Is Net Income The Same As Net Operating Profit After Tax Key Takeaways Operating profit is a company s profit after all expenses are taken out except for the cost of debt taxes and certain one off items Net income is the profit remaining after all

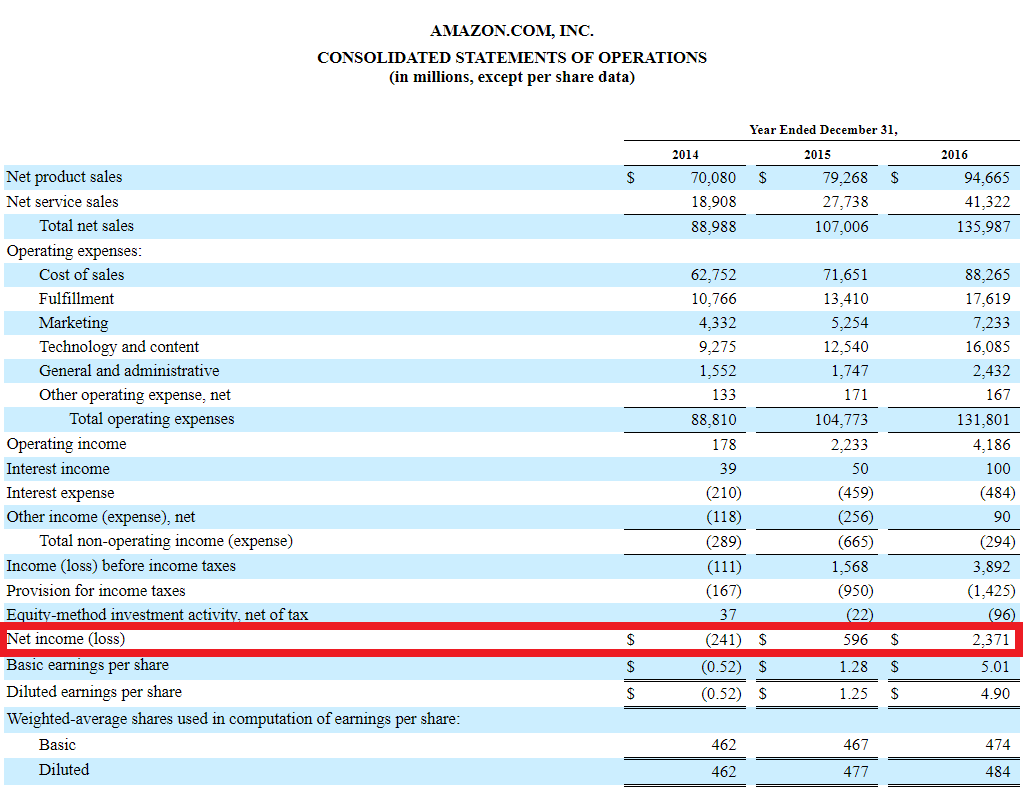

Total revenue was 23 9 billion It includes net sales and other revenue Operating income was 382 million and included all the expenses associated with operating for the year including cost of Thus the net operating profit after tax is a company s potential cash earnings if its capitalization were unleveraged that is if it had no debt i e tax savings from existing debt are NOT included We need to work our way from net income to EBIT before repeating the same process as the first approach EBIT Company A 137m Net

Is Net Income The Same As Net Operating Profit After Tax

Is Net Income The Same As Net Operating Profit After Tax

https://www.wallstreetmojo.com/wp-content/uploads/2017/01/Colgate-EBIT-768x401.png

Understanding Gross Vs Net MoneyHub NZ

https://www.moneyhub.co.nz/uploads/1/1/2/1/112100199/editor/gross-vs-net.png?1587546805

After tax Profit Margin Definition And Meaning Market Business News

http://marketbusinessnews.com/wp-content/uploads/2014/08/After-tax-profit-margin.jpg

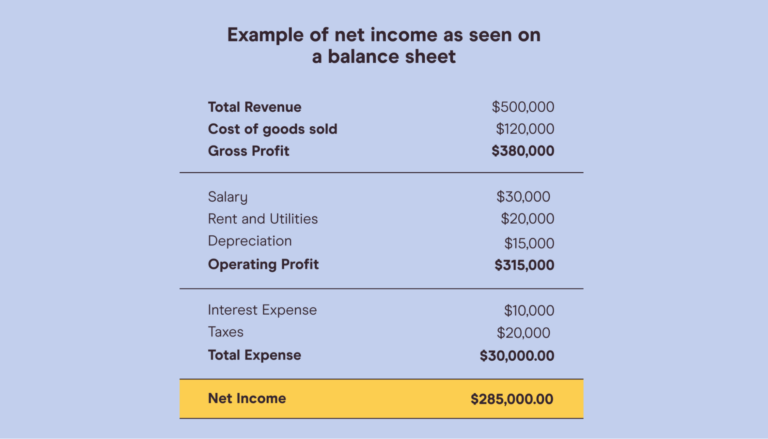

Net Income is a measure of accounting profitability or the residual after tax profit of a company once all operating and non operating costs are deducted The net income or net profit is recorded at the bottom of the income statement and represents the after tax profit remaining upon deducting all costs and expenses NOPAT Net Income 1 Inherent meaning NOPAT is calculated on operating income to determine the company s operating efficiency Net Income is calculated by deducting all the expenses from revenue 2 Application NOPAT is used to understand operational efficiency without leverage

