Is Base Pay Taxed Tax Exempt Allowances While all pays are taxable most allowances are tax exempt The primary allowances for most individuals are BAS and BAH which are tax exempt Conus COLA is one

In the military the federal government generally only taxes base pay and many states waive income taxes Other military pay things like housing allowances combat pay or cost of living adjustments may not be taxed In the civilian world just a few benefits are deducted before taxes and overall much more of your paycheck is taxable Updated December 08 2021 Reviewed by Erika Rasure What Is Base Pay Base pay is the initial salary paid to an employee not including any benefits bonuses or raises It is the rate of

Is Base Pay Taxed

Is Base Pay Taxed

https://una-acctg.com/wp-content/uploads/2022/05/How-is-Separation-Pay-Taxed.jpg

How Is Overtime Taxed Overtime Taxes Diversified Tax

https://diversifiedllctax.com/wp-content/uploads/2022/07/featured-image-for-blogs-1160x665-27-1-1024x587-1024x585.jpg

Military Base Pay Chart 2020 Pay Period Calendars 2023

https://military-paychart.com/wp-content/uploads/2020/12/understand-the-military-retirement-pay-system-2048x1365.png

11 min A base salary also known as base pay is the initial compensation amount or wage employers agree to pay an employee at the start of a job before taxes and other deductions Base Taxable Wage Base Also known as the Social Security Wage Base this base is the maximum amount of earned income upon which employees must pay Social Security taxes Generally the employee s

A taxable wage base generally refers to the maximum income amount on which certain taxes are based on particularly Social Security taxes or an employer s share of taxes that go toward unemployment insurance Key Takeaways A taxable wage base is the maximum income amount that certain taxes are based on The seven federal income tax brackets for 2023 and 2024 are 10 12 22 24 32 35 and 37 Your bracket depends on your taxable income and filing status

More picture related to Is Base Pay Taxed

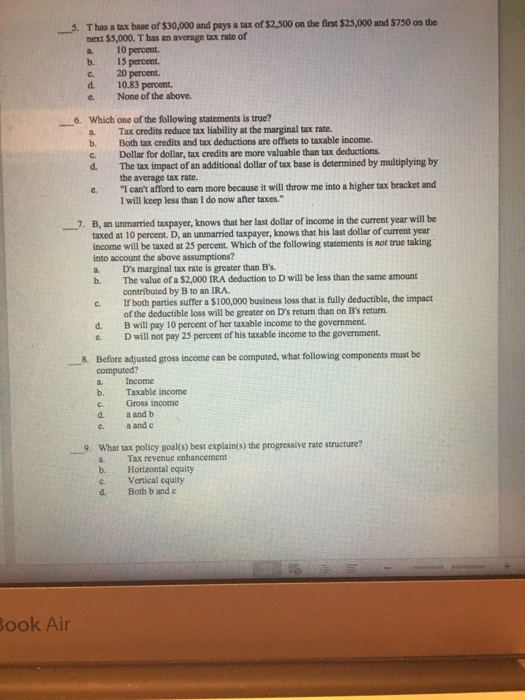

Solved Thas A Tax Base Of 30 000 And Pays A Next 5 000 T Chegg

https://media.cheggcdn.com/media/59c/59c08f3d-61de-4d88-b33e-8e07e061ec90/image

Is Overtime Taxed More

https://www.pineapplemoney.com/img/Is-Overtime-Taxed-More-1.jpg#header-image

How Severance Pay Is Taxed YouTube

https://i.ytimg.com/vi/zkzYD6bahZU/maxresdefault.jpg

For example an employee with earnings of 200 000 from each of two employers would pay the 6 2 employee payroll tax on earnings up to the current law taxable maximum in 2025 estimated at Make sure to enter 0 zero dollars for last year s adjusted gross income AGI on the 2023 tax return Everyone else should enter their prior year s AGI from last year s return 4 Free resources are available to help eligible taxpayers file online Free help may also be available to qualified taxpayers

HZD Hazardous Duty Pay ICCA Initial Civilian Clothing Allowance IDP Imminent Danger Pay can also mean Independent Duty Corpsman ISP Incentive Special Pay Jump Pay LQA Living Quarters Income taxes in the U S are calculated based on tax rates that range from 10 to 37 Taxpayers can lower their tax burden and the amount of taxes they owe by claiming deductions and credits Federal Income Tax W 2 Employees W 2 employees are workers that get W 2 tax forms from their employers These forms report the annual salary paid

Joe Biden Is Not In Charge Of Anything Wake Up Sheeple

https://wakeupsheeple.net/wp-content/uploads/2021/03/Joe-Biden-Smiling-768x432.jpg

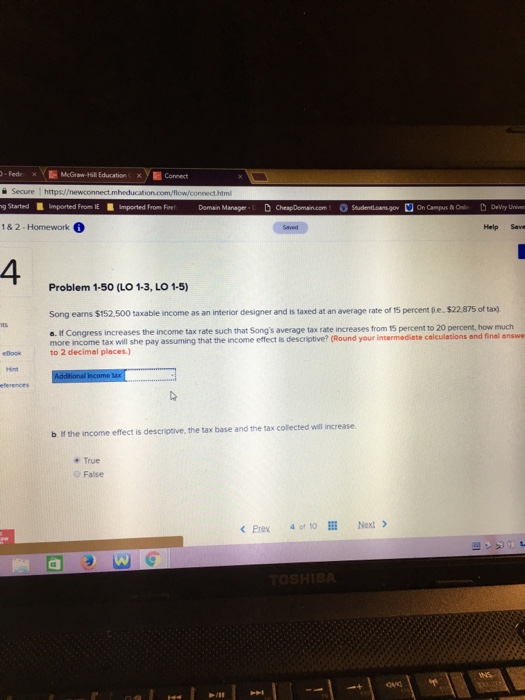

Solved Fede X McGe Hil Education X Y Correct G Started Chegg

https://media.cheggcdn.com/media/5eb/5eb52c8c-3883-4411-865e-a5bcb5cd146e/image

Is Base Pay Taxed - Taxable Wage Base Also known as the Social Security Wage Base this base is the maximum amount of earned income upon which employees must pay Social Security taxes Generally the employee s