How To Calculate Net Profit Before Tax From Balance Sheet Calculating Net Profit Before Tax for Different Business Types Different businesses may follow varyin g accounting principles and standards depending on their size industry and location This could lead to variations in the method used to calculate net profit before tax However at the core the basic formula remains the same subtract

Profit before tax PBT is a line item in a company s income statement that measures profits earned after accounting for operating expenses like COGS SG A Depreciation Amortization etc non operating expenses like interest expense but before paying off the income taxes By ignoring taxes and interest expenses EBIT identifies a company s ability to generate enough earnings to be profitable pay down debt and fund ongoing operations EBIT is not a GAAP metric

How To Calculate Net Profit Before Tax From Balance Sheet

How To Calculate Net Profit Before Tax From Balance Sheet

https://www.wallstreetmojo.com/wp-content/uploads/2019/07/Profit-Before-Tax-PBT-1.jpg

How To Calculate Net Profit Before Tax Extraordinary Items In Cash

https://i.ytimg.com/vi/EAoKze6rbg4/maxresdefault.jpg

Profit After Tax Definition Formula How To Calculate Net Profit

https://www.wallstreetmojo.com/wp-content/uploads/2019/07/Profit-After-Tax-PAT.jpg

Profit Before Tax PBT Profit before tax PBT is a profitability measure that looks at a company s profits before the company has to pay corporate income tax by deducting all expenses from Calculating net profit is straightforward Gathering all the figures you ll need may be complex but keeping proper records will make it easier To determine your total revenue Total Revenue net sales Quantity of goods services sold unit price

EBITDA or earnings before interest taxes depreciation and amortization is an alternate measure of profitability to net income By including depreciation and amortization as well as To arrive at net income you subtract the cost of goods sold COGS if any selling and administrative expenses taxes interest depreciation and amortization from the gross amount of revenue the business has generated The figure you arrive at is the net of those expenses and is called the company s net income

More picture related to How To Calculate Net Profit Before Tax From Balance Sheet

How To Calculate Net Profit Before Tax Extraordinary Item In Cash

https://i.ytimg.com/vi/8dz7tOGkk8A/maxresdefault.jpg

Hodv b Choroba Stato nos How To Calculate Net Profit Pay ialenstvo

https://wsp-blog-images.s3.amazonaws.com/uploads/2022/09/17160238/Net-Income-Calculator.jpg

Lakeland Dairies Reports 10 Increase To 12 8m In Profit Before Tax

https://www.lakeland.ie/images/uploads/news/highlights-banner.jpg

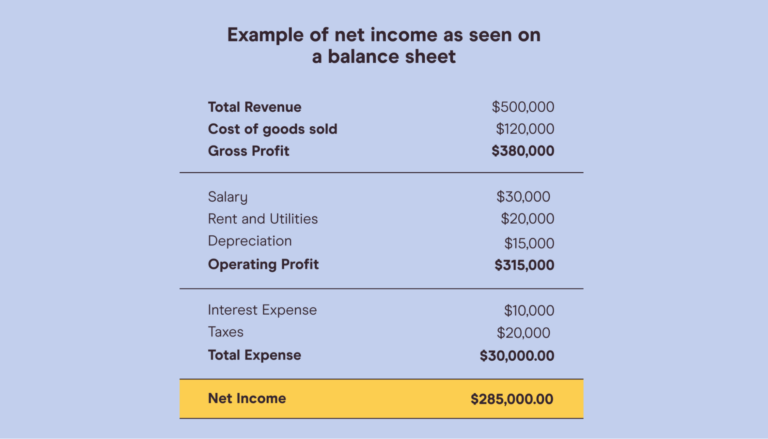

The formula for calculating net income is Revenue Cost of Goods Sold Expenses Net Income The first part of the formula revenue minus cost of goods sold is also the formula for gross income Check out our simple guide for how to calculate cost of goods sold So put another way the net income formula is Net profit is the amount of money that a company has after all its expenses are paid You can think of net profit like your paycheck It s the money left after all taxes and benefits are subtracted Found on the last line of the income statement net profit impacts the take home profit of a company Net profit is also referred to as

Once you have calculated the total expenses you can subtract them from the company s revenue to determine its net profit Let s say a company has the following financial information Revenue 100 000 Cost of Goods Sold COGS 40 000 Operating Expenses 20 000 Interest Expense 5 000 By calculating the net profit margin you ll find the percentage of profit a business gets from the total amount it brings in Profit margins can vary by sector and industry but the outcome is the same The higher a firm s net profit margin is compared to its competitors the better for the business Key Takeaways

How To Find Net Income For Beginners Pareto Labs

https://www.paretolabs.com/wp-content/uploads/2021/06/Example-of-net-income-as-seen-on-a-balance-sheet-768x439.png

How To Calculate Profit Percentage Of RETAIL SHOP How To Calculate Net

https://i.ytimg.com/vi/Cv0BgAjQDAY/maxresdefault.jpg

How To Calculate Net Profit Before Tax From Balance Sheet - To arrive at net income you subtract the cost of goods sold COGS if any selling and administrative expenses taxes interest depreciation and amortization from the gross amount of revenue the business has generated The figure you arrive at is the net of those expenses and is called the company s net income