How To Create A Biweekly Amortization Schedule In Excel Let s take a look at the interest payment differences between monthly and biweekly payments of a home mortgage of 200 000 with a 5 45 interest rate and a 30 year term The total interest payment is 206 552 25 after 30 years of the monthly payments whereas the total interest payment is 165 807 86 for borrowers who make biweekly payments

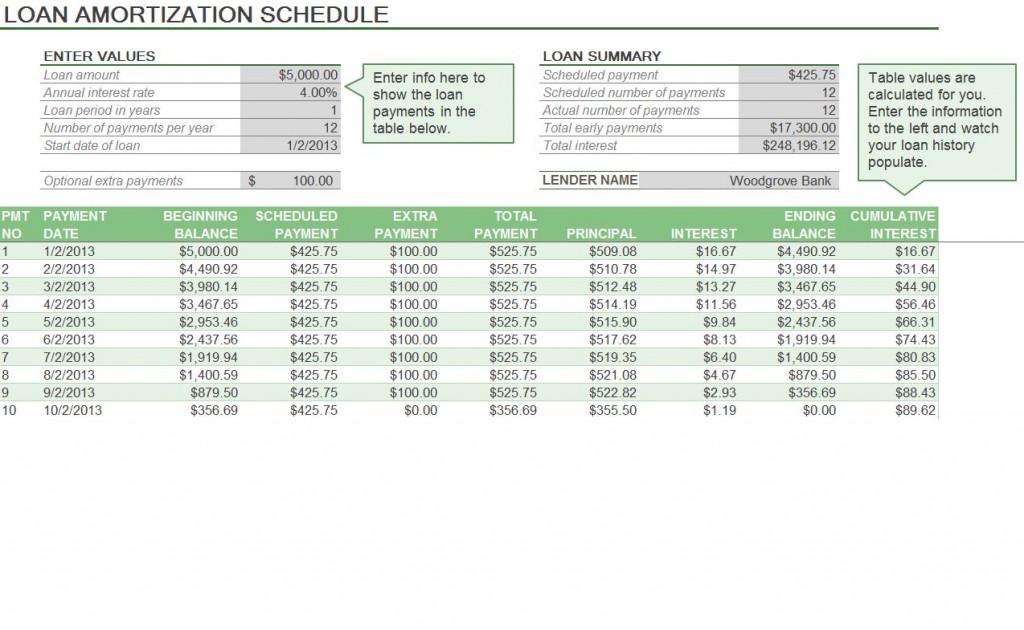

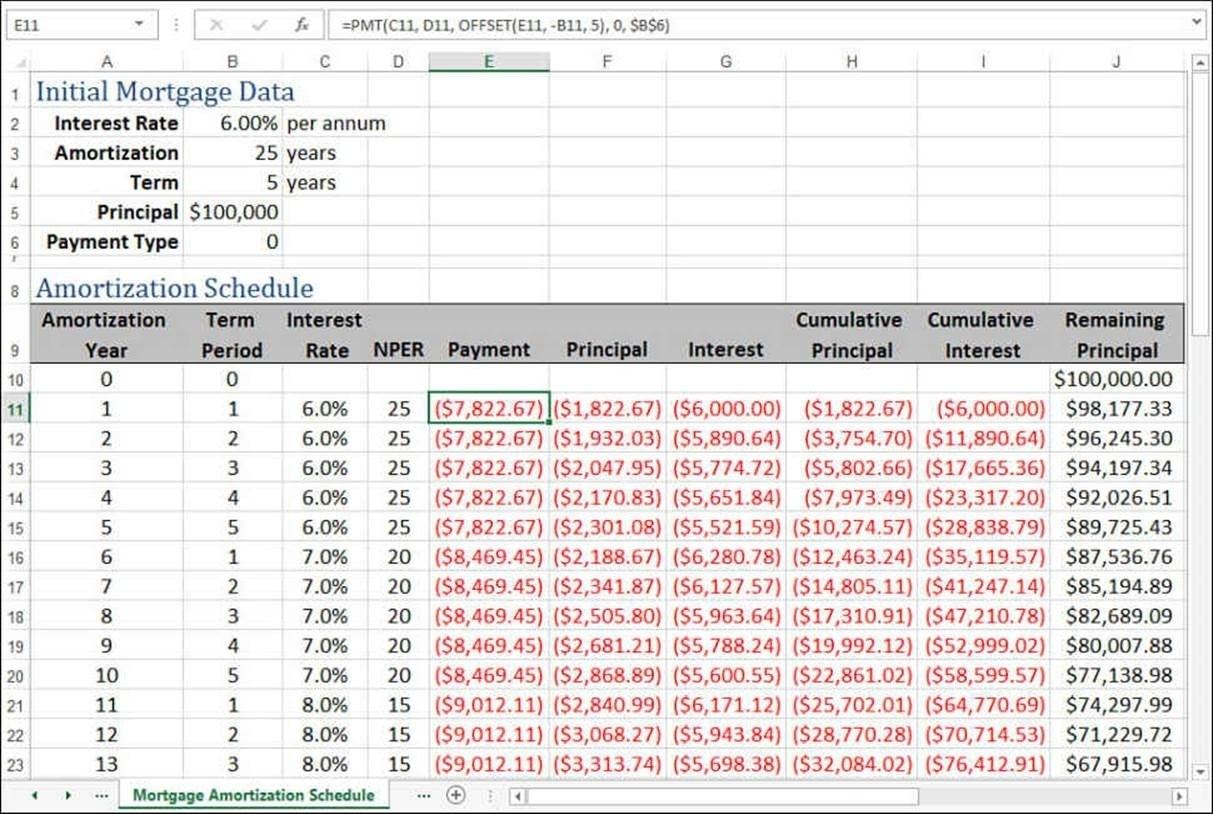

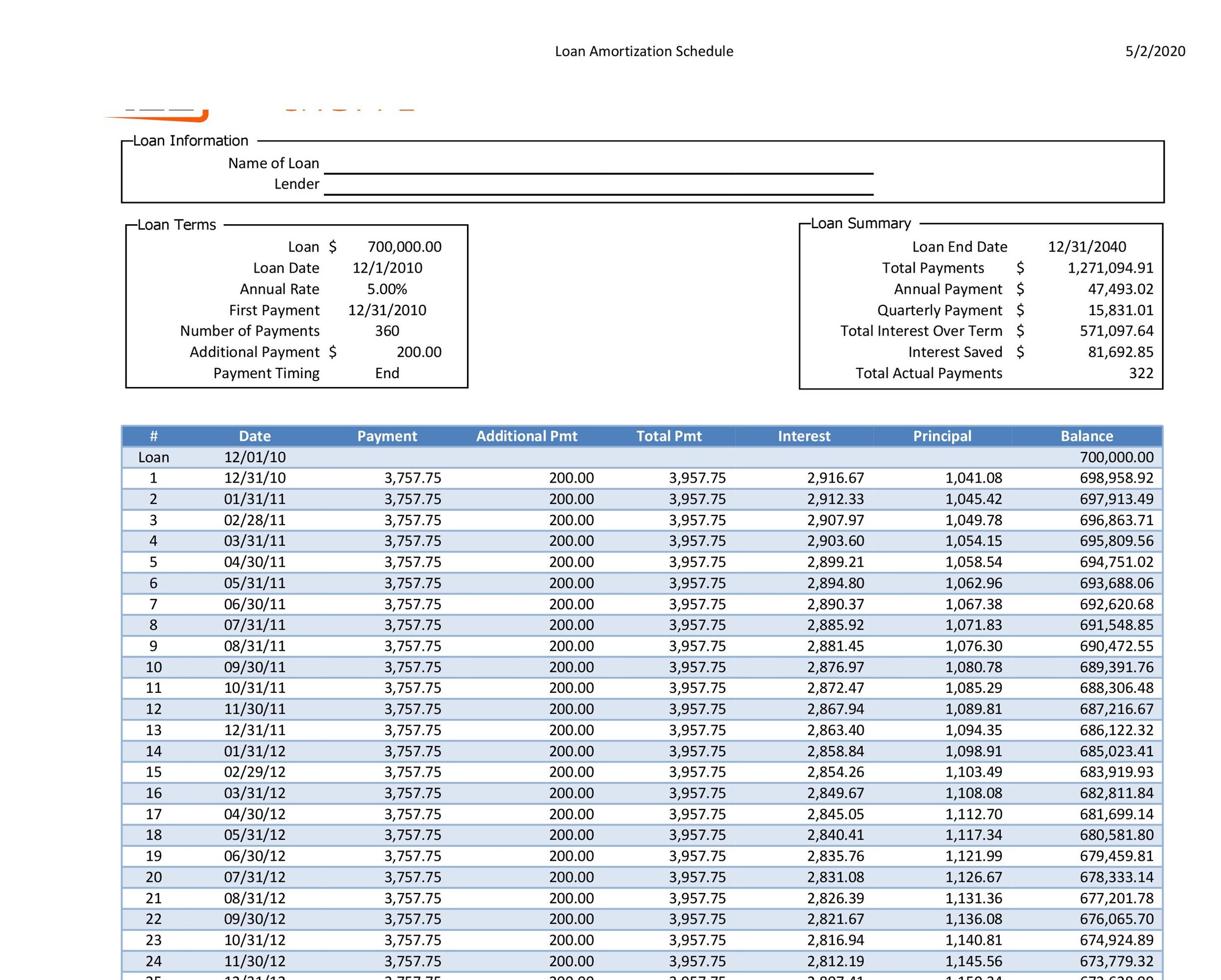

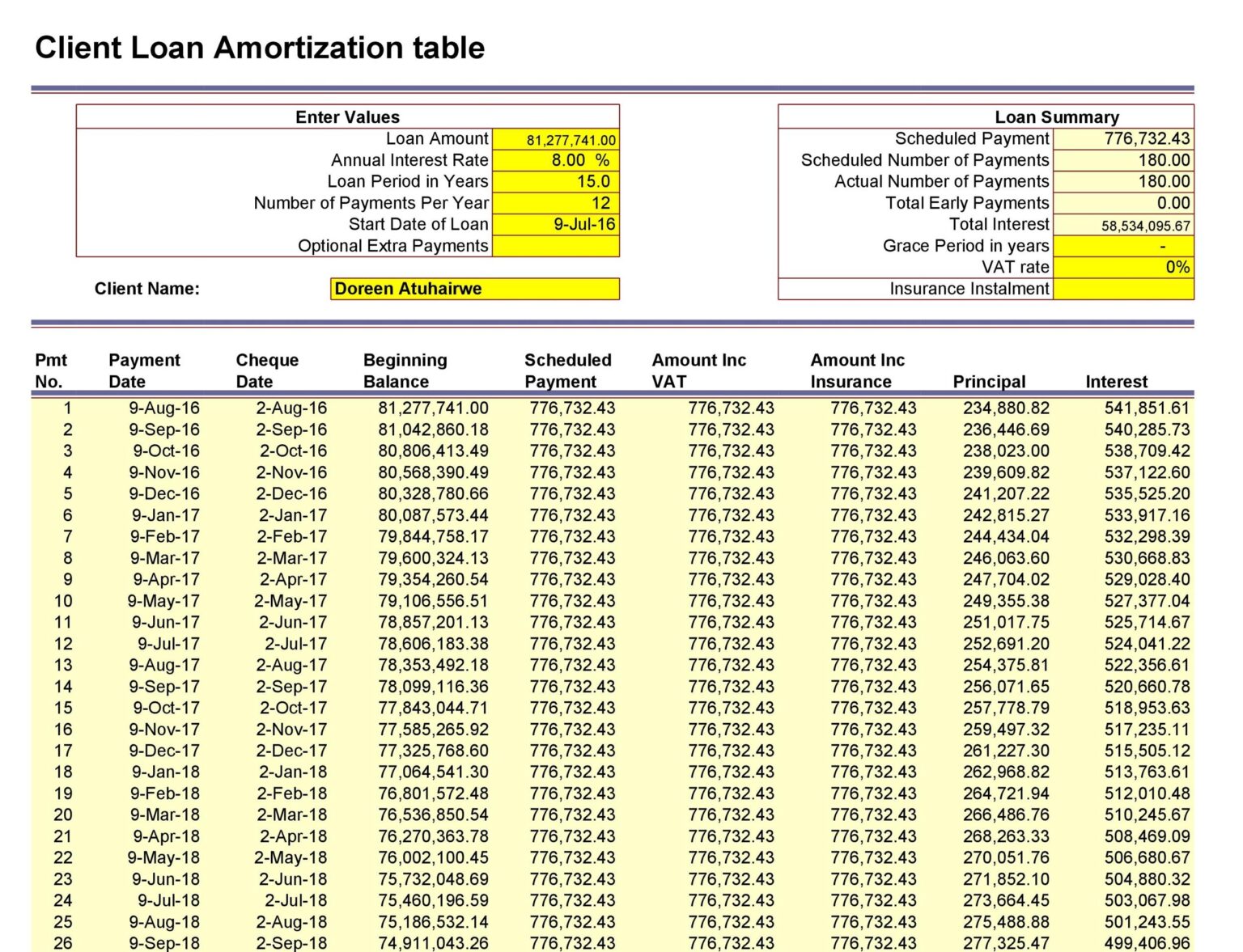

Now let s go through the process step by step 1 Set up the amortization table For starters define the input cells where you will enter the known components of a loan C2 annual interest rate C3 loan term in years C4 number of payments per year C5 loan amount Amortization Schedule You can view your amortization schedule monthly or yearly The amortization schedule is printable in pdf and excel format Extra Payments You can choose to make extra payments so that you can speed up your mortgage payments There are four types of extra payments that you can make one time biweekly quarterly or yearly

