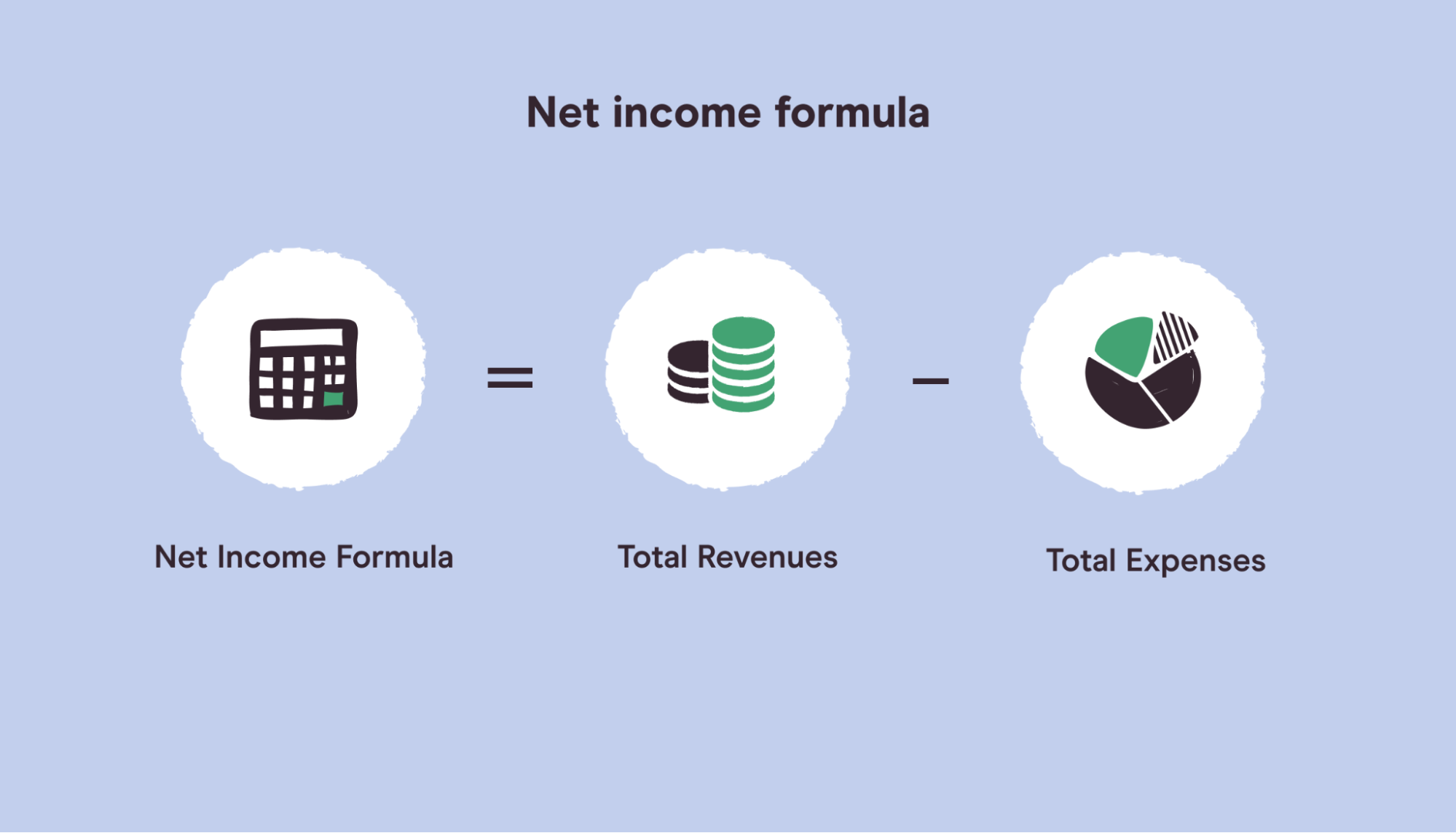

How To Find Annual Net Income On W2 How do you find the net income To calculate net income take the gross income the total amount of money earned then subtract expenses such as taxes and interest payments For the individual net income is the money you actually get from your paycheck each month rather than the gross amount you get paid before payroll deductions

