Payroll Calculator Kentucky Use ADP s Kentucky Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees Just enter the wages tax withholdings and other information required below and our tool will take care of the rest Looking for managed Payroll and benefits for your business

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information This Kentucky hourly paycheck calculator is perfect for those who are paid on an hourly basis Updated on Feb 14 2025 Free paycheck calculator to calculate your hourly and salary income after income taxes in Kentucky

Payroll Calculator Kentucky

Payroll Calculator Kentucky

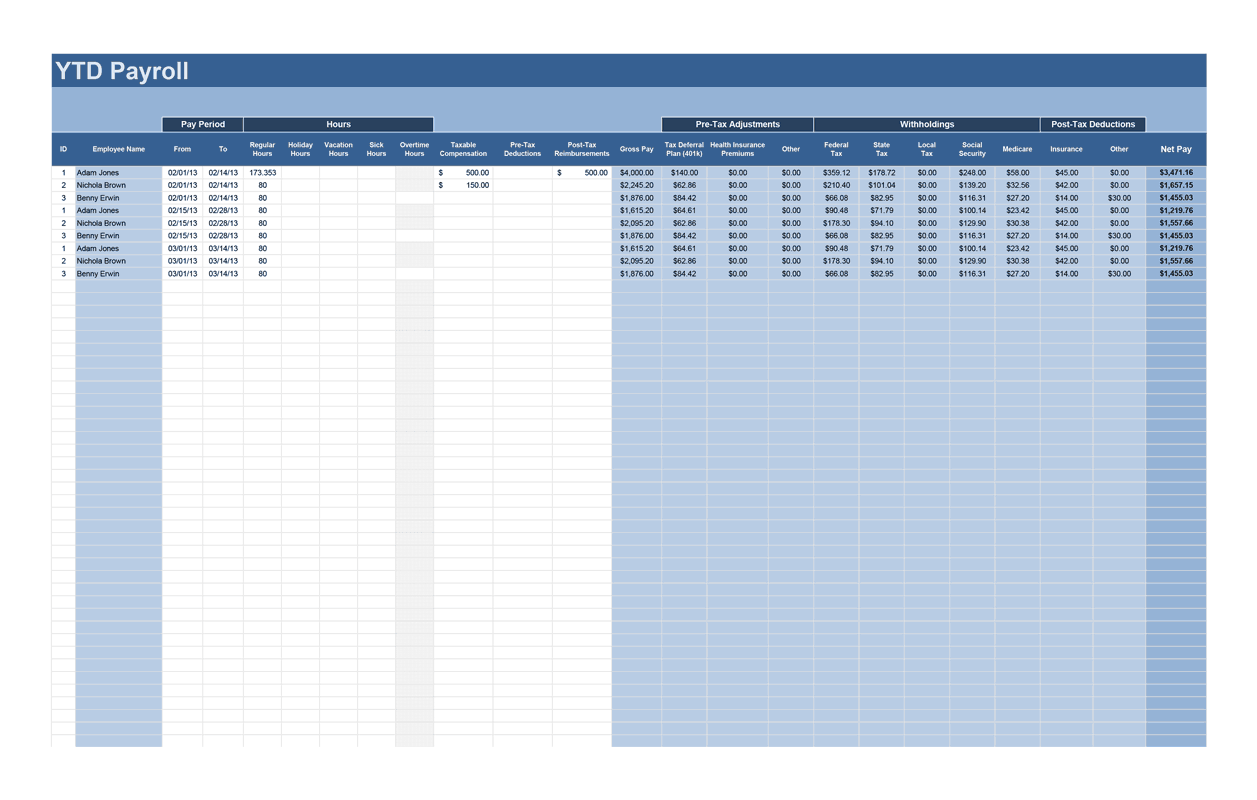

https://cdn.spreadsheet123.com/images/calculators/year-to-date-payroll-record.png

