How To Do Your Own Payroll For Small Business Step 1 Collect your tax information Before running payroll for the first time you ll need to set up an Employer Identification Number EIN with the Internal Revenue Service IRS Your EIN is a unique number that identifies your business The application is free and you can access it online by mail or by phone

Step 1 Choose a full service payroll provider If you re not sure how to do payroll yourself use payroll software that reduces the risk of errors or fines Many payroll processing services like Square Payroll handle your payroll taxes filings new hire reporting for you and allow you to complete payroll online Get an employer identification number 2 Find out your state s business requirements 3 Understand the difference between independent contractors and employees 4 Determine the payroll

How To Do Your Own Payroll For Small Business

How To Do Your Own Payroll For Small Business

https://actbookkeepinggroup.com.au/wp-content/uploads/2019/06/Payroll-for-Small-Business-ACT-Bookkeeping-Group.jpg

What Are The Best Small Business Payroll Services MBAFAS

https://www.mbafas.com/wp-content/uploads/payroll-solutions-for-your-business-scaled.jpeg

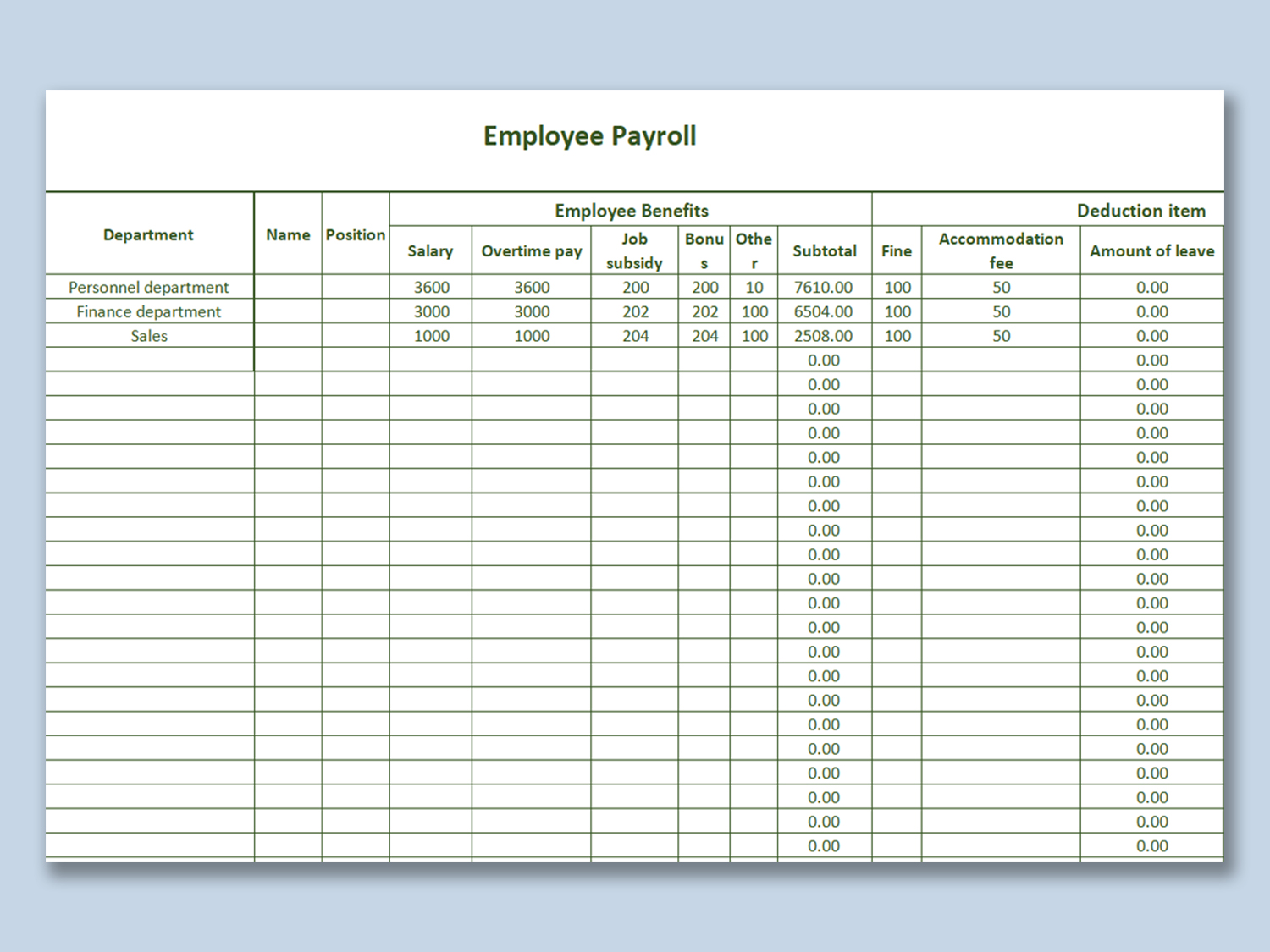

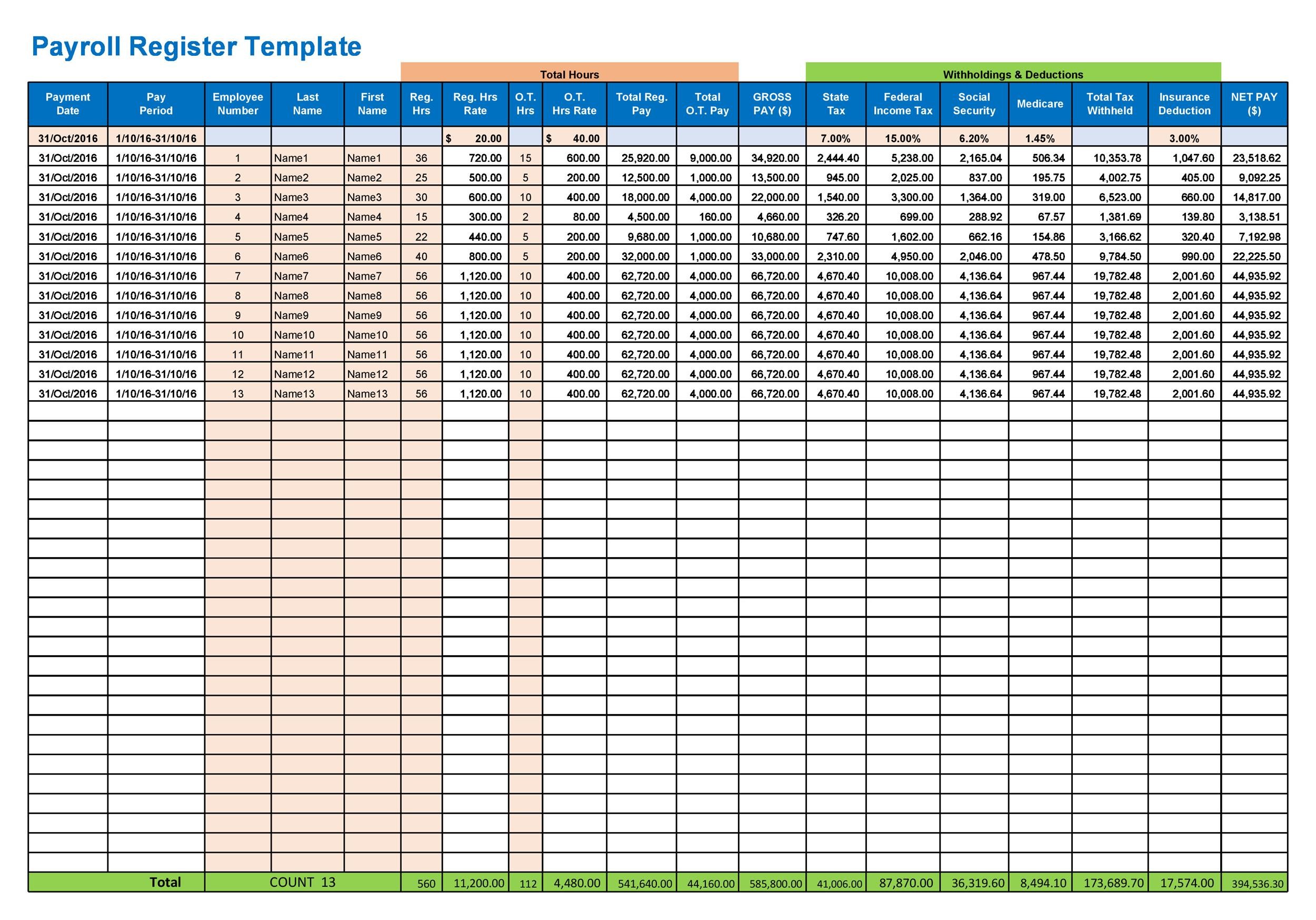

Make An Efficient Payroll Statement Template Using These Tips And

https://free-template.co/wp-content/uploads/2022/01/8955583aa7d0c677/payroll-statement-template.jpeg

Here are the eight essential steps to run payroll on your own 1 Set the Process Up If you are running payroll manually the process will be important to ensure that you don t overlook any 10 Calculate Payroll Taxes Withhold Them To calculate payroll taxes multiply your employee s gross wages by the payroll tax rate If your employee had pre tax deductions withheld from their paychecks their gross taxable wages should be calculated as their gross wages minus any pre tax deductions

Rippling is an easy to use payroll software for small businesses looking to save time and consolidate systems Guaranteed 100 error free payroll set it to run on auto pilot or do it yourself in less than 90 seconds Automated tax and compliance filings with the right federal state and local agencies Obtain a Federal Employer Identification Number FEIN This is assigned by the IRS and is used to identify a business entity You need this 9 digit number to pay federal taxes hire employees open bank accounts and apply for business licenses and permits You can do this online on the Depending on your business structure and location you

More picture related to How To Do Your Own Payroll For Small Business

Make An Efficient Payroll Statement Template Using These Tips And

https://free-template.co/wp-content/uploads/2022/01/1cf53f8084dd3be6/payroll-statement.jpeg

