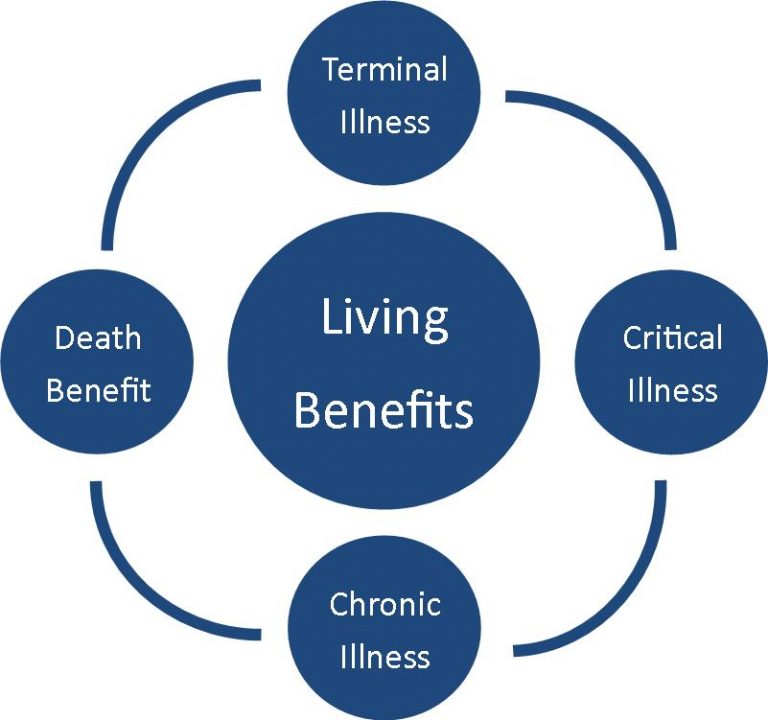

Pros And Cons Of Living Benefits Life Insurance Terminal illness you would be able to accelerate your life insurance policy benefits under this rider if you have been advised by a physician that your illness or physical condition is likely to result in death within 24 months Please note that some companies would require a life expectancy of 12 months or less One thing to be mindful of is that each category has a different waiting period

