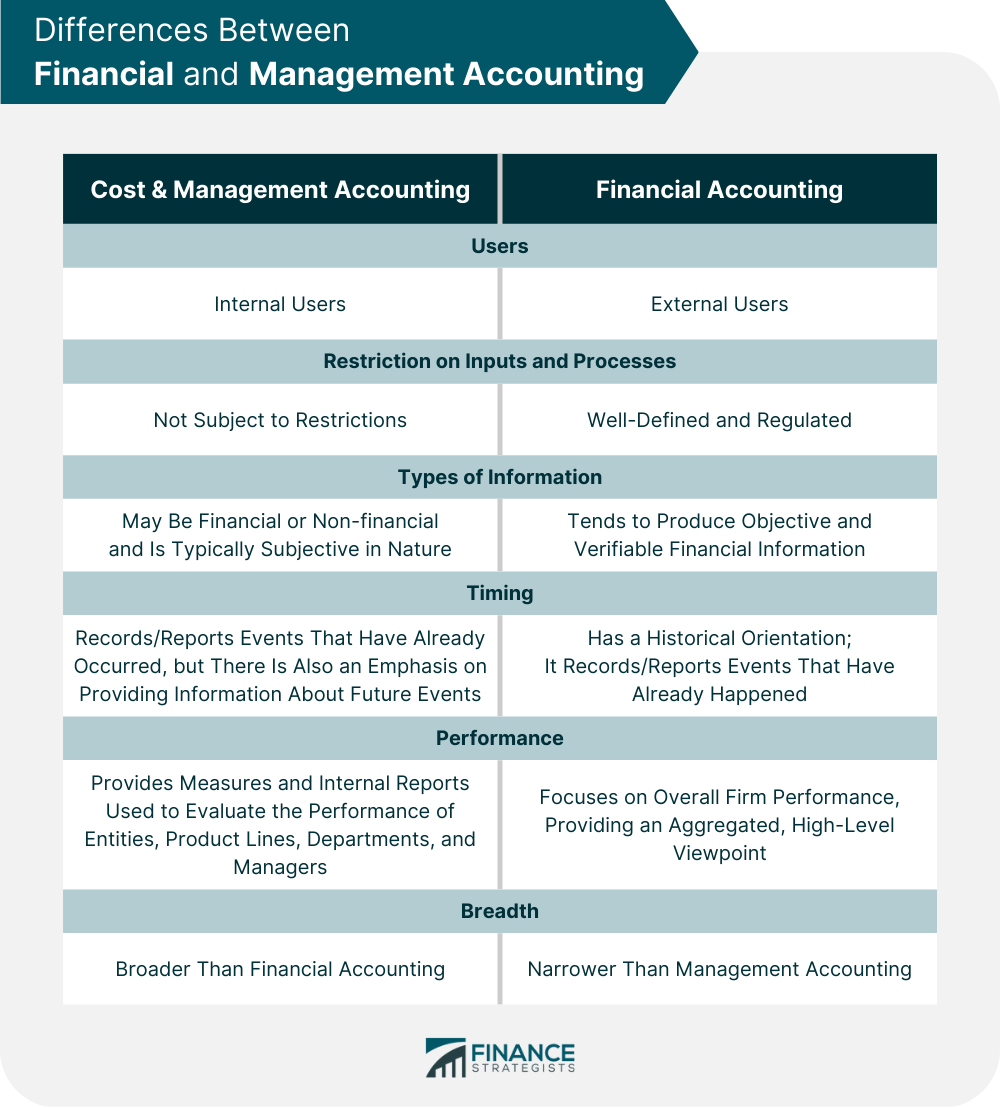

Cost Accounting Vs Financial Accounting Meaning And Comparison YouTube

https://i.ytimg.com/vi/D-J92fjOgVA/maxresdefault.jpg

What Is Margin Of Safety And How To Apply It In Investing YouTube

https://i.ytimg.com/vi/9QNFLFmC3aY/maxresdefault.jpg

Cost Accounting Definition Types Objectives And Advantages 48 OFF

https://clockify.me/learn/wp-content/uploads/2023/08/Elements-of-cost-accounting.jpg

The margin of safety is a key principle in financial management It s calculated as the difference between the break even point and expected profitability Managers use this metric to determine how much sales can drop before the company or a project becomes unprofitable This article covers what margin of safety means in cost accounting stocks and break even points You ll also learn the The Margin of Safety is the difference between budgeted sales and breakeven sales It is applied in two different terms i e investing and budgeting Budgeting and investing are the two different applications that define the Margin of Safety

[desc-10] [desc-11]

Cost Costing Cost Accounting And Cost Accountancy Cost Accounting

https://i.pinimg.com/originals/d1/a5/43/d1a54323e34fea016980107d81780808.png

Cost Accounting Formulas Formula Calculation And Example 48 OFF

https://www.financestrategists.com/uploads/Differences-Between-Financial-and-Management-Accounting.png

What Is Margin Of Safety In Cost Accounting With Example - Margin of safety is a term used in costing to determine the difference between the expected or budgeted sales and the actual or breakeven sales for a business It is an essential metric to assess a company s financial health and evaluate its ability to absorb unexpected changes in the market