If Wyatt wants to calculate his operating net income for the first quarter of 2021 he could simply add back the interest expense to his net income 20 000 net income 1 000 of interest expense 21 000 operating net income Calculating net income and operating net income is easy if you have good bookkeeping In that case you likely NOPAT Calculation Example Here is an example of how to calculate Net Operating Profit After Tax Please have a look at the sample income statement below which we will use for the calculation As you can see in the example above in 2017 the company has Net Earnings of 2 474 and a NOPAT of 4 195 Let s look at the difference between these

More picture related to Is Net Income The Same As Net Operating Profit After Tax

/dotdash_Final_Gross_Margin_vs_Net_Margin_Whats_the_Difference_Nov_2020-01-de889f0261d2482780bda560dc14a6ce.jpg)

Gross Margin Calculator Online RoseannToby

https://www.investopedia.com/thmb/KdOpX1jPdOTJmkLUOR0Xb1WdliM=/2448x1377/smart/filters:no_upscale()/dotdash_Final_Gross_Margin_vs_Net_Margin_Whats_the_Difference_Nov_2020-01-de889f0261d2482780bda560dc14a6ce.jpg

How To Find Net Income For Beginners Pareto Labs

https://www.paretolabs.com/wp-content/uploads/2021/06/Example-of-net-income-as-seen-on-a-balance-sheet-768x439.png

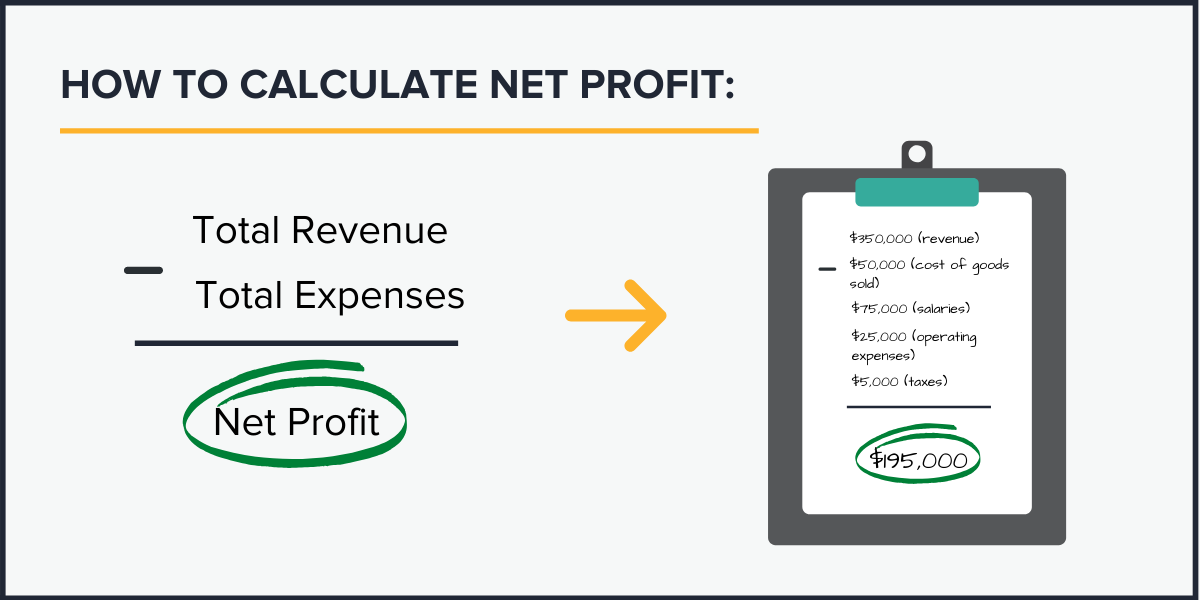

What Is Net Profit Net Profit Formula updated 2022

https://fastloans.ph/wp-content/uploads/2020/11/Created-by-2-copy.png

The Net Operating Profit After Tax NOPAT is a financial measure of profitability that provides an unbiased look at the income from a company s operations if it had no debt or leverage Calculate the Effective Tax rate for the same period tax rate income taxes income before income taxes tax rate Q1 2020 921 7 757 0 1187 11 Operating Profit Equation NOPAT 50 1 30 35 Net Income Equation NOPAT 28 10 1 30 28 7 35 It s no surprise that both the methods gave us the same result Interestingly the net profit of the company is 28 but if the interest component is removed the NOPAT becomes 35 Obviously if the company doesn t have debt on its

Net income shows a company s income after all expenses Gross profit shows a company s revenue minus the costs of sales costs of goods sold After product costs the remaining income should cover all other expenses Example of Net Income vs Gross Profit For example a car manufacturer sells 1 000 000 worth of cars to dealerships Next the interest expense is calculated You get this value by subtracting profit before tax from net profit The tax expense is calculated by multiplying profit before tax and the tax rate NOPAT examples Let us say you have an operating income of 200 000 and a tax rate of 40

Earnings Per Share Formula Examples How To Calculate EPS Wall Street Oasis

https://www.wallstreetoasis.com/files/inline-images/wall-street-oasis_finance-industry-resources_web_online-earnings-per-share-formula_3.png

What s The Difference Between Gross Profit Margin And Net Profit Margin

https://i.investopedia.com/image/jpeg/1524254621524/apple_net_profit_.jpg

Is Net Income The Same As Net Operating Profit After Tax - NOPAT Net Income 1 Inherent meaning NOPAT is calculated on operating income to determine the company s operating efficiency Net Income is calculated by deducting all the expenses from revenue 2 Application NOPAT is used to understand operational efficiency without leverage