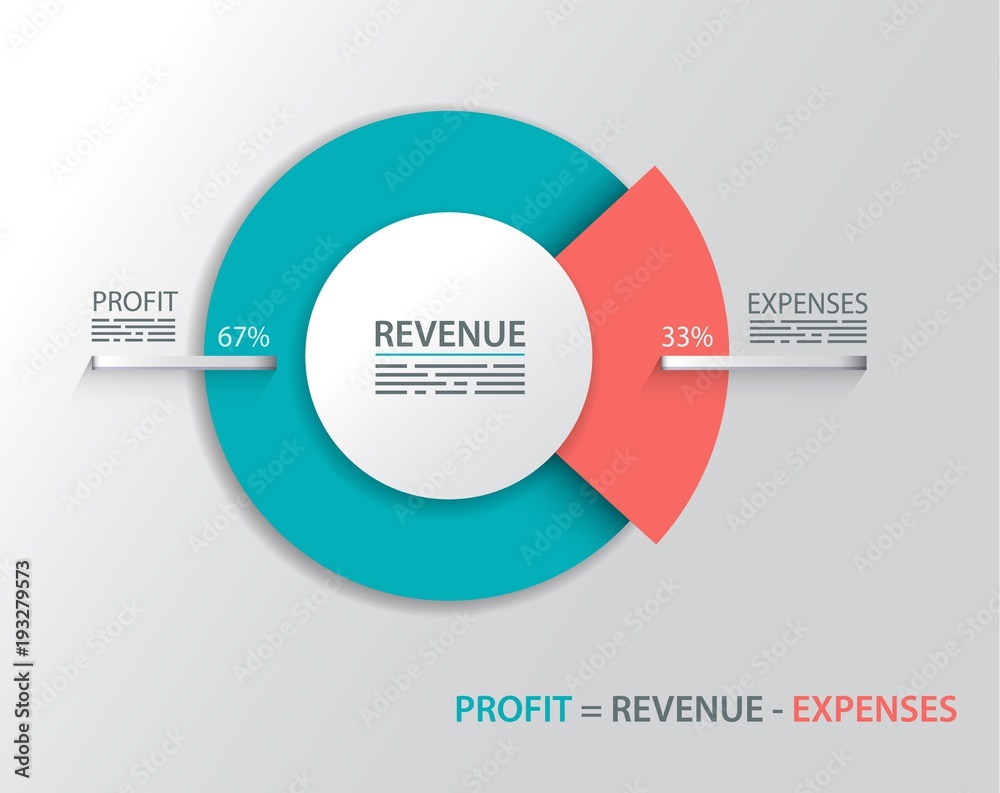

What Is Cost Of Revenue Vs Operating Expenses One of the main challenges for any business is to balance the trade off between cost of revenue and operating expenses in order to achieve revenue growth Cost of revenue refers to the direct costs associated with producing and delivering the goods or services that generate revenue such as raw materials labor inventory and shipping Operating expenses refer to the indirect costs associated

Denise adds up how much she spent in each of these categories and determines she spent 7 330 on operating expenses last year Cost of sales vs operating expenses While the cost of sales and operating expenses are both important metrics to assess whether your business is profitable there are some key differences in what they measure The operating margin is the percentage of revenue that is left after subtracting both the cost of revenue and the operating expenses For example if a company has 500 000 in revenue 250 000 in cost of revenue and 150 000 in operating expenses its operating profit is 100 000 and its operating margin is 20 100 000 500 000 4

What Is Cost Of Revenue Vs Operating Expenses

What Is Cost Of Revenue Vs Operating Expenses

https://as2.ftcdn.net/v2/jpg/01/93/27/95/1000_F_193279573_Lmen8o0G9Rq30VnWUFCevkzqv8uo0PnB.jpg

Cost Of Revenue Pengertian Komponen Dan Cara Menghitungnya

https://www.mas-software.com/wp-content/uploads/2021/08/Cost-of-Revenue.jpg

What Is Operating Income Operating Income Formula And EBITDA Vs

https://remote-tools-images.s3.amazonaws.com/Operatingincome.jpg

Revenue is a company s income from goods and services sold before deducting expenses while operating income is the revenue left after subtracting the expenses of day to day business operations Operating costs include the cost of goods sold and selling as well as general and administrative expenses like rent or insurance Reducing operating costs can increase profits but a reduction

Cost of revenue and operating expense are two different categories on the company s balance sheets and income statements that in one way or the other affect the company s financial analysis and decision making Cost of revenue contains all expenses related to cost of goods or services sold and include material cost labor and transportation Subtract operating income and Cost of Goods Sold from total revenue using the formula Operating Expenses Revenue Operating Income Cost of Goods Sold Cost of Goods Sold refers to costs directly related to the production of your goods or service including raw materials and labor costs Operating Expenses Example

