What Is Annual Investment Allowance 2022 This measure will temporarily increase the limit of the annual investment allowance maintain the current temporary 1 000 000 AIA limit for one year and three months from 1 January 2022

We ll show you the annual investment allowance examples vans and all you need to know The AIA allows firms to claim tax benefits on certain assets 2022 B Based on the 200 000 allowance for the accounting period beginning after January 1 2022 apportioned for the number of months in the accounting period beginning after January 1 2022 Annual Investment Allowance AIA The Annual Investment Allowance AIA is a form of tax relief for businesses in the UK that is designated for the purchase of business equipment The Annual

What Is Annual Investment Allowance 2022

What Is Annual Investment Allowance 2022

https://optps.b-cdn.net/wp-content/uploads/2020/10/annual-investment-allowance-1536x982.jpg

Annual Investment Allowance

https://www.streetsweb.co.uk/media/uploads/files/Annual_Investment_Allowance.jpg

Autumn Budget 2021 1M Annual Investment Allowance ECOVIS

https://www.ecovis.co.uk/wp-content/uploads/2021/10/98147ba3-03b5-4fc2-a3a6-6a49aac7b62e.jpg

This measure will permanently increase the limit of the annual investment allowance 2023 through section 12 Finance Act 2022 The AIA is a 100 capital allowance for qualifying expenditure The annual investment allowance AIA has been with us for 14 years helpfully blurring the tax significance for many taxpayers of whether expendit Section 12 of the Finance Act 2022 gives no indication of any exceptional treatment for a business which has only five days after 31 March 2023 Such a business typically but not necessarily

Annual Investment Allowance AIA is a form of tax relief aimed at helping UK based businesses buy necessary equipment However in January 2019 the amount was temporarily increased to 1 000 000 which will be in effect until 1st January 2022 Additionally businesses that are registered for VAT value added tax can claim the AIA on the The annual investment allowance provides a 100 first year allowance for businesses who incur capital expenditure on the provision of plant or machinery Who will be affected Businesses including companies and groups of companies who incur annual capital expenditure on plant and machinery assets in excess of 200 000 as from 1 January 2022

More picture related to What Is Annual Investment Allowance 2022

Autumn Statement 2022 HMRC Tax Rates And Allowances For 2023 24

https://images.contentstack.io/v3/assets/blt3de4d56151f717f2/blt8743826b67930bd8/63767939ac59ed1089b31054/table_1.png

Construction Plant Finance Explains The Increase To Annual Investment

https://thecea.org.uk/wp-content/uploads/2018/11/CPF-Image-5.jpg

Our Guide To The 2019 Annual Investment Allowance Increase CARS

https://www.propertycapitalallowance.com/wp-content/uploads/2021/10/May-2019-A-guide-to-2019-Annual-Investment-Allowance-increase.png

As part of his plans to promote growth in the economy Chancellor Kwasi Kwarteng announced changes to the Annual Investment Allowance AIA in his mini budget on 23 September 2022 The planned reduction in the AIA limit to 200 000 from 1 April 2023 will be scrapped The AIA limit to be permanently set at 1 million Capital allowances are a type of tax relief which businesses can claim when they invest in long term assets Sometimes known as fixed assets or capital assets these are assets which you can reasonably expect to stay in use by the business for longer than 12 months Claiming capital allowances means you can deduct part or all of the asset

The annual investment allowance has been permanently set at 1 000 000 for qualifying expenditure on plant and machinery from 1 April 2023 If you spend more than the AIA on qualifying plant and machinery the excess amount can be claimed as a writing down allowance You get a new allowance for each accounting period The measure maintains the existing incentives for businesses to invest in both main pool and special rate plant and machinery For many small and medium sized businesses fixing the annual investment allowance limit at a permanent level of 1m should provide a full write off for investment in plant and machinery

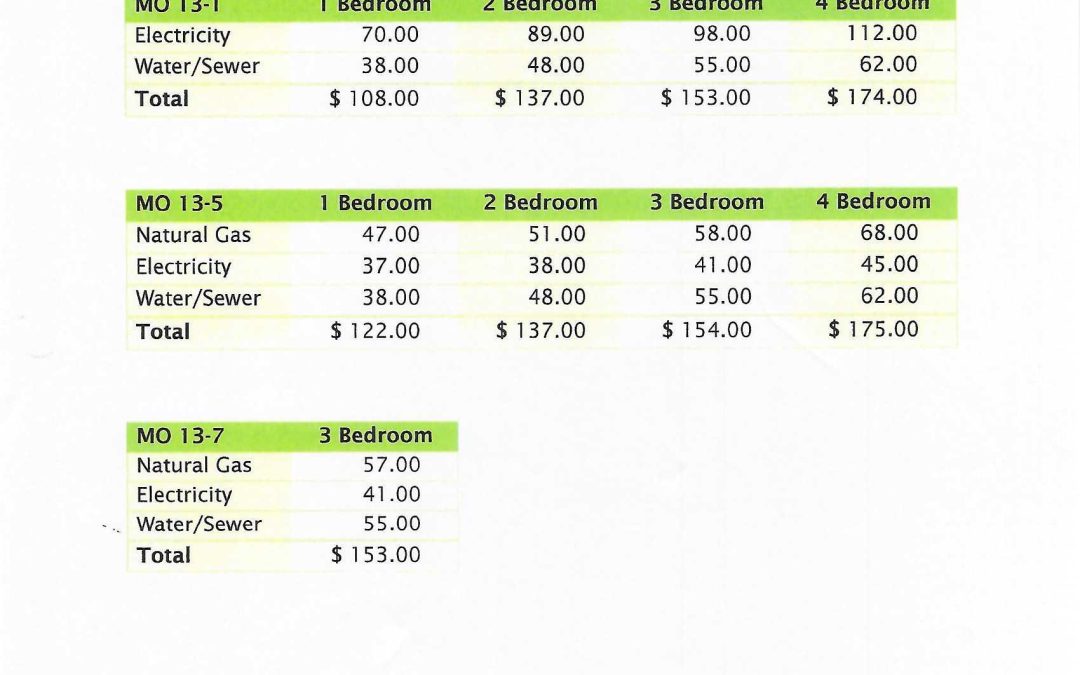

Utility Allowance 2022 PBHA

https://pbhousing.org/wp-content/uploads/2022/08/Utility-Allowance-2022-187208_1080x675.jpg

End Of The AIA Transitional Limit Beware Of The Traps

https://www.accountingfirms.co.uk/wp-content/uploads/2021/10/annual-investment-allowance-AIA.png

What Is Annual Investment Allowance 2022 - This measure will permanently increase the limit of the annual investment allowance 2023 through section 12 Finance Act 2022 The AIA is a 100 capital allowance for qualifying expenditure