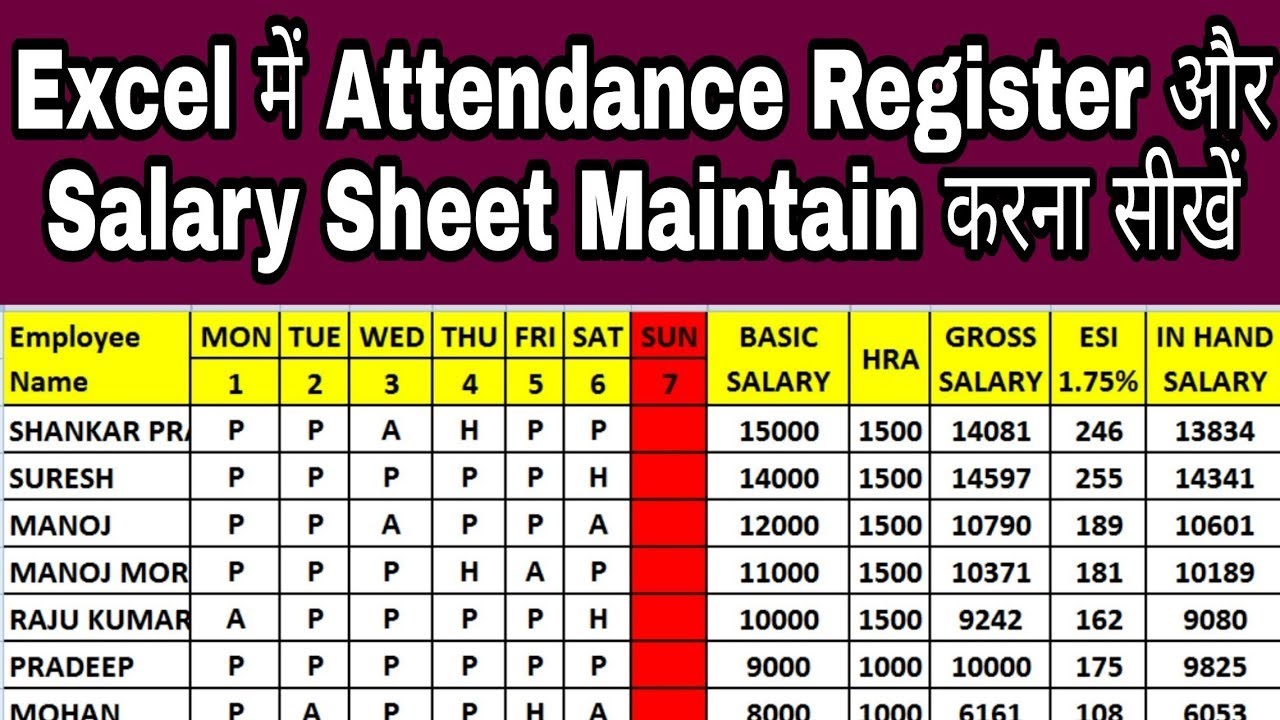

How To Make Salary Sheet In Excel Step By Step Mastering Excel Creating Salary Sheet with Formulas Excel Salary Sheet Learn how to efficiently create a salary sheet in Excel step by step using formul

In this video I ll guide you through multiple steps to make a salary sheet in Excel with Formula You ll learn about creating an employee database salary Salary payroll software free download excel format how to make salary sheet in excel with formula step by step LINKS Facebook https www facebook

