Is 85000 A Good Salary In Texas Texas Income Tax Calculator 2023 2024 Learn More On TurboTax s Website If you make 70 000 a year living in Texas you will be taxed 7 660 Your average tax rate is 10 94 and your marginal tax

Social Security 6 2 Medicare 1 45 to 2 35 Other non tax deductions health insurance 401k etc also reduce your take home pay The combined tax percentage usually ranges from 15 to 30 of your paycheck Updated on Jul 06 2024 Free tool to calculate your hourly and salary income after federal state and local taxes in Texas GoodCalculators A collection of really good online calculators for use in every day domestic and commercial use Home page To use our Texas Salary Tax Calculator all you need to do is enter the necessary details and click on the Calculate button 85 000 00 Salary Calculation with Graph 90 000 00 Salary Calculation with Graph

Is 85000 A Good Salary In Texas

Is 85000 A Good Salary In Texas

https://www.gannett-cdn.com/-mm-/389f33b6050a2664d0a5c4c7964c4fab0747cd63/c=0-38-2024-1181/local/-/media/2015/10/26/USATODAY/USATODAY/635814567737908846-salary.jpg?width=2024&height=1143&fit=crop&format=pjpg&auto=webp

Should You Talk About Your Salary With Coworkers By George HR Solutions

https://i0.wp.com/bygeorgehr.com/wp-content/uploads/2018/12/Salary-resize.jpg?fit=1200%2C801&ssl=1

What Is A Good Salary In Kansas City YouTube

https://i.ytimg.com/vi/5uWALM9Apog/maxresdefault.jpg

After entering it into the calculator it will perform the following calculations Federal Tax Filing 85 000 00 of earnings will result in 10 541 00 of that amount being taxed as federal tax FICA Social Security and Medicare Filing 85 000 00 of earnings will result in 6 502 50 being taxed for FICA purposes Texas State Tax Summary If you make 85 000 a year living in the region of Texas USA you will be taxed 17 971 That means that your net pay will be 67 030 per year or 5 586 per month Your average tax rate is 21 1 and your marginal tax rate is 29 7 This marginal tax rate means that your immediate additional income will be taxed at this rate

85k Salary After Tax in Texas 2024 This Texas salary after tax example is based on a 85 000 00 annual salary for the 2024 tax year in Texas using the State and Federal income tax rates published in the Texas tax tables The 85k salary example provides a breakdown of the amounts earned and illustrates the typical amounts paid each month week day and hour They are mandatory payroll taxes that fund the Social Security and Medicare programs Social Security tax is 6 2 of your pay up to a certain limit 160 200 in 2023 while Medicare tax is 1 45 of your pay with no limit If you earn more than certain limits you will also pay an additional 0 9 Medicare surtax

