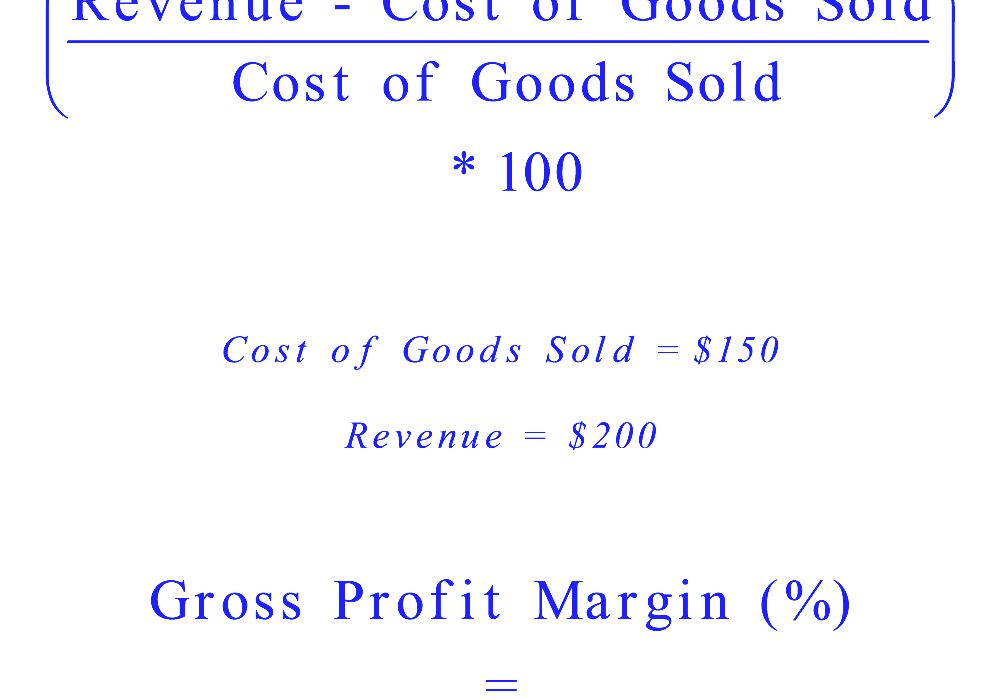

How To Compute Cost Ratio The formula for calculating the cost of sales ratio is Cost of sales Total value of sales X 100 To calculate the cost of sales add your beginning inventory to the purchases made during the period and subtract that from your ending inventory

Calculate cost ratios between values or expenses with our Cost Ratio Calculator Compare costs and make informed decisions based To calculate the cost ratio divide the business cost by the total revenue How to Calculate Cost Ratio The following example problems outline how to calculate Cost Ratio Example Problem 1 First determine the business cost The business cost is given as 300 Next determine the total revenue

How To Compute Cost Ratio

How To Compute Cost Ratio

http://4.bp.blogspot.com/-K7GKWe_EwLE/Wrf21FEuh2I/AAAAAAABgIg/aWf4g9PQS7wRC-8qSTtnfA-HQZ_O1JFEgCK4BGAYYCw/s1600/Gross%2BMargin%2B-%2BHow%2BTo%2BCalculate%2BGross%2BProfit%2BMargin%2BPercentage-715722.png

