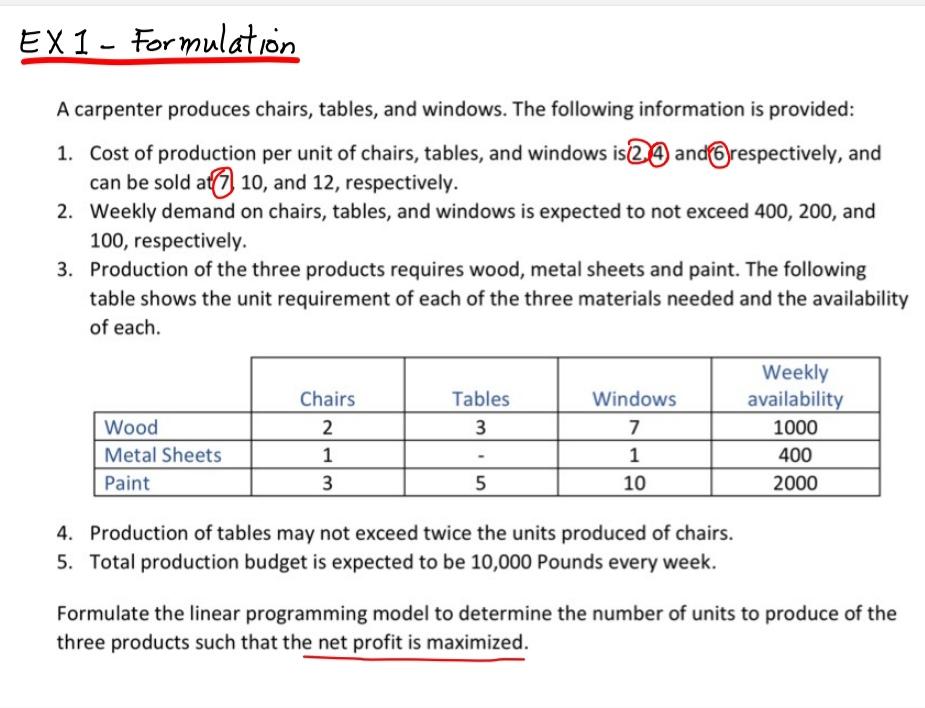

If You Work 40 Hours A Week At Minimum Wage Covered nonexempt workers are entitled to a minimum wage of not less than 7 25 per hour effective July 24 2009 Overtime pay at a rate not less than one and one half times the regular rate of pay is required after 40 hours of work in a workweek FLSA Minimum Wage The federal minimum wage is 7 25 per hour effective July 24 2009

This fact sheet provides general information concerning what constitutes compensable time under the FLSA The Act requires that employees must receive at least the minimum wage and may not be employed for more than 40 hours in a week without receiving at least one and one half times their regular rates of pay for the overtime hours The amount employees should receive cannot be determined Default overtime occurs after 40 hours per week Change 40 to another value as necessary Employers typically use decimal hours to calculate work week pay They take the number of hours worked in a week in decimal form and multiply that by the rate of pay If you worked 41 15 41 hours and 15 minutes how would you calculate your total pay

If You Work 40 Hours A Week At Minimum Wage

If You Work 40 Hours A Week At Minimum Wage

https://media.cheggcdn.com/media/a23/a2359bd5-d718-4ac0-8b9c-391d6b1cfbeb/php2cbskS

Work 40 hours a week for someone else Imgflip

https://i.imgflip.com/6su1gn.jpg

Job Hunt Baamboozle Baamboozle The Most Fun Classroom Games

https://media.baamboozle.com/uploads/images/64669/1592018172_111731

The Wage and Hour Division has a variety of compliance materials available for both employees and employers on the subject of work hours The Wage and Hour Division enforces federal labor laws pertaining to work hours such as Federal minimum wage Overtime pay Recordkeeping Child labor requirements of the Fair Labor Standards Act FLSA To start using The Hourly Wage Tax Calculator simply enter your hourly wage before any deductions in the Hourly wage field in the left hand table above In the Weekly hours field enter the number of hours you do each week excluding any overtime If you do any overtime enter the number of hours you do each month and the rate you get

The annual earnings for a full time minimum wage worker is 15 080 at the current federal minimum wage of 7 25 Full time work means working 2 080 hours each year which is 40 hours each week However many states have their own minimum wages including 29 that are currently higher than the federal rate California employers must pay salaried exempt employees at least twice the minimum hourly wage based on a 40 hour workweek 1 As of 2024 the California minimum wage is 16 00 an hour Though many California cities and counties have higher minimum wage requirements than the state minimum

More picture related to If You Work 40 Hours A Week At Minimum Wage

15 Per Hour Annual Salary Before After Taxes Budget Billz

https://budgetandbillz.com/wp-content/uploads/2022/03/15-an-Hour-is-How-Much-a-Year-1536x864.jpg

Why Do We Still Work 40 Hours A Week

https://slowgrowth.com/wp-content/uploads/2021/11/Blog-graphic-40-hour-work-week-2048x1152.jpg

Map Showing Minimum Wage Hours Rent Low Income Housing States

https://i.pinimg.com/originals/34/a0/71/34a071f088560df224c27ca474df2833.png

How many days per week do you work WDW Starting July 2009 the U S federal government allows a nationwide minimum wage per hour of 7 25 while depending by each state s policy employers may be requested to pay higher rates Scenario 1 An employee receives a hourly wage of 15 and he works 40 hours per week which will result in We assumed that the work week has 40 hours but you can easily configure it according to your preferences a year has 52 weeks and one month is 1 12 of a year This type of employee must be paid at least the minimum wage the amount varies across the U S states All the other regulations must be clearly covered in a personal contract

You re paid weekly and work 40 hours a week Your total weekly pay before tax is usually 540 This usually includes 100 in tips so you ll need to use 440 as the starting point to work out if you re getting the minimum wage Your average hourly rate is 11 440 divided by 40 This is below the minimum wage for a worker aged 22 For example you earn 15 per hour and work a standard 8 hours a day or 40 hours a week Converting the hourly pay to salary your rate of pay is Input the hourly wage 23 and weekly work hours 40 yearly 23 40 52 47 840 per year Hours per week Put in one of the wages to see the rest Hourly wage Daily wage

Nobody Ever Changed The World Working 40 Hours A Week Elon Musk

https://i.pinimg.com/originals/1b/f5/ee/1bf5ee1ae15194937750ef4eedce21df.png

20 Hour Work Week 12 Real Schedules To Try Buildremote

https://i0.wp.com/buildremote.co/wp-content/uploads/2021/10/15-hour-work-week.png?fit=1920%2C1080&ssl=1

If You Work 40 Hours A Week At Minimum Wage - The Wage and Hour Division has a variety of compliance materials available for both employees and employers on the subject of work hours The Wage and Hour Division enforces federal labor laws pertaining to work hours such as Federal minimum wage Overtime pay Recordkeeping Child labor requirements of the Fair Labor Standards Act FLSA