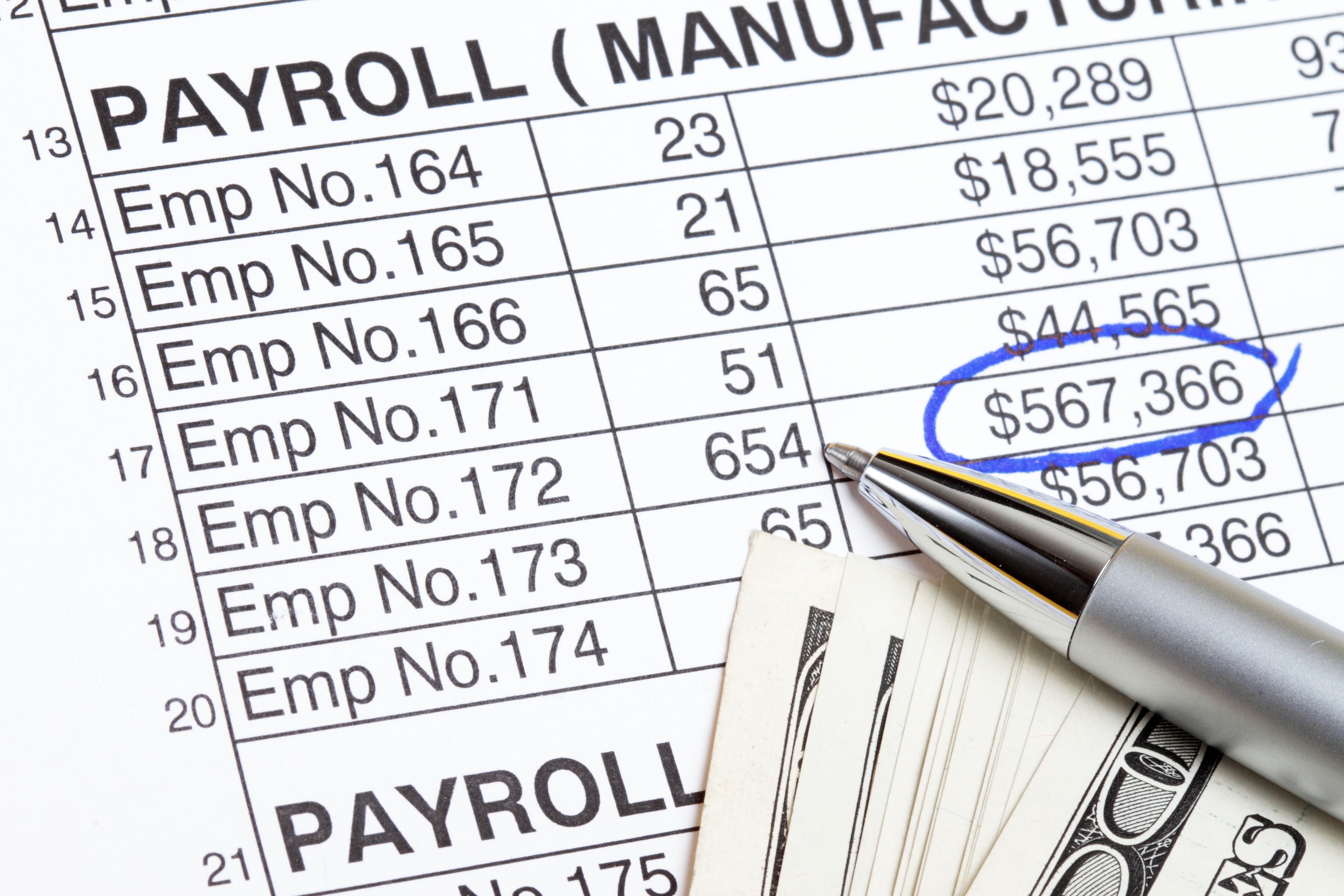

4 Advantages Of Outsourcing Payroll

https://www.youroffice.com/wp-content/uploads/2017/02/payroll.jpg

5 Occasions When Small Businesses Should Outsource Their Payroll

https://cdn2.hubspot.net/hubfs/2242316/Imported_Blog_Media/payroll.jpg

Step 1 Find your employer identification number Your first step is to set up an employer identification number EIN with the IRS The IRS issues this number so it can identify your business If you re a new business you must apply for an EIN You can read about how to apply for an EIN and learn more about the EIN program and process on 1 Calculate employee gross and net pay amounts You first need to determine an employee s gross pay or total earnings for the period before any deductions are made Gross pay includes salary or

Draft a Payroll Policy Apply for Your Employer Identification Number Choose a Payroll Administrator for Your Business Sort Out the Employee Paperwork 1 Understand the State and Federal Employment Laws The payroll process begins with understanding various state and local laws that apply to small businesses FICA taxes for 2022 amount to 7 65 of an employee s paycheck The precise amount may change so it s best to keep up with yearly trends Once the business withholds the payroll tax it must deposit it according to the IRS schedule Businesses that file payroll taxes up to 50 000 must deposit monthly