More picture related to What Is Cost Of Revenue Vs Operating Expenses

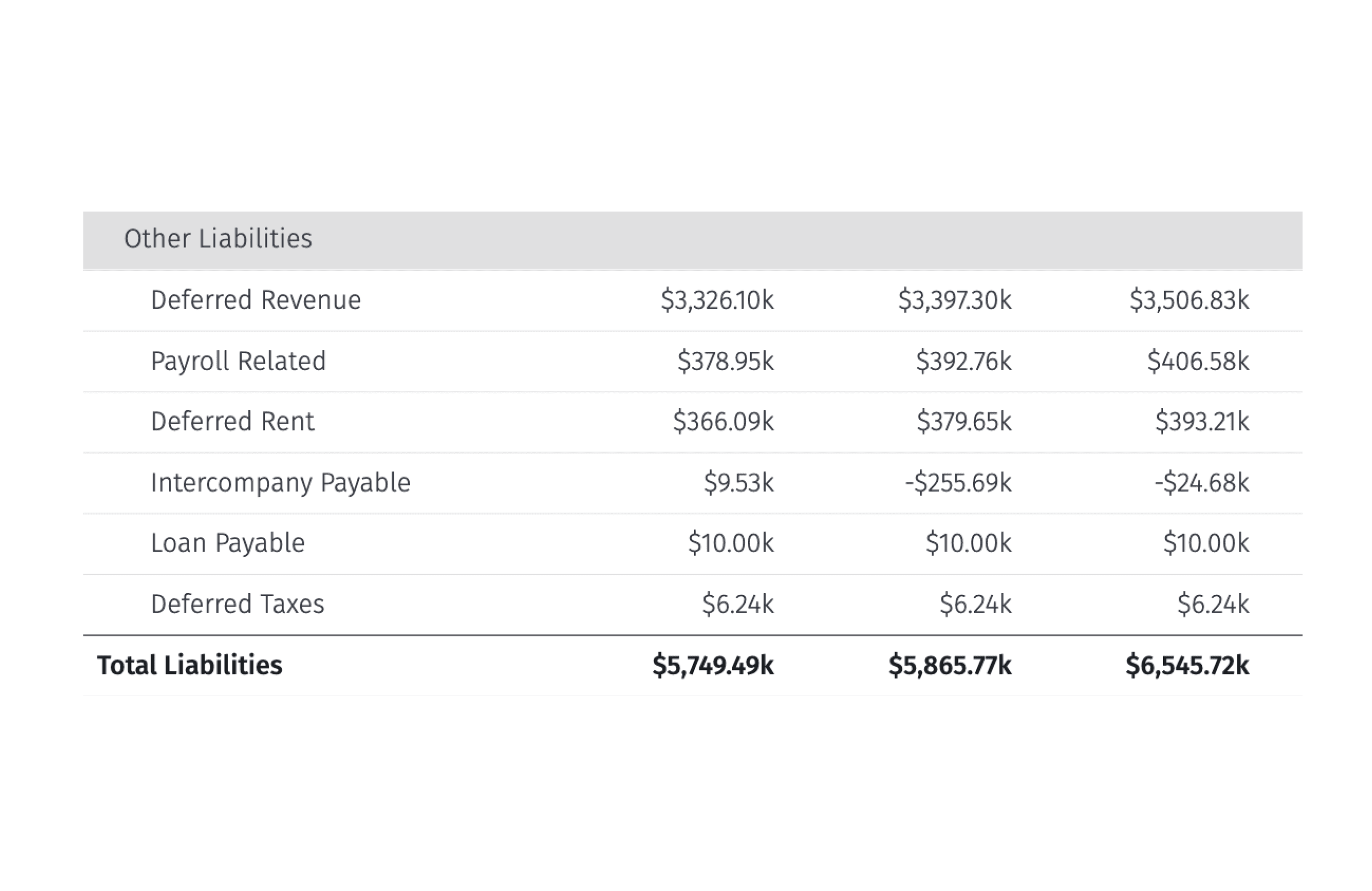

Deferred Revenue Examples How It Works For SaaS

https://www.mosaic.tech/_next/image?url=https%3A%2F%2Fmosaiccms.wpengine.com%2Fwp-content%2Fuploads%2F2023%2F08%2FMetrics-Catalog_Deferred-Revenue.png&w=3840&q=75

:max_bytes(150000):strip_icc()/dotdash_Final_Gross_Profit_Operating_Profit_and_Net_Income_Oct_2020-01-55044f612e0649c481ff92a5ffff1b1b.jpg)