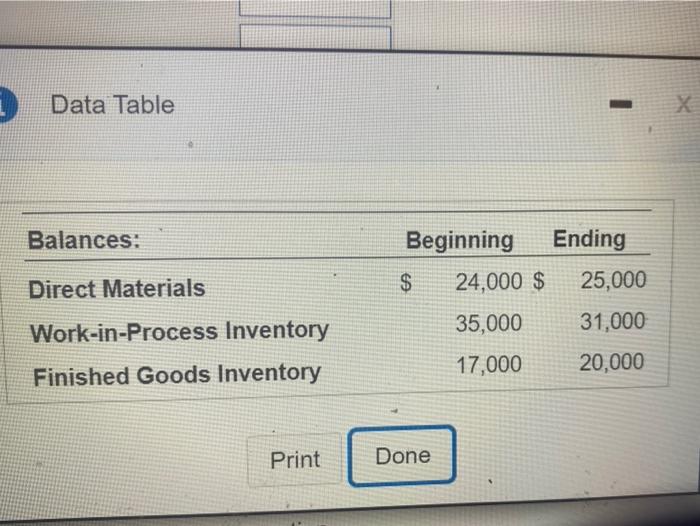

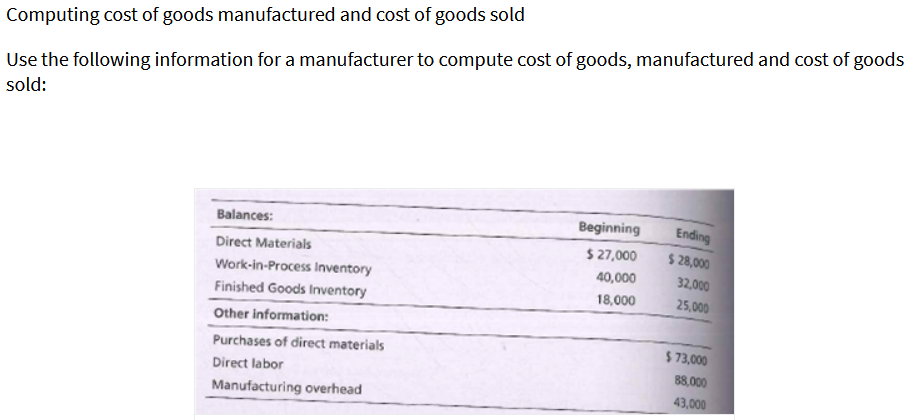

Solved Use The Following Information For A Manufacturer To Chegg

https://media.cheggcdn.com/study/246/246e2b18-40be-4d57-91bc-f83f942cb725/image

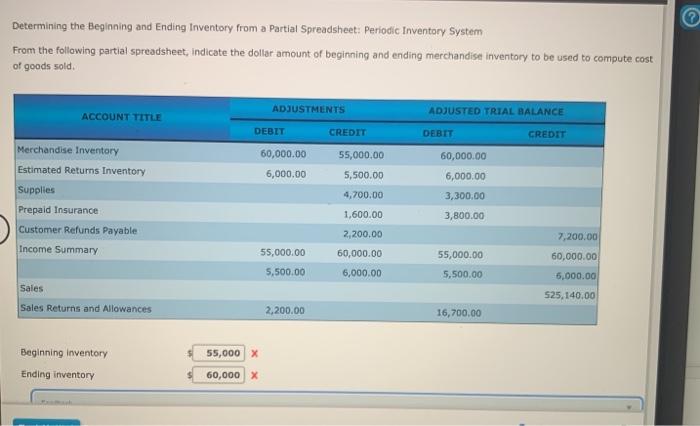

Solved Determining The Beginning And Ending Inventory From A Chegg

https://media.cheggcdn.com/study/b2b/b2bf85db-c15e-462f-8b42-817c22b94da1/image

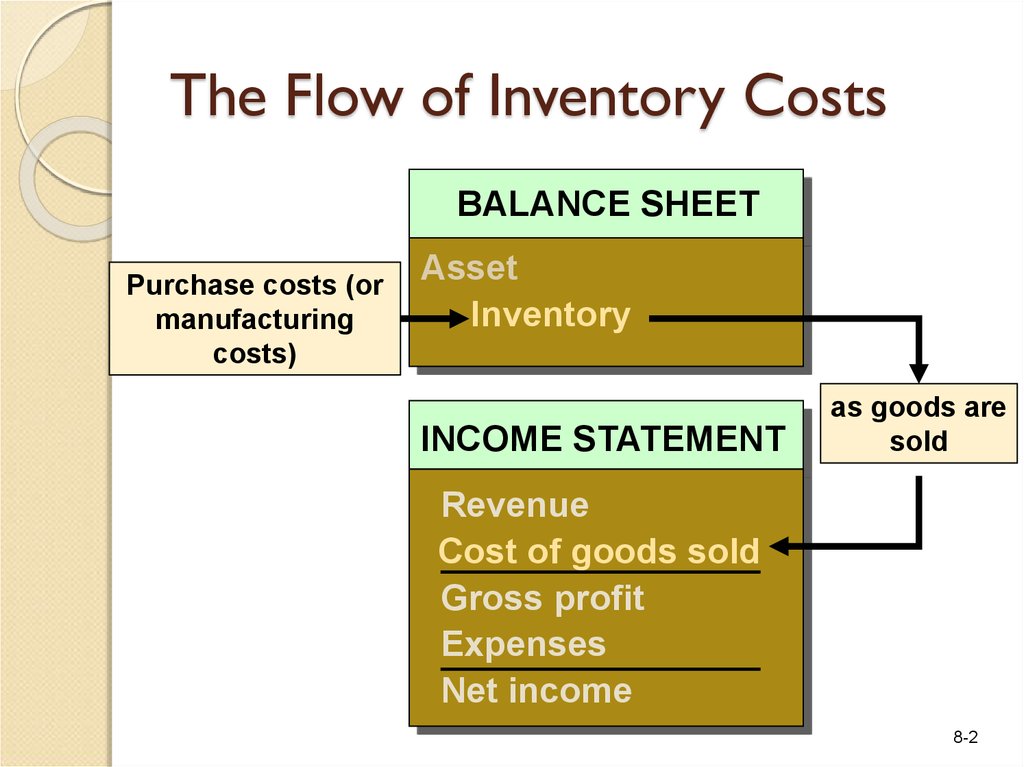

Updated January 31 2023 Financial professionals use many tools to measure and track business performance Whether you are an accountant investor or financial planner you might need to evaluate a company s efficiency The cost revenue ratio is one tool you can use to measure how effectively a business uses costs to create sales Cost Structure Fundamentals Cost