Llc Tax Benefits California There are perhaps a few reasons why a California LLC should not operate a business but the main one is that each member of the LLC will have a very noticeable self employment tax to pay each fiscal year

Home Form an LLC Benefits of Forming an LLC in California Last Updated July 27 2023 by TRUiC Team Benefits of Forming an LLC in California The key benefit of forming a limited liability company LLC in California is limited liability protection How Limited Liability Companies Are Taxed 4 LLC Tax Benefits Bottom Line Frequently Asked Questions FAQs Many entrepreneurs opt to structure their small business as a limited liability

Llc Tax Benefits California

Llc Tax Benefits California

https://mollaeilaw.com/wp-content/uploads/tax-benefit-llc-1024x576.jpg

What Are The LLC Tax Benefits Tailor Brands

https://www.tailorbrands.com/wp-content/uploads/2022/01/Tax_Rates_Table.png

Http www fair assessments Https plus google

https://i.pinimg.com/originals/58/83/60/5883607edbbeec62d66d1187d095081f.jpg

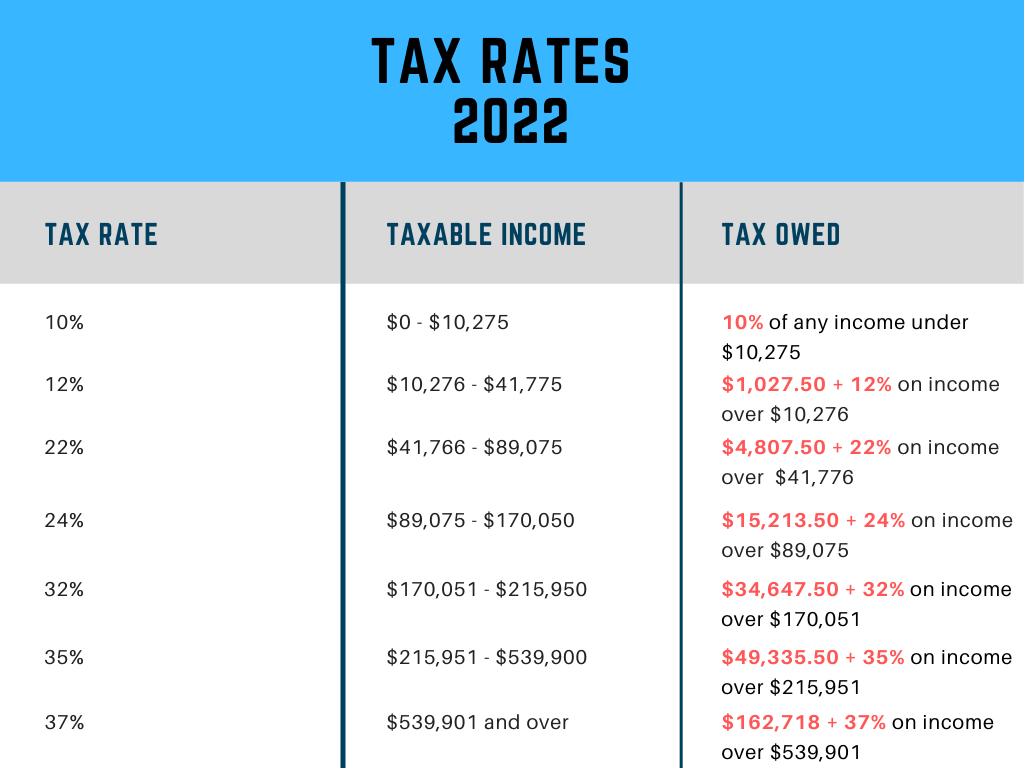

Tax Benefits of LLC in California In California an LLC Limited Liability Company offers tax benefits such as pass through taxation This means that the company s profits are only taxed once at the individual members personal income tax rates avoiding the double taxation typically seen in corporations By Douglas Wade Attorney The tax is due within 75 days of formation and then every year thereafter If the organization reports more than 250 000 the annual franchise tax increases This results in double taxation considering members have to pay income taxes too Uncertainties in how LLC members will be required to meet corporate formalities is unclear at this time

424 421 5114 California LLC Tax Essential Insights And Requirements Every LLC operating in California must fulfill its obligation to pay specific taxes and fees on an annual basis The California Franchise Tax Board classifies LLCs in the state as partnerships corporations or disregarded entities Step 4 File articles of organization The next step to form your LLC is to file articles of organization with the state of California You can file the form online for faster processing or print

More picture related to Llc Tax Benefits California

4 Different Types Of Loans That Have Tax Benefits

https://life.futuregenerali.in/media/2zmp035j/tax-benefit-on-loans.jpg

Tax Accounting Services Lee s Tax Service

https://leestaxservicellc.com/files/IMG_1348.png

Tax Benefits On Investments Nave Marg

https://navemarg.files.wordpress.com/2016/10/tax-benefits.png

This 800 fee must be paid annually regardless of business income or activity For more information on due dates and step by step instructions on how to file and pay this fee read our California LLC Annual Franchise Tax guide You can also contact the California Franchise Tax Board at 800 852 5711 While LLCs typically benefit from pass through taxation by default they can elect to be taxed as one of the following C Corporations The LLC is treated as a separate entity to its owners paying corporate income tax rates on its total profit while the owners also pay personal income tax on any distributions they take

Starting an LLC in California can benefit your business offering unique legal protections tax advantages and access to a vast network of resources and opportunities by LawInc Staff November 20 2023 With over 500 000 LLCs formed each year in California alone limited liability companies remain a popular choice for many small business owners The LLC formation process in the state involves selecting a name submitting the articles of organization appointing a registered agent acquiring an Employer Identification Number EIN and complying with California licenses permits and tax regulations This guide will help you navigate these steps whether you re forming a domestic or

Tax Software KW Revised Taxes LLC

https://4ec8eb0ff7cf8e6a3f6a.cdn6.editmysite.com/uploads/b/4ec8eb0ff7cf8e6a3f6ae5a1eeb6ccbc6e44b38edc9122e3070471a1f1b9b5c7/2021-10-07_17-15-51_1633645006.png?width=2400&optimize=medium

LLC Vs Corporation Explained Tax Benefits Of Each YouTube

https://i.ytimg.com/vi/kHX2fsVLaO4/maxresdefault.jpg

Llc Tax Benefits California - Tax Benefits of an LLC in California A key advantage of an LLC is its flexible taxation options By default a California LLC is subject to pass through taxation so it s taxed like a partnership or sole proprietorship As a pass through entity the LLC itself doesn t pay taxes This is unlike a corporation in which profits are taxed at