Marginal Tax Rate Formula Excel This result matches the value in cell F15 Next let s look at how to calculate the marginal and effective tax rates Marginal vs Effective Tax Rates When discussing income tax there are two rates you are likely to encounter the marginal tax rate and the effective tax rate The marginal tax is the tax rate applied to the last dollar earned

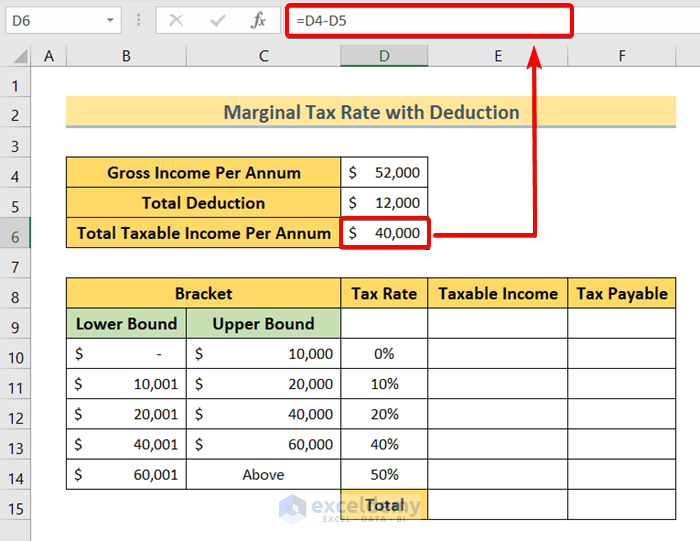

Step 2 Calculate Taxable Income For the first bracket due to the zero lower limit the maximum Taxable Income will be 9 315 To calculate the taxable income for the second Bracket we need to subtract the lower limit Cell D6 from the upper limit Cell E6 and then add the result with 1 Determine the taxable income for the third bracket in the same way The cumulative helper column formula is straightforward we simply apply the marginal rate to the bracket income The sample file below contains the formula for reference If we assume a taxable income of 50 000 we need to write a formula that basically performs the following math

Marginal Tax Rate Formula Excel

Marginal Tax Rate Formula Excel

https://wsp-blog-images.s3.amazonaws.com/uploads/2022/02/15150323/Effective-Tax-Rate-Formula.jpg

How To Calculate Tax On Salary Wholesale Deals Save 40 Jlcatj gob mx

https://wsp-blog-images.s3.amazonaws.com/uploads/2022/02/15150753/Apple-Effective-Tax-Rate.jpg

How And Why To Calculate Your Marginal Tax Rate DeliberateChange ca

https://www.deliberatechange.ca/wp-content/uploads/2019/01/Marginal-Tax-Rate-Equation.png