Structure Fixed Cost Variable Cost Semi Variable Cost Operating Leverage Analysis Operating Leverage Break Even Point BEP Average Fixed Cost AFC Average Variable Cost AVC Average Total Cost ATC Cost Structure Ratio Analysis

What Is the Variable Cost Ratio The variable cost ratio is a calculation of the costs of increasing production in comparison to the greater revenues that will result from the increase An What Does the BCR Tell You If a project has a BCR that is greater than 1 0 the project is expected to deliver a positive net present value NPV and will have an internal rate of return IRR

More picture related to How To Compute Cost Ratio

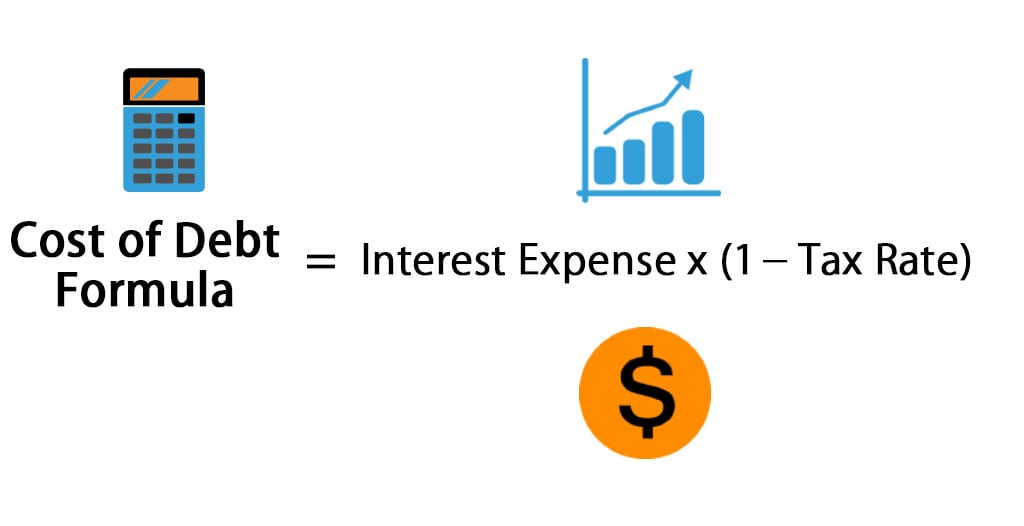

Cost Of Debt Formula How To Calculate With Examples

https://cdn.educba.com/academy/wp-content/uploads/2019/01/Cost-of-Debt-Formula.jpg

