Net Present Value Excel Monthly Payments Learn how to use the Excel NPV function to calculate net present value of a series of cash flows build your own NPV calculator in Excel and avoid common errors If you are to find quarterly or monthly NPV in Excel be sure to adjust the discounting rate accordingly as explained in this How do you calculate NPV for 6 monthly payments

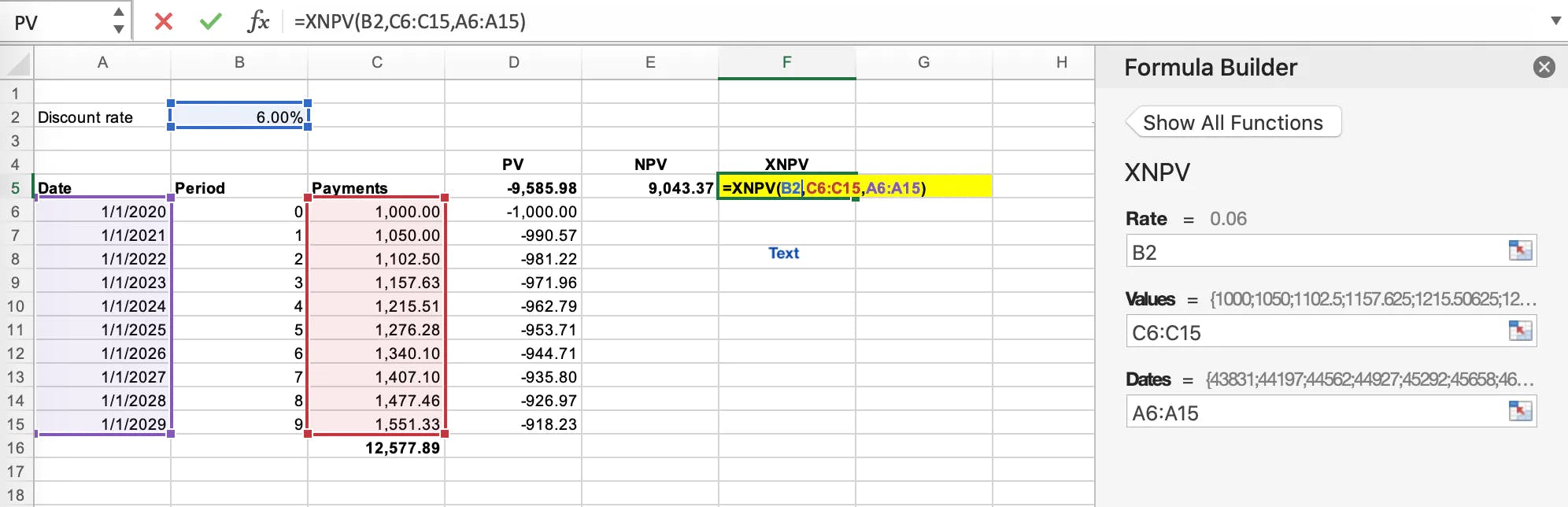

How to Calculate NPV Using Excel NPV Formula Explained Net present value is a core topic of Financial Modeling calculates the Net Present Value of any investment as of today and the interest rate I get to pay the bank is 12 5 Turns out that the discount rate for this cashflow analysis must be an average of them both more The reason for writing E6 instead of E6 E17 is Excel NPV discounts the first value So with E6 E17 NPV effectively makes the present value date the month before 4 1 2018 Nevertheless you might note that NPV and XNPV return very different values about 647 22 for NPV and about 0 11 for XNPV

