Roth 401k Employer Match Rules Contribution Limits Contribution limits are the same for both traditional and Roth 401 k s For 2022 employees can contribute up to 20 500 to 401 k accounts with an additional catch up

The SECURE 2 0 Act passed at the end of 2022 made significant changes to retirement accounts Employers will now have the option to make Roth contributions to their workers Roth 401 k s You New Guidance Fills in the Blanks for Roth Employer Contributions Cohen Buckmann P C Clarification of the rules for electing Roth employer contributions should spur more plan sponsors and vendors to consider allowing them

Roth 401k Employer Match Rules

Roth 401k Employer Match Rules

https://choosegoldira.com/wp-content/uploads/2022/07/can-you-rollover-a-simple-ira-while-still-employed.jpg

Roth 401k Employer Match Calculator Santisqomariyah

https://districtcapitalmanagement.com/wp-content/uploads/2022/01/Roth-401k-vs-Roth-IRA.jpg

Average 401k Employer Match YouTube

https://i.ytimg.com/vi/IfDzHBnpgto/maxresdefault.jpg

Roth 401 k s don t have an income limit for contributions You can only make contributions to a Roth IRA if your modified adjusted gross income MAGI is less than 153 000 for single filers or 228 000 for married couples filing jointly or a qualified widow er for 2023 For 2023 Roth 401 k s must take RMDs if over age 73 Secure 2 0 the new retirement rules that lawmakers passed in late December includes several provisions that will make the tax free savings vehicle known as a Roth more accessible and flexible

Employers match Roth 401 k contributions at the same rate as traditional 401 k contributions dollar for dollar or partially but the funds go into a traditional 401 k account instead of your Roth 401 k Making the most of your employer sponsored retirement plan can be critical to financial stability in retirement along with core How Matching Works Assume your employer offers a 100 match on all your contributions each year up to a maximum of 3 of your annual income If you earn 60 000 the maximum amount your employer

More picture related to Roth 401k Employer Match Rules

How Much Can An Employer Match In A 401k 401kInfoClub

https://www.401kinfoclub.com/wp-content/uploads/401k-matching-grow-your-401k-magnifymoney-706x1024.png