Solved Computing Cost Of Goods Manufactured And Cost Of Chegg

https://media.cheggcdn.com/study/328/3286c6a3-89df-4f4c-b7ca-7d06b90af18c/image_1265938984.png

Use The Following Information For A Manufacturer To Compute Cost Of

https://img.homeworklib.com/questions/49e28d50-124a-11eb-9c0d-814dc48c1f86.png?x-oss-process=image/resize,w_560

How to Calculate the Variable Cost Ratio We will now talk about the formula Variable Cost Ratio VCR Variable Costs VC Net Sales NS Another formula is VCR 1 Contribution Margin CM The total contribution margin is calculated by subtracting the value of the company s VC of total produced goods from the total sales revenue The Benefit Cost Ratio BCR indicates the relationship between the cost and benefit of project or investment for analysis as it is shown by the present value of benefit expected divided by present value of cost which helps to determine the viability and value that can be derived from investment or project

6 Subtract the cost from the outcome The next step involves finding your cost analysis ratio by subtracting the total costs from the project s estimated benefits For example if a project costs 1 000 and the benefits are 2 500 then 2 500 1 000 1 500 A cost benefit analysis CBA is a process that s used to estimate the costs and benefits of projects or investments to determine their profitability for an organization A CBA is a versatile method that s often used for business administration project management and public policy decisions

How To Calculate Cost Of Goods Sold Online Accounting

https://online-accounting.net/wp-content/uploads/2020/10/image-cICqXM48djVQnZml.png

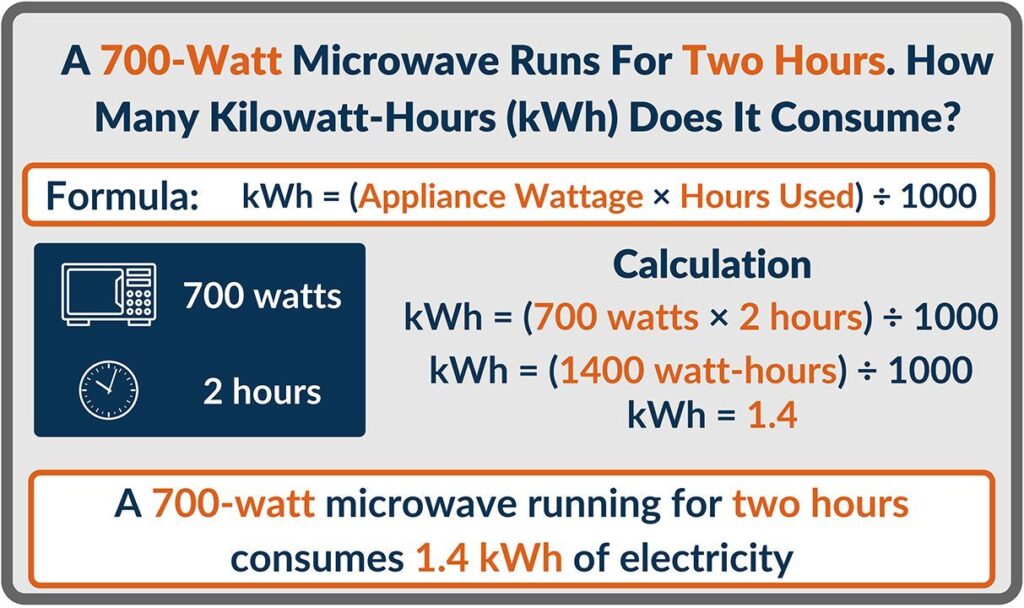

Holdfel let Kaliber Kalap How To Calculate Kilowatts Cs rg Egyetemista

https://electricityrates.com/wp-content/uploads/2021/08/Kilowatt-Hour-Calculation-graphic-1024x608.jpg

How To Compute Cost Ratio - Cost Structure Fundamentals Cost Structure Fixed Cost Variable Cost Semi Variable Cost Operating Leverage Analysis Operating Leverage Break Even Point BEP Average Fixed Cost AFC Average Variable Cost AVC Average Total Cost ATC Cost Structure Ratio Analysis