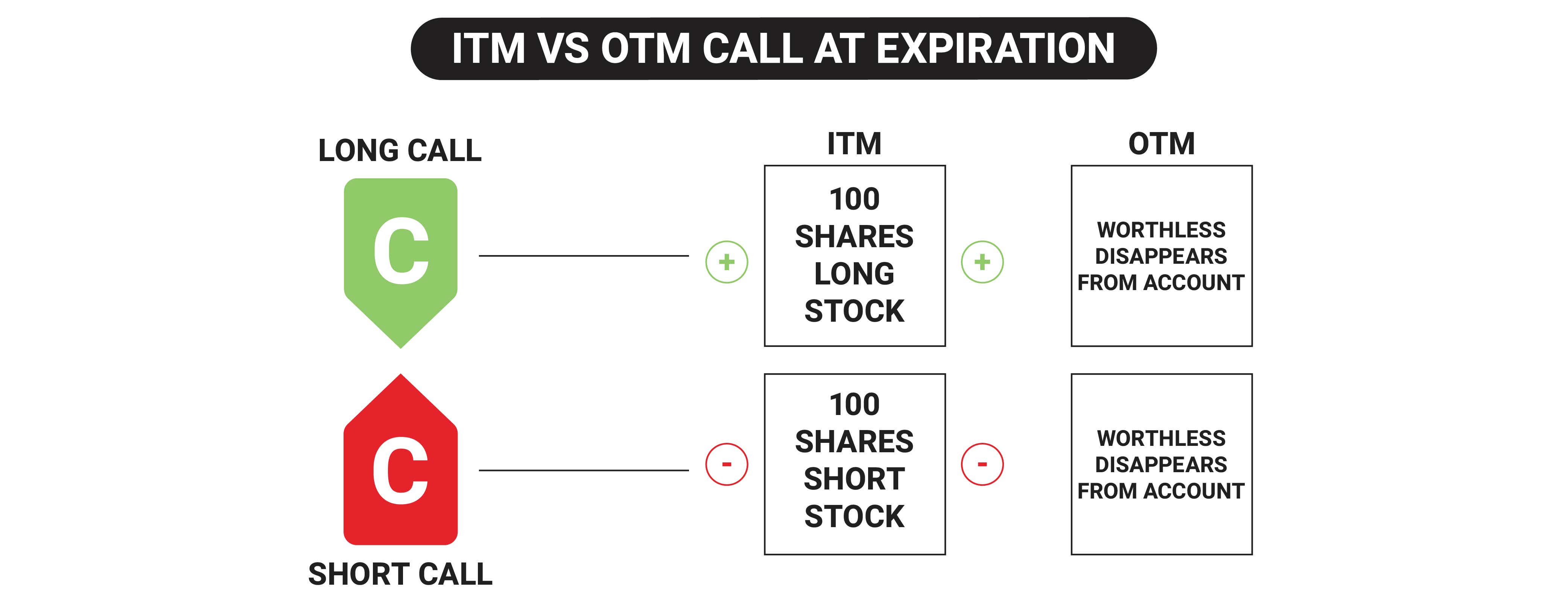

What Happens When Options Expire Otm At expiration one of two things happens depending on whether one s option is in the money ITM or out of the money OTM If an option has intrinsic value to the owner it is considered ITM If it does not it is considered OTM Put options below the stock price are OTM and put options above the stock price are ITM

Brokerage will be charged on both sides i e when the options are bought and when they are settled on the expiry day Contracts expiring OTM OTM option contracts expire worthlessly The entire amount paid as a premium will be lost Brokerage will only be charged on one side which is when the options are purchased and not when they expire Example 2 OTM Call Option On the other hand let s say the market price of the stock is 45 on the expiration date This option is now OTM If you exercised it you d buy the stock for more than it s worth which doesn t make much financial sense So in this case the option expires worthless and you re out the premium you paid for it

What Happens When Options Expire Otm

What Happens When Options Expire Otm

https://www.projectfinance.com/wp-content/uploads/2022/03/In-The-Money-Option-at-Expiration.png

Options Expiration What Happens When Options Expire Tastylive

https://images.contentstack.io/v3/assets/blt40263f25ec36953f/blt9eab85a0db75eb25/63878e2c9405fa1010ee9ff7/options_expiration_ITM-OTM-Call-Expiration-nl.png?format=pjpg&auto=webp&quality=50

Explained What Happens When Options Expire Best Stock Strategy

https://beststockstrategy.com/wp-content/uploads/2021/04/options-expire-scaled.jpg

When the option is OTM and expiration arrives the investor accepts the 100 loss of their purchase price and allows the option to expire Professional traders or market makers people who purchase stocks that are being sold by an investor then resell them essentially creating a market will have instances when they exercise OTM options at A put option is OTM if its strike price is below the price of the underlying stock 3 An options contract gives the owner the right but not the obligation to buy in the case of a call or sell in the case of a put the underlying security at the strike price on or before the option s expiration date When the owner claims the right i e

The value of a call option or the value of a put option on its expiration date is its intrinsic value For example if you have a call option with a 50 strike and the stock closed at expiration at 55 then the option contract is worth exactly 5 which is the difference between the strike price and where the stock closed 14 Out Of The Money OTM Out of the money OTM is term used to describe a call option with a strike price that is higher than the market price of the underlying asset or a put option with a