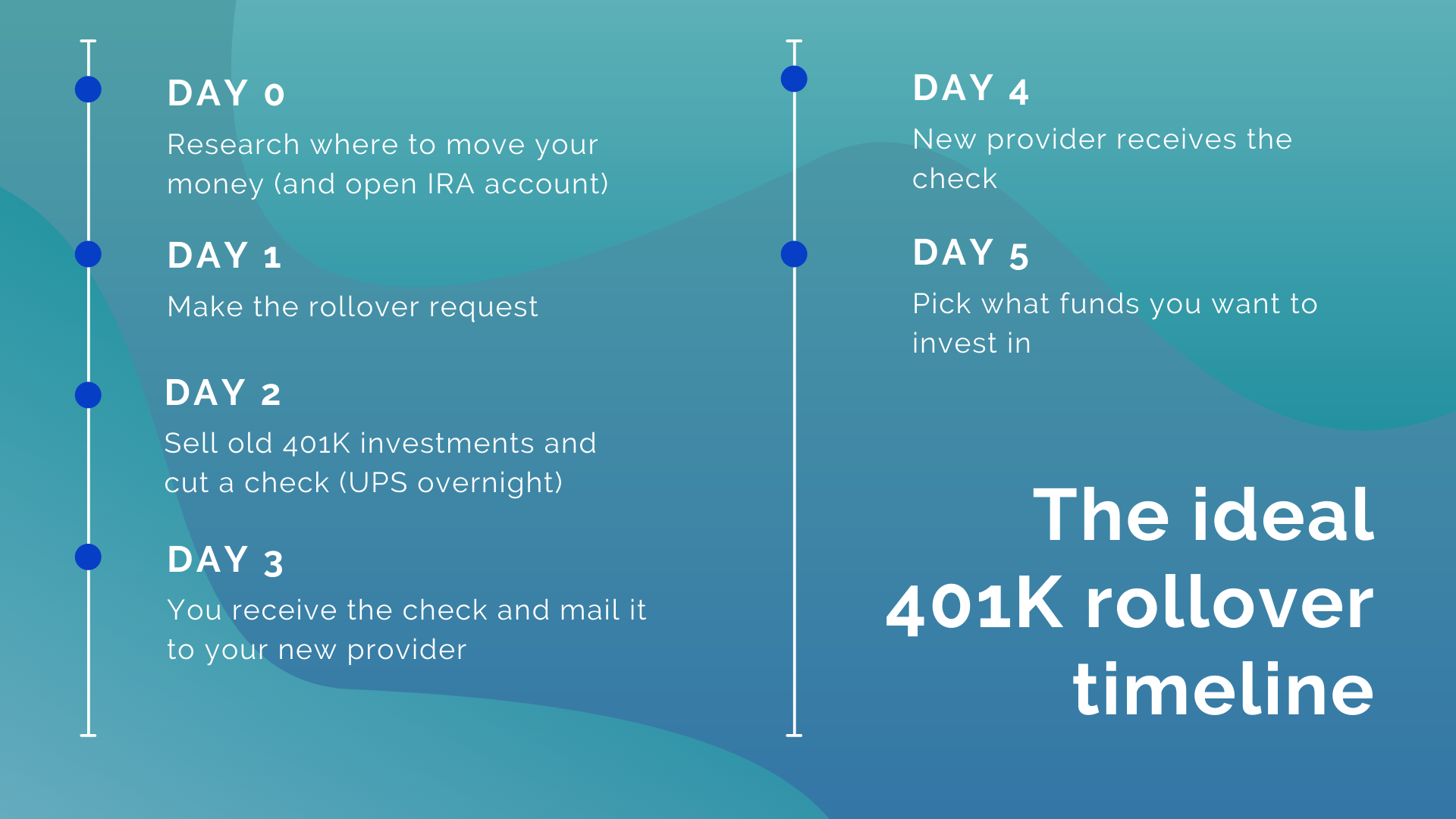

How To Rollover 401k From Previous Employer To New Employer

https://www.401kinfoclub.com/wp-content/uploads/the-complete-401k-rollover-guide-retire.png