How To Calculate Net Income In Finance Haiper

https://www.investopedia.com/thmb/kXfSkhhw0-QCdPUbrNqPeI9rpn4=/2092x0/filters:no_upscale():max_bytes(150000):strip_icc()/dotdash_Final_Gross_Profit_Operating_Profit_and_Net_Income_Oct_2020-01-55044f612e0649c481ff92a5ffff1b1b.jpg

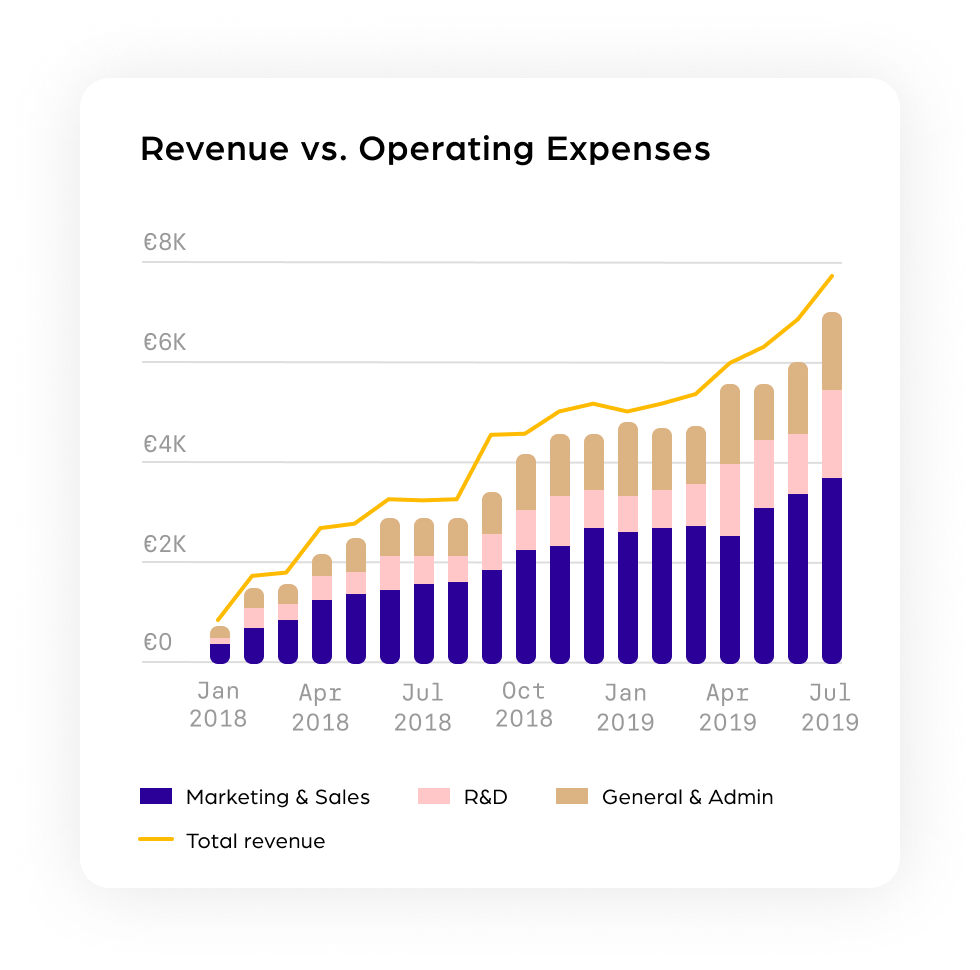

3 Metrics That Are Closely Related To Your Chart Of Accounts

https://www.calqulate.io/hs-fs/hubfs/Revenue_vs._Operating_Expenses-1.png?width=980&name=Revenue_vs._Operating_Expenses-1.png

No Cost of Revenue and Operating Expenses OpEx which include factory overhead costs are not the same Cost of Revenue includes direct costs related to the production and delivery of goods and services like Shipping freight charges and packing expenses In contrast Operating Expenses encompass the broader day to day costs of running a Cost of revenue is a major determinant of gross profit which is calculated as total revenue minus cost of revenue Operating expenses on the other hand are deducted from gross profit to arrive at operating income which represents the company s core earnings from ongoing operations Types of Expenses Variable vs Fixed Expenses

[desc-10] [desc-11]

How To Calculate Total Revenue In Economics The Tech Edvocate

https://www.thetechedvocate.org/wp-content/uploads/2023/10/Revenue-c58225e21ce34fcbb6e072f36e977e37-1.jpg

Understanding Profit And Loss P L And The Benefits For Hoteliers STR

https://str.com/sites/default/files/Components-of-pnl-statement-rev-expenses-profit.jpg

What Is Cost Of Revenue Vs Operating Expenses - Subtract operating income and Cost of Goods Sold from total revenue using the formula Operating Expenses Revenue Operating Income Cost of Goods Sold Cost of Goods Sold refers to costs directly related to the production of your goods or service including raw materials and labor costs Operating Expenses Example