Nebraska Salary Calculator Use ADP s Nebraska Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees Just enter the wages tax withholdings and other information required below and our tool will take care of the rest Important note on the salary paycheck calculator The calculator on this page is provided through the ADP

For salaried employees the number of payrolls in a year is used to determine the gross paycheck amount If this employee s pay frequency is weekly the calculation is 52 000 52 payrolls 1 000 gross pay If this employee s pay frequency is semi monthly the calculation is 52 000 24 payrolls 2 166 67 gross pay Nebraska Paycheck Calculator Payroll check calculator is updated for payroll year 2023 and new W4 It will calculate net paycheck amount that an employee will receive based on the total pay gross payroll amount and employee s W4 filing conditions such us marital status payroll frequency of pay payroll period number of dependents or federal and state exemptions

Nebraska Salary Calculator

Nebraska Salary Calculator

https://napeafscme.org/wp-content/uploads/2022/05/calculator-logo-1.png

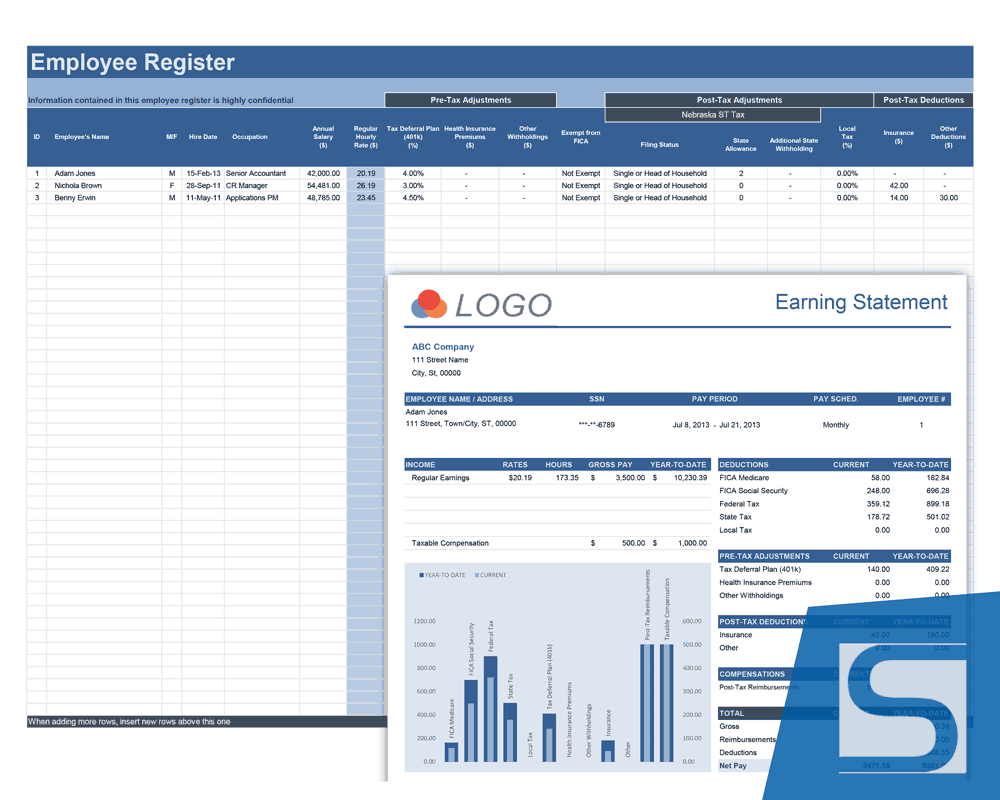

Payroll Calculator - Free Employee Payroll Template for Excel

https://cdn.spreadsheet123.com/images/products/bonus/payroll-calculator-pro-nebraska.png

Annual Income Calculator: Gross & After Tax | Casaplorer

https://casaplorer.com/static/img/opengraph/annual-income-calculator.png

Nebraska Paycheck Calculator For Salary Hourly Payment 2023 Curious to know how much taxes and other deductions will reduce your paycheck Use our paycheck tax calculator Nebraska Salary Paycheck Calculator Ready set grow You ve started your small business in Nebraska and it s grown to the point that you now need to hire employees Congratulations Employers pay Nebraska unemployment tax on the first 9 000 of an employee s wages New employers pay at a rate of 1 25

How much taxes are deducted from a 60 000 paycheck in Nebraska The total taxes deducted for a single filer are 1046 35 monthly or 482 93 bi weekly Updated on Sep 19 2023 Free tool to calculate your hourly and salary income after federal state and local taxes in Nebraska Nebraska Paycheck and Payroll Calculator Free Paycheck Calculator to calculate net amount and payroll taxes from a gross paycheck amount Paycheck Calculator is a great payroll calculation tool that can be used to compare net pay amounts after payroll taxes in different states

More picture related to Nebraska Salary Calculator

Nebraska Salary Paycheck Calculator | Gusto

https://prod.gusto-assets.com/wp-content/uploads/Hiring-and-onboarding%402x.png

![Free Paycheck Calculator: Hourly & Salary [USA] | DrEmployee free-paycheck-calculator-hourly-salary-usa-dremployee](https://dremployee.com/images/paycheck-calculator-US.png)

