Overtime Calculator Minnesota The Minnesota Fair Labor Standards Act requires employers to pay overtime for all hours worked over 48 per workweek unless the employee is exempt under Minnesota Statutes 177 23 subdivision 7 Overtime pay must be at least 1 5 times the employee s regular rate of pay This is calculated by dividing the total pay in any work week by the total

The Minnesota Fair Labor Standards Act requires employers to pay overtime for all hours worked in excess of 48 per workweek unless the employee is specifically exempt under Minn Stat 177 23 subd 7 Overtime pay must be at least one and one half times the employee s regular rate of pay You can use this calculator to determine your pre tax earnings at an hourly wage earning job in Minnesota This calculator can determine overtime wages as well as calculate the total earnings for tipped employees regular time 0 0 hours 7 25 0 00 overtime 0 0 hours 7 25 0 00

Overtime Calculator Minnesota

Overtime Calculator Minnesota

https://gpetrium.com/wp-content/uploads/2020/01/data-note-notebook-970198-min.jpg

Rest Day Overtime Calculator - SaverAsia App - YouTube

https://i.ytimg.com/vi/zeCGhmIWmPU/maxresdefault.jpg

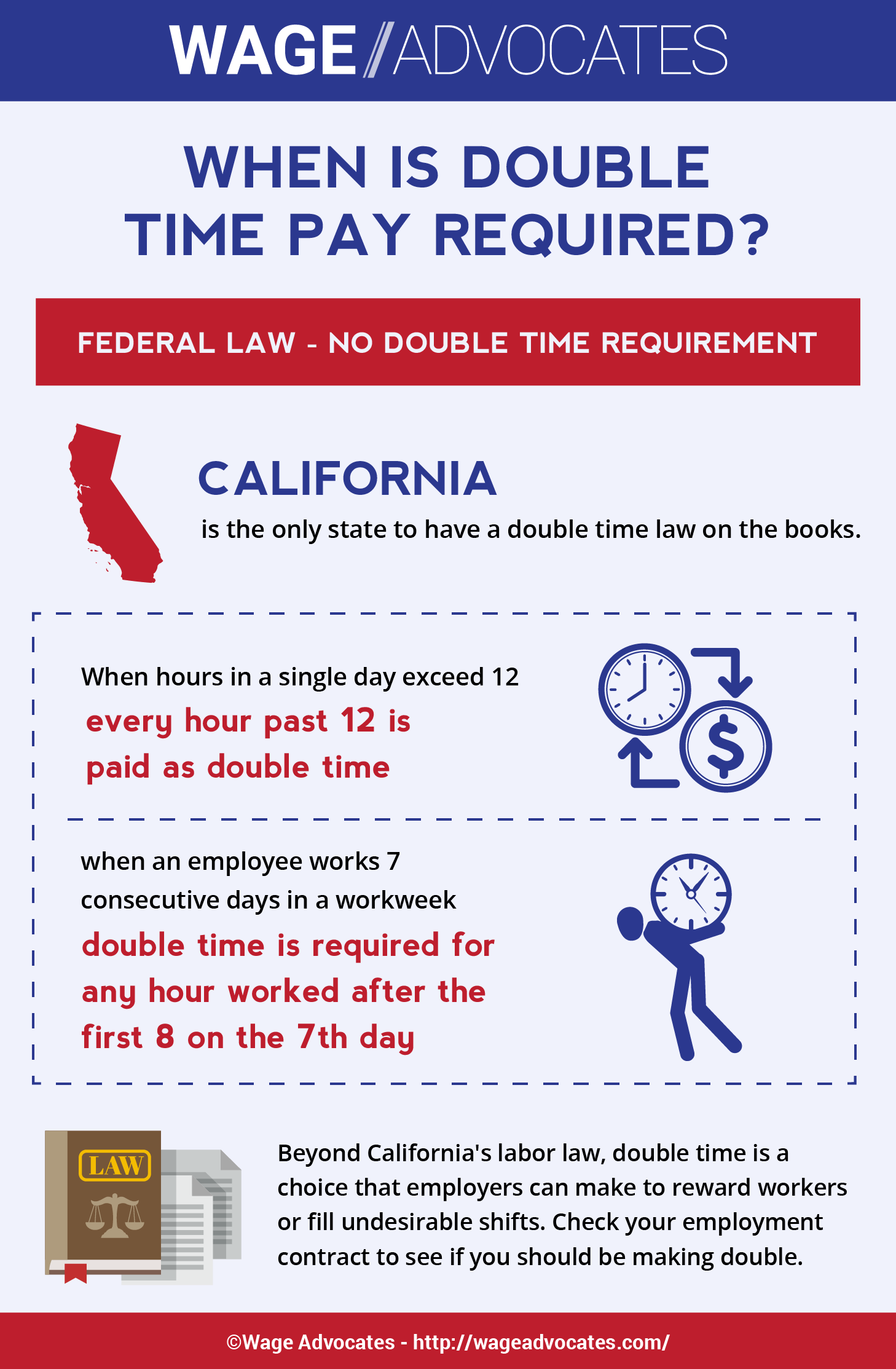

What Is Double Time Pay & When Is It Mandatory? | Overtime Lawsuit

https://wageadvocates.com/wp-content/uploads/2016/12/Double-Time-Pay-Infographic.png

Overtime pay is not discretionary Both state and federal laws prohibit any agreement to not pay overtime to employees All firms must pay Minnesota s overtime wage regardless of the firm s size location or gross sales the method of compensation hourly salary commission piece rate or other or designations such as For the purpose of overtime calculation Minnesota Statutes 177 25 states hours worked in excess of 48 hours in a workweek must be paid at one and one half times the regular rate of pay If you have questions related to eligibility for benefits as a full time or part time employee contact the U S Department of Labor s Pension and Benefits

Federal prevailing wage overtime requirements A laborer or mechanic must be paid for all hours in excess of 40 hours per week at an hourly rate not less than 1 5 times the hourly basic rate of pay plus fringe benefits The minimum hourly basic rate may not be lower than the basic rate established by the United States Secretary of Labor or Contact us at dli laborstandards state mn us 651 284 5075 or 800 342 5354 What is wage theft When an employer avoids paying or fails to pay wages earned by its employees it is wage theft View examples of wage theft here Learn about the wage theft law here

More picture related to Overtime Calculator Minnesota

Cost of Living in Minnesota / Minnesota Department of Employment and Economic Development

https://public.tableau.com/static/images/Gr/GreinerCostofLivingTool/Data/1_rss.png