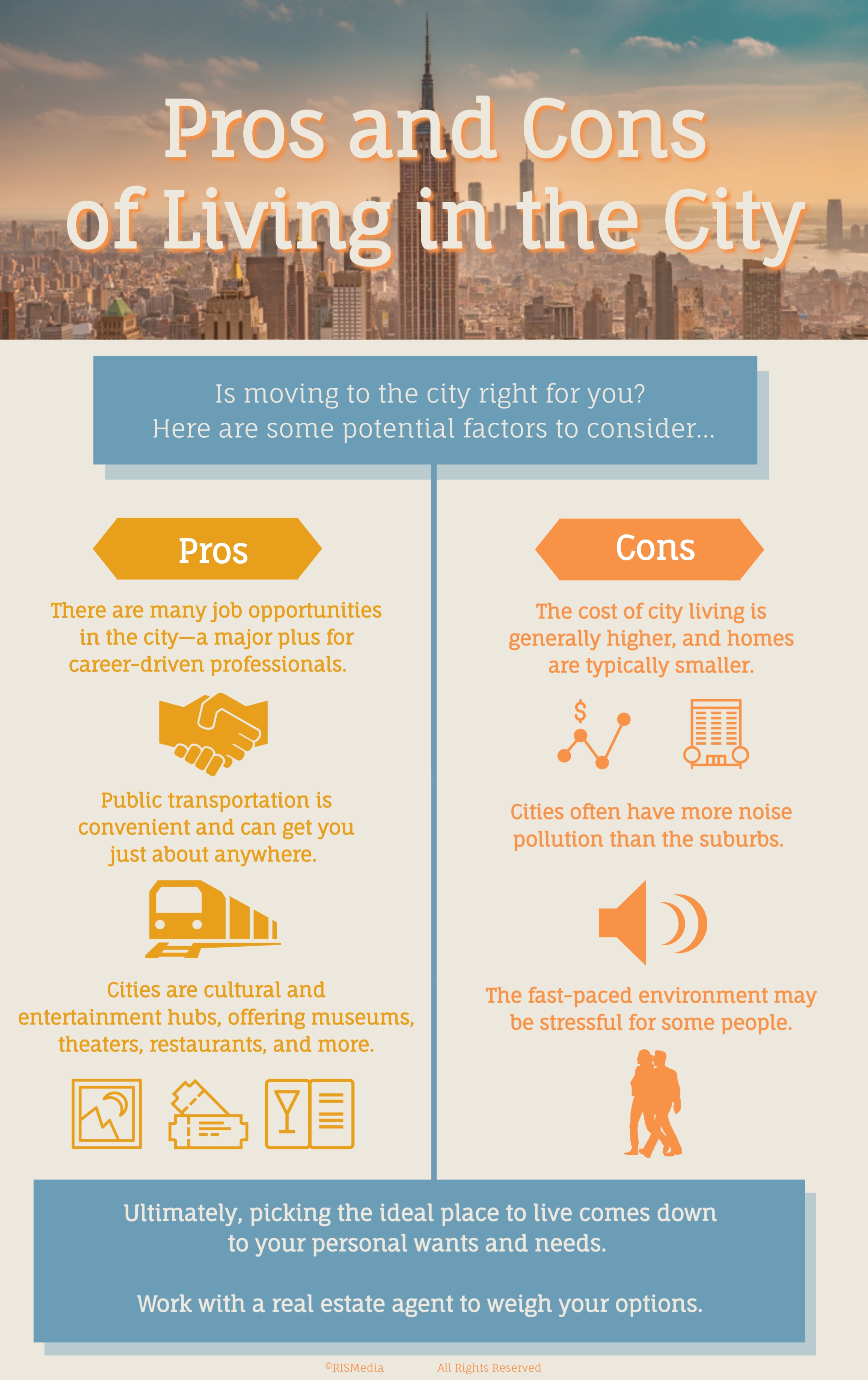

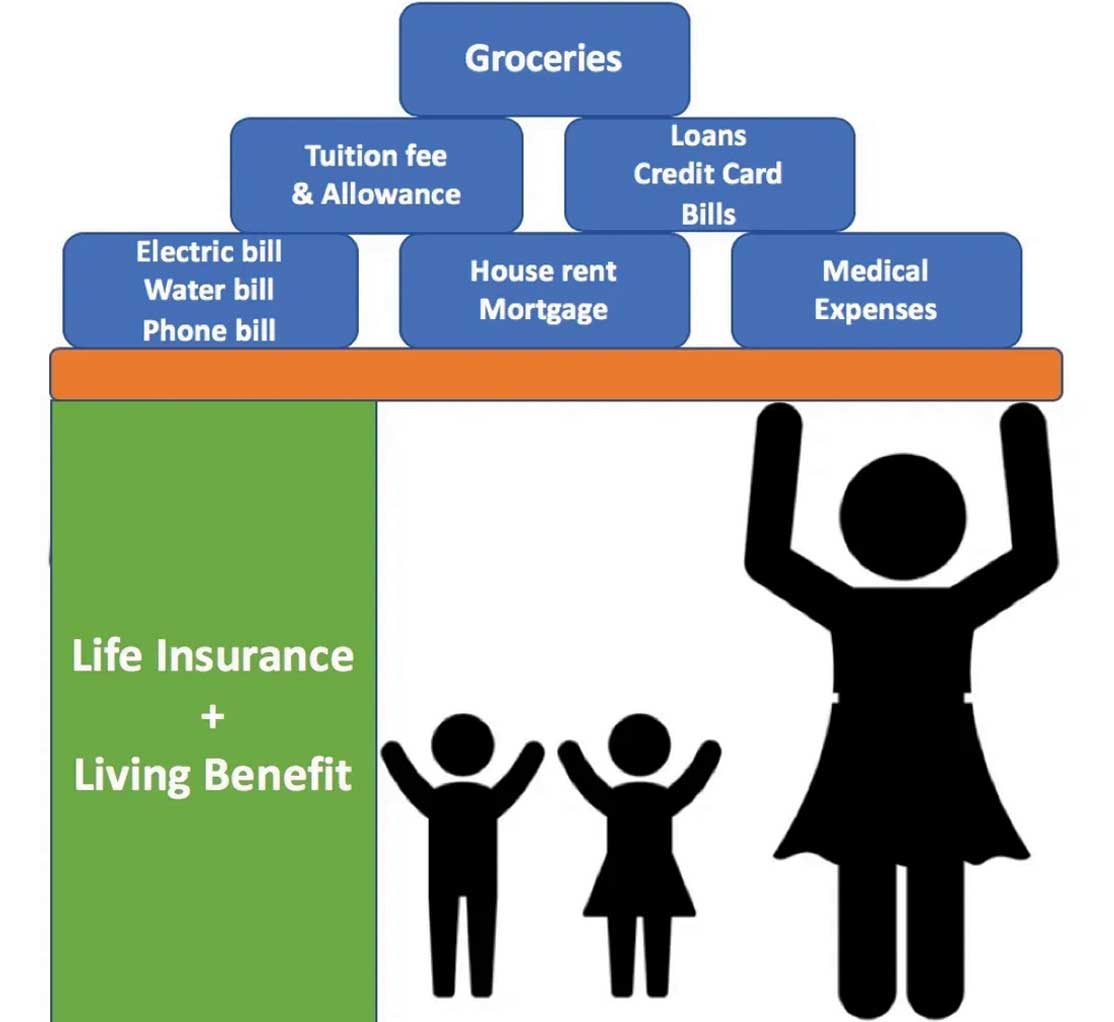

Life insurance with living benefits can provide you with the financial support you need if you have a chronic illness but it may raise your premiums It s important to weigh the pros and cons of living benefits in life insurance before you decide whether it s right for your circumstances If you re considering this type of policy They can be added to term life whole life and universal life policies making them accessible to a wide range of consumers This flexibility allows individuals to choose the type of coverage that best suits their needs while still gaining access to living benefits Cons Of Living Benefits Life Insurance 1 Reduction In Death Benefit

Pros And Cons Of Living Benefits Life Insurance

Pros And Cons Of Living Benefits Life Insurance

https://i.ytimg.com/vi/W6Gzc7pmWF8/maxresdefault.jpg

Achieve Peace Of Mind With Living Benefits Life Insurance PinnacleQuote

https://www.pinnaclequote.com/wp-content/uploads/2018/08/Living-benefits.jpeg

Life Insurance With Living Benefits KANFEE AGENCY

https://i.imgur.com/lzoDGcK.jpg

Life insurance living benefits are financial benefits that life insurance policyholders can access during their lifetime The two main types are cash value and living benefit riders Pros and Cons of Living Benefits Life Insurance In general for a fee these riders provide benefits to you while you re alive should a specific event occur Each rider has its pros and cons Accelerated Death Benefit Rider Pros Provides financial relief when facing a terminal illness Gives you flexibility in using funds