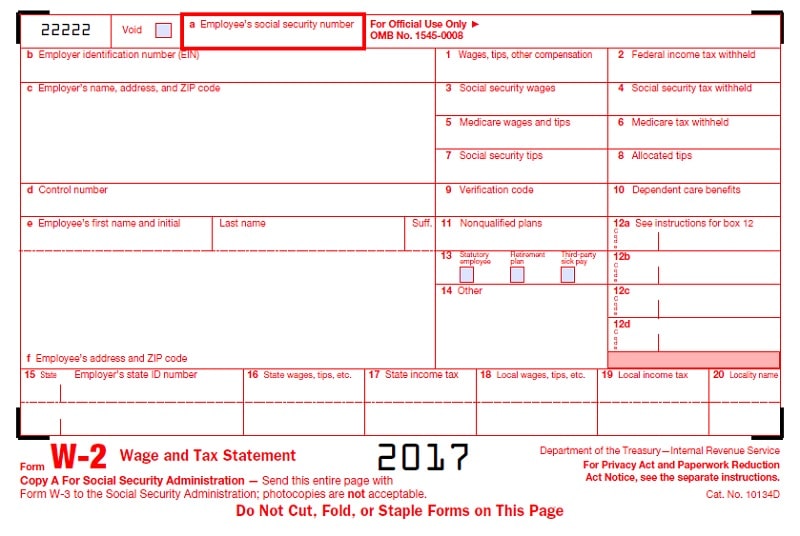

To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year For example if an employee earns 1 500 per week the individual s annual income would be 1 500 x 52 78 000 How to calculate taxes taken out of a paycheck Or if your employer withheld income Social Security or Medicare tax from your paycheck it is required to file a Form W 2 even if they paid you less than 600 during the tax year Additionally there are other situations in which an employer may be required to file a W 2 on your behalf

How To Find Annual Net Income On W2

How To Find Annual Net Income On W2

https://moneybliss.org/wp-content/uploads/2022/11/annual-net-income-683x1024.jpg

Adjusted Gross Income On W2 Immogreenway

https://immogreenway.weebly.com/uploads/1/2/3/7/123700685/487654246.png

How To Calculate Net Income 12 Steps with Pictures WikiHow

https://www.wikihow.com/images/7/74/Calculate-Net-Income-Step-12-Version-2.jpg

Annual net income is the amount of money you earn in a year after certain deductions have been removed from your gross income You can determine your annual net income after subtracting certain expenses from your gross income Your annual net income can also be found listed at the bottom of your paycheck Use SmartAsset s paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes Overview of Federal Taxes