How To Make Salary Sheet In Excel Step By Step

How To Make Salary Sheet In Excel Step By Step

https://i.ytimg.com/vi/q97IwMlPuwg/maxresdefault.jpg

How To Make Salary Sheet In Professional Way YouTube

https://i.ytimg.com/vi/1v3wACMYanM/maxresdefault.jpg

207 How To Make Salary Sheet In Ms Excel Hindi YouTube

https://i.ytimg.com/vi/XpuQJkUVIlI/maxresdefault.jpg

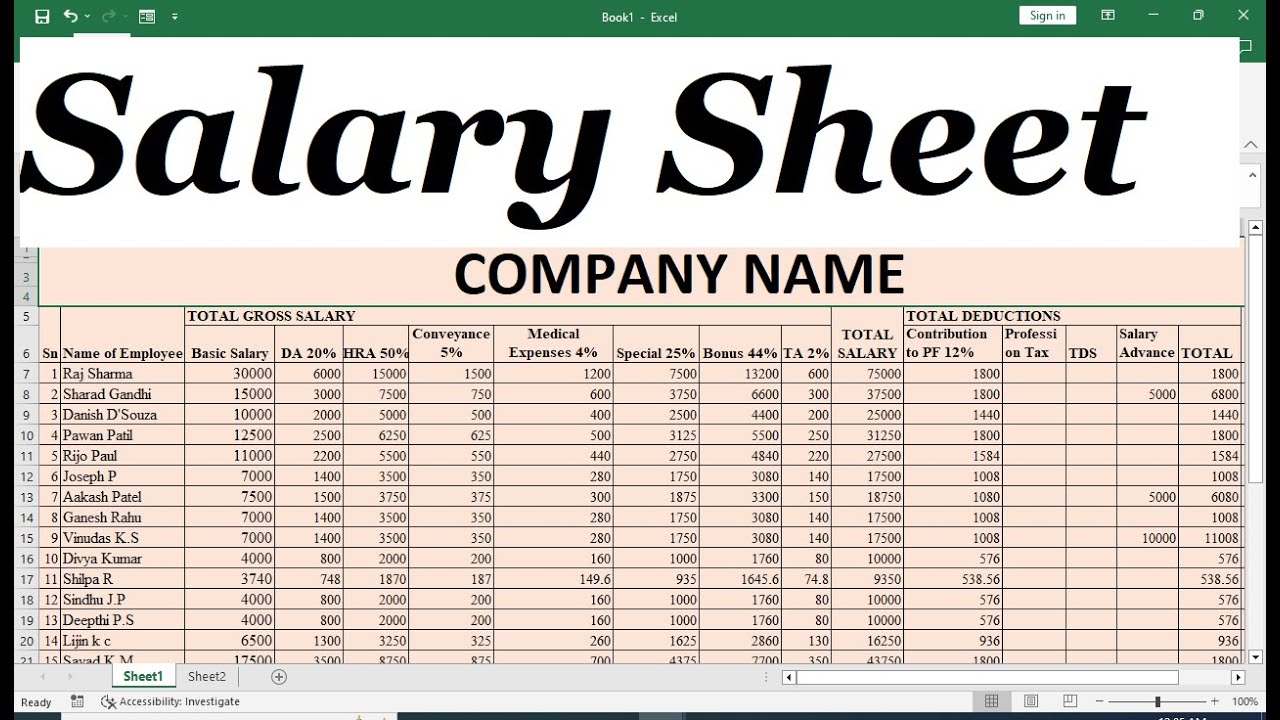

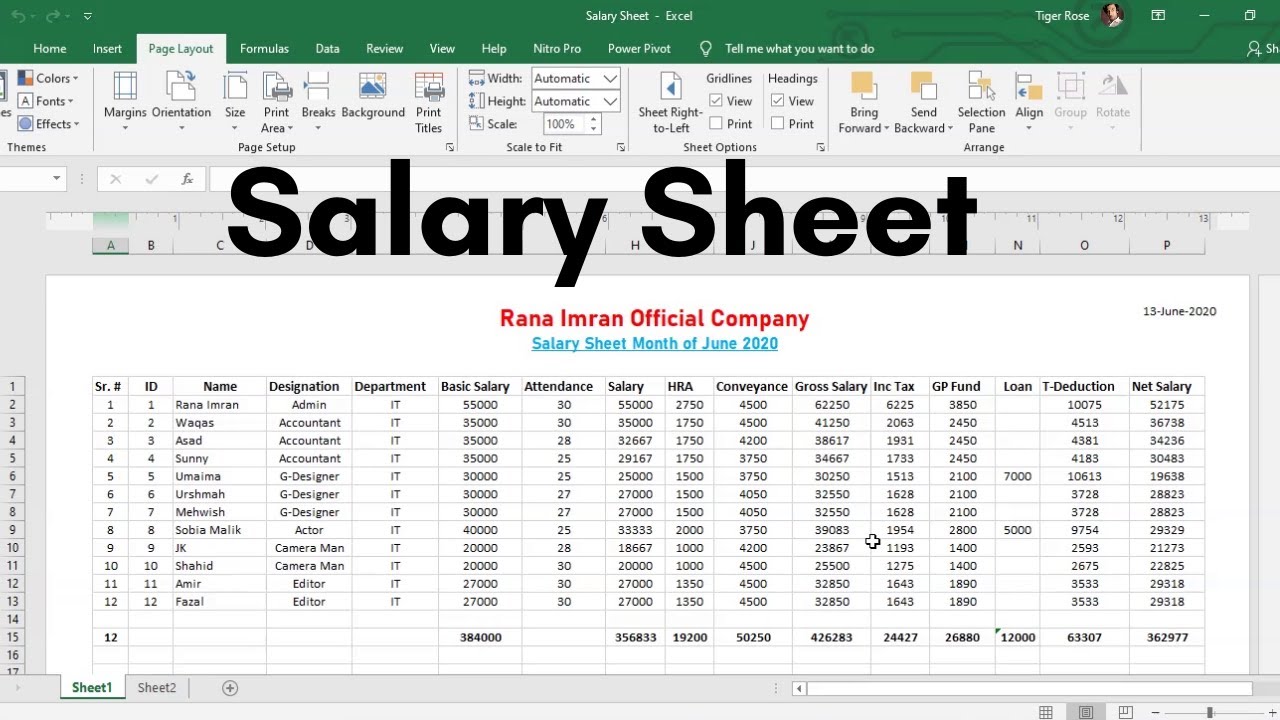

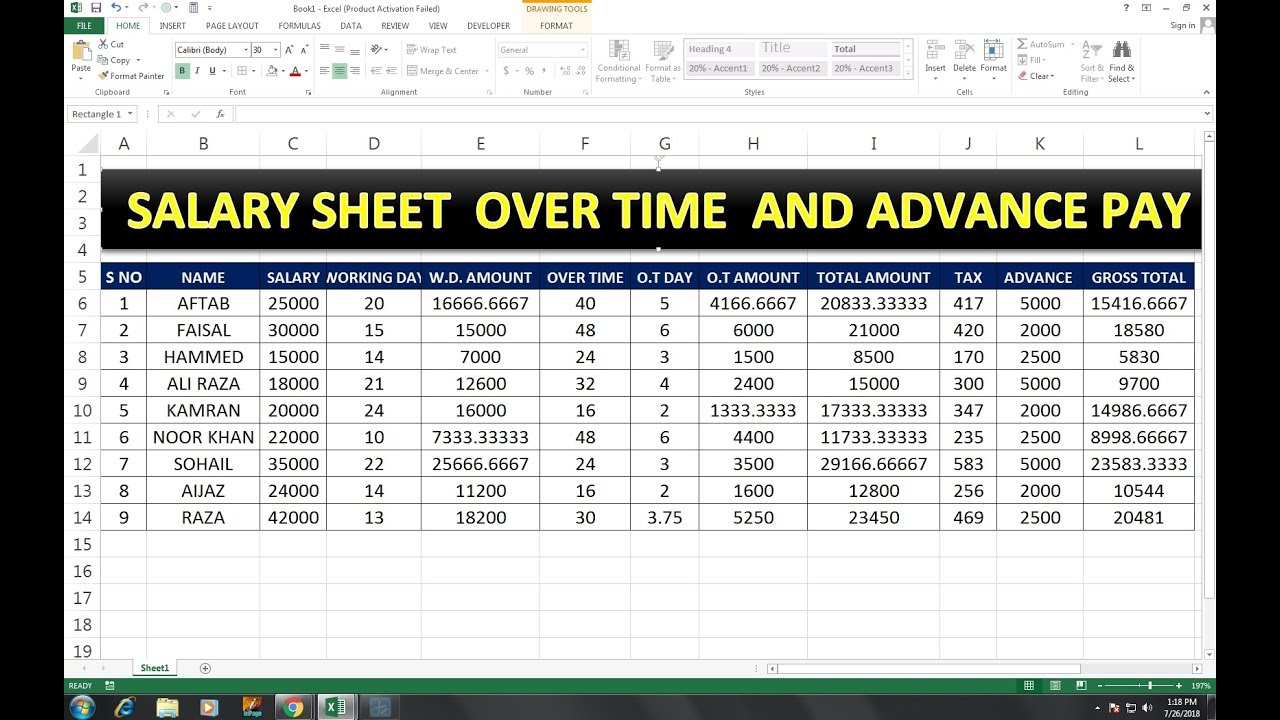

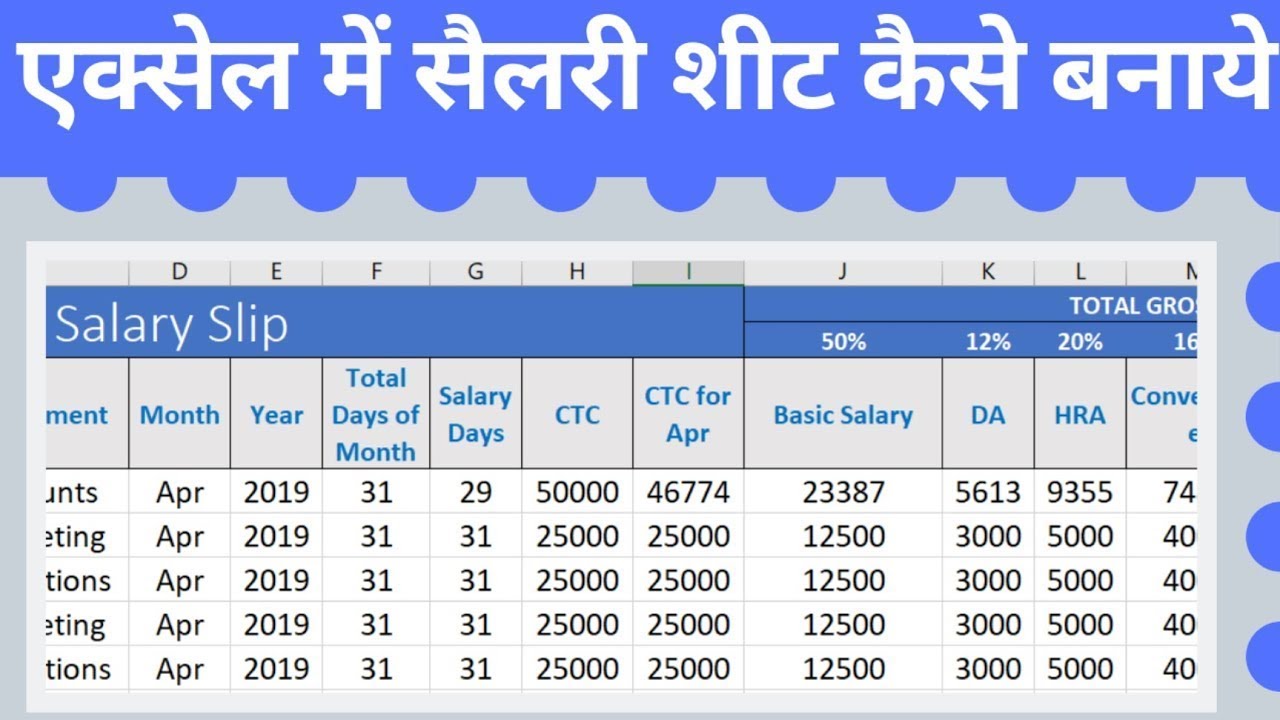

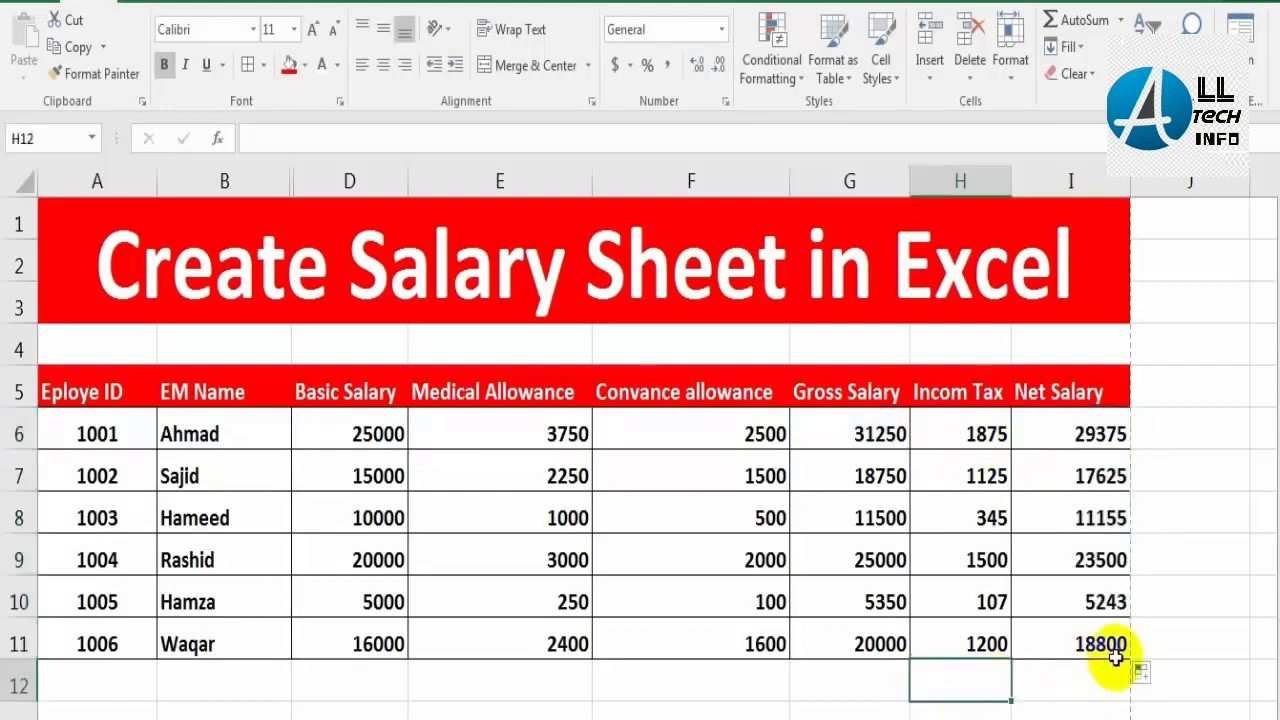

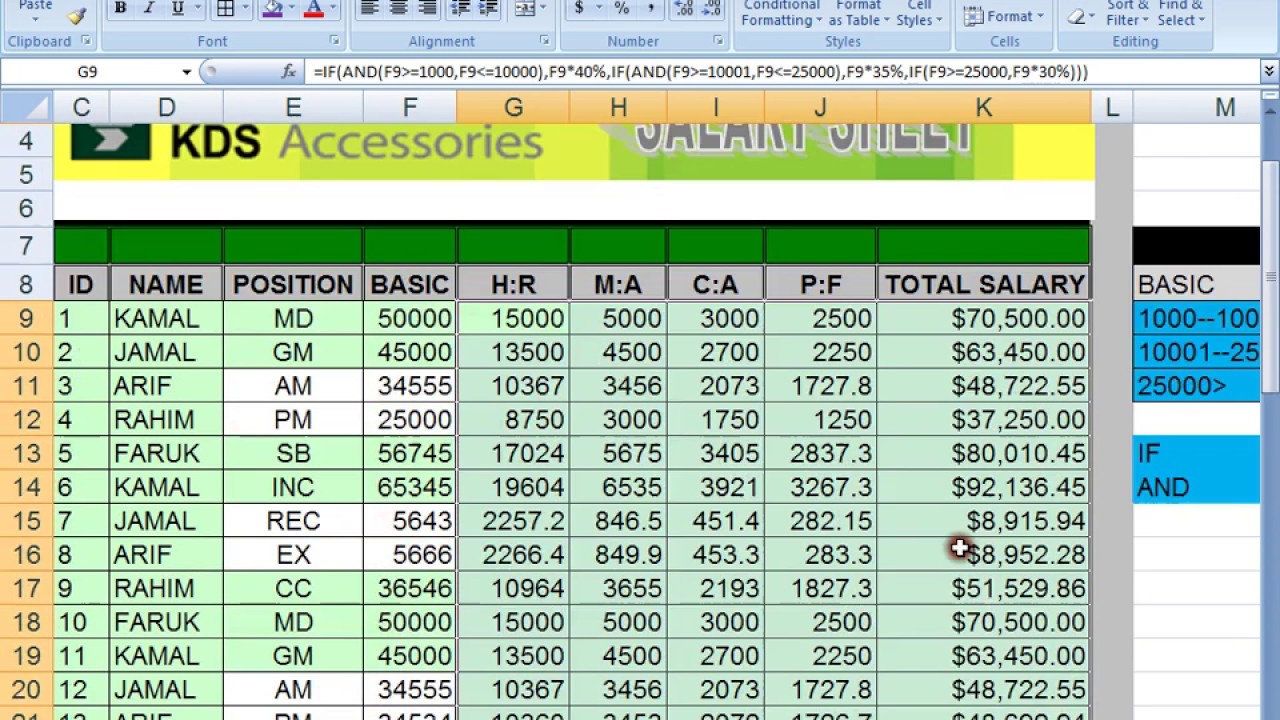

This will be represented in a formula as SUM 15 F2 This result will give you 15 of the gross pay and is the amount that should be deducted for income tax To apply this to the rest of the employees