How To Calculate Nominal Annual Interest Rate In Excel To calculate monthly interest rate the formula in C6 is RATE C2 12 C3 C4 Please note that C2 contains the number of years To get the total number of payment periods we multiply it by 12 To get annual interest rate we multiply the monthly rate by 12 So the formula in C8 is RATE C2 12 C3 C4 12

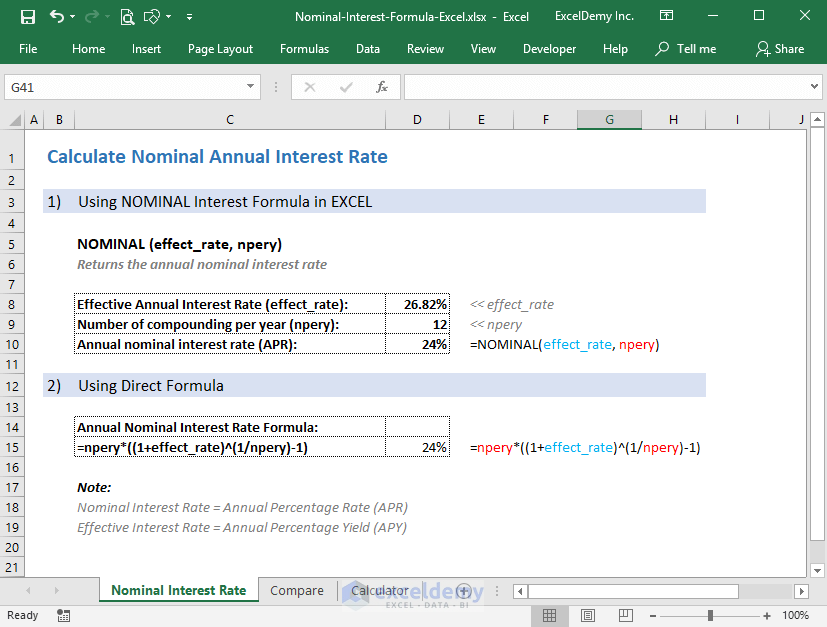

This article describes the formula syntax and usage of the NOMINAL function in Microsoft Excel Description Returns the nominal annual interest rate given the effective rate and the number of compounding periods per year Syntax NOMINAL effect rate npery The NOMINAL function syntax has the following arguments Effect rate Required The Nominal Annual Interest Rate Formulas Suppose If the Effective Interest Rate or APY is 8 25 compounded monthly then the Nominal Annual Interest Rate or Stated Rate will be about 7 95 An effective interest rate of 8 25 is the result of monthly compounded rate x such that i x 12 The formula can be written as

How To Calculate Nominal Annual Interest Rate In Excel

How To Calculate Nominal Annual Interest Rate In Excel

https://www.wallstreetmojo.com/wp-content/uploads/2019/03/Nominal-Interest-Rate.jpg

Nominal Interest Rate Intelligent Economist

https://www.intelligenteconomist.com/wp-content/uploads/2020/05/Nominal-Interest-Rate-Formula.png

:max_bytes(150000):strip_icc()/dotdash_INV_final-Stated-Annual-Interest-Rate_2021-01-b21e3142ad46439fa021c4ce978baa68.jpg)

Apr Calculation Tool Darelomerchant

https://www.investopedia.com/thmb/VfMz350xHMpcop4A6sfkF-bQaBA=/2751x793/filters:no_upscale():max_bytes(150000):strip_icc()/dotdash_INV_final-Stated-Annual-Interest-Rate_2021-01-b21e3142ad46439fa021c4ce978baa68.jpg