More picture related to What Happens When Options Expire Otm

What Happens When You Trade In ATM OTM Options On Expiry Day

https://www.marketcalls.in/wp-content/uploads/2021/09/image-1.png

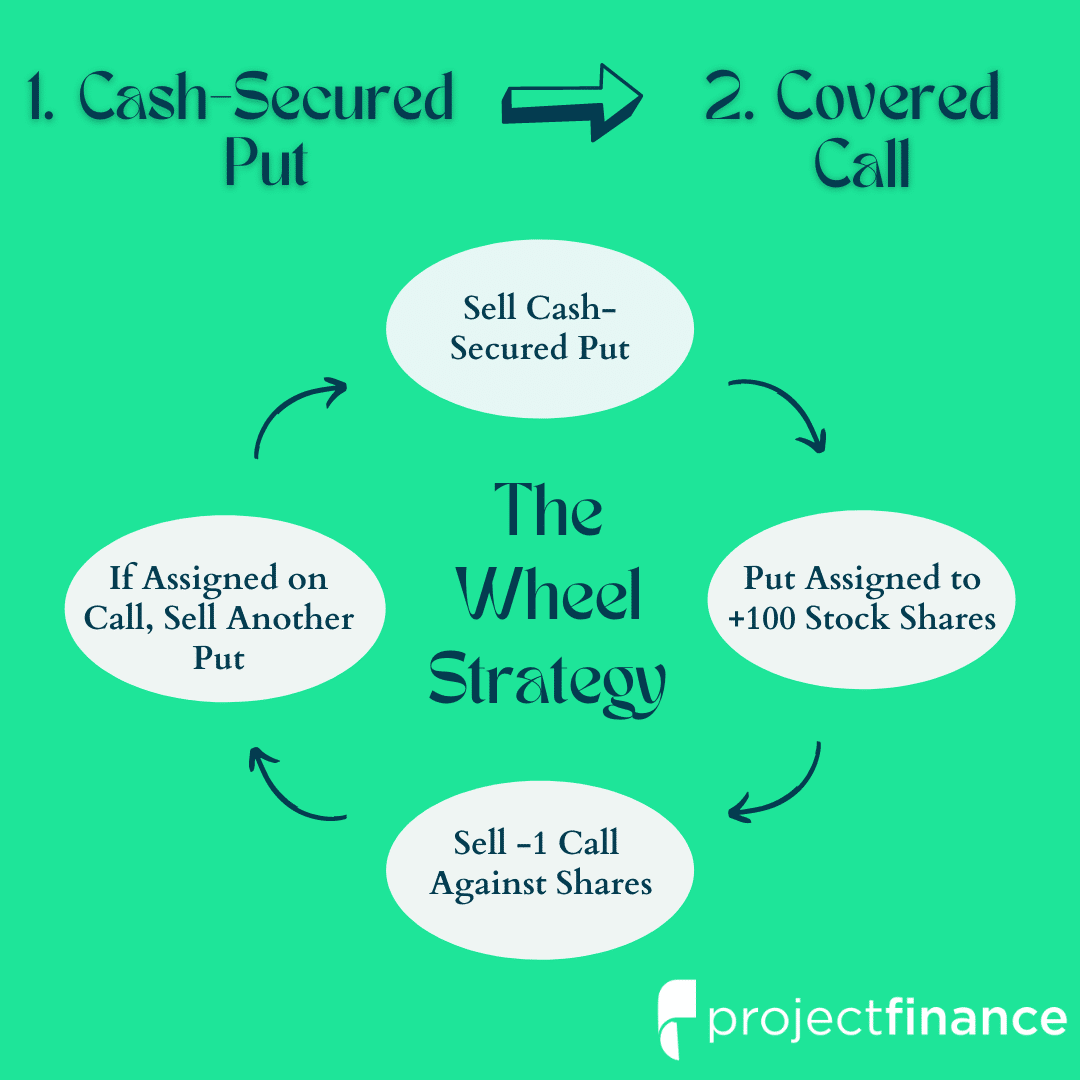

The Wheel Options Strategy Collect Income From Options Projectfinance

https://www.projectfinance.com/wp-content/uploads/2022/05/The-Wheel-Options-Strategy.png

What Is ATM OTM ITM In Options Dhan Blog

https://blog.dhan.co/blog/wp-content/uploads/2023/01/ATM-OTM-ITM-in-Options.jpg

For example if an option is trading for 1 40 the price of one contract excluding fees is 140 or 1 40 x 100 multiplier 140 Expiration Each option has an expiration date which is when the contract expires and ceases to exist Strike price Each option also has a strike price and if the contract is exercised the underlying What Happens When an Option Expires OTM If an OTM contract expires it becomes worthless This means you ll lose the right to exercise the contract You ll also lose any premiums you paid in

Out of the money OTM options where the exercise price for a call is more than the current underlying security s price or less for a put OTM options expire worthless on expiry This makes sense If the above option for example expires with the stock price below 140 the option holder will be able to buy stock at 140 All options have an expiration date It is part of the creation and listing of all new series of calls and puts on the various underlying stocks ETFs indexes and futures on which options are made available to buy and sell The expiration date is the end of the contract the last day the owner of the option has the right to buy or sell the underlying asset at the strike price

Learn How To Trade Options A Step By Step Guide To Get Started

https://media.realvision.com/wp/20210910160929/Put-vs-Call-Chart.jpg

Verdauungsorgan Borke Kartoffeln Xbox Live Expired But Still Working

https://cdn.windowsreport.com/wp-content/uploads/2021/10/Your-Windows-license-will-expire-soon.jpg

What Happens When Options Expire Otm - A put option is OTM if its strike price is below the price of the underlying stock 3 An options contract gives the owner the right but not the obligation to buy in the case of a call or sell in the case of a put the underlying security at the strike price on or before the option s expiration date When the owner claims the right i e