drag the formula down to the last row This will apply 15 to the respective gross pay for each individual Creating a Salary Sheet in Excel Initial Setup for Salary Sheet To start making a salary sheet in Excel open a new workbook and create three separate sheets the employee database sheet the consolidation sheet and the employee salary slip sheet Employee Database Sheet The employee database sheet acts as the master sheet

In the end press the Enter key SUM C5 C8 C11 Now the gross salary and allowances are displayed in front of you Calculate Amounts to Deduct In the next step we need to find the deductions from the salary of an employee For this choose cell B5 and refer to cell B5 of the Calculate Gross Salary sheet Step 2 Create various columns in your employee salary sheet in Excel Now you need to set up different columns to fill in the crucial employee information for salary calculation Employee name as mentioned in the business records Standard pay rate in the currency applicable

More picture related to How To Make Salary Sheet In Excel Step By Step

How To Make Salary Sheet In Excel Volweriine YouTube

https://i.ytimg.com/vi/SdLFX7hTIzQ/maxresdefault.jpg

How To Make Salary Sheet In Excel Part 1 YouTube

https://i.ytimg.com/vi/MwlKbt-SEe8/maxresdefault.jpg

How To Make Salary Sheet In Microsoft Excel YouTube

https://i.ytimg.com/vi/mil3QhiT95Y/maxresdefault.jpg

Step 1 Open a New Excel Spreadsheet The first step in making payroll in Excel is to open a new Excel sheet For this Go to the Search Box at the bottom left end of the Windows desktop screen Type Excel Click the Excel icon to open a new