More picture related to Is 85000 A Good Salary In Texas

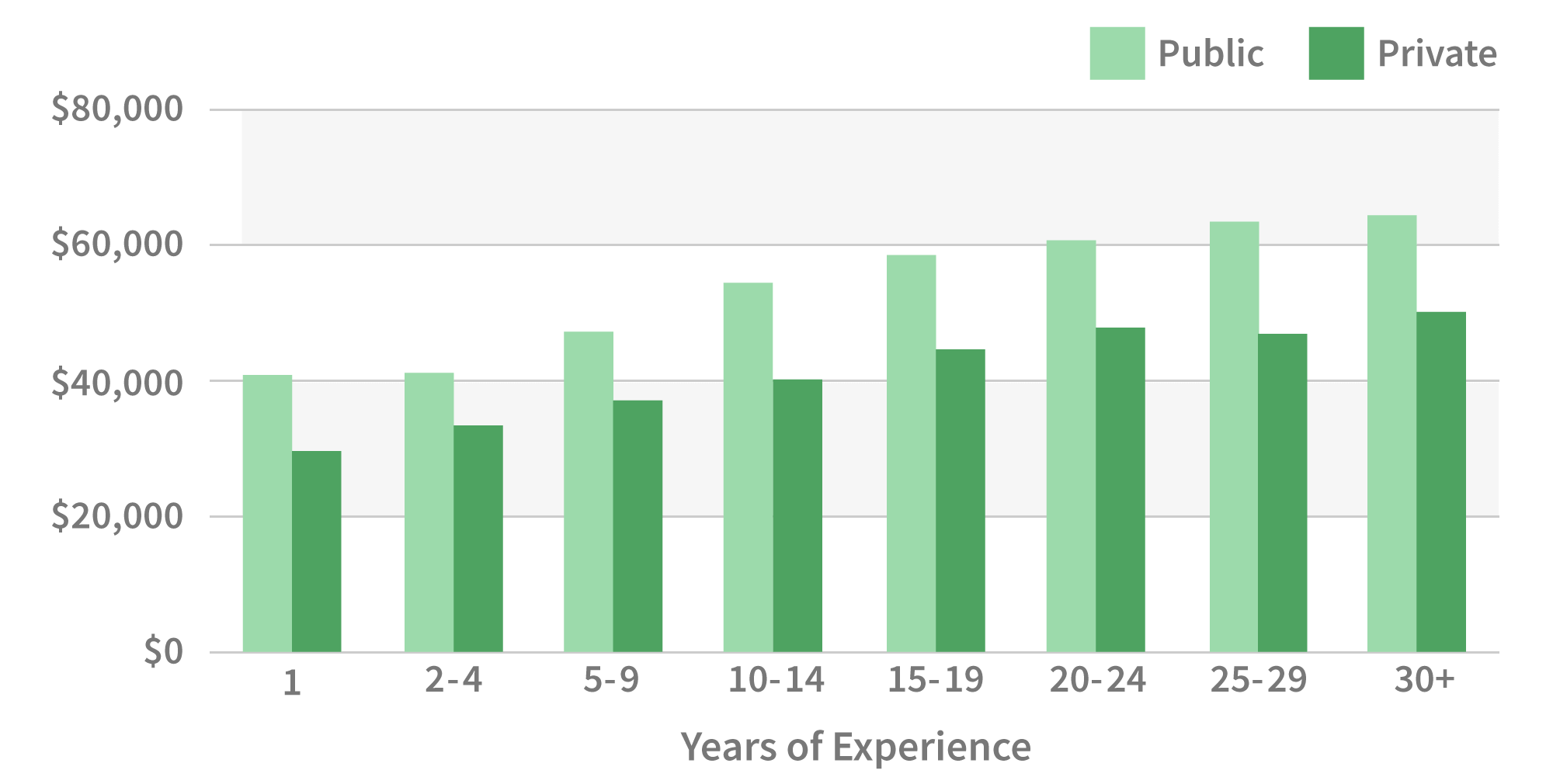

Average Teacher Salary In New York State CollegeLearners

https://collegelearners.com/wp-content/uploads/2020/09/average-teacher-salary-1.png

A Job That Pays 150k Is A Good Salary By Most Standards List Foundation

https://lsitlcnd.listfoundation.org/is_k_job_good_salary.jpg

Essays On Different Topics MAKING A GOOD SALARY IS MORE IMPORTANT

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/86f94d7de9b37583b1369e04fc2af14f/thumb_1200_1553.png

2014 53 875 2013 51 406 2012 51 926 Payroll taxes in Texas are relatively simple because there are no state or local income taxes Texas is a good place to be self employed or own a business because the tax withholding won t as much of a headache And if you live in a state with an income tax but you work in Texas you ll be sitting 85 000 00 Salary Income Tax Calculation for Texas This tax calculation produced using the TXS Tax Calculator is for a single filer earning 85 000 00 per year The Texas income tax example and payroll calculations are provided to illustrate the standard Federal Tax State Tax Social Security and Medicare paid during the year when filing a tax return in Texas for 85 000 00 with no special

What s considered a good salary in Texas depends on your household size and lifestyle but most Texans make between 45 000 and 100 000 annually Texas cities have differing costs of living of course Austin is much pricier than Amarillo so where you live in the Lone Star State also matters Let s break it down further Enter your gross salary pay frequency and other relevant details to calculate your net income after all state and federal taxes To effectively use the Texas Paycheck Calculator follow these steps Enter your gross pay for the pay period Choose your pay frequency e g weekly bi weekly monthly Input your filing status and the number of

