Salary Tips And Interest Are All Included In These transitions often give you a significant salary increase During the last few years people have jumped ship because the incentive to do so has been salary increases of 20 30 40 even 50

2 Integrate wellbeing programs into HR programs more holistically For example having a robust total rewards plan can also help address financial stress improving an employee s emotional wellbeing 3 Communicate the firm s promotion criteria and advancement potential to employees Wages salaries tips other income gross income adjustments to income AGI The changes are generally going to be made on the Schedule 1 Renn says For 2021 there were 25

Salary Tips And Interest Are All Included In

:max_bytes(150000):strip_icc()/understanding-form-w-2-wage-and-tax-statement-3193059-v4-5bc643e646e0fb0026d3aafc-5c0ab974c9e77c000168e8d4-aa8231daf99c4a29b2eea9e58e5fdca8.png)

Salary Tips And Interest Are All Included In

https://www.thebalancemoney.com/thmb/SoUx-p0DktOZVeWtTPDNwQ1uPLk=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/understanding-form-w-2-wage-and-tax-statement-3193059-v4-5bc643e646e0fb0026d3aafc-5c0ab974c9e77c000168e8d4-aa8231daf99c4a29b2eea9e58e5fdca8.png

Form W-2, Wage and Tax Statement for Hourly & Salary Workers

https://www.efile.com/image/w2-sample.jpg

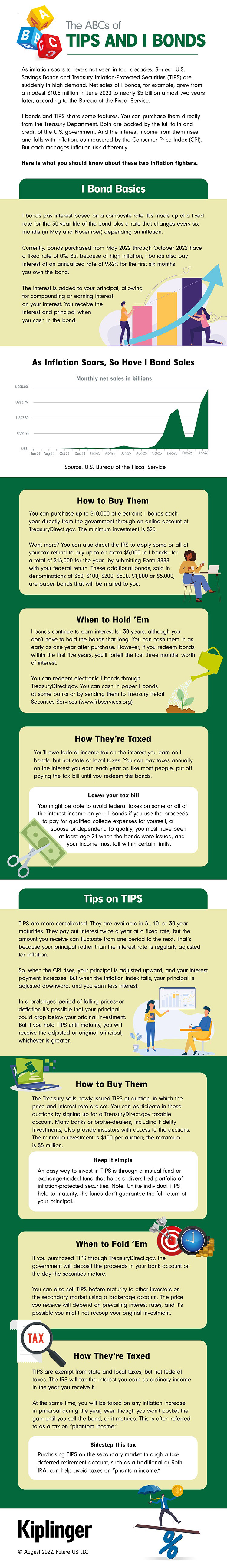

The ABCs of Tips and I Bonds

https://www.fidelity.com/bin-public/060_www_fidelity_com/images/Insights/multimedia/tips-and-ibonds-infographic-750x5192.jpg

Box 7 reflects the amount of tips you reported to your employer and this amount should already be included in Box 5 and the associated withholding should be in Box 6 Box 8 Allocated Tips are not included in Box 1 3 5 or 7 and will need to be added to your wage on line 1 of the 1040 unless you can demonstrate typically with a daily A 10 Step Plan for Negotiating Salary Like anything else going into salary negotiations feeling prepared is your best bet Taking steps to calm your nerves so you come off self assured can go a long way in projecting confidence to your employer even if you have to fake it till you make it 1 Stay positive

Comparison based on starting price for H R Block file with a tax pro excluding returns that include Child Tax Credit or Earned Income Credit combined with interest and dividend forms compared to TurboTax Full Service Basic price listed on TurboTax as of 3 16 23 Over 50 of our customers can save All tax situations are different It s your gross income the money you make before taxes and paycheck deductions minus certain adjustments You ll most often come across AGI when filing your taxes It plays a vital role in

More picture related to Salary Tips And Interest Are All Included In

:max_bytes(150000):strip_icc()/what-is-included-on-a-pay-stub-2062766-FINAL-edit-f9458e043f2e4c5ab87a4ef5cec0cd5d.jpg)

How To Read a Pay Stub

https://www.thebalancemoney.com/thmb/qWN0kqMop0Uz29CLXINjdQtLcjI=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/what-is-included-on-a-pay-stub-2062766-FINAL-edit-f9458e043f2e4c5ab87a4ef5cec0cd5d.jpg

:max_bytes(150000):strip_icc()/most-important-factors-investing-real-estate.asp-ADD-FINALjpg-32950329a30d4500b6d7e0fd0ba95189.jpg)

The Most Important Factors for Real Estate Investing

https://www.investopedia.com/thmb/MBWA-PxPX951Pd8WETL7WSN9Kvc=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/most-important-factors-investing-real-estate.asp-ADD-FINALjpg-32950329a30d4500b6d7e0fd0ba95189.jpg

W-2 vs Last Pay Stub: What's the Difference? | APS Payroll

https://apspayroll.com/wp-content/uploads/2021/11/W-2-vs.-Final-Paystub-1.png

This includes both earned income from wages salary tips and self employment and unearned income such as dividends and interest earned on investments royalties and gambling winnings Adjusted gross income AGI is a measure of income used to calculate an individual s federal income taxes AGI includes all forms of taxable income such as wages interest dividends and

Income in its simplest form is money that an individual or business receives in exchange for providing a good or service or through investing capital It s the lifeblood of financial planning allowing us to cover daily expenses save for future goals and invest for growth The importance of income in cannot be overstated The Internal Revenue Service IRS classifies earned income as any taxable income you obtained from working your hourly or salaried job and revenue gained from self employment It s taxed differently from certain types of unearned income such as capital gains Note

:max_bytes(150000):strip_icc()/types-of-employee-benefits-and-perks-2060433-Final-edit-60cedb43c4014fdeb51aa3cd3c25f027.jpg)

Types of Employee Benefits and Perks

https://www.thebalancemoney.com/thmb/qE22XyBMb2AJC4OC4vM3cpOk3WU=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/types-of-employee-benefits-and-perks-2060433-Final-edit-60cedb43c4014fdeb51aa3cd3c25f027.jpg

:max_bytes(150000):strip_icc()/dotdash-040615-what-difference-between-residual-income-and-passive-income-final-ead4eaafb219438c98555810177928c7.jpg)

Passive Income vs. Residual Income: What's the Difference?

https://www.investopedia.com/thmb/OunmY1qDh19jUYxgBCQ5KTa_LdI=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/dotdash-040615-what-difference-between-residual-income-and-passive-income-final-ead4eaafb219438c98555810177928c7.jpg

Salary Tips And Interest Are All Included In - Ability to pay A concept of tax fairness that states that people with different amounts of wealth or different amounts of income should pay tax at different rates Wealth includes assets such as houses cars stocks bonds and savings accounts Income includes wages interest and dividends and other payments