blank Excel spreadsheet Click anywhere within your list of data and then select Insert Table Highlight the range of data in your list that you want to use Ensure that the range is correct in the Create Table window and that the My Table Has Headers box is checked Click the OK button to create your table The list is now formatted as a table

And lastly we arerequired to make a salary sheet in Microsoft Excel with a formula and we need to calculate the employee s total salary To achieve this first and foremost we will click on the C5 cell and put an equal sign selecting a cell C5 from the Calculate Gross Salary worksheet Next we are required to click on the Enter button Calculating salaries accurately is a critical aspect of any salary sheet format Excel offers a wide range of functions and formulas that can simplify this process Use the SUM function to calculate the total of basic salary allowances and deductions for each employee You can also make use of built in functions like IF VLOOKUP or HLOOKUP

Excel Salary Sheet How To Make Salary Sheet In Excel

https://logicaldost.in/wp-content/uploads/2022/08/excel-me-salary-sheet-kaise-banaye.jpg

How To Make Salary Sheet Using Microsoft Excel In Bangla ViYoutube

https://i.ytimg.com/vi/gcJA7Weo-FA/maxresdefault.jpg

How To Make Salary Sheet In Excel Step By Step - This will be represented in a formula as SUM 15 F2 This result will give you 15 of the gross pay and is the amount that should be deducted for income tax To apply this to the rest of the employees drag the formula down to the last row This will apply 15 to the respective gross pay for each individual