How To Do Your Own Payroll In Quickbooks Step 3 Understand how owner s equity factors into your decision Owner s equity is a term you ll hear frequently when considering whether to take a salary or a draw from your business Accountants define equity as the remaining value invested into a business after deducting all liabilities

Step 2 Create your paychecks and send your payroll Next you ll need to create your direct deposit or paper paychecks then send them to us for processing If you ve set up a payroll schedule you can create a scheduled payroll or an unscheduled payroll Scheduled payroll paychecks you give your employees regularly Here are the eight essential steps to run payroll on your own 1 Set the Process Up If you are running payroll manually the process will be important to ensure that you don t overlook any

How To Do Your Own Payroll In Quickbooks

How To Do Your Own Payroll In Quickbooks

https://digitalasset.intuit.com/IMAGE/A4Kg2rw2C/pay-date-employee-toggle-prepare-payroll-standard-payroll.gif

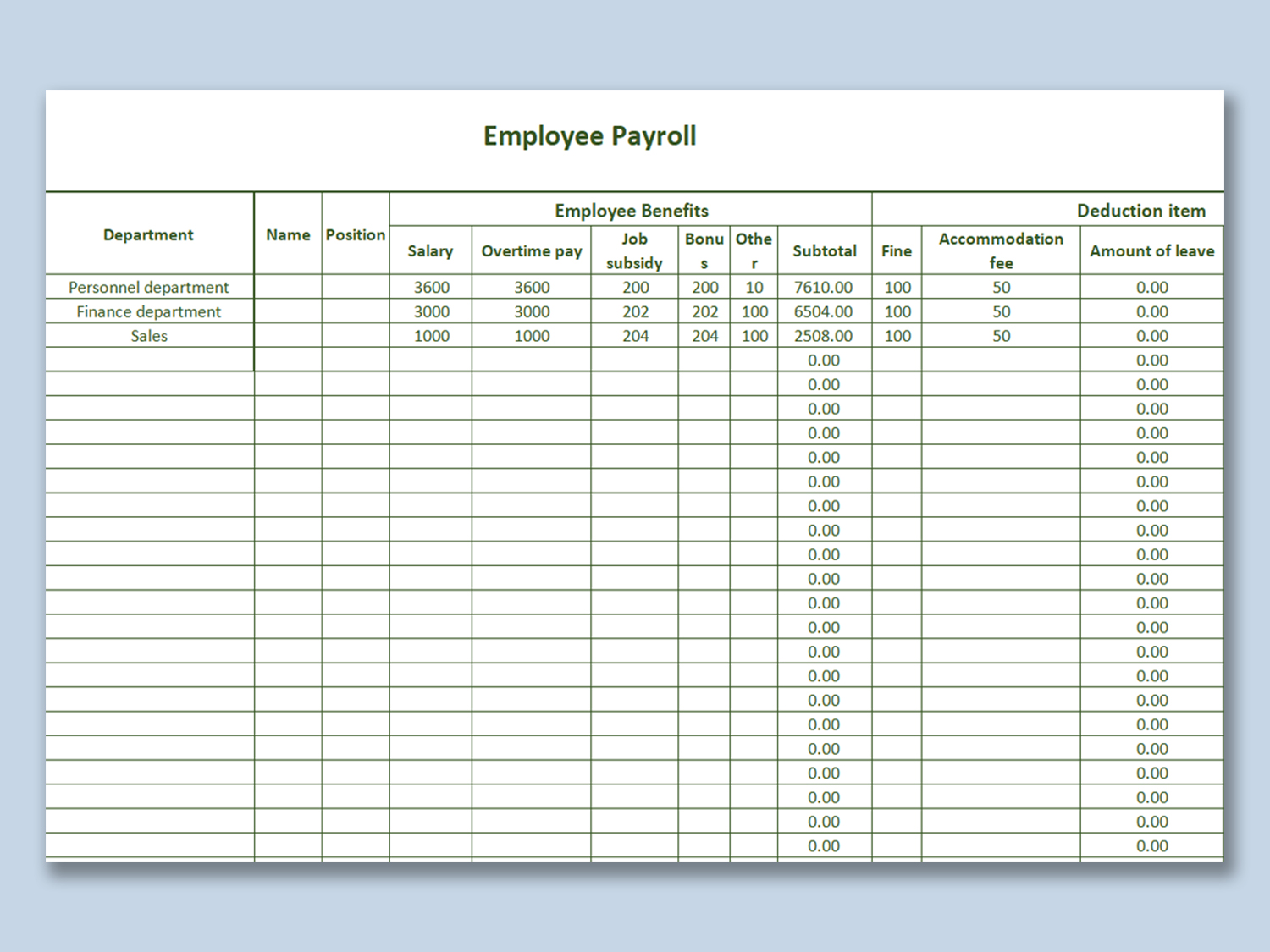

Make An Efficient Payroll Statement Template Using These Tips And

https://free-template.co/wp-content/uploads/2022/01/8955583aa7d0c677/payroll-statement-template.jpeg

4 Advantages Of Outsourcing Payroll

https://www.youroffice.com/wp-content/uploads/2017/02/payroll.jpg

10 Calculate Payroll Taxes Withhold Them To calculate payroll taxes multiply your employee s gross wages by the payroll tax rate If your employee had pre tax deductions withheld from their paychecks their gross taxable wages should be calculated as their gross wages minus any pre tax deductions According to the wage bracket table the tentative withholding amount is 256 Step 3 Next you ll account for additional tax credits like your employee s dependents Look at your employee s W 4 and line 3 of Step 3 This is where your employee claims their dependents

Rippling is an easy to use payroll software for small businesses looking to save time and consolidate systems Guaranteed 100 error free payroll set it to run on auto pilot or do it yourself in less than 90 seconds Automated tax and compliance filings with the right federal state and local agencies Instead of recording them as checks in your bank account you will set up a new bank account in QuickBooks Online Call it Payroll Clearing When you record the paychecks in the Payroll