How To Create A Biweekly Amortization Schedule In Excel

How To Create A Biweekly Amortization Schedule In Excel

https://exceltemplates.net/wp-content/uploads/2014/02/Amortization-Formula-Excel-1024x630.jpg

Build An Amortization Schedule In Excel Hellvsa

https://db-excel.com/wp-content/uploads/2018/10/loan-amortization-schedule-excel-with-extra-payments-bulat-inside-loan-amortization-spreadsheet.jpg

Create Amortization Schedule Excel Knowledgeklo

https://i.pinimg.com/originals/d0/7c/b6/d07cb66bcb77ad32077d6a846fd7f193.jpg

Accelerate Amortization With Refinancing If your loan is set on a 30 year time period as are most mortgages one way to use amortization to your advantage is to refinance your loan Refinancing is how you change the schedule on which you re required to pay off the loan say from 30 years to 20 or even 15 For the latter open Excel go to the Home section and select More Templates Type Amortization in the search box and you ll see the Simple Loan Calculator Select the template and click Create to use it You ll see a tool tip in the top left corner of the sheet as well as when you select the cells containing the loan details at the top

In this video I provide a clear guide on how to create a loan amortization schedule in Google Sheets and Microsoft Excel This can be useful to break down ea Using The Pmt Function Excel s PMT function calculates payments with ease It factors in interest rate loan term and principal balance To get started open Excel and select a blank cell Here s the formula you ll use PMT rate nper pv rate your loan s interest rate per period nper total number of payments

More picture related to How To Create A Biweekly Amortization Schedule In Excel

How To Prepare Amortization Schedule In Excel with Pictures

https://www.wikihow.com/images/f/ff/Prepare-Amortization-Schedule-in-Excel-Step-21.jpg

Free Printable Amortization Schedule Printable Templates

http://templatelab.com/wp-content/uploads/2016/07/Loan-Amortization-Template-28.jpg?w=320

Basic Amortization Schedule Excel Excel Templates

https://i.pinimg.com/originals/f5/69/5e/f5695e6ed851026dc84d94b488770694.jpg

9 Highlight cells B9 through H9 When you rest the mouse cursor over the bottom right part of the highlighted area the cursor will turn to a crosshair 10 Drag the crosshair all the way down to row 367 This populates all the cells through row 367 with the amortization schedule Using the Bi Weekly Amortization Calculator is straightforward Input your loan details into the provided fields click the Calculate button and instantly receive detailed information about your bi weekly loan payments Formula The formula used for bi weekly loan amortization is P 1 1 r n t r P V Where P is the bi

An amortization schedule is a list of payments for a mortgage or loan which shows how each payment is applied to both the principal amount and the interest The schedule shows the remaining balance still owed after each payment is made so you know how much you have left to pay To create an amortization schedule using Excel you can use our free amortization calculator which is able to Auto Loan Amortization Calculator Amortization Calculator web based You can also find a free excel loan amortization spreadsheet by doing a search in Excel after going to File New Some of them use creative Excel formulas for making the amortization table and a couple allow you to manipulate the schedule by including extra payments

How To Make Loan Amortization Schedule In Excel ORDNUR

https://i2.wp.com/ordnur.com/wp-content/uploads/2019/12/Loan-Amortization-Schedule-in-Excel.jpg?fit=2529%2C2137&ssl=1

Loan Amortization Schedule Excel 30 Free Example RedlineSP

https://www.redlinesp.net/wp-content/uploads/2020/08/loan-amortization-schedule-excel-22-1536x1177.jpg

How To Create A Biweekly Amortization Schedule In Excel - Accelerate Amortization With Refinancing If your loan is set on a 30 year time period as are most mortgages one way to use amortization to your advantage is to refinance your loan Refinancing is how you change the schedule on which you re required to pay off the loan say from 30 years to 20 or even 15