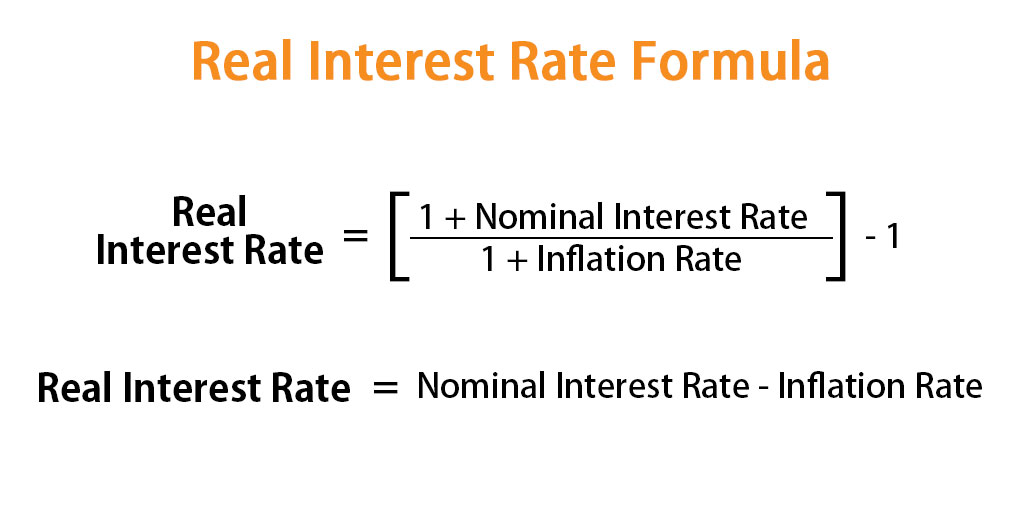

The formula for calculating the nominal interest rate is as follows Nominal Interest Rate i 1 r 1 1 Where r Real Interest Rate i Nominal Interest Rate Inflation Rate Note that as a rough approximation the following equation can be used with reasonable accuracy How to use The Excel NOMINAL function calculates the nominal interest rate when given an effective annual interest rate and the number of compounding periods per year Nominal interest rate is typically the stated rate on a financial product Effective annual interest rate is the interest rate actually earned due to compounding

Inputting Data into Excel When calculating the nominal interest rate in Excel it s important to input the necessary data accurately Here are the steps to input the data A Enter the stated interest rate This is the annual interest rate that is stated by the lender or financial institution The NOMINAL Function 1 is categorized under Excel Financial functions The function will return the nominal annual interest rate when the effective rate and number of compounding years are given In financial analysis we often evaluate more than one bond and hence are interested in knowing the net return offered by each

More picture related to How To Calculate Nominal Annual Interest Rate In Excel

If The Nominal Annual Interest Rate Is 24 Compounded Continuously

https://img.homeworklib.com/questions/7ce75f80-6108-11eb-a048-afee5102e241.png?x-oss-process=image/resize,w_560

Nominal Interest Rate Formula Excel calculate From Effective Rate

https://www.exceldemy.com/wp-content/uploads/2018/10/Nominal-Interest-Formula-Excel-1.png

How To Calculate Annual Percentage Rate APR In MS Excel Hindi

https://i.ytimg.com/vi/fLXh4p1E8ZQ/maxresdefault.jpg

To calculate the effective annual interest rate when the nominal rate and compounding periods are given you can use the EFFECT function In the example shown the formula in D5 copied down is EFFECT rate C5 where rate is the named range H4 The generic formula for calculating EAR in Excel formula syntax is 1 i n n 1 Step 1 Type the following formula in cell F4 RATE C4 C5 C6 Step 2 Because years include 12 months multiply the previous calculation by the value of C7 or write the following formula to get the annual interest rate RATE C4 C5 C6 C7 Therefore the Annual Interest Rate will be shown in cell F6 Notes

Nominal Interest Rate Real Interest Rate Inflation Rate So here we are considering the inflation rate in nominal interest rate so in this example we can see that the purchasing power of an investor and consumer erodes by 4 and the reason for purchasing price erosion is inflation Calculating the future value of a present payment needs you to know two things the nominal annual interest rate and the number of compounding periods per year Let s say you ve invested 500 for a year at 8 Excel s NOMINAL formula can be used to calculate the nominal annual interest rate for calculating compound interest

Real Interest Rate Formula Calculator Examples With Excel Template

https://www.educba.com/academy/wp-content/uploads/2019/07/Real-Interest-Rate-Formula.jpg

The Nominal Annual Interest Rate Compounded Quarterly Is 24 36 It Is

https://img.homeworklib.com/questions/84413800-0ecb-11eb-b1a6-d358130942cf.png?x-oss-process=image/resize,w_560

How To Calculate Nominal Annual Interest Rate In Excel - How to use The Excel NOMINAL function calculates the nominal interest rate when given an effective annual interest rate and the number of compounding periods per year Nominal interest rate is typically the stated rate on a financial product Effective annual interest rate is the interest rate actually earned due to compounding