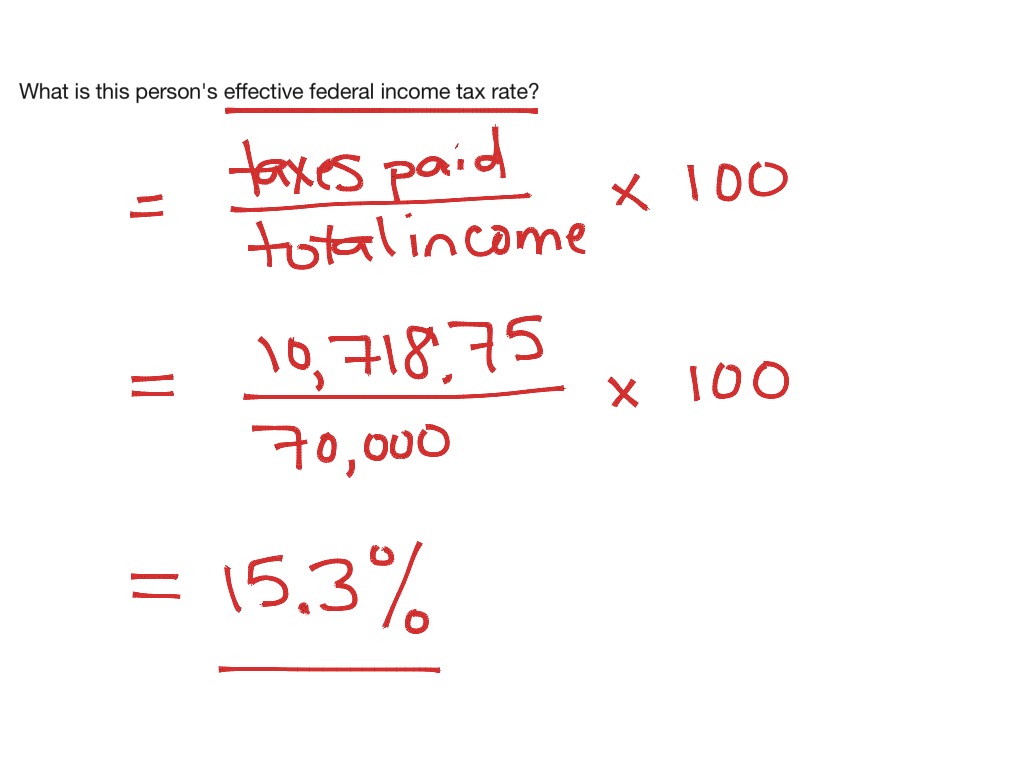

The first step to calculating your marginal tax rate in Excel is setting up your spreadsheet with the relevant tax brackets and rates Here s how you can do it Use the formula A2 B2 in cell C2 to multiply the income threshold by the tax rate Copy the formula Drag the fill handle the small square at the bottom right corner of the Tax Calculation in Excel Using SUMPRODUCT Function The tax system in the United States like that of many other countries operates on a structured framework Let s take a closer look at the concept of marginal tax rates using an example from the provided table Imagine your annual income is 36 000 In this scenario your tax liability

Step 3 Use the VLOOKUP function to find the tax rate for each income level based on the tax brackets you input Step 4 When calculating your marginal tax rate in Excel it s important to take into account any deductions and credits that you may be eligible for These can have a significant impact on your overall tax liability and can If it does and the income is at least 9 951 then I can multiply that by the tax rate of 10 as that would be the maximum that can be taxed at the first bracket 9 951 x 10 If the income is not at least 9 951 then I just multiply the total income by the tax rate Here is what the formula looks like using named ranges

More picture related to Marginal Tax Rate Formula Excel

Marginal Tax Rate Definition Formula How To Calculate

https://www.wallstreetmojo.com/wp-content/uploads/2019/07/Marginal-Tax-Rate-Formula-Example-2.png

Effective Tax Rate Vs Marginal Tax Rate Effective Tax Rate

https://i.ytimg.com/vi/yVHk9obdti8/maxresdefault.jpg

How To Calculate Marginal Tax Rate In Excel 2 Quick Ways ExcelDemy

https://www.exceldemy.com/wp-content/uploads/2022/06/how-to-calculate-marginal-tax-rate-in-excel-7.png

Let s create a formula to calculate the marginal tax rate You ll need to calculate the tax for each bracket your income falls into and then add them up for the total tax Here s a step by step guide to set up your formula Identify the Brackets Determine which brackets your income falls into Calculate the Tax Per Bracket Use Excel Step 1 Set up Income Tax Slab To illustrate how to calculate taxes we ll use the following tax rate sample A flat 7 for incomes 0 to 10 000 750 12 for income from 10 001 to 15 000 1000 18 for income from 15 001 to 20 000 1 350 27 for income from 20 001 to 30 000 1 700 32 for income from 30 001 and higher

[desc-10] [desc-11]

Income Tax Formula Math Marginal Tax Rate Bogleheads If You Claim

https://showme0-9071.kxcdn.com/files/1000093366/pictures/thumbs/2302829/last_thumb1456332448.jpg

Marginal Tax Rate Formula Definition InvestingAnswers

https://investinganswers.com/sites/www/files/definition-featured-image/_mastheadOriginal/kelly-sikkema-wgcUx0kR1ps-unsplash.jpg

Marginal Tax Rate Formula Excel - [desc-14]