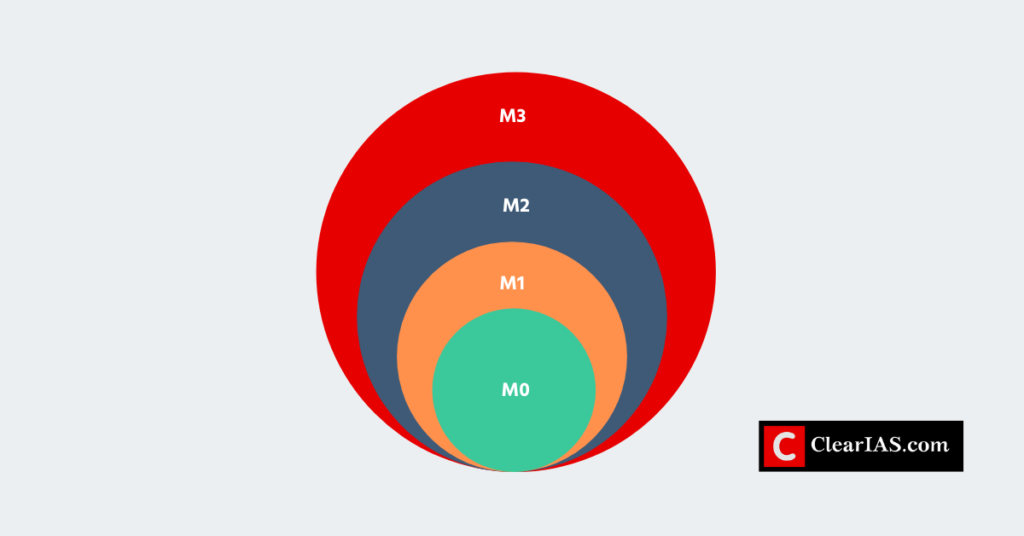

M1 Vs M2 Vs M3 Vs M4 Money The U S money supply is reported in two main categories M1 and M2 M0 is included in both M1 and M2 M0 is the total amount of paper money and coins in circulation plus the current amount of

The various types of money supply including M1 M2 M3 and M4 represent different measures of the total amount of money circulating within an economy These measures offer insights into the liquidity and overall monetary conditions of an economy with M3 often regarded as the most commonly used measure China M2 money supply vs USA M2 money supply Comparative chart on money supply growth against inflation rates M2 as a percent of GDP The euro money supplies M0 M1 M2 and M3 and euro zone GDP from 1980 2021 Logarithmic scale M4 M3 plus all deposits with post office savings banks excluding National Savings Certificates

M1 Vs M2 Vs M3 Vs M4 Money

M1 Vs M2 Vs M3 Vs M4 Money

https://i.ytimg.com/vi/vPBYYvMeIPg/maxresdefault.jpg

Broad Money And Narrow Money M1 M2 M3 And M4 YouTube

https://i.ytimg.com/vi/-WRzBlboA9E/maxresdefault.jpg

MEANING OF MONEY SUPPLY MEASURES M1 M2 M3 M4 Money Suppy

https://i.ytimg.com/vi/BPt8jlCDurM/maxresdefault.jpg

RBI publishes 4 types of figures in case of Money Supply M1 M2 M3 M4 Write short note on M1 M2 M3 and M4 M1 M1 is total of currency notes and coins CU net demand deposits issued DD M1 CU DD Note Net demand Deposits means Term Deposits of public and not term deposit of one bank with other bank Broad Money and Narrow Money Formula Difference M1 M2 M3 M4 Broad money and narrow money are two measures of money supply used in economics Know all about the Difference Between Broad Money and Narrow Money Definition Types Formula for UPSC Exam M3 M1 M2 Time deposits with banks Other deposits with the RBI

Narrow Money and Broad Money While M1 M0 are used to describe narrow money M2 M3 M4 qualify as broad money and M4 represents the largest concept of the money supply Broad money may include various deposit based accounts that would take more than 24 hours to reach maturity and be considered accessible To adequately capture the variety of assets Post 1998 the RBI publishes figures for four alternative measures of money supply viz M0 M1 M2 and M3 etc BROAD MONEY M3 and M4 are known as broad money These are the least liquid money In terms of Liquidity M1 is most liquid and easiest for transactions whereas M4 is least liquid of all

More picture related to M1 Vs M2 Vs M3 Vs M4 Money

Monetary Aggregates Understand The Monetary Statistics M0 M1 M2 M3

https://www.clearias.com/up/Monetary-Aggregates-1024x536.png

M1 M2 M3 docx Money Supply Money

https://imgv2-1-f.scribdassets.com/img/document/364337046/original/eca13d2682/1593158051?v=1

Monetary Aggregates Understand The Monetary Statistics M0 M1 M2 M3

https://www.clearias.com/up/Narrow-Money-vs-Broad-Money-768x768.png

M1 vs M2 vs M3 The M1 money supply includes all physical currency traveler s checks demand deposits and other checkable deposits e g checking accounts Further Details About M4 Data It is a narrow measure of the money supply that includes the most liquid forms of money M2 M2 includes M1 plus savings deposits with post office This aggregate is more relevant in countries where a significant portion of savings is held in postal savings systems M3 Broad Money M3 is a broader measure of the money supply

[desc-10] [desc-11]

20 Measurement Of The Money Supply M1 M2 M3 M4

https://i.ytimg.com/vi/xzr1lcuZoQg/maxresdefault.jpg

Eco What Is The Different Measures Of Money Supply M1 M2 M3 M4

https://d1avenlh0i1xmr.cloudfront.net/e8d63bd2-e29d-427d-8146-0d4f1afede0f/different-measures-of-money-supply---teachoo.jpg

M1 Vs M2 Vs M3 Vs M4 Money - [desc-14]