Miami Dade Pay Property Taxes Real Estate Taxes Discounts for Early Payment Payment Methods Value Adjustment Board VAB Petitioners Accounts Exempt from Public Disclosure Delinquent Taxes Returned Payments Quarterly Installment Payment Plan 2023 Partial Payment Plan 2023 Homestead Tax Deferral Receive Bills by Email Tax Paying Agents Lis Pendens Tax Collector s Office

About Us Important Messages The Miami Dade County Office of the Tax Collector will be closed on Monday Dec 25 in observance of Christmas Day and Monday Jan 1 in observance of New Year s Day Effective Oct 1 a daily maximum of five transactions per customer will be processed in our office Property taxes as assessed from Jan 1 through Dec 31 are payable beginning Nov 1 Take advantage of the early payment discounts available November through February Tax notices are mailed on or before of November 1 each year with the following discounts offered 4 if paid in November 3 if paid in December 2 if paid in January

Miami Dade Pay Property Taxes

Miami Dade Pay Property Taxes

https://img.hechtgroup.com/1665542724270.jpg

How To Pay Miami Dade Property Taxes Property Walls

https://www.thenextmiami.com/wp-content/uploads/2019/11/CBYBQgp-770x436.jpg

Miami Dade School Board Advances Property Tax Hike To Pay For Teachers

http://mediad.publicbroadcasting.net/p/shared/npr/styles/medium/nprshared/201807/630244357.jpg

Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Edit Business Tax account Apply for Business Tax account Run a Business Tax report Run a Real Estate report Run a Tangible Property report Get bills by email Cart 0 items Cart 0 items Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Apply for Business Tax account Edit Business Tax account Run a Business Tax report Run a Real Estate report Run a Tangible Property report Get bills by email Cart 0 items Cart 0 items

May 12 2021 Tax Collector Forgot to pay your property taxes As of April 1 taxes became delinquent and additional interest and fees will be applied to the unpaid accounts If your taxes remain unpaid on June 1 your taxes will be sold as a tax certificate and you risk losing the property The Property Search application provides key property characteristics ownership sales assessment exemption benefits and taxable value information Address name folio and subdivision name View key property characteristics such as ownership property legal description and sales information

More picture related to Miami Dade Pay Property Taxes

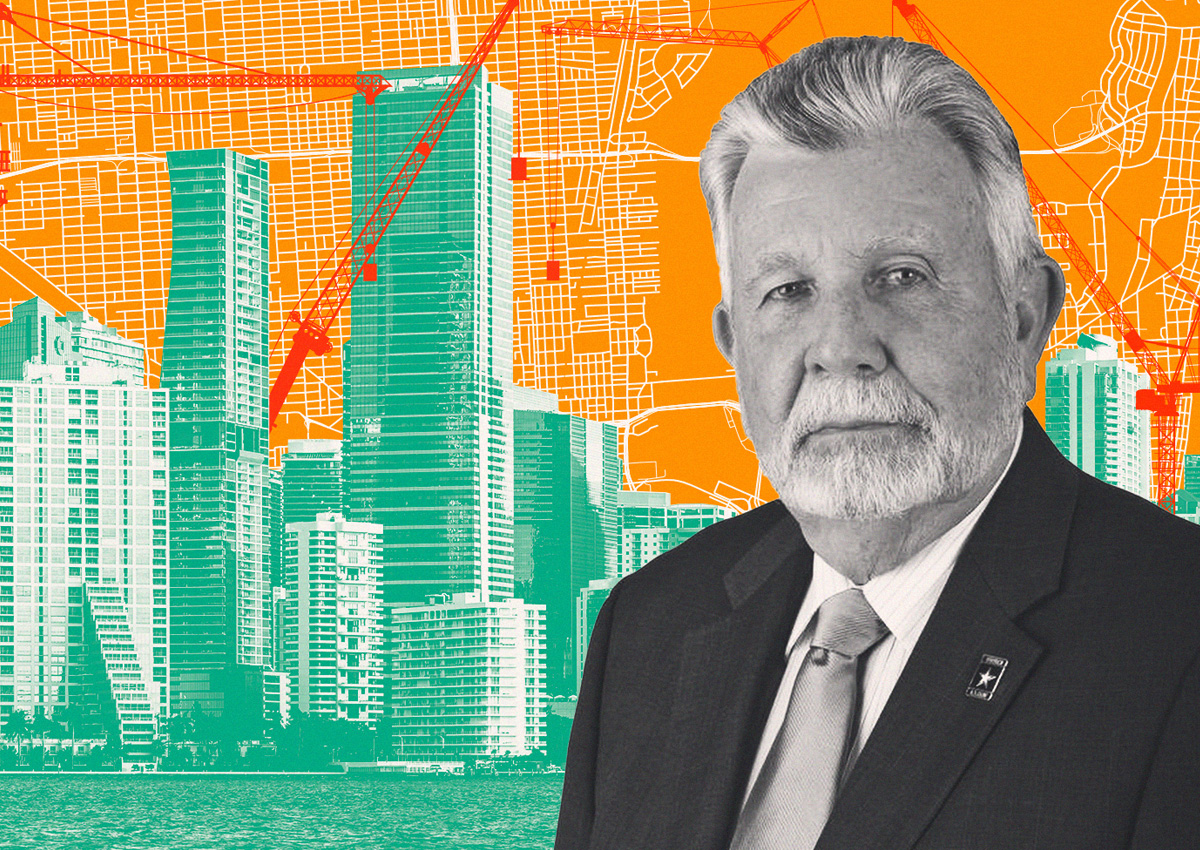

Map Of Miami Dade Property Value Growth In 2023

https://static.therealdeal.com/wp-content/uploads/2023/07/Map-of-Miami-Dade-Property-Value-Growth-in-2023-f.jpg

Hecht Group Do Nonprofits Pay Property Taxes In Miami Dade County

https://img.hechtgroup.com/1664329152087.jpg

Hecht Group 5 Tips For Paying Your Miami Dade County Property Taxes

https://img.hechtgroup.com/1663558103201.jpg

Conveniently make your payments online The following is the schedule for early payment discounts on your property tax bill Save 3 before Sunday Dec 31 2023 Save 2 before Wednesday Jan 31 2024 Save 1 before Thursday Feb 29 2024 The last day to pay your property tax bill without penalties is Sunday March 31 2024 The Office of the Property Appraiser is continually editing and updating the tax roll This website may not reflect the most current information on record

View Tangible Property Tax Information email protected Tax Collector s Office 200 NW 2nd Avenue Miami FL 33128 Taxes must be paid on tangible personal property which are assets used in a business to derive income Taxes must be paid on tangible personal property which are assets used in a business to derive income Online Tools Please note that some of the online tools may only be compatible with Internet Explorer See the online functions available at the Property Appraiser s Office

Miami dade County Claim Of Exemption Form ExemptForm

https://i0.wp.com/www.exemptform.com/wp-content/uploads/2022/08/miami-dade-homestead-exemption-form-fill-online-printable-fillable-1.png

Hecht Group Do Nonprofits Pay Property Taxes In Miami Dade County

https://img.hechtgroup.com/1664329151332.png

Miami Dade Pay Property Taxes - Pay the Impact Fee assessment using the Process Number s Pay Impact Fees If you have questions about payments assessment acceptable forms of payment or other payment processing issues call 786 315 2100