Net Present Value Excel Monthly Payments

Net Present Value Excel Monthly Payments

https://i.ytimg.com/vi/VxhdHl4lDg8/maxresdefault.jpg

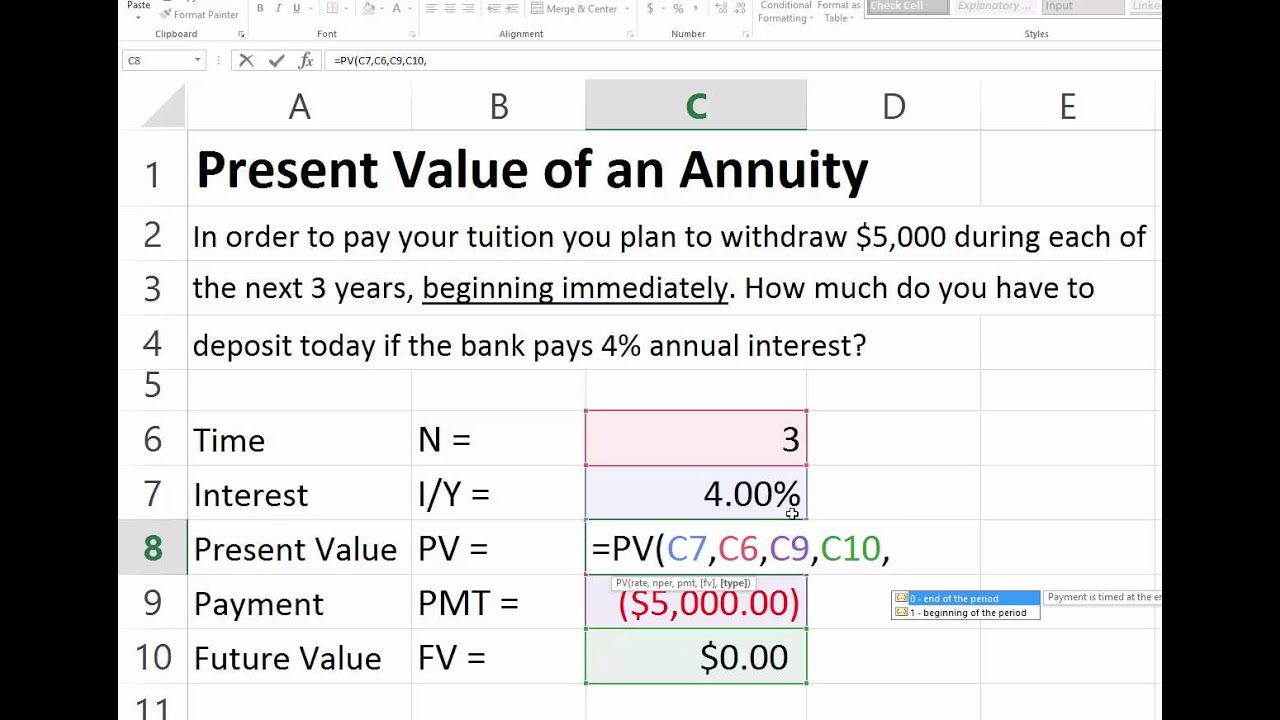

Finding The Present Value Of An Annuity Due In Excel YouTube

https://i.ytimg.com/vi/r_hOGfSgvHQ/maxresdefault.jpg

How To Calculate Net Present Value Npv In Excel YouTube

http://i.ytimg.com/vi/hG68UMupJzs/maxresdefault.jpg

Example 1 Calculate the Present Value for a Single Payment The sample dataset B4 C8 showcases the annual interest rate No of years and the future value of a single payment Steps Select C8 to keep the present value To calculate the present value enter the formula Determine the net present value using cash flows that occur at irregular intervals Each cash flow specified as a value occurs at a scheduled payment date IRR function values guess Determine the internal rate of return using cash flows that occur at regular intervals such as monthly or annually

NPV calculations bring all present and future cash flows to a fixed point in time in the present thus the term present value NPV essentially works by figuring out what the expected future cash Caclulate the net present value in Excel with NPV and XNPV xlsx Download XLSX 12KB What is NPV Net Present Value NPV measures the present value of future cash flows minus the initial investment It helps evaluate whether a project is profitable based on a discount rate often the cost of capital e g monthly quarterly yearly

More picture related to Net Present Value Excel Monthly Payments

Excel PMT Function Exceljet

https://exceljet.net/sites/default/files/styles/og_image/public/images/functions/main/exceljet_pmt.png

Present Value Formula Calculator Examples With Excel Template

https://cdn.educba.com/academy/wp-content/uploads/2019/06/Present-Value-Formula.jpg

Images Of NPV JapaneseClass jp

https://cdn.educba.com/academy/wp-content/uploads/2019/08/Net-Present-Value-Formula.jpg