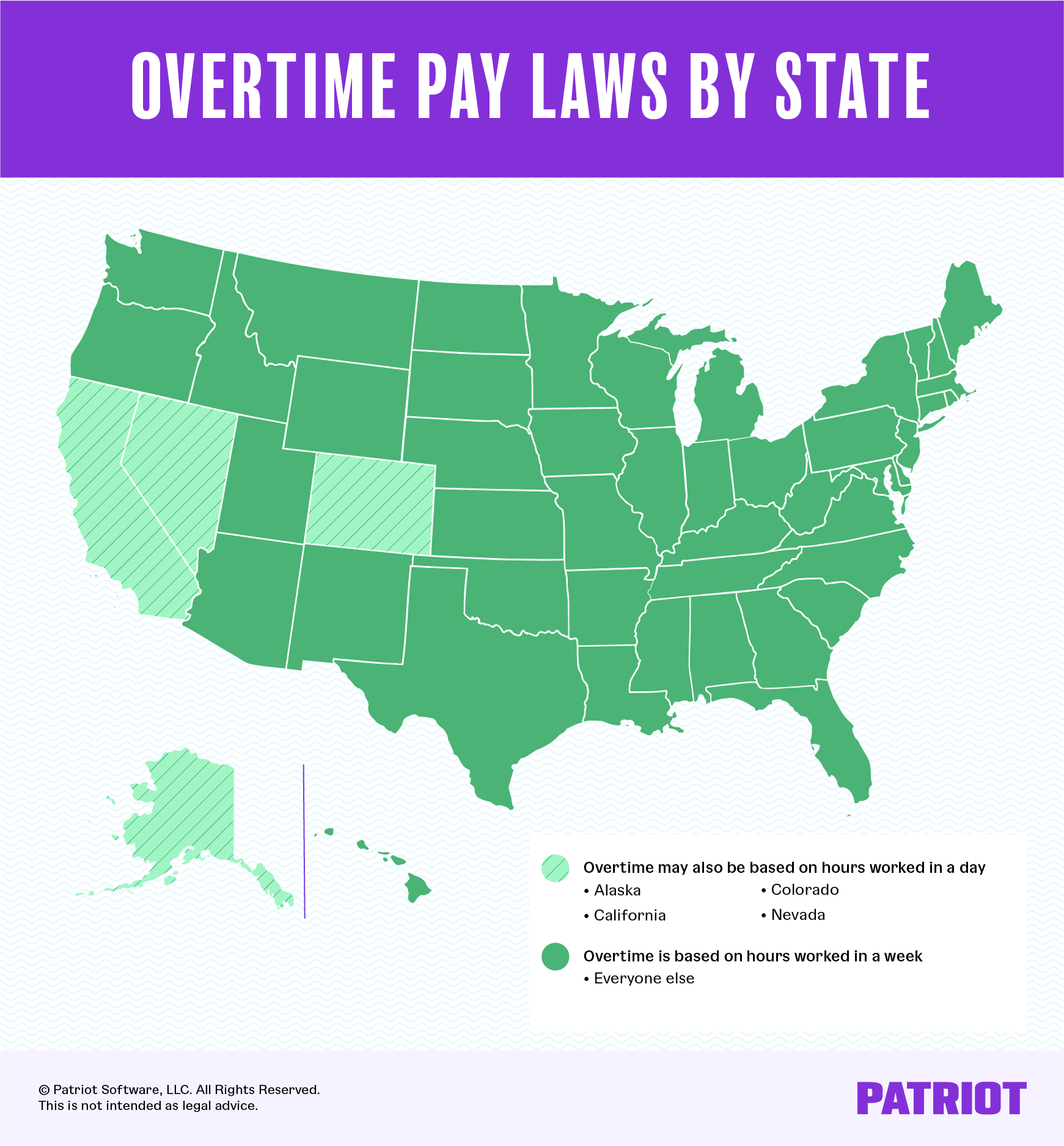

Overtime Laws by State | Overview, Map, & Beyond

https://www.patriotsoftware.com/wp-content/uploads/2020/07/overtime-pay-laws-by-state-map.png

Minnesota Hourly Paycheck Calculator | Gusto

https://prod.gusto-assets.com/wp-content/uploads/Hiring-and-onboarding%402x.png

Minnesota Statutes 177 25 Overtime Law for Minnesota Methods For Overtime Calculation Hourly Employees 1 5 x Normal pay rate for all hours above 40 in a single workweek Hourly Employees with Plus Bonus and or Commission To determine the regular rate take the total hours worked multiplied by the hourly rate then add the workweek bonus Work hours can t be averaged over a pay period If you are paid every 2 weeks your employer can t have you work 50 hours one week and then only 30 the next to avoid overtime pay You have to be paid overtime for the 10 overtime hours in the first week A work week can be any period of 7 days in a row

State and Federal Statutes Minnesota Statutes 177 25 Minnesota overtime Laws Fair Labor Standards Act FLSA Overtime Provision Overtime Calculation Methods Hourly Pay time and a half 1 5 times the regular rate for hours over 48 hours in a workweek Hourly Plus Bonus and or Commission Regular rate Total hours times hourly rate plus the workweek equivalent of the bonus and or In Minnesota an employee is not entitled to overtime pay if they do not work more than 48 hours in a seven day work week Overtime hours are based on actual hours worked in a seven day workweek so holiday hours vacation time and sick leave are not counted Keep in mind that even though you as the employer can decide what seven day period

