How To Get A Cpa License In Virginia Please note As of July 1 2022 the VBOA will no longer accept credits or credentials issued by the Association of Chartered Certified Accountants ACCA and similar accounting professional organizations All evaluation of foreign education must be from properly accredited colleges or universities Virginia state law requires CPA applicants be graduates of accredited educational institutions

Applicants without a U S SSN or control number issued by the Virginia DMV are not eligible for a Virginia CPA license Please note All applications for a CPA license in Virginia will expire six years from the original application date and a new application with the corresponding fees and requirements will need to be submitted per VBOA Get Your Virginia CPA License Passing the Uniform CPA Examination completing the ethics course completing 150 semester hours of college education and fulfilling Virginia s work experience requirement renders you ready to apply for a CPA license Make sure you have taken care of the following checklist items a

How To Get A Cpa License In Virginia

How To Get A Cpa License In Virginia

https://licenselookup.org/images/2022-11/florida-accountant-license-2a92d349a6.jpg

Pennsylvania CPA License License Lookup

https://licenselookup.org/images/2022-11/pennsylvania-accountant-license-scaled-743095f95c.jpg

How To Get Cpa In New York NewYorkDaily

https://www.newyorkdaily.net/wp-content/uploads/npi-and-license-number-lookup-nys-cpa-license-lookup.jpeg

Experience requirements Prior to applying for your CPA license candidates must complete 2 080 work hours the equivalent of one year of full time employment in a firm government industry or educational setting that involves using accounting financial tax or other relevant skills Learn the 7 simple steps to qualifying to become a licensed CPA in Virginia Find CPA exam requirements and qualifications fees if 150 credit hours required fulfilling the education class requirements licensing ethics residency citizenship and age requirements for Virginia

Apply for a CPA license Receive a CPA license 1 Complete 150 semester hours of college level education in accounting Virginia follows the 150 hour rule meaning that CPA applicants in the state must complete at least 150 semester hours of college education that include the award of a bachelor s degree You do however have to complete 150 semester hours to be eligible for a CPA license These rules are pretty standard among most states today and allow a good deal of flexibility Let s take a look at what you need to do to take the exam and get licensed Virginia CPA Exam Requirements

More picture related to How To Get A Cpa License In Virginia

North Carolina CPA License License Lookup

https://licenselookup.org/images/2022-11/north-carolina-accountant-license-2-1-396da50a59.jpg

California CPA License License Lookup

https://licenselookup.org/images/2022-11/california-certified-public-accountant-license-3ecb8573e1.jpg

Virginia CPA Exam Requirements 2023 Detailed Breakdown

https://www.superfastcpa.com/wp-content/uploads/2022/06/Virginia-CPA-Exam-Requirements-1024x576.png

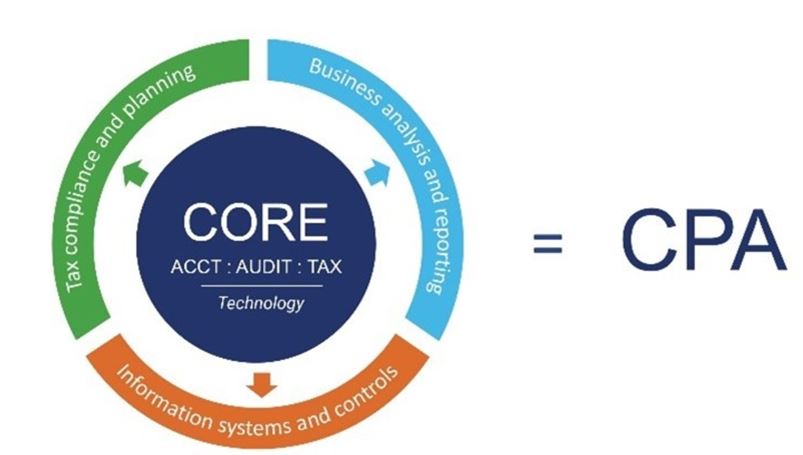

Most states and territories don t have minimum age requirements in place In those that do the minimum age is almost always 18 though you must be 21 in New York and Missouri to take the exam and obtain your CPA license CPA Exam requirements Sitting for the exam While the individual states have CPA Exam requirements you ll need to meet Concentrations Courses and Credits As of Jan 1 2026 Virginia CPA requirements for education will include three pathways Pathway one requires a master s degree plus one year of documented accounting experience Pathway two stipulates that a candidate must have a bachelor s degree plus 30 additional semester credits or the equivalent and one year of professional experience

[desc-10] [desc-11]

Transition Policy Announced For The 2024 CPA Exam Under The CPA

https://nasba.org/wp-content/uploads/2022/02/chart.jpg

How To Get A CPA License In 4 Simple Steps InfiniGEEK

https://infinigeek.com/assets/8-Classes-You-Need-to-Take-to-Become-an-Entrepreneur-710x434.jpg

How To Get A Cpa License In Virginia - You do however have to complete 150 semester hours to be eligible for a CPA license These rules are pretty standard among most states today and allow a good deal of flexibility Let s take a look at what you need to do to take the exam and get licensed Virginia CPA Exam Requirements