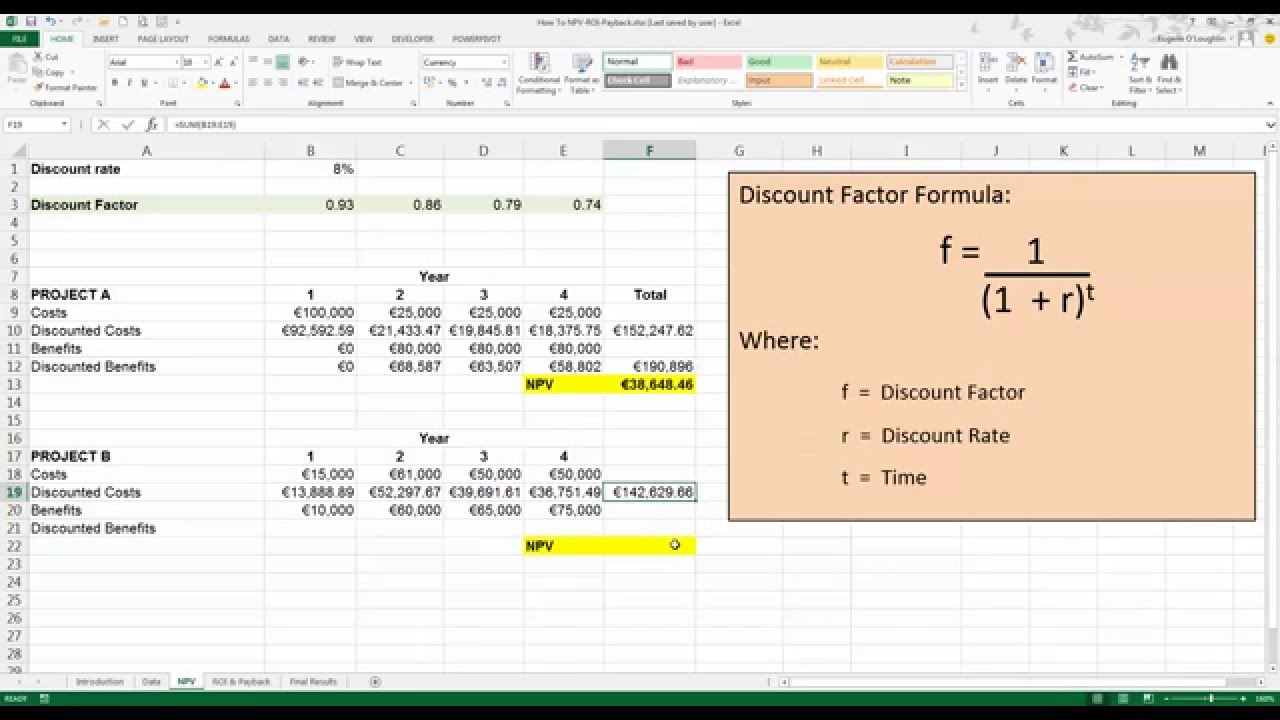

The correct NPV formula in Excel uses the NPV function to calculate the present value of a series of future cash flows and subtracts the initial investment Net Present Value For example project X requires an initial investment of 100 cell B5 1 We expect a profit of 0 at the end of the first period a profit of 50 at the end of the second period and a profit of 150 at the end of the So if dates are involved use XNPV to calculate Net Present Value in Excel Free NPV Net Present Value Calculator Below is a free net present value calculator where you can enter the initial investment value the discount rate and the total cash flows separated by commas and it will give you the NPV value

[desc-10] [desc-11]

Net Present Value Excel Template

https://images.prismic.io/cradle/b1376fec-046a-438e-bc23-16aba218d8b5_0df1059c-0f56-40c8-8d5c-c61b8a02daf9_XNPV.png?auto=compress

Excel Npv Template

https://i.ytimg.com/vi/N7pZZuCkFbM/maxresdefault.jpg

Net Present Value Excel Monthly Payments - Example 1 Calculate the Present Value for a Single Payment The sample dataset B4 C8 showcases the annual interest rate No of years and the future value of a single payment Steps Select C8 to keep the present value To calculate the present value enter the formula