Why Are Indian Companies Not Paying A Good Salary Salary In India

https://i.ytimg.com/vi/7E1FoMnwlIo/maxresdefault.jpg

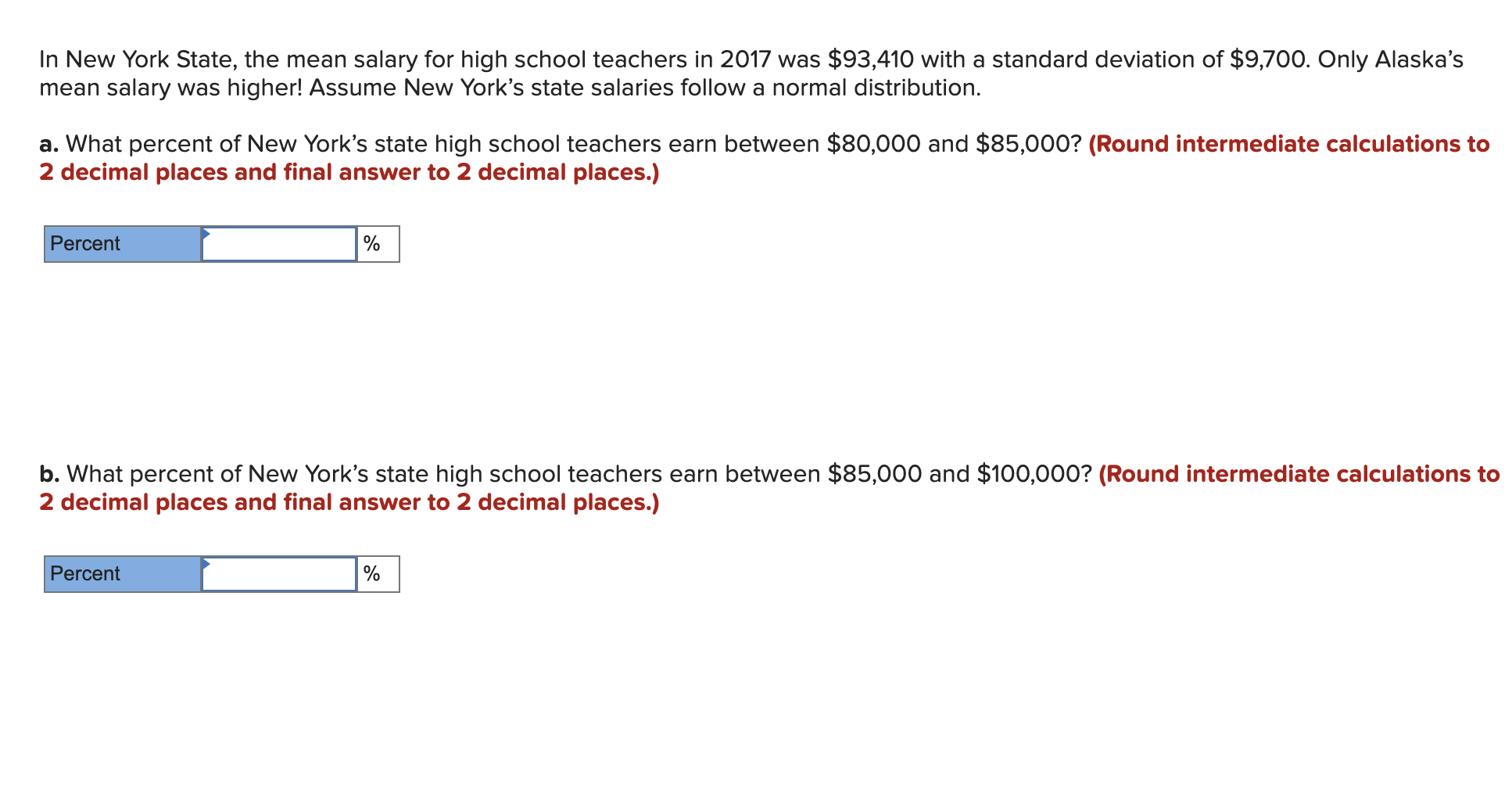

Solved In New York State The Mean Salary For High School Chegg

https://media.cheggcdn.com/media/41b/41bfaa78-6c9c-4dc7-8df8-25ac93ddaeb7/phpaGv4Vi.png

Is 85000 A Good Salary In Texas - Roughly if you make a yearly salary of 85 000 you will need to pay between 13 6k to 20 4k in taxes Let s be conservative and estimate based on the higher taxes of 20 4k We are also going to assume that you get two weeks of paid vacation per year 85 000 20400 2080 31 an hour That means that after taxes you will have an