Kentucky Salary Calculator 2023 | iCalculator™

https://www.icalculator.info/images/kentucky-salary-calculator.png

How to Calculate Payroll | Taxes, Methods, Examples, & More

https://www.patriotsoftware.com/wp-content/uploads/2022/01/how-to-calculate-payroll-3.jpg

The Kentucky paycheck calculator estimates the taxes deducted from your earnings as an employee including federal taxes Kentucky state taxes local occupational taxes as well as Social Security and Medicare contributions Use the payroll calculator Kentucky employers trust to quickly run payroll or look up 2025 KY payroll tax rates

Need help estimating net pay Use our free paycheck calculator to figure out wages tax withholdings deductions for salaried employees and hourly employees in Kentucky Calculate your Kentucky net pay or take home pay by entering your per period or annual salary along with the pertinent federal state and local W4 information into this free Kentucky paycheck calculator

More picture related to Payroll Calculator Kentucky

Employer Payroll Tax Calculator - Free Online Tool by IncFile

https://www.incfile.com/hubfs/Calculator.png

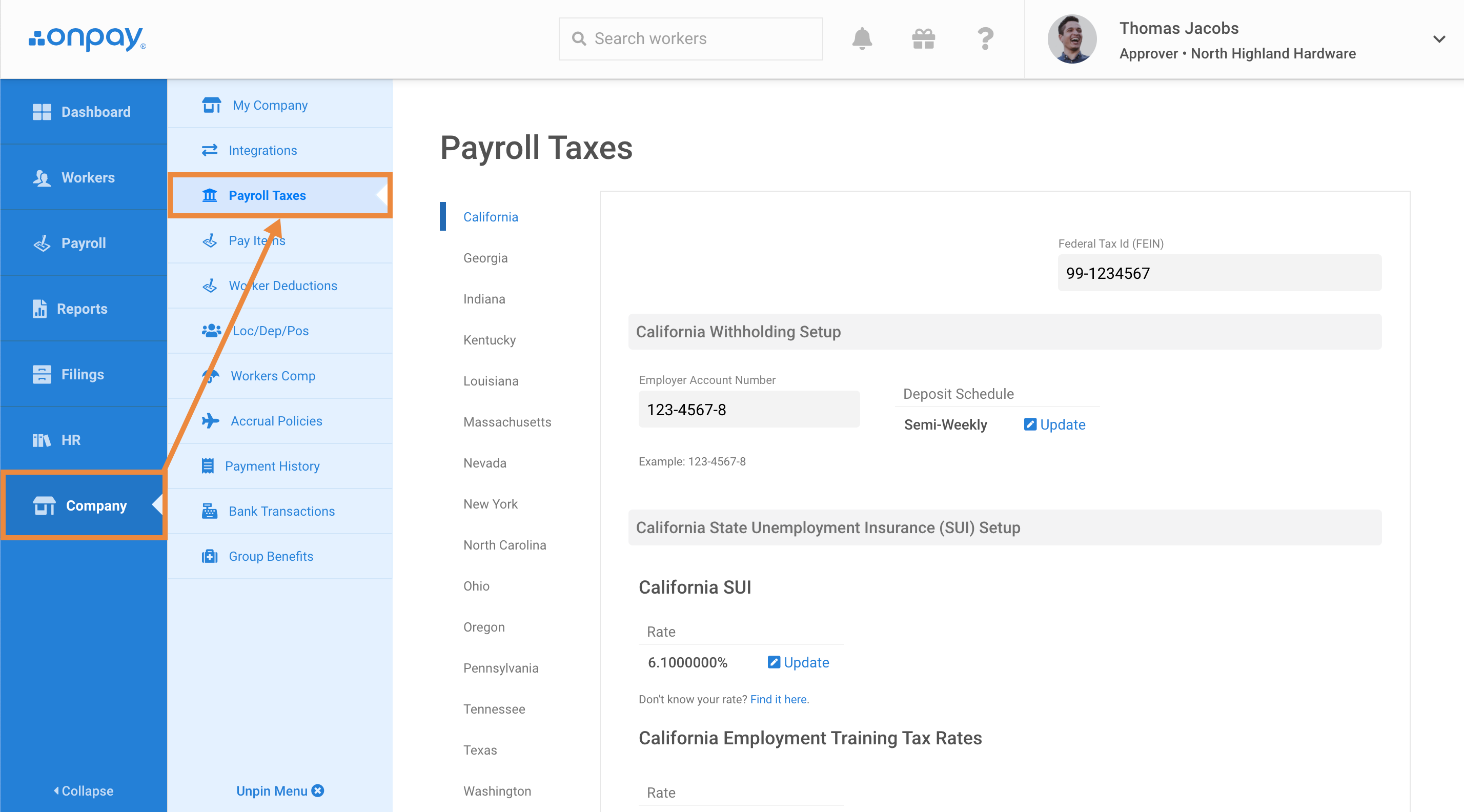

Add or update state payroll tax information – Help Center Home

https://help.onpay.com/hc/article_attachments/360066464891/2020-08-26_12-03-59.png

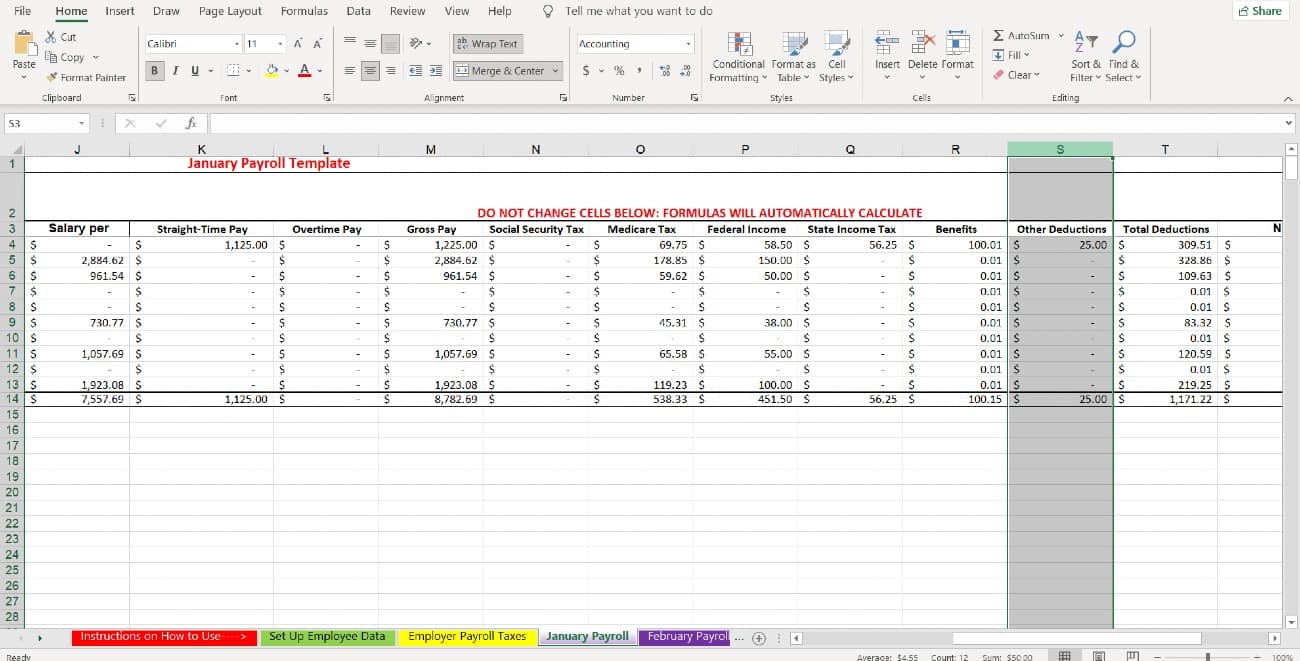

How to Do Payroll in Excel in 7 Steps + Free Template

https://fitsmallbusiness.com/wp-content/uploads/2021/10/Screenshot_of_Monthly_Payroll_Tabs_Sum_in_One_Column.jpg