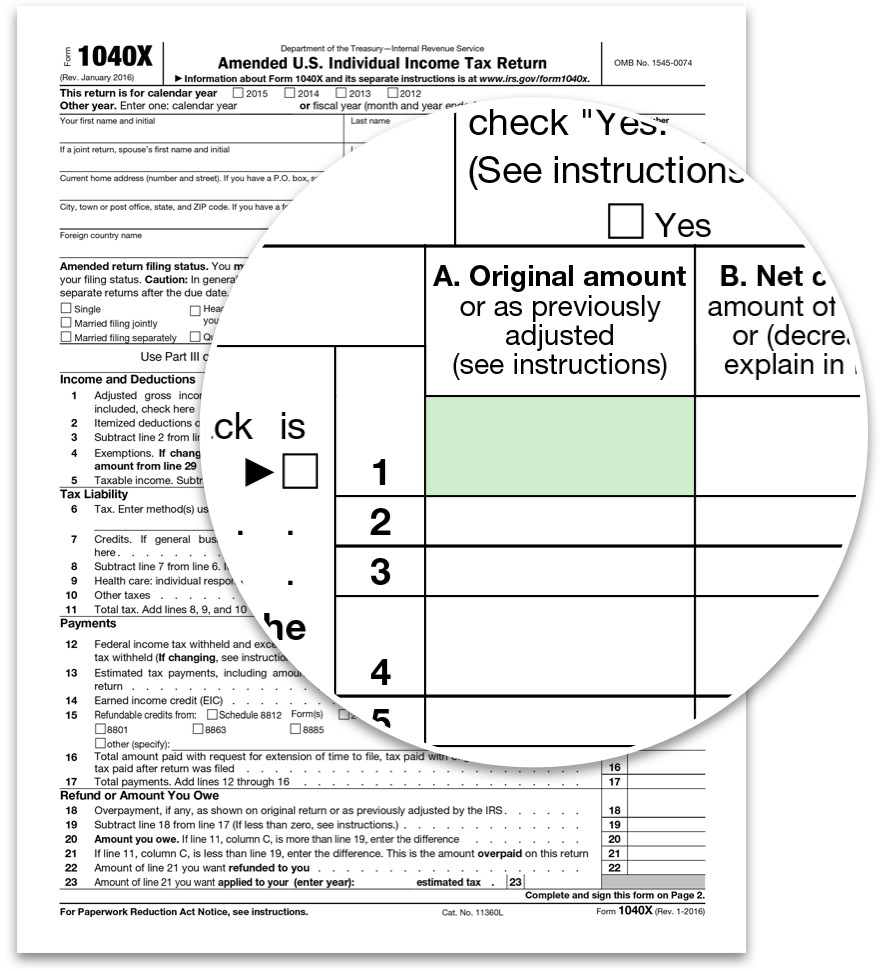

Form W 2 also known as the Wage and Tax Statement is the document an employer is required to send to each employee and the Internal Revenue Service IRS at the end of the year A W 2 reports The formula for annual net income is Annual net income Gross income Expenses Additional income Gross income is the combination of all income including salary investments and interest on savings Expenses include deductions like local state and federal taxes pre tax healthcare premium payments and social security

More picture related to How To Find Annual Net Income On W2

How To Calculate AGI Adjusted Gross Income Using W 2 ExcelDataPro

https://d25skit2l41vkl.cloudfront.net/wp-content/uploads/2017/12/W-2-Form.jpg

Adjusted Gross Income On W2 Ifpowerup

https://ifpowerup.weebly.com/uploads/1/2/4/1/124188410/689973464.jpg

How To Find Net Income For Beginners Pareto Labs

https://www.paretolabs.com/wp-content/uploads/2021/06/Illustration-of-net-income-formula.png

1 Calculate your gross annual income Your first step to calculating your net income is finding out your gross income Gross income is the total amount of money you make in a year before taking taxes or deductions into account 1 It serves as your starting point for calculating net income Your estimated annual net salary would be 31 200 600 per week x 52 weeks 31 200 Additional sources of income like those listed above can also count toward your annual net income If you

The formula for calculating net income is Revenue Cost of Goods Sold Expenses Net Income The first part of the formula revenue minus cost of goods sold is also the formula for gross income Check out our simple guide for how to calculate cost of goods sold So put another way the net income formula is To arrive at your total salary using Box 1 add your federal taxable wages shown in that box to your nontaxable wages plus your pretax deductions that are exempt from federal income tax

How To Find Net Income For Beginners Pareto Labs

https://www.paretolabs.com/wp-content/uploads/2021/06/Example-of-net-income-as-seen-on-a-balance-sheet-1536x878.png

How To Calculate Net Income With Tax Rate Haiper

https://learn.financestrategists.com/wp-content/uploads/2020/09/Net-Income-Formula-SIMPLE-1024x512.jpg

How To Find Annual Net Income On W2 - The formula for annual net income is Annual net income Gross income Expenses Additional income Gross income is the combination of all income including salary investments and interest on savings Expenses include deductions like local state and federal taxes pre tax healthcare premium payments and social security