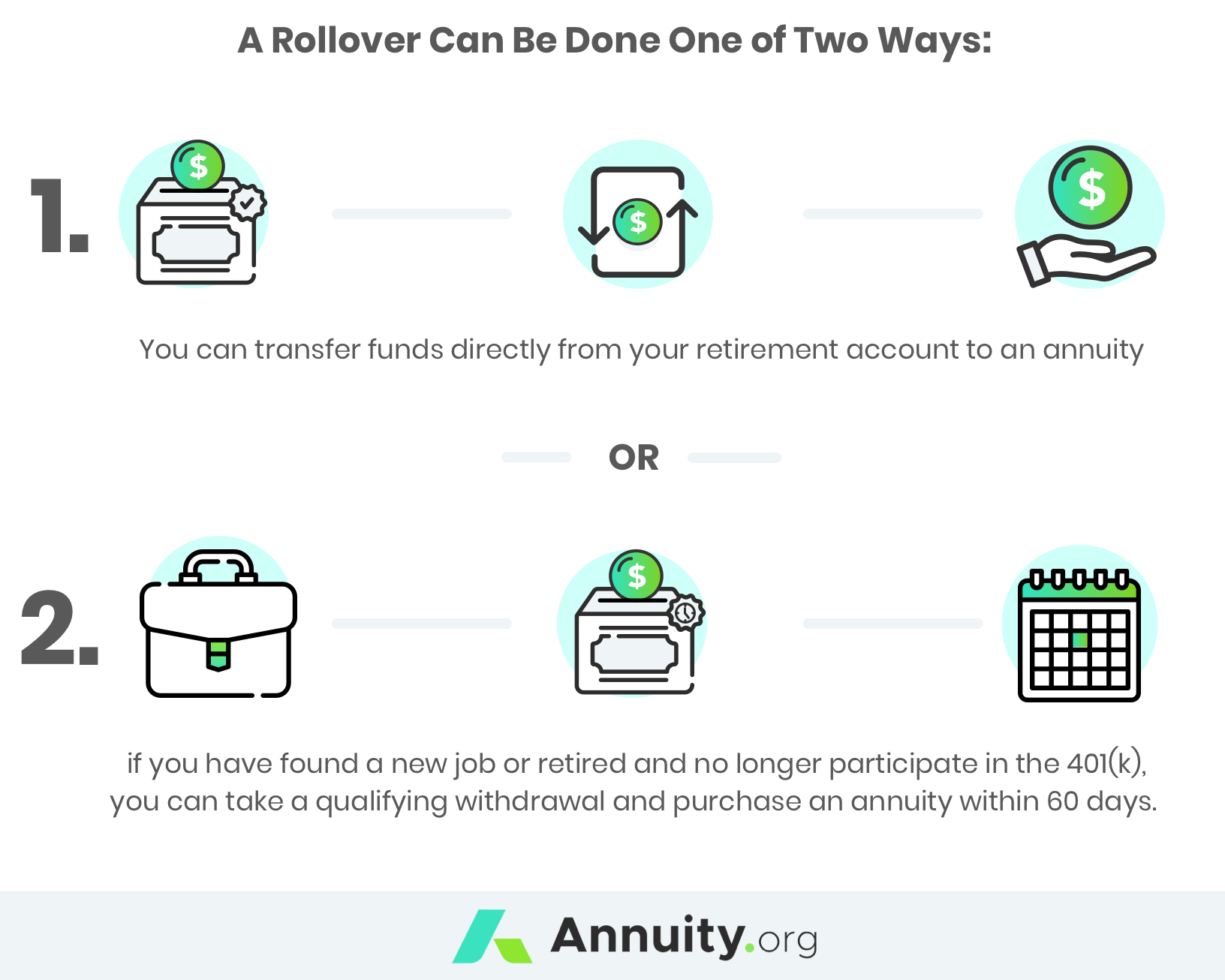

What Is A 401k Rollover 401kInfoClub

https://www.401kinfoclub.com/wp-content/uploads/roll-over-ira-or-401k-into-an-annuity-rollover-strategies.png

Yes for 2022 if you are age 50 or older you can make a contribution of up to 27 000 to your 401 k 403 b or governmental 457 b plan 20 500 regular and 6 500 catch up contributions and 7 000 to a Roth IRA 6 000 regular and 1 000 catch up IRA contributions for a total of 34 000 Income limits apply to Roth IRA contributions Roth 401 k s have a different rule You must take money out on the same schedule as you would with a regular 401 k With the new bill however Roth 401 k s would have the same rule as Roth I

401 k Plan Overview A 401 k plan is a qualified plan that includes a feature allowing an employee to elect to have the employer contribute a portion of the employee s wages to an individual account under the plan The underlying plan can be a profit sharing stock bonus pre ERISA money purchase pension or a rural cooperative plan A Roth 401 k is an employer sponsored after tax retirement account that has features of both a Roth IRA and a 401 k Like a Roth IRA contributions to a Roth 401 k are made with income that

Can A Roth Ira Be Rolled Into A 401k 401kInfoClub

https://www.401kinfoclub.com/wp-content/uploads/how-to-roll-a-401k-into-a-roth-ira-the-wicked-wallet.png

How Much Can You Rollover From 401k To Roth Ira 401kInfoClub

https://www.401kinfoclub.com/wp-content/uploads/401k-rollover-into-roth-ira-youtube.jpeg

Roth 401k Employer Match Rules - Employers match Roth 401 k contributions at the same rate as traditional 401 k contributions dollar for dollar or partially but the funds go into a traditional 401 k account instead of your Roth 401 k Making the most of your employer sponsored retirement plan can be critical to financial stability in retirement along with core