Featured 2025 paycheck calculator will calculate applicable payroll taxes federal state medicare social security state disability insurance and state unemployment insurance As an informational resource for business owners and payroll specialists this website provides current rates for payroll taxes including KY state and federal income withholdings in addition to accurate paycheck Kentucky Paycheck Calculator Payroll check calculator is updated for payroll year 2025 and new W4 It will calculate net paycheck amount that an employee will receive based on the total pay gross payroll amount and employee s W4 filing conditions such us marital status payroll frequency of pay payroll period number of dependents or federal and state exemptions Please enter the

[desc-10] [desc-11]

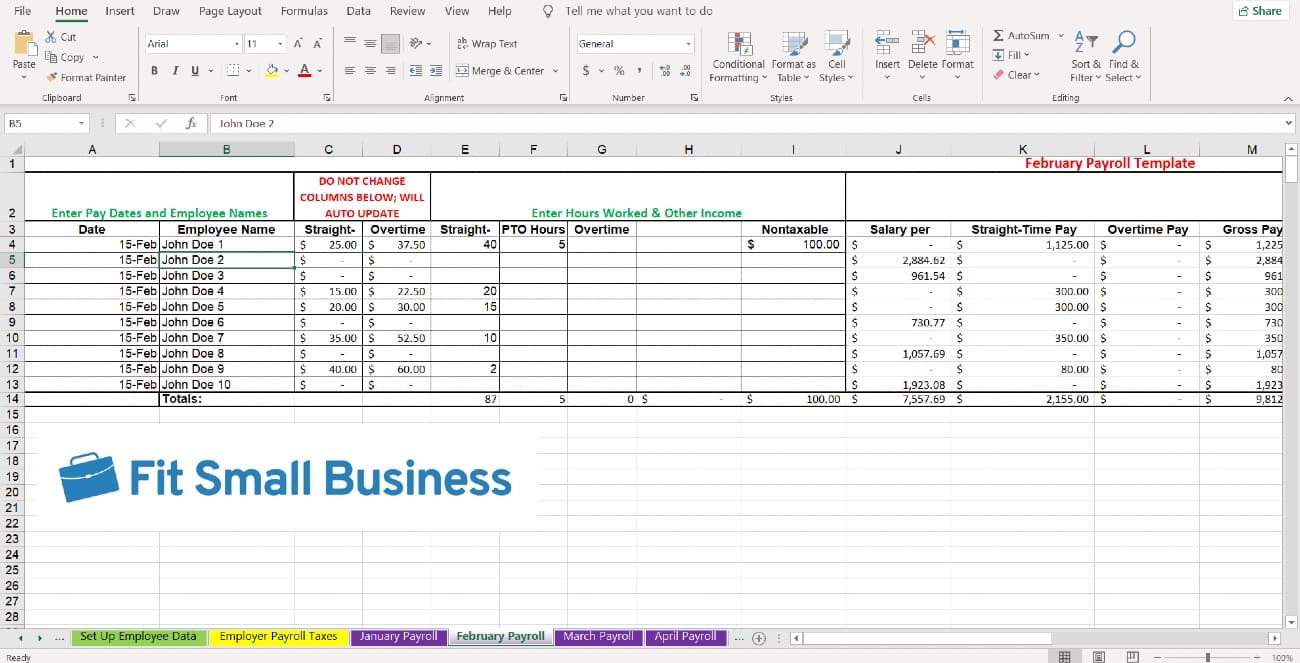

How to Do Payroll in Excel in 7 Steps + Free Template

https://fitsmallbusiness.com/wp-content/uploads/2021/10/Screenshot_of_Monthly_Payroll_Tabs_Specific_Columns.jpg

Budget Your Production Payroll Costs | Wrapbook

https://assets-global.website-files.com/5f9078f5cfd10c2e509e2a29/62fe6c2dfc5fc3db33af8a5e_payroll-calculator-meta.png

Payroll Calculator Kentucky - [desc-13]