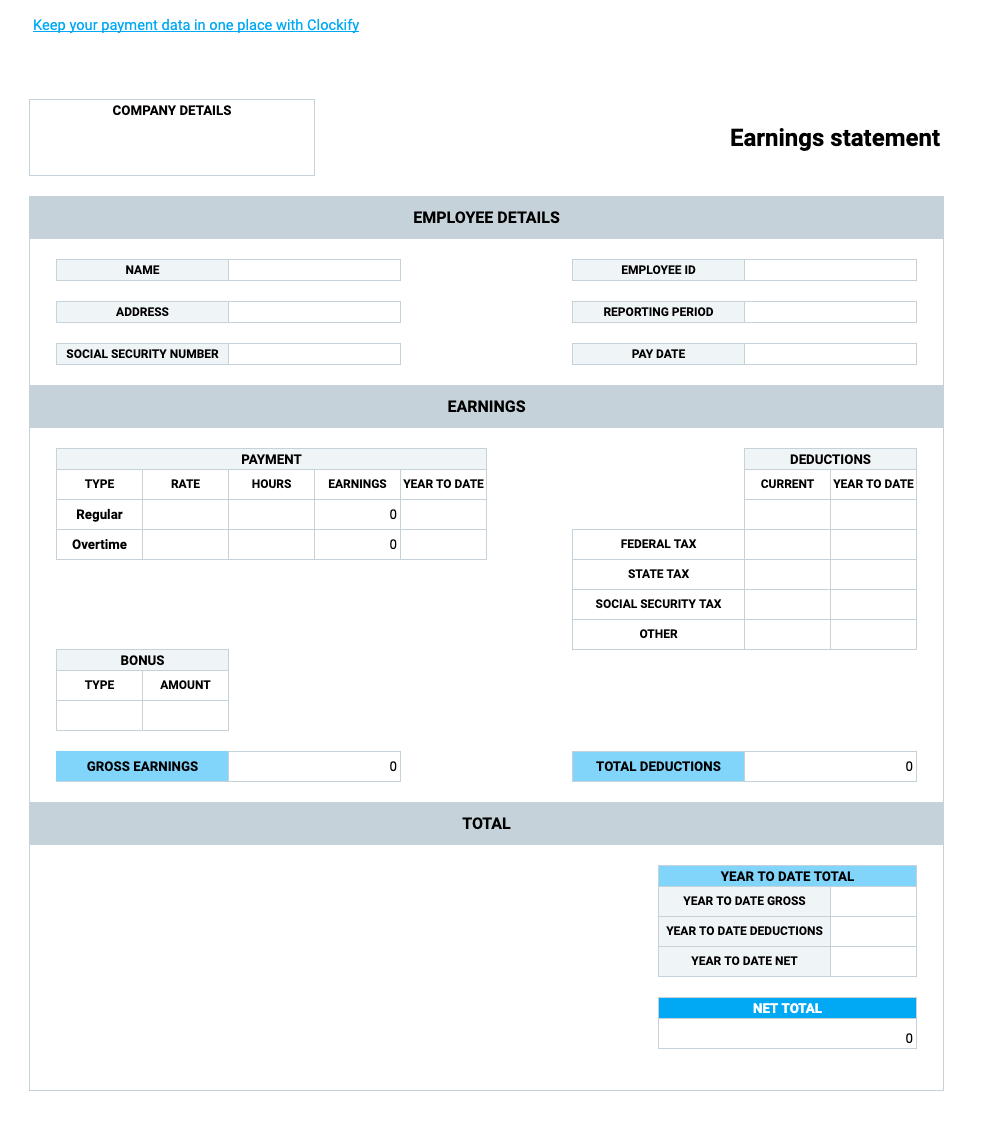

Free Pay stub Templates — Clockify

https://clockify.me/assets/images/pay-stub-template-overtime-and-calculator-min.png

FREE Employee Overtime Tracker — Clockify

https://clockify.me/assets/images/features/timesheet-screenshot.svg

Overtime Calculator Minnesota - Therefore Minnesota s overtime minimum wage is 15 89 per hour one and a half times the regular Minnesota minimum wage of 10 59 per hour If you earn more then the Minnesota minimum wage rate you are entitled to at least 1 5 times your regular hourly wage for all overtime worked OVERTIME Under Minnesota law employers are required to pay 1