Neuvoo Tax Calculator Bc The amount of tax your employer deducts from your paycheque varies based on where you fall inside the federal and British Columbia tax brackets Federal income tax rates in 2022 range from 15 to 33 British Columbia income tax rates in 2022 range from 5 06 to 20 5 The amount of income tax that was deducted from your paycheque appears in

For the 2021 tax year individuals with an income below 21 418 can deduct up to 481 from their income tax bill However this tax credit is reduced by 3 56 for income above 21 418 meaning that the maximum income eligible for the tax reduction credit is 34 929 For example if your income is 25 000 your tax reduction credit will be 481 In British Columbia taxes are paid according to graduated rates Graduated rates mean that for a specified increase in your income your tax rate for that portion of your income goes up For every dollar a taxpayer earns above 240 716 their income is taxed on the marginal tax rate of 20 5

Neuvoo Tax Calculator Bc

Neuvoo Tax Calculator Bc

https://image.winudf.com/v2/image1/Y29tLmd1YXJhbmEubmV1dm9vX3NjcmVlbl8zXzE1NTUxMTU1MDNfMDM1/screen-3.jpg?fakeurl=1&h=500

BC Property Transfer Tax Calculator Vancouver Homes

https://jaybanks.ca/images/2010/12/vancouver-downtown-architecture.jpeg

17 1765 Paddock Drive Coquitlam Bridgewell Group

https://iss-cdn.myrealpage.com/apXcXaFy7M8fx-4vQ2ifhNS05-AW3NpZ4eF4uv7EHW0/auto/0/0/sm/0/aHR0cDovL3MzLmFtYXpvbmF3cy5jb20vbXJwLWxpc3RpbmdzLzIvMi82LzkyMjE2NjIyL2IxOGU1ZGI4Y2JkYzdhNTBkZTBmOTRhNzQxNWY3NTgxLmpwZWc

Salary Calculator Results If you are living in Canada in Ontario and earning a gross annual salary of 73 793 or 6 149 monthly before taxes your net income or salary after tax will be 55 428 per year 4 619 per month or 1 066 per week Taxes and contributions may vary significantly based on your location Select the year you can use the payroll calculator to compare your salaries between 2017 and 2023 Select the province the calculator is updated with the tax rates of all Canadian provinces and territories Enter your pay rate the amount can be hourly daily weekly monthly or even annual earnings Enter the number of hours worked a week

In 2022 British Columbia provincial government increased all tax brackets and base amount by 2 1 and tax rates are the same as previous year Base amount is 11 302 Taxable income Rate from 0 to 43 070 5 06 from 43 071 to 86 140 7 70 from 86 141 to 98 899 In Canada each province and territory has its own provincial income tax rates besides federal tax rates Below there is simple income tax calculator for every Canadian province and territory Or you can choose tax calculator for particular province or territory depending on your residence Alberta tax calculator British Columbia tax calculator

More picture related to Neuvoo Tax Calculator Bc

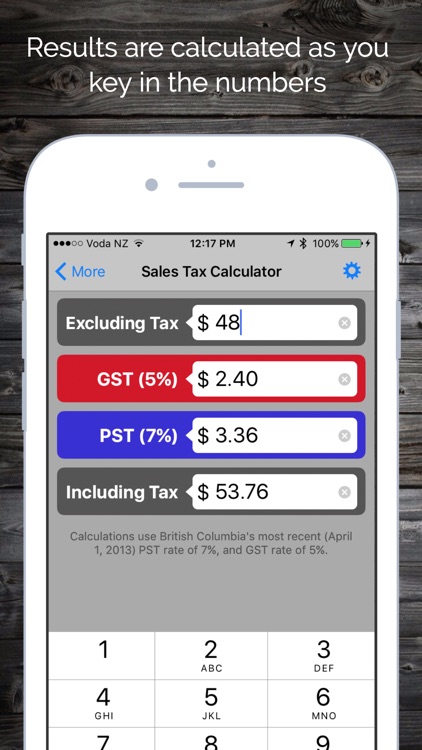

Reverse Sales Tax Calculator Bc Dishy Microblog Gallery Of Photos

https://is2-ssl.mzstatic.com/image/thumb/Purple122/v4/65/1b/a1/651ba151-5450-0dda-e574-a71c008c72b2/pr_source.png/750x750bb.jpeg

Asesor a En Comercio Internacional En Toledo Y Madrid EGO Asesores

https://www.egoasesores.es/wp-content/uploads/2015/04/importacion-exportacion-750x380.jpg

River Springs Coquitlam Neighbourhood Information Real Estate

https://bridgewellgroup.ca/wp-content/uploads/2016/12/river-springs-trail.jpg

Personal Income Tax Calculator 2021 Select Province British Columbia NL British Columbia Calculate your after tax salary for the 2023 tax season on CareerBeacon Use our free tool to explore federal and provincial tax brackets and rates Search Jobs British Columbia Total Income 0 00 Total Deductions 0 00 Net Pay 0 00 Average Tax Rate 0 Comprehensive Deduction Rate 0 Manitoba Total Income 0 00