Living benefits in life insurance provide financial support during your lifetime allowing you to access a portion of the death benefit if certain conditions are met This comprehensive guide explores the pros and cons of living benefits life insurance including the types of coverage eligibility criteria and impact on the death benefit It also emphasizes the importance of considering your Want to know how living benefits from life insurance policies help Bankrate explains Pros cons of financial advising 7 min read Explore all investing resources Credit cards

More picture related to Pros And Cons Of Living Benefits Life Insurance

30 Intense Pros And Cons Of Technology 2023 Ablison Energy Quick Guide

https://www.rismedia.com/wp-content/uploads/2020/01/Infographic_101519_3.jpg

Life Insurance With Living Benefits Lifeguard Insurance Services

https://lifeguardinsurance.net/wp-content/uploads/2019/04/Living_Benefits-768x720.jpg

Life Insurance Future Picture Team

https://www.futurepictureteam.com/wp-content/uploads/2021/09/117.jpg

Living needs benefits in life insurance provide policyholders with early access to a portion of their death benefit when facing terminal chronic or critical illnesses This financial support helps cover medical expenses daily living costs and other essential needs during challenging times Pros and Cons of Life Insurance with Living Benefits Life insurance with living benefits can be invaluable to someone who becomes terminally ill or requires long term care With some life insurance providers these benefits are automatically included with the policies they sell at no additonal cost to the policyholder

[desc-10] [desc-11]

What Is Living Benefits Life Insurance

https://mls643heoxm8.i.optimole.com/gZNFpgs-zlomgGRK/w:auto/h:auto/q:98/wm:86966:1:soea:0:0:0.02/https://www.easyquotes4you.com/wp-content/uploads/2018/09/cropped-Living-Benefits-Rider-Critical-Illness-Rider-1.jpg

Life Insurance With Living Benefits Top 5 Term Policy Riders You Need

https://insurancebrokersusa.com/wp-content/uploads/2020/06/living-benefits.jpg

Pros And Cons Of Living Benefits Life Insurance - [desc-14]