Free Paycheck Calculator: Hourly & Salary [USA] | DrEmployee

https://dremployee.com/images/paycheck-calculator-US.png

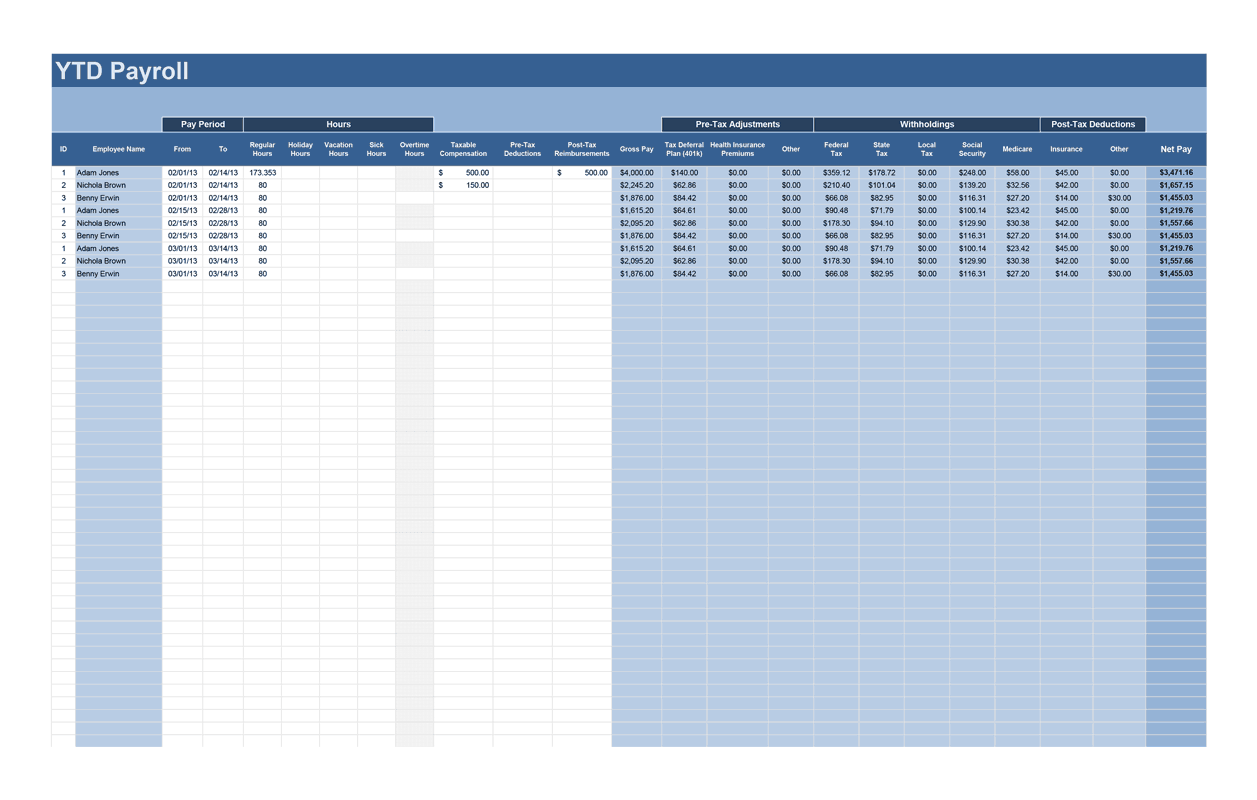

Payroll Calculator - Free Employee Payroll Template for Excel

https://cdn.spreadsheet123.com/images/calculators/year-to-date-payroll-record.png

Below are your Nebraska salary paycheck results The results are broken up into three sections Paycheck Results is your gross pay and specific deductions from your paycheck Net Pay is your take home pay and Calculation Based On is the information entered into the calculator To understand your paycheck better and learn how to calculate The state income tax rate in Nebraska is progressive and ranges from 2 46 to 6 84 while federal income tax rates range from 10 to 37 depending on your income This paycheck calculator can help estimate your take home pay and your average income tax rate

Nebraska s payment frequencies are monthly quarterly Nebraska minimum wage In 2023 the minimum wage in Nebraska is 10 50 per hour Nebraska overtime pay Because Nebraska doesn t have any state law governing overtime pay the federal rules under the Fair Labor Standards Act apply Generally speaking hourly employees are to be paid The Nebraska Salary Calculator is a good tool for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2024 and Nebraska State Income Tax Rates and Thresholds in 2024 Details of the personal income tax rates used in the 2024 Nebraska State Calculator are published below the calculator

Income Tax Calculator: Estimate Your Refund in Seconds for Free

https://assets-global.website-files.com/5cdcb07b95678daa55f2bd83/634d9ac59f5a851e0cbb2d93_Tax%20Demonstration.jpg

Step Pay Is Here! - Nebraska Association of Public Employees

https://napeafscme.org/wp-content/uploads/2021/04/web-raisecalc.png

Nebraska Salary Calculator - How much taxes are deducted from a 60 000 paycheck in Nebraska The total taxes deducted for a single filer are 1046 35 monthly or 482 93 bi weekly Updated on Sep 19 2023 Free tool to calculate your hourly and salary income after federal state and local taxes in Nebraska