More picture related to How To Do Your Own Payroll In Quickbooks

Payroll Services Payroll Service Providers Top Payroll Outsourcing

https://www.shrofile.com/assets/img/payroll-services.png

The Comprehensive Guide To Workday Payroll Management System And Its

https://s3.amazonaws.com/contents.newzenler.com/1134/library/60995ab08f294_1620662960_payroll-analytics.jpeg

How To Do Your Own Payroll Manually 2024 Complete Guide

https://store.magenest.com/wp/wp-content/uploads/2021/06/how-to-do-your-own-payroll-1-1-1024x683.png

To use a paycheck calculator you simply enter the information on your employee s W 4 You then list the employee s gross wages and select which state you re filing from to calculate state income tax if your state has one which some don t The calculator automatically calculates the amount to deduct 6 In this QuickBooks Pro 2021 training tutorial video we take a crash course in how to set up Payroll in QuickBooks First we ll look at an overview of the p

Step 1 Navigate to Payroll After having logged in to your QuickBooks account you ll want to navigate to the Payroll tab to get started Hovering over the Payroll tab you ll see three options Employees Contractors and Workers comp You can explore each of these options but we re going to get started with Employees Step 1 Have all employees complete a W 4 form To get paid employees need to complete Form W 4 to document their filing status and keep track of personal allowances The more allowances or dependents workers have the less payroll taxes are taken out of their paychecks each pay period For each new employee you hire you need to file a new

Payroll Systems What To Ask Before Choosing A Payroll System And Why

https://devineconsultingllc.com/wp-content/uploads/2020/06/Payroll-credit_tumsasedgars.jpg

Connect QuickBooks Payroll Powered By KeyPay With QuickBooks Online

https://attachments.developer.intuit.com/appcard-d2fe6be9-7547-4527-974e-8d0b0655a21f.png

How To Do Your Own Payroll In Quickbooks - Step 3 Collect completed tax forms I 9 W 4 W 9 from employees and contractors Step 4 Choose a payroll schedule weekly bi weekly etc and timekeeping system Step 5 Collect time cards