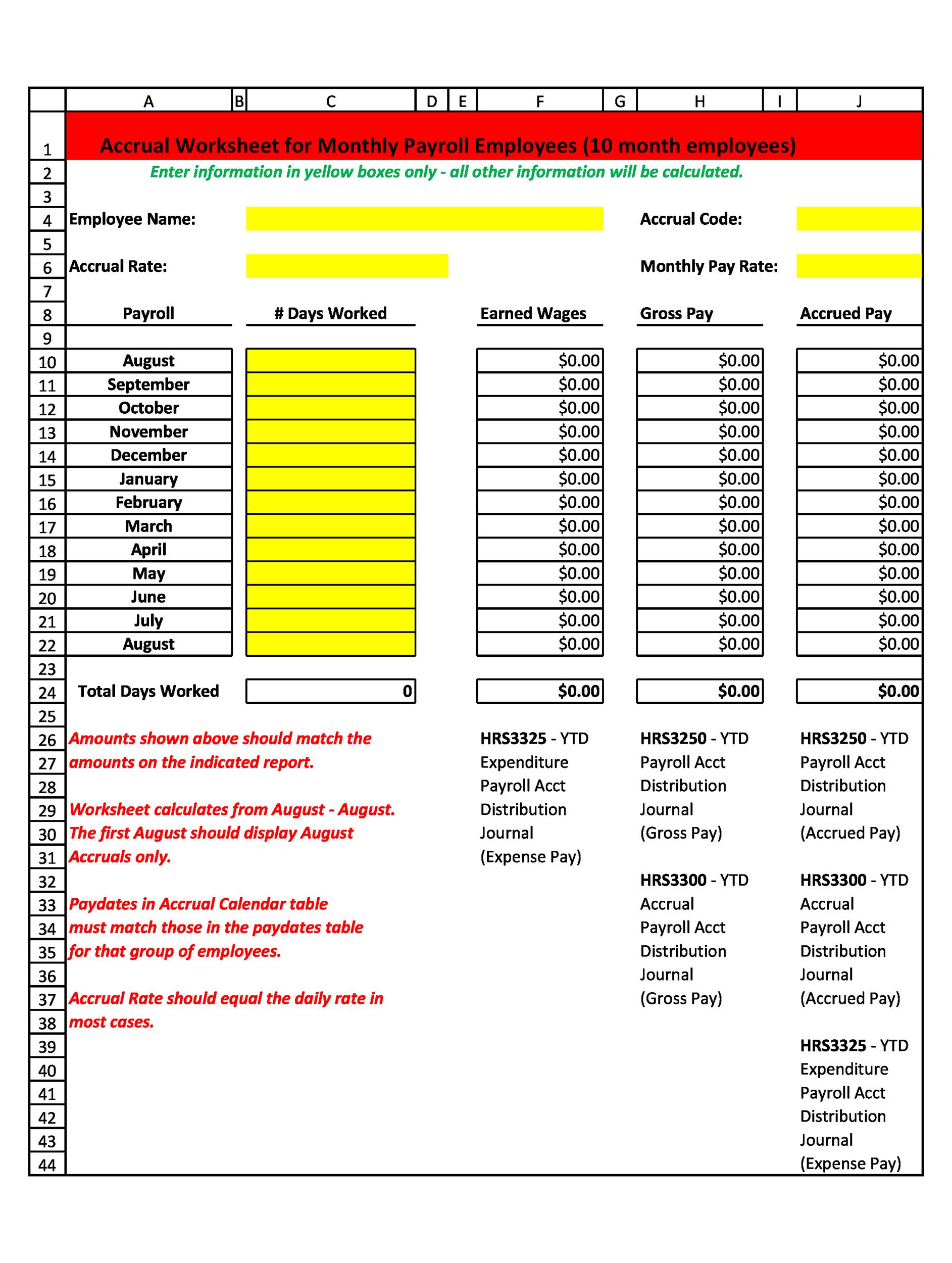

Payroll Calculator Template Microsoft PDF Template

https://templatelab.com/wp-content/uploads/2018/03/payroll-template-25.jpg

How To Do Your Own Payroll As A Small Business Owner A Step By Step

https://www.thefreemanonline.org/wp-content/uploads/2020/04/9fb1c7a9c6281e254a99f8b802f3b237-1024x683.jpeg

How To Do Your Own Payroll For Small Business - Here are the eight essential steps to run payroll on your own 1 Set the Process Up If you are running payroll manually the process will be important to ensure that you don t overlook any