Tax calculator Fr En Tax Accountant 89 076 Administrative Assistant 42 234 Data Entry Clerk 37 538 British Columbia Abbotsford Aldergrove Burnaby Campbell River Chilliwack Use our simple 2022 income tax calculator for an idea of what your return will look like this year Get a rough estimate of how much you ll get back or what you ll owe Province Select Province Alberta British Columbia Manitoba New Brunswick Newfoundland and Labrador Northwest Territories Nova Scotia Nunavut Ontario Prince Edward Island

Asesor a Fiscal Y Contable En Madrid Y Toledo EGO Asesores

https://www.egoasesores.es/wp-content/uploads/2018/08/Captura-de-pantalla-2018-08-29-a-las-9.07.18.png

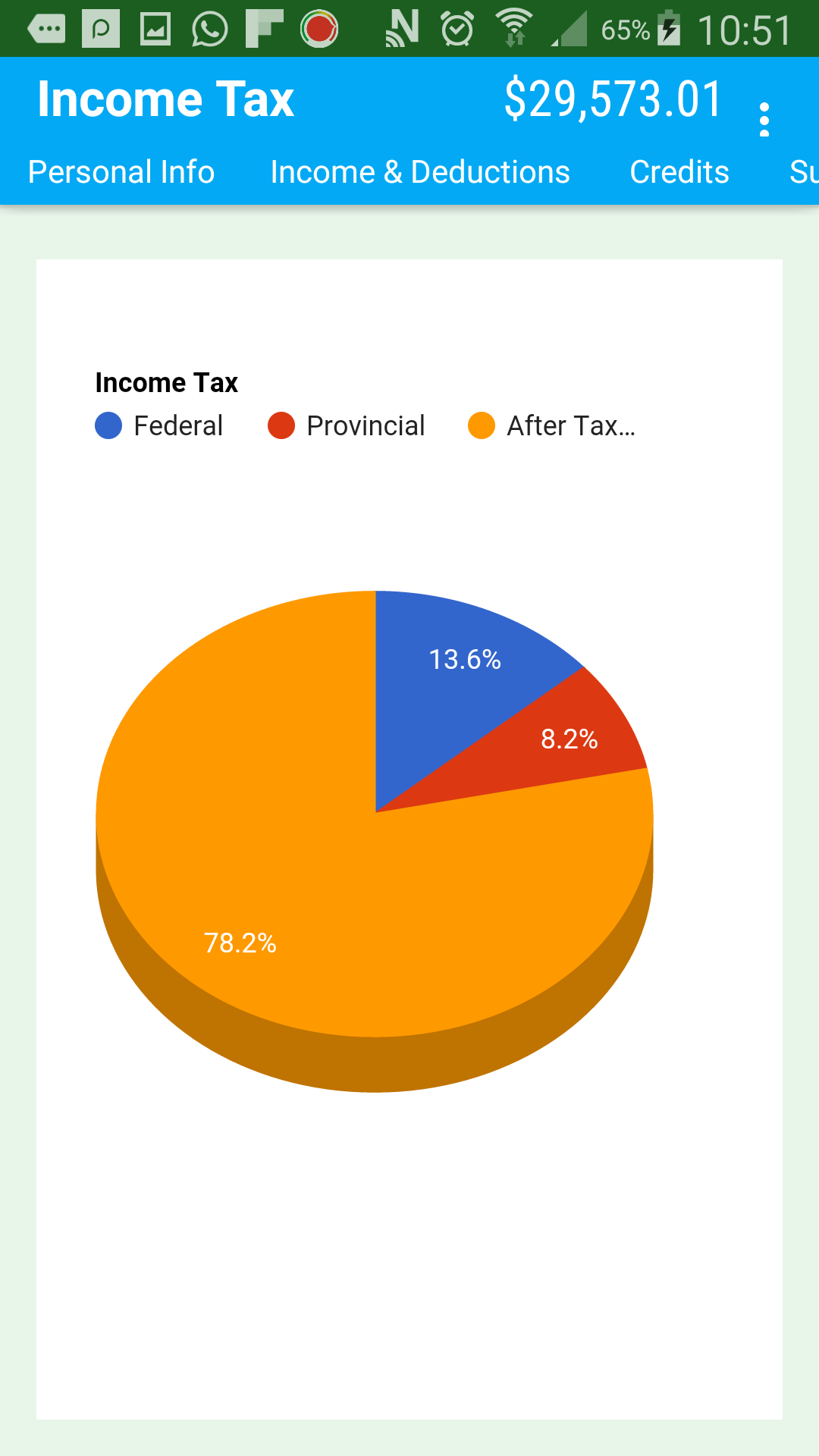

Canadian Income Tax Calculator 2016 Amazon ca Appstore For Android

https://images-na.ssl-images-amazon.com/images/I/61XnWyPwL8L.png

Neuvoo Tax Calculator Bc - Select the year you can use the payroll calculator to compare your salaries between 2017 and 2023 Select the province the calculator is updated with the tax rates of all Canadian provinces and territories Enter your pay rate the amount can be hourly daily weekly monthly or even annual earnings Enter the number of hours worked a week